Integrated Cloud Management Platform Market Size, Share, Trends, & Industry Analysis Report

By Component (Solutions and Services), By Deployment, By Enterprise Size, Application, End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6088

- Base Year: 2024

- Historical Data: 2020-2023

Overview

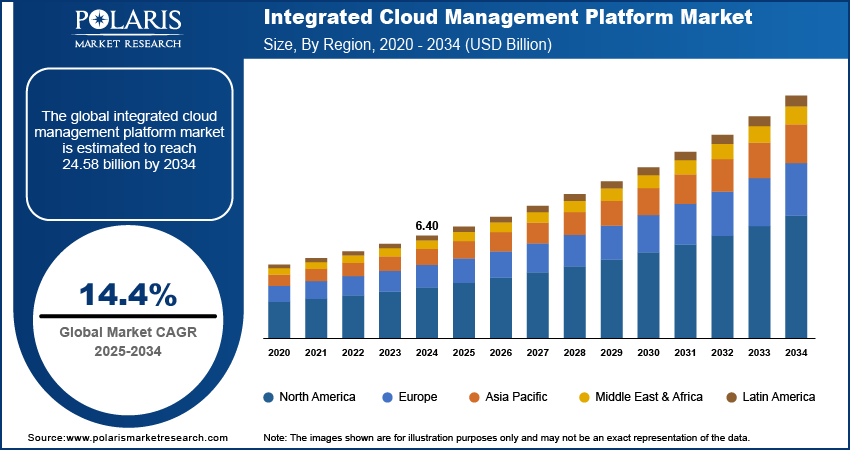

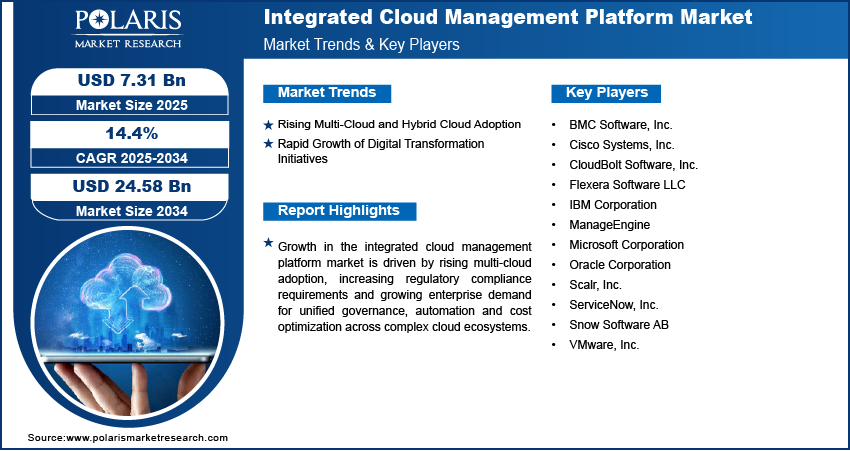

The global integrated cloud management platform market size was valued at USD 6.40 billion in 2024, growing at a CAGR of 14.4% from 2025–2034. Rising adoption of multi-cloud and hybrid cloud architectures, coupled with the rapid growth of digital transformation initiatives is driving demand for integrated cloud management platforms that enable unified visibility, seamless workload orchestration and efficient governance across distributed IT environments.

Key Insights

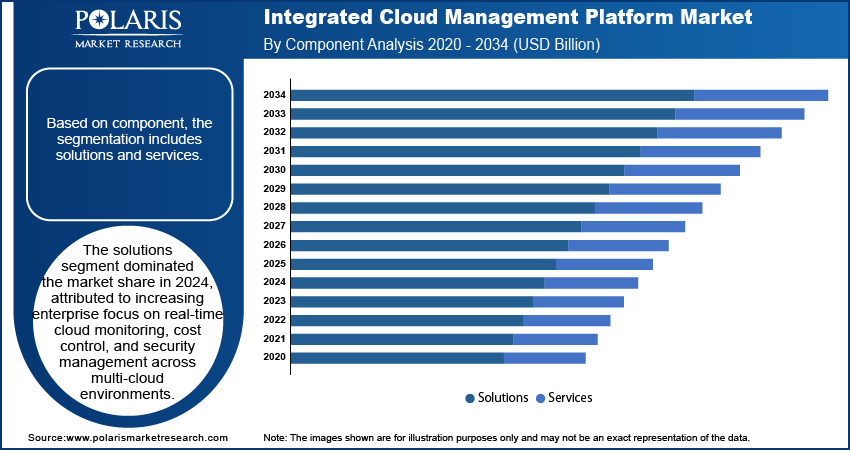

- The solutions segment dominated the integrated cloud management platform market share in 2024.

