Injection Molded Plastic Market Size, Share, Trends, Industry Analysis Report

By Raw Material [Acrylonitrile Butadiene Styrene (ABS), Polypropylene (PP), High-Density Polyethylene (HDPE)], By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM1060

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

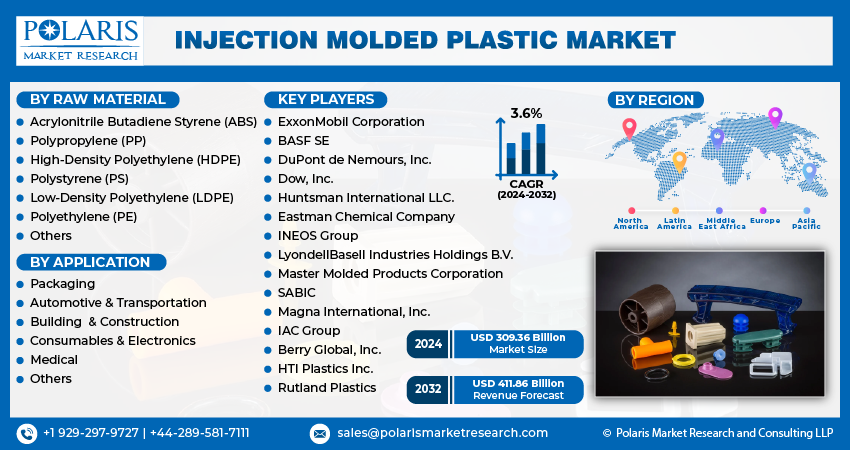

The injection molded plastic market size was valued at USD 338.70 billion in 2024 and is expected to register a CAGR of 3.4% from 2025 to 2034. The growing packaging industry globally propels the market growth. Further, the rising penetration of e-commerce platforms is expected to offer opportunities for the industry during the forecast period.

Key Insights

- The polypropylene (PP) segment dominated the market share in 2024. The leading position is attributed to its cost-effectiveness, and superior chemical resistance.

- The packaging segment dominated the revenue share in 2024. Rising demand for lightweight, durable, and cost-efficient packaging solutions across industries boosts the adoption of injection molded plastics across the segment.

