In Situ Hybridization Market Size, Share, Trends, & Industry Analysis Report

By Offering (Consumables, Instruments, and Services & Software), By Technology, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5882

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

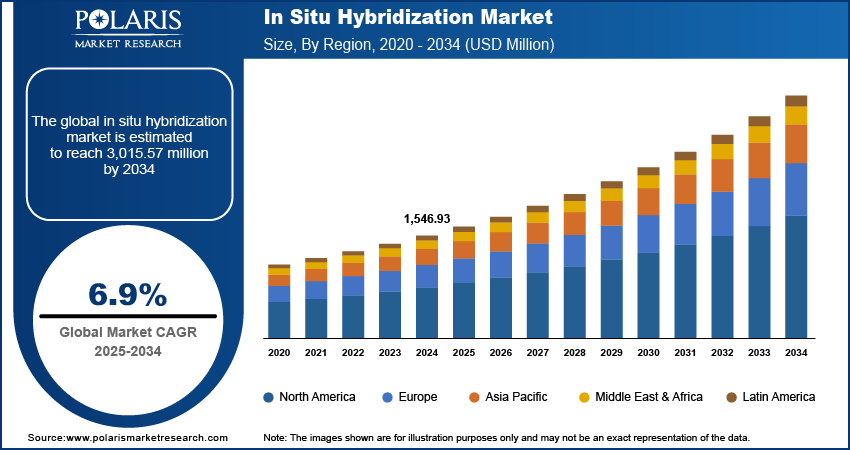

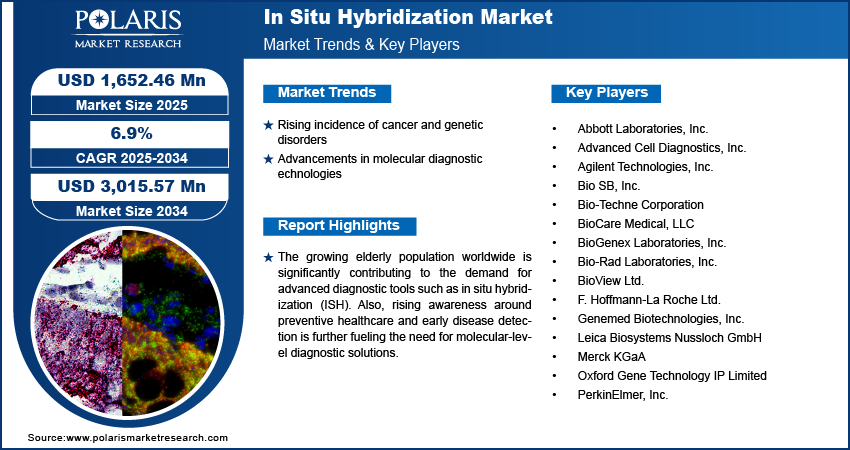

The in situ hybridization market size was valued at USD 1,546.93 million in 2024, growing at a CAGR of 6.9% from 2025–2034. Rising incidence of cancer and genetic disorders coupled with advancements in molecular diagnostic technologies is accelerating the market growth.

In situ hybridization (ISH) is a molecular diagnostic technique used to detect specific nucleic acid sequences within preserved tissue samples or cells. It allows for the localization of targeted DNA or RNA sequences in native cellular context, providing spatial and morphological information that traditional molecular biology methods cannot offer. The method involves the use of labeled complementary probes that bind to targeted genetic material, making it possible to visualize gene expression analysis patterns and chromosomal arrangements directly in tissue sections or cell preparations. ISH is integral to research and clinical diagnostics, particularly in oncology clinical trials, genetics, and neuroscience, as it enables high-resolution mapping of gene activity and mutation detection without the need to extract genetic material.

In situ hybridization techniques are extensively applied in clinical pathology laboratories, pharmaceutical research, and academic institutions. The technique is frequently used in cancer diagnostics, infectious disease detection, and developmental biology to determine the spatial distribution of specific biomarkers. Its ability to detect gene amplification, chromosomal translocations, and viral genomes in situ made ISH essential in managing complex diseases such as cancer and neurodegenerative disorders.