- The services segment is projected to grow at the fastest CAGR, driven by increasing demand for cloud lifecycle management, configuration support, and regulatory compliance services.

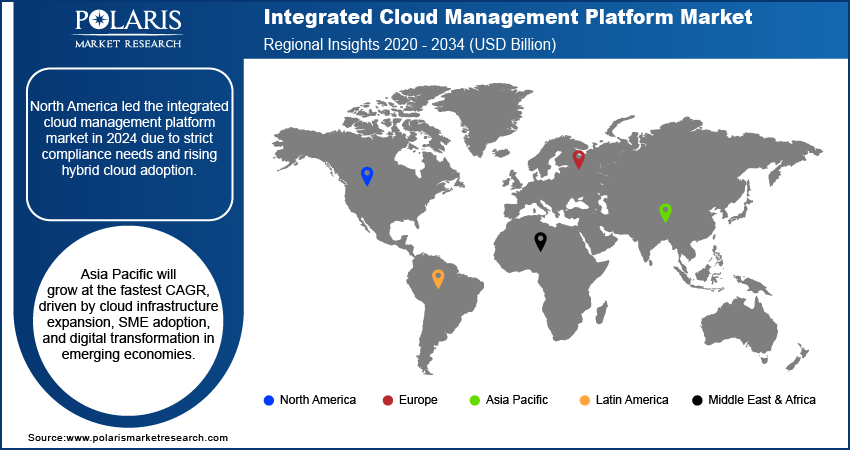

- The North America integrated cloud management platform market dominated the global market share in 2024.

- The U.S. integrated cloud management platform market held the largest regional share of the North America market in 2024, fueled by early adoption of hybrid cloud strategies and strong focus on data governance and automation.

- The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period, owing to rapid cloud infrastructure development and increasing enterprise investments in centralized cloud governance tools.

- The China integrated cloud management platform market is expanding steadily, driven by national digitalization initiatives, the growth of domestic cloud providers and rising demand for platform-based multi-cloud management across public and private sectors.

Industry Dynamics

- Rising multi-cloud and hybrid cloud adoption is driving the demand for integrated cloud management platforms, as enterprises seek unified solutions to manage diverse infrastructure environments while ensuring operational consistency and control.

- Rapid growth of digital transformation initiatives across industries is accelerating the deployment of these platforms to support agile IT operations, centralized policy enforcement and seamless cloud integration.

- Increasing adoption of AI-driven automation and AIOps is enabling predictive analytics, self-healing capabilities, and intelligent workload optimization, which opens up value-added service opportunities.

- High implementation complexity and integration challenges are hindering adoption among small and medium-sized enterprises.

Market Statistics

- 2024 Market Size: USD 6.40 billion

- 2034 Projected Market Size: USD 24.58 billion

- CAGR (2025-2034): 14.4%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Integrated cloud management platforms, also known as unified cloud management systems, are centralized software solutions designed to manage and optimize multi-cloud and hybrid cloud environments. These platforms enable organizations to monitor, automate, and govern their cloud infrastructure through a single interface. Key benefits include improved operational visibility, reduced cloud sprawl, optimized resource utilization and enhanced compliance across various regulatory frameworks. Enterprises use these platforms to manage workloads across public, private and edge cloud systems while ensuring consistent policy enforcement and data security. The applications span across IT operations, financial services, manufacturing, government and retail sectors, where managing multiple cloud vendors and services is essential for operational continuity and cost control.