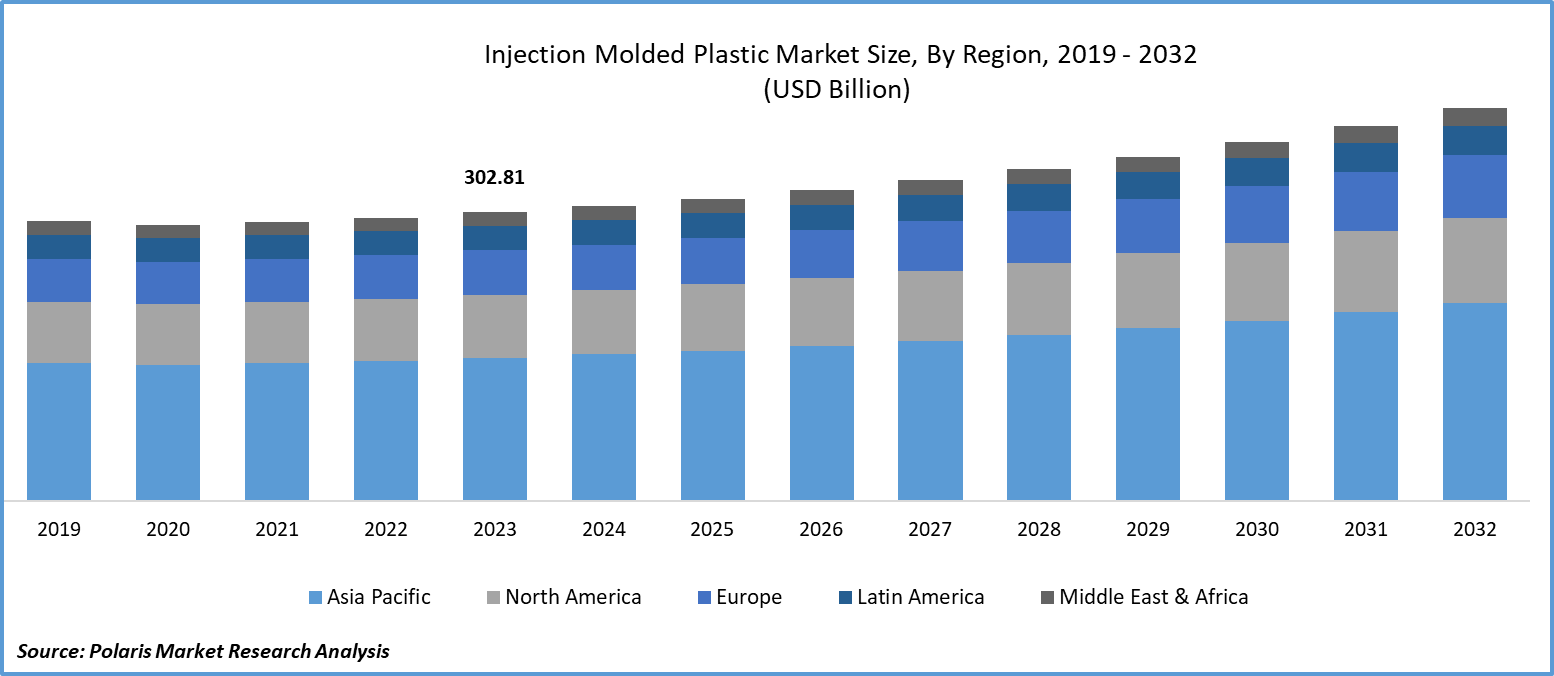

- In 2024, Asia Pacific accounted for the largest global revenue share. The regional industry growth is attributed to robust manufacturing base, rising urbanization, and increasing consumer demand across key industries such as automotive, packaging, and electronics.

- The North America market is expected to expand at a rapid pace in the coming years, owing to the technological advancements in precision molding and increasing adoption of high-performance polymers in the automotive and healthcare sectors.

Industry Dynamics

- Surging popularity and adoption of electric vehicles (EVs) boosts the demand for injection molded plastics.

- Rising demand for molded plastics from various end-use industries such as packaging, construction, agriculture, and automotive drives the industry growth.

- Increasing use of 3D printing technology in commercial applications is expected to provide lucrative opportunities for the industry during the forecast period.

- Imposition of stringent rules and regulations on plastic use hinders the market expansion.

Market Statistics

2024 Market Size: USD 338.70 Billion

2034 Projected Market Size: USD 471.35 Billion

CAGR (2025–2034): 3.4%

Asia Pacific: Largest market in 2024

AI Impact on Injection Molded Plastic Market

- AI technology is used in plastic injection molding to monitor parameter adjustments in real time. Its adoption helps in ensuring consistent and high-quality output. The AI technology helps reduce defects, minimizes the requirement for costly rework, and enhances production efficiency.

- The technology enables predictive maintenance as it analyzes data from sensors embedded in equipment. With the prediction of potential equipment malfunction, manufacturers can schedule maintenance proactively. It lowers downtime and optimizes production schedules.

- The adoption of AI plays a key role in optimizing energy consumption. AI tools are used to reduce scrap and minimize machine downtime. This benefit contributes to achieving sustainability goals and results in significant cost savings.

To Understand More About this Research:Request a Free Sample Report

Injection molding is a manufacturing process for the fabrication of plastic parts. The process uses an injection molding machine, raw plastic material, and a mold. The injection molding machine melts the plastic, which is then injected into the mold, cooled, and solidified into the final product. The injection molded plastic market is experiencing significant growth driven by several factors such as reduced labor costs, faster manufacturing speeds, reduced waste, and enhanced material flexibility. However, challenges such as increasing demand for bio-based polymers and concerns over environmental impact are hindering complete market expansion.