The growing elderly population worldwide is significantly contributing to the demand for advanced diagnostic tools such as in situ hybridization (ISH). According to the World Health Organization, by 2030, one out of every six individuals globally will be aged 60 years or older. By 2050, this demographic is projected to double, reaching 2.1 million. This is increasing the global burden of chronic diseases and neurodegenerative disorders, that require accurate and early-stage diagnostics. ISH is essential for detecting genetic mutations, chromosomal abnormalities, and RNA expression within tissue samples, making it highly valuable in age-related disease diagnostics.

The growing awareness around preventive healthcare and early disease detection is further fueling the need for molecular-level diagnostic solutions. Healthcare providers and laboratories are investing in advanced technologies that offer spatial and cellular insights to improve clinical outcomes. ISH is well-positioned to meet this demand as it delivers high-resolution localization of disease-related genes and pathogens directly in tissue samples. This ability to detect and localize molecular targets is increasing its adoption in pathology labs, hospitals, and diagnostic centers aiming to provide more accurate and patient-centered care.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Rising Incidence of Cancer and Genetic Disorders

The increasing prevalence of cancer and inherited genetic disorders is boosting the growth of the in situ hybridization (ISH) market. Cancer is one of the leading causes of death worldwide, with an escalating number of cases each year. According to the World Health Organization, the number of new cancer cases is projected to reach over 35 million by 2050, representing a 77% increase compared to the estimated 20 million cases in 2022. The rising burden of cancer is driving increased demand for early and reliable diagnostic tools capable of identifying chromosomal abnormalities, gene mutations, and oncogenic rearrangements at the cellular level. ISH provides high-resolution visualization of gene expressions directly in tissue samples, enabling accurate tumor characterization and better prognosis assessment. This is pushing healthcare institutions and pathology laboratories to incorporate ISH into their diagnostic workflows for improved clinical decision-making.

Genetic disorders such as down syndrome, cystic fibrosis, and Duchenne muscular dystrophy are also rising, particularly in regions with growing access to genomic screening. ISH extensively identify gene deletions, duplications, and translocations that are linked to these conditions. The growing preference for tissue-based genetic analysis in prenatal, pediatric, and neurological care settings is increasing the uptake of ISH in clinical diagnostics. Healthcare providers are further relying on ISH to confirm results from other molecular tests, making it an integral part of broader ecosystem of diagnostic precision.

Advancements in Molecular Diagnostic Technologies

Rapid technological progress in molecular diagnostics is significantly enhancing the performance and adoption of in situ hybridization (ISH) techniques, thus fueling the market growth. For instance, in May 2025, Diagnostics.ai launched the industry’s first CE-IVDR certified transparent AI platform specifically built for molecular diagnostics. This platform supports enhanced traceability, regulatory compliance, and interpretability addressing evolving IVDR requirements. These advancements are improving the accuracy, scalability, and reliability of ISH workflows. Innovations such as fluorescence in situ hybridization (FISH) allow for multiplex detection of chromosomal abnormalities with higher sensitivity and specificity. These tools enable healthcare providers and researchers to meet growing demands for fast, reliable diagnostic results.

Digital imaging platforms are further accelerating ISH utility by offering high-resolution visualization, quantification, and long-term signal archiving ensuring consistent interpretation. Additionally, the integration of artificial intelligence (AI) and machine learning in digital pathology is revolutionizing ISH signal assessment by automating probe interpretation and reducing diagnostic errors. As a result, ISH is gaining traction in time-sensitive areas such as oncology and infectious disease diagnostics. The growing focus among healthcare providers and diagnostic laboratories on operational efficiency, reproducibility, and precision is fueling demand for next-generation ISH platforms that integrate automation, AI analytics, and advanced fluorescence detection.