The deployment of integrated cloud management platforms is accelerating due to the increasing need for centralized control, cost optimization and improved risk management in cloud operations. Growing regulatory initiatives focusing on data security, transparency, and service reliability are influencing enterprises to implement integrated solutions that streamline governance and compliance. For instance, in March 2024, the U.S. National Institute of Standards and Technology (NIST) released the official 2.0 version of the Cyber Security Framework (CSF) for cloud infrastructure management guidelines, which are driving enterprises to upgrade to advanced platforms. In addition, vendors are offering AI-enabled features such as automated orchestration, predictive analytics and real-time anomaly detection to reduce manual intervention and improve system efficiency. This transition toward consolidated cloud operations is enabling organizations to meet performance goals while minimizing overhead and complexity.

The evolution of integrated cloud management platforms is shaped by the growing need for real-time analytics, cross-platform visibility and intelligent workload orchestration. Vendors are incorporating advanced telemetry, cloud-native monitoring and policy-based automation to support dynamic resource allocation and service continuity across complex environments. These technologies are helping reduce manual oversight, improve system responsiveness and enable data-driven decision-making for enterprise IT teams. Additionally, integration with DevOps pipelines and infrastructure-as-code frameworks is streamlining configuration management and accelerating application delivery cycles. As enterprise architectures become more decentralized, the ability to unify operational control, maintain configuration consistency and enforce security baselines is driving further innovation in platform capabilities.

Drivers & Opportunities

Rising Multi-Cloud and Hybrid Cloud Adoption: The increasing use of multi-cloud and hybrid cloud environments is driving strong demand for integrated cloud management platforms. In May 2025, Informatica introduced Agentic AI capabilities on its unified AI-powered cloud data management platform to enhance automation, governance, and centralized control across hybrid and multi-cloud environments. Enterprises are deploying workloads across multiple public and private clouds to enhance flexibility, scalability and resilience. However, managing these distributed environments requires unified platforms that offer centralized control, real-time visibility and consistent policy enforcement. Integrated solutions help reduce complexity by consolidating infrastructure monitoring, cost tracking and security management within a single interface. This trend is accelerating adoption across sectors such as finance, manufacturing and telecommunications, where workload mobility, vendor interoperability and operational efficiency are critical for long-term cloud strategy execution.

Rapid Growth of Digital Transformation Initiatives: The global acceleration of digital transformation initiatives is fueling the adoption of integrated cloud management platforms. The EU Commission announced a USD 1.42 billion investment under its Digital Europe Programme (2025–2027) to boost digital skills, AI, and cybersecurity. The funding aims to speed up the adoption of key digital technologies and strengthen Europe’s tech independence. Enterprises are shifting toward cloud-native infrastructure to support automation, remote operations and modern application development. This shift is creating demand for platforms that streamline resource orchestration, ensure regulatory compliance and support continuous deployment across hybrid environments. Integrated solutions allow IT teams to manage complex cloud ecosystems while minimizing downtime, improving cost control and securing data assets. The rising adoption of integrated cloud platforms enables enterprise-wide digital resilience and operational standardization across global locations, due to businesses prioritize agile operations and scalable infrastructure.

Segmental Insights

Component Analysis

Based on component, the segmentation includes solutions and services. The solution segment dominated the market in 2024, due to the rising demand for centralized tools that offer resource monitoring, cost tracking and security management. Enterprises are rapidly investing in platform-based solutions to manage multi-cloud operations efficiently. These solutions provide comprehensive visibility, automation and policy enforcement across cloud environments. Large organizations are deploying solutions to enhance control over their hybrid infrastructure. Thus, vendors are continuously updating platforms with AI capabilities and predictive analytics. This made solutions suitable for addressing operational complexity, compliance and governance needs in regulated sectors such as finance, telecom, and public administration.

The services segment is projected to grow at the fastest CAGR during the forecast period, due to rising enterprise dependency on managed services, consulting and support for cloud integration. The organizations are facing challenges in handling complex multi-cloud environments due to limited in-house capabilities. This is increasing reliance on third-party service providers for the implementation, optimization, and maintenance of cloud management platforms. The service providers are expanding their offerings to include customization, training and real-time technical support due to rapidly rising digital transformation in end-use industries. These factors are contributing to increasing service demand across small and mid-sized businesses in emerging economies.