The growing packaging industry globally is propelling the injection molded plastic market growth. Injection molded plastics provide excellent protection for products, enhancing their shelf life and reducing damage during transit. The lightweight nature of these plastics also contributes to lower transportation costs, making them a cost-effective choice for packaging businesses. Additionally, advancements in plastic materials have led to the development of sustainable and recyclable options, aligning with the increasing demand for biodegradable packaging. According to data published by the Packaging Industry Association of India, the packaging sector in India was valued at USD 50.5 billion in 2019, and it is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7%. Therefore, the growing packaging industry globally is propelling the market revenue.

The demand for injection molded plastics is driven by the rising number of e-commerce platforms. E-commerce platforms rely heavily on durable, lightweight, and cost-efficient packaging materials to ship products safely and economically. Injection molded plastics provide the needed strength and precision required to ship products safely and economically through protective packaging components such as trays, inserts, containers, and closures. E-commerce platforms also drive innovation in packaging design, prompting businesses to create customized, brand-specific packaging that enhances customer experience. Injection molded plastics support this trend by allowing manufacturers to produce complex shapes, textures, and colors with high accuracy. Thus, the rising number of e-commerce platforms is fueling the injection molded plastic industry expansion.

Market Dynamics

Rising Adoption of Electric Vehicles Globally

EV manufacturers prioritize weight reduction to improve battery efficiency and vehicle range. Injection molded plastics provide an ideal solution by replacing heavier metal parts without compromising structural integrity or performance. Automakers use injection molded plastics in interior panels, housings, brackets, battery casings, and various under-the-hood components to enhance energy efficiency. Electric vehicles also require advanced thermal management and electrical insulation, which injection molded plastics deliver. Additionally, electric vehicles are equipped with modern and sleek interiors, which injection molding provides through customizable and aesthetically appealing plastic components. As per the data published by the International Energy Agency, electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. Hence, the rising adoption of electric vehicles globally is fueling the injection molded plastic market expansion.

Growing Urbanization Worldwide

The construction of residential and commercial buildings is increasing with the growing urbanization. The World Economic Forum, in its report, stated that the global urban population is set to increase by 2.5 billion by 2050. Injection molded plastics offer a versatile solution for various construction components, including pipes, fittings, and insulation materials. The lightweight nature and resistance to corrosion make injection molded plastics ideal for modern urban infrastructure, which requires efficient and sustainable building solutions. Urbanization also drives the expansion of healthcare facilities and services, further boosting the demand for injection molded plastics. Connected medical devices, disposables, and packaging solutions often utilize these plastics due to their biocompatibility, sterility, and precision in manufacturing. Moreover, urbanization leads to an increased demand for consumer goods and appliances, which heavily rely on injection molded plastic parts. Thus, the growing urbanization worldwide is driving the market expansion.