Segmental Insights

Offering Analysis

The global segmentation, based on offering includes, consumables, instruments, and services & software. The consumables segment is projected to reach substantial revenue share by 2034. This growth is attributed to the growing demand for reagents, probes, buffers, and detection kits in both clinical and research laboratories. These consumables are critical for ensuring high assay sensitivity and reproducibility, making them indispensable for routine diagnostic and research applications. Growing utilization of chromogenic and fluorescent probes for detecting gene mutations and chromosomal aberrations in formalin-fixed tissues has increased procurement volumes across pathology labs. The rising prevalence of cancer and genetic disorders is also reinforcing the demand for these consumables, as they are essential for conducting high-volume ISH assays in diagnostic services.

The services & software segment is projected to register the fastest growth rate during the forecast period. This growth is fueled by the increasing demand for advanced image analysis tools, data interpretation platforms, and outsourced hybridization services. Laboratories aiming to improve operational efficiency and accuracy are increasingly adopting software solutions that incorporate artificial intelligence and machine learning. These platforms assist in automating signal quantification, improving standardization, and minimizing interpretation errors. Additionally, research institutions and smaller clinics are increasingly outsourcing ISH services to specialized laboratories, driven by the high complexity and cost of establishing in-house capabilities, further boosting the market growth.

Technology Analysis

The global segmentation, based on technology includes, fluorescent In situ hybridization (FISH), and chromogenic In situ hybridization (CISH). The fluorescent in situ hybridization (FISH) segment accounted for significant market share in 2024 due to its superior sensitivity and ability to detect multiple genetic targets simultaneously using color-coded probes. FISH is widely adopted in oncology and prenatal diagnostics, as it allows visualization of chromosomal translocations, gene amplifications, and deletions with high specificity. Its widespread clinical utility in identifying HER2/neu status in breast cancer and BCR-ABL rearrangements in leukemia is driving the demand across hospitals and diagnostic laboratories. Moreover, the availability of automated FISH systems and FDA-approved probe kits is boosting the segment’s dominance in clinical diagnostic workflows.

The chromogenic in situ hybridization (CISH) segment is expected to expand at the fastest CAGR from 2025 to 2034, owing to its compatibility with brightfield microscopy and permanent slide storage. CISH enables pathologists to examine hybridization signals alongside histological features on the same slide, improving clinical interpretation. This makes CISH a preferred choice in laboratories lacking access to fluorescent microscopy. Advancements in probe chemistry and detection enzymes are also enhancing CISH performance, enabling multiplex assays and faster turnaround times. The technique's cost-effectiveness and ease of integration into traditional pathology workflows are contributing to its accelerated adoption in emerging markets and mid-sized diagnostic labs.

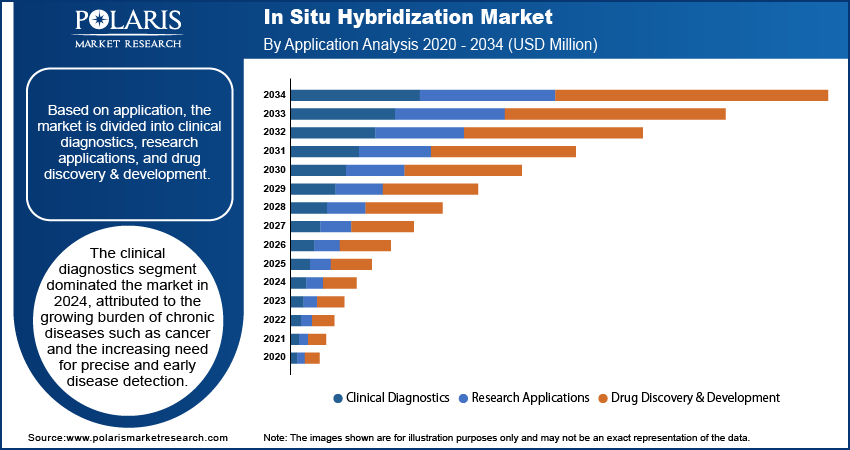

Application Analysis

The global segmentation, based on application includes, clinical diagnostics, research applications, and drug discovery & development. The clinical diagnostics segment dominated the market, in 2024. This dominance is attributed to the growing burden of chronic diseases such as cancer and the increasing need for precise and early disease detection. ISH are crucial in identifying gene expression levels, viral genomes, and chromosomal abnormalities, in oncology and genetic testing. Hospitals and diagnostic laboratories rely heavily on ISH to confirm diagnoses and guide treatment decisions, particularly in cases involving targeted therapies. The use of FISH in identifying predictive biomarkers and chromosomal aberrations in solid tumors and hematological malignancies is further fueling demand for ISH-based diagnostic applications.