Deployment Analysis

By deployment, the segment includes public cloud, private cloud, and hybrid cloud. The public cloud segment dominated the market in 2024, due to the growing use of cloud-native applications, scalable computing, and pay-as-you-go pricing models. Enterprises offer public cloud environments for hosting high-volume workloads without investing in on-premise infrastructure. This trend is strong among technology-driven sectors such as BFSI, telecom, and e-commerce. Integrated cloud management platforms are used to monitor public cloud services, manage billing and ensure compliance. Key players are offering specialized public cloud management modules to address cost visibility, usage analytics and risk mitigation.

The hybrid cloud segment is projected to grow at the fastest CAGR during the forecast period, as enterprises shift toward flexible architectures combining private and public cloud infrastructure. Integrated platforms are critical in hybrid environments for managing workload portability, policy enforcement and seamless connectivity. Industries such as healthcare, manufacturing and government are increasingly adopting hybrid models to meet security, performance and compliance requirements. The need for operational continuity across on-premise and off-premise systems is driving strong interest in platforms that manage complex hybrid workloads. These platforms further enable organizations to modernize legacy systems while maintaining infrastructure control.

Enterprise Size Analysis

Based on enterprise size, the segmentation includes small and medium-sized enterprises (SMEs) and large enterprises. The large enterprises segment accounted for the highest market share in 2024. This is due to their extensive multi-cloud strategies and high investment capacity in infrastructure modernization. These organizations are deploying integrated platforms to manage diverse cloud environments, automate operations, and meet regulatory requirements. Large enterprises require advanced functionalities such as real-time analytics, role-based access, and unified dashboards to support global operations. The growing volume of cloud-native applications and distributed teams is further increasing the demand for centralized cloud management. Market leaders in telecom, banking, and manufacturing are implementing enterprise-grade platforms to improve operational efficiency and security across global data environments.

The small and medium-sized enterprises (SMEs) segment is projected to grow at the fastest CAGR during the forecast period, due to rising cloud adoption and the need for simplified IT management tools. SMEs are looking for cost-effective platforms that offer automation, governance, and performance visibility without high implementation complexity. Cloud vendors are offering tailored solutions for SMEs, including managed services and subscription-based pricing. These platforms are helping SMEs enhance operational agility, ensure compliance, and control IT spending. Growing startup activity and digital adoption in developing countries are also driving demand for integrated cloud platforms among small and mid-sized firms.

Application Analysis

Based on application, the segmentation includes performance monitoring, cost management and optimization, security and compliance, workload and resource management, cloud automation and orchestration, and backup and disaster recovery. The cost management and optimization segment dominated the market in 2024, due to the growing need among enterprises to monitor cloud spending and avoid resource over-provisioning. Integrated cloud platforms enable financial visibility by tracking usage patterns, detecting idle resources, and providing cost forecasting. With rising cloud expenditure, organizations are prioritizing tools that company with resource usage with budget constraints. This segment is growing popular across large enterprises and managed service providers that operate across multiple cloud environments. Features such as cost dashboards, chargeback mechanisms, and budget alerts are key factors contributing to its dominance in the current market landscape.

The cloud automation and orchestration segment is projected to grow at the fastest CAGR during the forecast period, driven by increasing demand for faster provisioning, reduced manual errors, and improved service delivery. Enterprises are automating infrastructure workflows to streamline cloud operations and enhance scalability to offer pre-configured templates, task schedulers and policy-driven automation are witnessing growing adoption. For instance, in February 2025, OpsNow announced "OpsNow Prime," an AI-powered hybrid cloud management platform that unifies public cloud and on-premise operations. It offers real-time cost optimization, automated workflows, and GPU resource management to enhance efficiency and support global expansion. This trend is visible in IT, telecom, and financial sectors, where continuous deployment and workload optimization are critical. As businesses move toward infrastructure-as-code models, the demand for automation-enabled platforms is expected to grow significantly across global markets.