Segment Insights

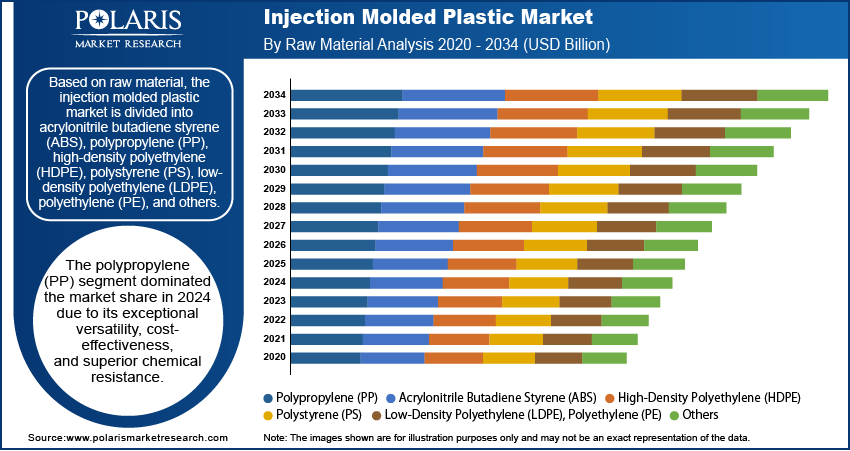

Market Evaluation by Raw Material

Based on raw material, the market is divided into acrylonitrile butadiene styrene (ABS), polypropylene (PP), high-density polyethylene (HDPE), polystyrene (PS), low-density polyethylene (LDPE), polyethylene (PE), and others. The polypropylene (PP) segment dominated the injection molded plastic market share in 2024 due to its exceptional versatility, cost-effectiveness, and superior chemical resistance. Manufacturers across the automotive, consumer goods, and packaging industries increasingly favored PP due to its lightweight nature and high impact strength, which enhanced fuel efficiency in vehicles and reduced transportation costs in logistics. Its ease of processing and recyclability also align with the rising demand for sustainable and economically viable plastic solutions. These advantages made it the preferred choice for a wide array of applications, contributing significantly to its segment dominance during the year.

The acrylonitrile butadiene styrene (ABS) segment is expected to grow at a robust pace in the coming years, owing to its rising adoption in the automotive and electronics sectors. ABS combines strength, rigidity, and aesthetic appeal, making it ideal for interior car components, dashboards, and consumer electronic housings. Furthermore, the rapid expansion of the electric vehicle and increased consumer demand for high-performance electronics have amplified the need for materials that offer superior dimensional stability and heat resistance, qualities inherent in ABS. These trends position ABS as a key raw material segment.

Market Insight by Application

In terms of application, the market is segregated into packaging, automotive & transportation, building & construction, consumables & electronics, medical, and others. The packaging segment dominated the market share in 2024 due to rising demand for lightweight, durable, and cost-efficient packaging solutions across industries. Food and beverage companies, in particular, increasingly rely on plastic packaging to ensure product safety, extend shelf life, and reduce transportation costs. The booming e-commerce sector also fueled the need for protective packaging that balances strength with minimal material usage. Furthermore, advancements in sustainable and recyclable plastics provided packaging manufacturers with new opportunities to meet growing consumer and regulatory demands for eco-friendly solutions, strengthening the segment’s market leadership.

Regional Outlook

By region, the injection molded plastic market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to its robust manufacturing base, rising urbanization, and increasing consumer demand across key industries such as automotive, packaging, and electronics. China led the region, supported by its vast industrial infrastructure, low production costs, and strong domestic consumption. The government of China's investments in expanding manufacturing capabilities and promoting industrial automation further fueled growth. Additionally, rapid economic development in India and Southeast Asia contributed to a surge in demand for affordable, high-performance plastic components, consolidating Asia Pacific's dominance in the global market.

The market in North America is expected to expand at a rapid pace in the coming years, owing to the technological advancements in precision molding, increasing adoption of high-performance polymers in the automotive and healthcare sectors, and growing investments in sustainable material innovation. US-based companies are continuously pushing the boundaries of lightweighting in vehicle design and medical device development, creating demand for complex, durable plastic components. Moreover, the region’s strict environmental regulations are accelerating the shift toward recyclable and bio-based materials, which aligns with growing consumer and industrial sustainability goals. These factors position North America as a key region in the market.

Key Players and Competitive Analysis

The injection molded plastic market is highly competitive, with key players leveraging mergers and acquisitions (M&A), collaborations, and strategic partnerships to enhance product portfolios and expand market reach. Major companies have aggressively pursued M&A to consolidate their positions. Collaborations between industry leaders and research institutions are also shaping the market. Strategic partnerships are further driving innovation and commercialization. To expand and survive in a more competitive and rising market climate, the injection molded plastic industry must offer cost-effective products.