The drug discovery & development segment is anticipated to record the highest growth rate during the forecast period. Pharmaceutical and biotechnology firms are utilizing ISH to understand disease mechanisms, validate therapeutic targets, and assess tissue-specific gene expression in preclinical models. The technique provides spatial insights that are not captured by bulk molecular assays, making it an essential tool in translational research. The expanding focus on precision medicine and companion diagnostics is also contributing to ISH adoption in drug development workflows. Moreover, the integration of multiplexed ISH platforms is enabling researchers to analyze multiple gene targets in a single assay, accelerating target validation and biomarker discovery processes.

End User Analysis

The global segmentation, based on end user includes, pharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, academic & research institutes, and contract research organizations. The pharmaceutical & biotechnology segment is projected to grow at a significant CAGR during the forecast period. This rapid growth is attributed to the increasing focus on developing targeted therapies and personalized medicines. Companies are extensively utilizing ISH in preclinical studies, toxicology assessments, and biomarker validation to support regulatory submissions and product development. For instance, in July 2023, KromaTiD launched over 300 centromere, telomere, and gene probes for its directional Genomic Hybridization (dGH) in‑Site DNA assay. This launch expanded molecular cytogenetics by enabling high-resolution, orientation-specific in situ hybridization, boosting the capabilities of preclinical studies and gene-editing research. ISH provides vital information on tissue-specific gene expression patterns, helping researchers better understand drug mechanisms and disease pathways. Additionally, advancements in automated ISH platforms are allowing biopharma firms to streamline operations and reduce turnaround times for histopathological studies, further reinforcing segment leadership.

The contract research organizations (CROs) segment is poised to witness the fastest growth from 2025 to 2034, supported by the rising trend of outsourcing complex molecular biology services. CROs are increasingly offering ISH-based analysis as part of their comprehensive research solutions for pharmaceutical and biotech clients. These organizations are investing in cutting-edge imaging systems, automated hybridization stations, and experienced pathology teams to deliver high-quality, reproducible results. For instance, in May 2025, Bayer launched Centafore Imaging Core Lab, transforming its internal imaging arm into a full-fledged Imaging CRO for external clinical trials and Software as a Medical Device (SaMD) development. Compressed drug development timelines are pushing sponsors to outsource ISH services to CROs, offering faster and more cost-effective alternatives to in-house testing and fueling rapid growth of the market.

