Insurtech Market Size, Share, Trends, & Industry Analysis Report

By Deployment Model (On-Premise, Cloud), By Insurance Type, By Technology, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 113

- Format: PDF

- Report ID: PM1825

- Base Year: 2024

- Historical Data: 2020-2023

What is Insurtech Market Size?

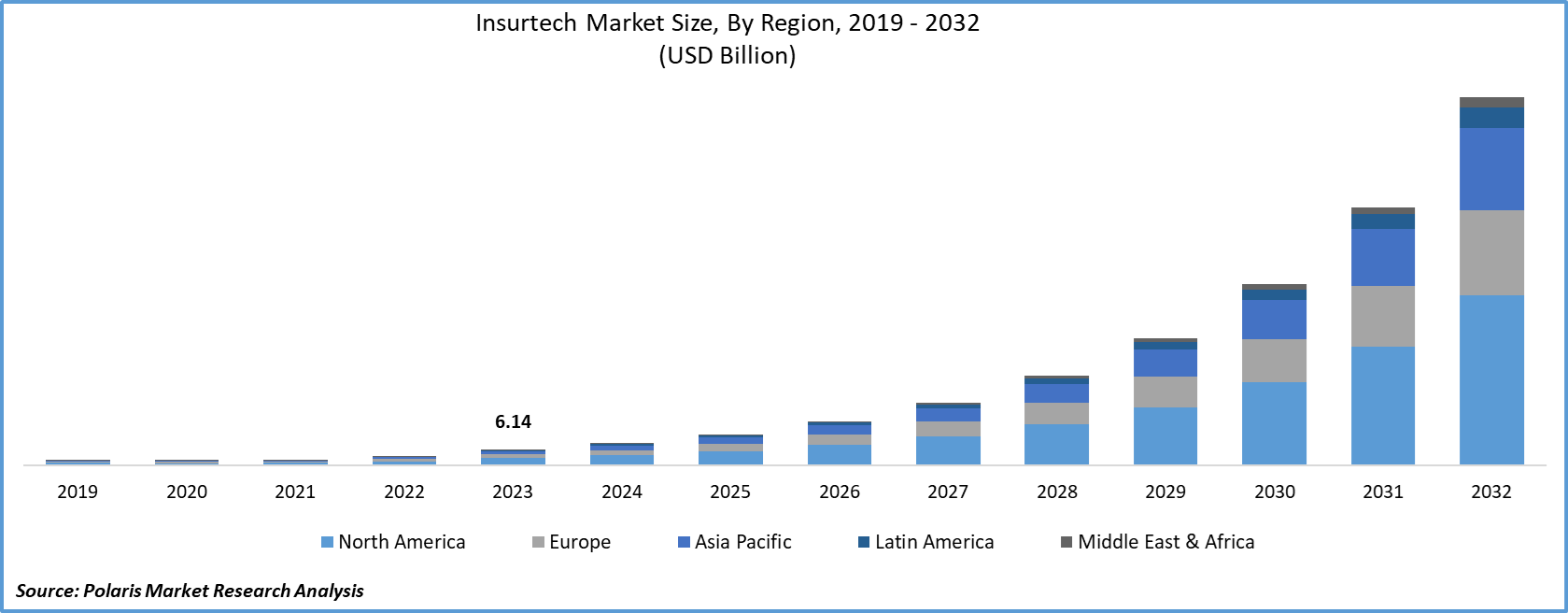

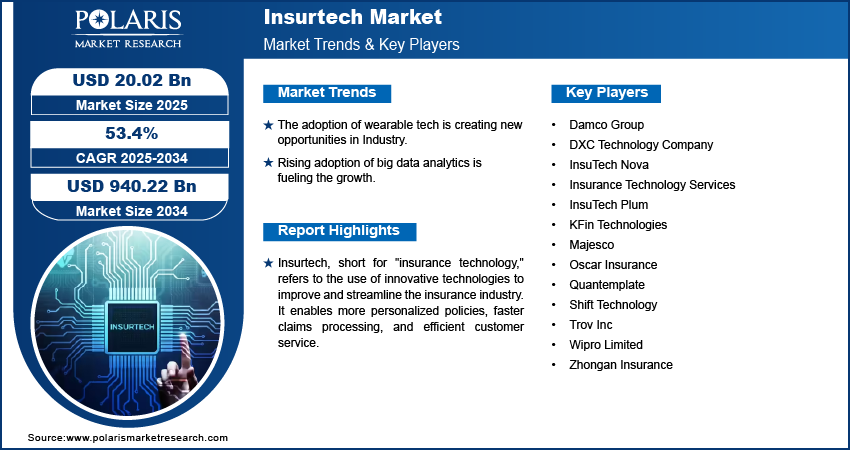

The global insurtech market size was valued at USD 13.16 billion in 2024. The market is anticipated to exhibit the CAGR of 53.4% during the forecast period. The growth is driven by rising adoption of big data analytics, rising usage of smartphones, and technological advancement.