The market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are ALPLA; AptarGroup, Inc.; BASF SE; Berry Global, Inc.; Dow, Inc.; DuPont de Nemours, Inc.; Eastman Chemical Company; ExxonMobil Corporation; Heppner Molds; HTI Plastics Inc.; Huntsman International LLC.; IAC Group; INEOS Group; LACKS ENTERPRISES, INC.; LyondellBasell Industries Holdings B.V.; Magna International, Inc.; Master Molded Products Corporation; Rutland Plastics; SABIC; and The Rodon Group.

BASF SE is a chemical corporation that operates all over the world through seven segments—chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. Injection molded plastic and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. In February 2022, BASF expanded its European portfolio with Solvay's polyamide acquisition, offering advanced plastics such as Ultramid One J for diverse industrial applications.

Dow Inc., operating through its subsidiaries, is a provider of materials science solutions worldwide, catering to diverse industries such as packaging, mobility, infrastructure, and consumer applications. The company's operations are organized into three main segments: Industrial Intermediates & Infrastructure, Packaging & Specialty Plastics, and Performance Materials & Coatings. The Packaging & Specialty Plastics segment focuses on delivering a range of products, including ethylene, propylene, polyethylene, and elastomers for applications in mobility, transportation, consumer goods, wire and cable, and construction. The company is headquartered in Midland, Michigan, and has a global presence, serving markets in the US, Canada, Europe, the Middle East, Africa, India, Asia Pacific, and Latin America. In June 2024, Dow launched Revoloop Recycled Plastics Resins for non-food packaging, enhancing circularity with up to 100% post-consumer recycled content.

List of Key Companies

- ALPLA

- AptarGroup, Inc.

- BASF SE

- Berry Global, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- ExxonMobil Corporation

- Heppner Molds

- HTI Plastics Inc.

- Huntsman International LLC.

- IAC Group

- INEOS Group

- LACKS ENTERPRISES, INC.

- LyondellBasell Industries Holdings B.V.

- Magna International, Inc.

- Master Molded Products Corporation

- Rutland Plastics

- SABIC

- The Rodon Group

Injection Molded Plastic Industry Developments

May 2024: ALPLA, a global leader in the development and production of plastic packaging solutions, announced that it had strengthened its injection molding business with the new ALPLAinject division.

September 2023: PulPac announced the launch of the world’s first injection molding machine platform, Scala. The Scala platform is based on technology associated with plastic conversion.

March 2023: Nexa3D Acquired Addifab, the parent company of Freeform Injection Molding, to expand its offering and material capabilities.

Injection Molded Plastic Market Segmentation

By Raw Material Outlook (Revenue, USD Billion, 2020–2034)

- Acrylonitrile Butadiene Styrene (ABS)

- Polypropylene (PP)

- High-Density Polyethylene (HDPE)

- Polystyrene (PS)

- Low-Density Polyethylene (LDPE)

- Polyethylene (PE)

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Packaging

- Automotive & Transportation

- Building & Construction

- Consumables & Electronics

- Medical

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Injection Molded Plastic Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 338.70 Billion |

|

Market Forecast in 2025 |

USD 349.47 Billion |

|

Revenue Forecast in 2034 |

USD 471.35 Billion |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 338.70 billion in 2024 and is projected to grow to USD 471.35 billion by 2034.

The global market is projected to register a CAGR of 3.4% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are ALPLA; AptarGroup, Inc.; BASF SE; Berry Global, Inc.; Dow, Inc.; DuPont de Nemours, Inc.; Eastman Chemical Company; ExxonMobil Corporation; Heppner Molds; HTI Plastics Inc.; Huntsman International LLC.; IAC Group; INEOS Group; LACKS ENTERPRISES, INC.; LyondellBasell Industries Holdings B.V.; Magna International, Inc.; Master Molded Products Corporation; Rutland Plastics; SABIC; and The Rodon Group.

The packaging segment dominated the market revenue in 2024.

The acrylonitrile butadiene styrene (ABS) segment is expected to grow at the fastest pace in the coming years.