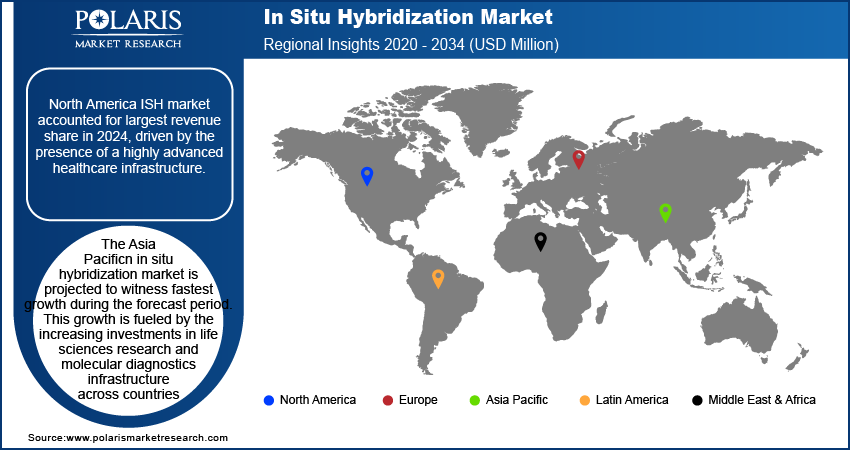

Regional Analysis

North America ISH market accounted for largest revenue share in 2024, driven by the presence of a highly advanced healthcare infrastructure. The region is home to a large network of well-equipped clinical laboratories, diagnostic centers, and academic research institutions. These facilities are adopting ISH technologies at a rapid pace, supported by the availability of high-quality reagents, automated imaging systems, and trained personnel. The presence of established pathology workflows and robust funding for molecular diagnostics further contributing to ISH adoption in routine clinical practice. Also, the strong presence of leading market players such as Thermo Fisher Scientific, Agilent Technologies, and Bio-Techne further drives the region’s dominance. These companies are consistently expanding their ISH portfolios, offering advanced probe kits, automation platforms, and image analysis software that improve testing accuracy and speed.

US In Situ Hybridization Market Insight

The US, in particular, dominated the regional market in 2024, due to the high incidence of cancer and genetic disorders in the country. According to the American Cancer Society, an estimated 2.04 million new cancer cases and 0.62 million cancer-related deaths are expected in the United States in 2025. This surge in disorders is increasing the demand for diagnostic tools capable of identifying genetic alterations with precision and reliability. ISH, particularly fluorescence-based techniques, is widely used across pathology labs to detect gene amplifications and translocations associated with solid tumors and hematologic malignancies. The country’s focus on early detection and precision therapy is further driving the integration of ISH into routine diagnostic workflows. In addition, federal initiatives aimed at enhancing genomic medicine adoption and funding research into rare diseases are also contributing to market expansion.

Asia Pacific ISH Market Assessment

The Asia Pacific In situ hybridization market is projected to witness fastest growth during the forecast period. This growth is fueled by the increasing investments in life sciences research and molecular diagnostics infrastructure across countries such as China, Japan, and South Korea. Governments and private institutions in these countries are boosting funding for genomic and molecular biology research, boosting the adoption of advanced techniques such as ISH. According to the latest report by the Mercator Institute for China Studies (MERICS), the National Natural Science Foundation of China (NSFC) allocated around USD 1.18 million, accounting for 34% of its total budget, to life science and healthcare research in support of basic research initiatives. China’s emphasis on building a domestic biotechnology sector and Japan’s focus on regenerative medicine are creating strong demand for ISH in both academic and clinical settings. Expanding national genomics programs and cancer screening initiatives are further boosting the region’s market growth.

Rapid expansion in diagnostic laboratories and academic research centers across the region is further accelerating the market growth. Hospitals and research institutions are investing in automated platforms, image analysis tools, and advanced probe technologies to meet increasing diagnostic and research needs. ISH is gaining ground in cancer diagnostics, virology studies, and developmental biology research, in university hospitals and centralized laboratories. Training programs and government-backed skill development initiatives are strengthening workforce capabilities, enabling more widespread use of ISH. Growing demand for precision diagnostics and translational research is propelling faster adoption of ISH technologies across the region.

Europe In Situ Hybridization Market Overview

Europe ISH market growth is driven by the strong government support for genomic medicine. Initiatives at both the EU and national levels, including Horizon Europe and country-specific precision medicine programs, are promoting the integration of genomics into clinical practice. Funding for research projects, infrastructure development, and collaborative innovation is pushing laboratories and hospitals to adopt molecular tools such as ISH. For example, in April 2025, the Swedish government announced funding of approximately USD 7.4 million for Genomic Medicine Sweden (GMS). The funding supports the ongoing efforts to advance and sustainably integrate precision medicine into healthcare, particularly in the fields of cancer, rare diseases, and microbiology. The presence of active biobanking programs, cancer registries, and pathology networks across the region is further enhancing the demand for spatially resolved molecular diagnostics.

Additionally, supportive regulatory environment further contributing to ISH market growth in Europe. Agencies such as the European Medicines Agency (EMA) and national regulatory bodies are setting quality benchmarks for diagnostic technologies used in clinical applications. This emphasis on validated, high-quality diagnostic tools increased the trust and adoption of ISH, particularly in oncology and genetic testing. Clinical laboratory tests are increasingly adopted by ISH to meet compliance standards for companion diagnostics and precision oncology. Combined with growing interest in personalized healthcare and biomarker-driven research, these regulatory and policy initiatives are driving market expansion across the region.