Key Insights

- The blockchain technology is expected to witness significant growth during the forecast period due to its transparency and trust.

- The health insurance dominated with largest share in 2024 due to rising consumers demand and urgency.

- North America dominated with largest share in 2024 due to the need for automation of insurance operations.

- Asia Pacific is projected to accounted for a significant share in the global market due to due to large undeserved population base.

Industry Dynamics

- The adoption of wearable tech is creating new opportunities in Industry.

- Rising adoption of big data analytics is fueling the growth.

- The growing usage of mobile devices and social media is driving the growth.

- Stringent regulatory compliance and data privacy concerns limiting rapid innovation and adoption.

Market Statistics

- 2024 Market Size: USD 13.16 Billion

- 2034 Projected Market Size: USD 940.2 Billion

- CAGR (2025-2034): 53.4%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Automates and accelerates claims assessment and reduce turnaround time and human error.

- Improves fraud detection by detecting suspicious patterns and points out potential fraud with high accuracy.

- Improves consumer service by handling queries 24/7.

Insurtech, short for "insurance technology," refers to the use of innovative technologies to improve and streamline the insurance industry. It enables more personalized policies, faster claims processing, and efficient customer service. Insurtech companies often challenge traditional insurers by offering digital-first, customer-centric solutions

There has been a massive increase in data generation owing to the increased adoption of mobile devices and social media. Data availability allows a company to follow customer behavior and obtain insights to improve the customer experience and provide better services. As insurtech becomes more widely used, it enables more effective decision-making and the implementation of creative business strategies to meet the expanding needs in the global insurance market.

Insurtech has simplified micropayments for consumers owing to the increased adoption of mobile phones and wearable tech. Key players operating in the Insurtech market are developing micropayment systems to service consumers in regions with low insurance penetration levels. Insurtech enables the development of platforms offering one-stop solutions for customers for purchase, payments, servicing, and interaction with social media. Insurance companies are developing self-directed solutions for customer acquisition and customer service to cater to the growing demand for online and mobile channels. Customer-centric solutions are increasingly used for enhanced user experience, transaction efficiency, and transparency. Rising consumer demands for efficient services and personalized solutions are leading to the emergence of Usage-based Insurance (UBI) models.

Industry Dynamics

Growth Drivers

What Factors are Driving the Insurtech Market Growth?

The adoption of wearable tech has increased significantly over the past few years, leading to insurtech being implemented in the telemedicine market. The demand for insurtech is expected to increase considerably in the healthcare sector during the forecast period. Implementation of insurtech enables data gathering by carriers for risk mitigation and improving customer experience. Integration of technologies such as big data analytics, cloud computing, and IoT assists in avoiding the development of chronic health conditions while resulting in considerable savings in claims. Digitization of complete healthcare data would provide a healthy ecosystem to manage risks and customer engagement. Growing adoption of genomic and epigenetic technology in the market for biological age determination would alter the costing and execution of life policies. Some companies operating in this segment of the insurtech market include Babylon, Discovery Vitality, Good Doctor, and Wellthy Therapeutics, among others. Greater availability of transactional data is fueling increased adoption of data analytics in insurtech to minimize risks, reduce costs, optimize profits, and offer enhanced customer services and customized solutions. The move towards data analytics for customer analytics, marketing analytics, etc., enables companies to provide personalized customer solutions while improving operating efficiency and profits. The growing adoption of artificial intelligence simplifies and improves onboarding and customer service, claims settlement experience, fraud prevention, and anti-money laundering.

Report Segmentation

The market is primarily segmented based on insurance type, deployment mode, technology, end-use, and region.

|

By Insurance Type |

By Deployment Model |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Which Segment By Insurance Type Dominated with Largest Share in 2024?

The health insurance dominated with largest share in 2024 due to rising consumers demand and urgency. Health insurance is considered as one a non-discretionary expense, especially in countries without universal healthcare, which ensures consistent demand year-round. This growth is also driven by rising prevalence of chronic disorder and ageing population. Moreover, many governments worldwide have mandated health insurance coverage for instance Indian Government’s Auyushman Bharat and U.S. ACA. This government mandate is further fueling the demand for the health insurance. Increasing digital adoption is boosting the demand for insurtect in healthcare insurance, thereby driving the segment growth.