End User Analysis

By end user, this segment includes BFSI, IT and telecom, healthcare and life sciences, retail and e-commerce, government and public sector, energy and utilities, manufacturing, media and entertainment, and others. The IT and telecom segment dominated the market in 2024, owing to its complex and large-scale cloud infrastructure that requires centralized control and automation. Integrated platforms help telecom providers manage distributed workloads, optimize bandwidth allocation, and ensure security compliance. In the IT sector, these platforms are used to support DevOps operations, manage multi-tenant environments, and maintain service uptime. With high dependence on public and hybrid clouds, this sector prioritizes tools that offer real-time monitoring, configuration management, and workload mobility. The segment continues to lead in platform adoption due to its advanced cloud maturity and need for operational agility.

The healthcare and life sciences segment is projected to grow at the fastest CAGR during the forecast period, fueled by the increasing digitalization of healthcare systems, regulatory complexity, and the need for secure data handling. Integrated cloud platforms are enabling hospitals, clinics, and research institutions to manage electronic health records, imaging systems, and clinical applications in a compliant and efficient manner. In March 2025, Boehringer Ingelheim and Cognizant launched a unified cloud management platform aimed at accelerating the development and delivery of innovative therapies. This platform enables streamlined data integration, improved collaboration and faster decision-making across Boehringer’s global operations. The platforms support interoperability, automate compliance checks, and safeguard sensitive data under frameworks such as HIPAA and GDPR. As healthcare providers adopt cloud infrastructure to support telehealth, diagnostics, and genomics research, the demand for integrated cloud management is expected to increase rapidly.

Regional Analysis

North America integrated cloud management platform market dominated the global market in 2024. This is driven by high adoption of multi-cloud and hybrid cloud infrastructure across enterprises such as BFSI, healthcare and telecom to enhance visibility, reduce operational silos and improve control. Moreover, strict regulatory frameworks from institutions such as National Institute of Standards and Technology (NIST), Federal Information Security Management Act (FISMA) and others are pushing enterprises to adopt integrated platforms to ensure continuous compliance, data protection and secure workload distribution across distributed cloud environments.

The U.S. Integrated Cloud Management Platform Market Insight

The U.S. held a dominating market share in North America integrated cloud management platform landscape in 2024, driven by widespread deployment of multi-cloud strategies across sectors such as financial services, healthcare, and government. As an example, in May 2025, Apono expanded its unified cloud access management platform to enhance the security of both human and non-human identities across multi-cloud environments. This enables organizations to manage permissions at scale with greater speed and precision, fueling secure and automated access control across distributed cloud infrastructure. These enterprises are adopting integrated platforms to ensure operational resilience, real-time visibility, and policy control across complex cloud environments. Moreover, increasing federal frameworks such as FedRAMP and the revised NIST guidelines are increasing enterprise focus on compliance, security automation, and centralized management of public, private, and edge cloud systems.

Asia Pacific Integrated Cloud Management Platform Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is witnessed due to the expanding cloud service investments across emerging economies including India, China, and Indonesia. Enterprises in these countries are focusing on modernizing IT infrastructure through cloud-native applications and cross-platform integration. In addition, rising focus on national digital transformation programs such as India’s Digital India and China’s Smart City initiatives is accelerating demand for centralized platforms that support real-time monitoring, cost optimization, and governance across distributed cloud systems.

China Integrated Cloud Management Platform Market Overview

The market in China is expanding due to the strong cloud adoption across state-owned enterprises, manufacturing firms and public infrastructure projects. According to Canalys, China’s cloud infrastructure services market reached USD 7.7 billion in the fourth quarter of 2021, marking a 33% year-on-year increase. The report forecasts that the market will grow to USD 85 billion by 2026, with a five-year compound annual growth rate of 25%. These enterprises are investing in integrated platforms to manage large-scale, distributed cloud operations and improve data center efficiency. Moreover, growing national policies such as the New Infrastructure Initiative are accelerating enterprise modernization, which is increasing demand for unified cloud control systems that meet domestic security standards and facilitate seamless platform orchestration.