Key Players & Competitive Analysis Report

The in situ hybridization (ISH) market is characterized by growing competition, driven by continuous innovation, product portfolio expansion, and strategic collaborations among global and regional players. Companies in this space are actively investing in advanced probe technologies, automation platforms, and AI-based image analysis systems to meet the rising demand for accurate, scalable, and user-friendly diagnostic solutions. The competition is further intensified by the growing clinical emphasis on precision diagnostics, as laboratories seek tools that offer high spatial resolution, reproducibility, and compatibility with formalin-fixed paraffin-embedded (FFPE) tissues. Emerging technologies such as multiplex fluorescence labeling, digital pathology integration, and AI-driven data interpretation are transforming the market.

Prominent companies operating in the global in situ hybridization market include Abbott Laboratories, Inc., Advanced Cell Diagnostics, Inc., Agilent Technologies, Inc., Bio SB, Inc., Bio-Techne Corporation, BioCare Medical, LLC, BioGenex Laboratories, Inc., Bio-Rad Laboratories, Inc., BioView Ltd., F. Hoffmann-La Roche Ltd., Genemed Biotechnologies, Inc., Leica Biosystems Nussloch GmbH, Merck KGaA, Oxford Gene Technology IP Limited, and PerkinElmer, Inc.

Key Players

- Abbott Laboratories, Inc.

- Advanced Cell Diagnostics, Inc.

- Agilent Technologies, Inc.

- Bio SB, Inc.

- Bio-Techne Corporation

- BioCare Medical, LLC

- BioGenex Laboratories, Inc.

- Bio-Rad Laboratories, Inc.

- BioView Ltd.

- F. Hoffmann-La Roche Ltd.

- Genemed Biotechnologies, Inc.

- Leica Biosystems Nussloch GmbH

- Merck KGaA

- Oxford Gene Technology IP Limited

- PerkinElmer, Inc.

Industry Developments

April 2025: Leica Biosystems collaborated with Bio-Techne to integrate the RNAscope Multiomic LS Assay into Leica’s BOND RX research staining platform. This integration enables protease-free workflows for spatial multiomics, enhancing Leica’s capabilities in spatial biology and enabling precise, automated ISH applications for research use.

March 2025: Vitro Master Diagnostica signed a distribution agreement with Biocare Medical, LLC to introduce the NeoPATH Pro instrument in the U.S. market. The system is designed to support immunohistochemistry (IHC), in situ hybridization (ISH), and fluorescence ISH (FISH) workflows, broadening access to advanced diagnostic platforms.

February 2025: Bio-Techne expanded its RNAscope ISH probe portfolio, now offering over 70,000 unique probes spanning more than 450 species. This expansion supports comprehensive coverage of human and mouse transcriptomes, further strengthening spatial biology research applications.

In Situ Hybridization Market Segmentation

By Offering Outlook (Revenue, USD Million, 2020–2034)

- Consumables

- Instruments

- Services & Software

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Fluorescent In Situ Hybridization (Fish)

- Chromogenic In Situ Hybridization (Cish)

By Application Outlook (Revenue, USD Million, 2020–2034)

- Clinical Diagnostics

- Research Applications

- Drug Discovery & Development

By End User Outlook (Revenue, USD Million, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- Contract Research Organizations

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

In Situ Hybridization Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,546.93 Million |

|

Market Size in 2025 |

USD 1,652.46 Million |

|

Revenue Forecast by 2034 |

USD 3,015.57 Million |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,546.93 million in 2024 and is projected to grow to USD 3,015.57 million by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Abbott Laboratories, Inc., Advanced Cell Diagnostics, Inc., Agilent Technologies, Inc., Bio SB, Inc., Bio-Techne Corporation, BioCare Medical, LLC, BioGenex Laboratories, Inc., Bio-Rad Laboratories, Inc., BioView Ltd., F. Hoffmann-La Roche Ltd.

The clinical diagnostic segment dominated the market share in 2024.

The contract research organizations (CROs) segment is poised to witness the fastest growth during the forecast period.