Why Blockchain Adoption is Rising in Insurtech Industry?

The blockchain technology is expected to witness significant growth during the forecast period due to its transparency and trust. Blockchain creates a tamper-proof, decentralized ledger of all transactions and policy changes. This in turn is fueling the adoption of the technology in the Insurtech sector. Rising cases of fraud is also driving the adoption of the technology. Blockchain technology enables verification of customer identities, document authenticity, and claim histories across networks which makes it harder to manipulate or duplicate information. Moreover, rising focus on efficiency in the major sectors is further driving the demand for the technology, thereby driving the segment growth.

Geographic Overview

How North America Captured Largest Market Share in 2024?

North America market dominated the global insurtech market in 2024 due to a significant increase in the need for automation of insurance operations, timely services, and improved efficiency, businesses are increasingly turning towards insurtech solutions. Established internet infrastructure in the region combined with increasing integration of advanced technologies in the insurance sector fuels the growth of the market for insurtech in the region.

What is Reason for Asia Pacific's Significant Growth?

The Asia Pacific is expected to witness significant growth during the forecast period due to large undeserved population base. A significant portion of the APAC population in countries such as India, Vietnam, Indonesia, and Philippines remains underinsured or uninsured. Government in these countries are aiming to cover insurance these population, which in turn is driving the demand for the Insurtech. Insurtechs are addressing this protection gap by offering affordable, accessible, and digital-first insurance products. Moreover, rising smartphone and internet penetration in the region is further improving the accessibility in urban as well as rural areas, due to which the demand for microinsurance and usage-based models is growing, thereby fueling the growth in the region. .

Who are the Major Players in Insurtech Market?

The leading players in the insurtech market include Damco Group, DXC Technology Company, InsuerTech Nova, Insurance Technology Services, InuserTech Plum, KFin Technologies, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Trov, Inc., Wipro Limited, and Zhongan Insurance. These players collaborate with other market leaders to expand their offerings and acquire new customers.

Recent Development

- October 2025, DXC Technology launched the DXC APEX Program to simplify integration between insurers and certified InsurTech providers. The program accelerated innovation, reduced costs, and enhanced efficiency across the insurance value chain using DXC’s Assure Platform..

- September 2025, Manchester-based insurtech startup Veridox raised USD 1.34 million to launch its AI-powered forensic fraud detection platform. The technology quickly identified potential document manipulation, helping insurers accelerate investigations and reduce fraud losses with clear explanations for detected risks.

- June 2023: Clover Health announced consensus to resolve derivative litigation, settling all endured civil litigation connected to its de-SPAC transaction. These lawsuits are unsettled in Delaware, New York, and Tennessee courts.

- March 2024: CNB bank and trust NA associated with Insuritas to launch CNB Insurance Services, its embedded full-service insurance agency. Through the association, CNB is now capable of offering its customers the auto, home, commercial, and ancillary insurance commodities they buy every year. It deepens wallet allocation and structuring a vital source of annuitizing non-interest income.

Insurtech Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.16 Billion |

| Market size value in 2025 | USD 20.02 Billion |

|

Revenue forecast in 2034 |

USD 940.22 Billion |

|

CAGR |

53.4% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 - 2034 |

|

Segments covered |

By Insurance Type, By Deployment Mode, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Damco Group, DXC Technology Company, InsuerTech Nova, Insurance Technology Services, InuserTech Plum, KFin Technologies, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Trov, Inc., Wipro Limited, and Zhongan Insurance. |

Uncover the dynamics of the Insurtech Market sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Extruded Polystyrene Market Size, Share 2024 Research Report

Healthcare Contract Research Organization Market Size, Share 2024 Research Report

EV Connector Market Size, Share 2024 Research Report

FAQ's

• The market size was valued at USD 13.16 Billion in 2024 and is projected to grow to USD 940.22 Billion by 2034.

• The market is projected to register a CAGR of 53.4% during the forecast period.

• A few of the key players in the market are Damco Group, DXC Technology Company, InsuerTech Nova, Insurance Technology Services, InuserTech Plum, KFin Technologies, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Trov, Inc., Wipro Limited, and Zhongan Insurance.

• The health insurance segment accounted for the largest market share in 2024.

• The blockchain technology segment is expected to record significant growth.