Europe Integrated Cloud Management Platform Market

The integrated cloud management platform landscape in Europe is projected to hold a substantial share in 2034. This is owing to the strong digital infrastructure across Germany, France, and the UK, where enterprises are investing in scalable cloud solutions to manage operations across public and private clouds. These industrial sectors such as automotive, energy, and public administration are prioritizing centralized control and resource efficiency. For instance, in October 2023, Amazon Web Services announced the launch of the AWS European Sovereign Cloud, a dedicated cloud infrastructure designed to help public sector and highly regulated industries meet stringent data sovereignty and compliance requirements in Europe. This shows the growing demand for unified cloud management platforms that offer localized data control, regulatory compliance, and seamless integration across global and sovereign environments. Furthermore, growing compliance with data protection laws under GDPR is increasing demand for platforms that offer automated policy enforcement, access control, and secure data handling across cloud-based environments.

Key Players & Competitive Analysis Report

The integrated cloud management platform is moderately competitive, with key players focusing on platform enhancements through AI-driven automation, real-time analytics and hybrid cloud integration. Key vendors are investing in partnerships, regulatory compliance and product differentiation to strengthen their market presence. In addition, growing enterprise demand for centralized governance and cost optimization is driving collaborations among cloud service providers and software vendors, supporting long-term growth and innovation across global cloud management ecosystems.

Major companies operating in the integrated cloud management platform industry include VMware, Inc., IBM Corporation, Microsoft Corporation, BMC Software, Inc., Cisco Systems, Inc., ServiceNow, Inc., Snow Software AB, Flexera Software LLC, Oracle Corporation, ManageEngine, CloudBolt Software, Inc., and Scalr, Inc.

Key Players

- BMC Software, Inc.

- Cisco Systems, Inc.

- CloudBolt Software, Inc.

- Flexera Software LLC

- IBM Corporation

- ManageEngine

- Microsoft Corporation

- Oracle Corporation

- Scalr, Inc.

- ServiceNow, Inc.

- Snow Software AB

- VMware, Inc.

Industry Developments

- June 2025: Broadcom launched its unified cloud management platform, VMware Cloud Foundation, that enables enterprises to modernize private cloud operations by integrating compute, storage, networking and management into a single, streamlined stack. This solution supports improved infrastructure agility, operational efficiency and centralized control across virtualized environments.

- May 2025: HPE introduced a unified cloud management platform as part of its advanced private cloud portfolio to help enterprises modernize and streamline hybrid IT operations. This platform enables centralized control, automation, and scalability across on-premises and public cloud environments, addressing the growing demand for integrated hybrid cloud solutions.

- May 2025: Aderant introduced a unified cloud management platform as part of its next-generation suite to centralize control across its legal business applications. This platform streamlines operations, enhances security, and provides firms with real-time visibility and scalability across all cloud-deployed solutions.

Integrated Cloud Management Platform Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Services

- Professional Services

- Managed Services

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Performance Monitoring

- Cost Management and Optimization

- Security and Compliance

- Workload and Resource Management

- Cloud Automation and Orchestration

- Backup and Disaster Recovery

By End User Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- IT and Telecom

- Healthcare and Life Sciences

- Retail and E-commerce

- Government and Public Sector

- Energy and Utilities

- Manufacturing

- Media and Entertainment

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Integrated Cloud Management Platform Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.40 Billion |

|

Market Size in 2025 |

USD 7.31 Billion |

|

Revenue Forecast by 2034 |

USD 24.58 Billion |

|

CAGR |

14.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.40 billion in 2024 and is projected to grow to USD 24.58 billion by 2034.

The global market is projected to register a CAGR of 14.4% during the forecast period.

North America dominated the market in 2024, driven by strong enterprise demand for centralized cloud governance and increasing adoption of hybrid and multi-cloud platforms across finance, telecom, and public sector applications.

A few of the key players in the market are VMware, Inc., IBM Corporation, Microsoft Corporation, BMC Software, Inc., Cisco Systems, Inc., ServiceNow, Inc., Snow Software AB, Flexera Software LLC, Oracle Corporation, ManageEngine, CloudBolt Software, Inc., and Scalr, Inc.

The solutions segment dominated the market in 2024, driven by widespread deployment of centralized platforms for cloud performance monitoring, cost optimization, and policy enforcement across complex IT infrastructures.

The healthcare and life sciences segment is projected to grow at the fastest CAGR, due to rising cloud adoption for managing clinical applications, patient data, and diagnostics systems while ensuring compliance with data privacy regulations.