Intelligent Power Module Market Share, Size, Trends, Industry Analysis Report

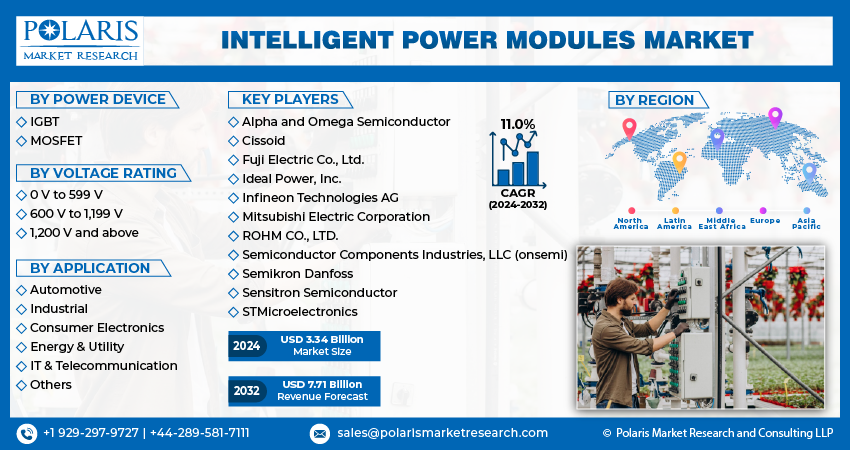

By Power Device (IGBT, MOSFET), By Voltage Rating (0 V To 599 V, 600 V To 1,199 V, 1,200 V And Above), By Application, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4391

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

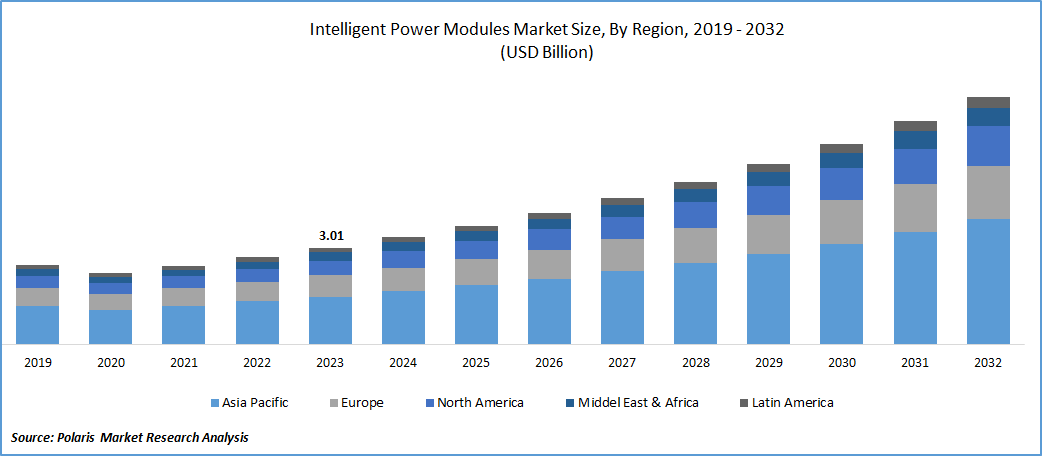

The global intelligent power module market was valued at USD 3.01 billion in 2023 and is expected to grow at a CAGR of 11.0% during the forecast period.

Market is fueled by the increasing sales of electric vehicles, the growing adoption of renewable energy sources, and the rising demand for highly reliable and compact power devices. The intelligent power modules, with their advanced features and simplified design processes, play a vital role in improving system efficiency and meeting the evolving needs of modern power applications. There is need for highly reliable, compact, and user-friendly power devices.

Intelligent power modules serve as advanced power-switching devices, incorporating components like Insulated-Gate Bipolar Transistors (IGBT) and Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFET). These modules also integrate additional protection and control circuitry. The inclusion of such circuitry enhances the reliability and performance of these modules.

To Understand More About this Research:Request a Free Sample Report

The electronics industry faced substantial challenges due to labor shortages and disruptions in the supply chain. As reported by the World Semiconductor Trade Statistics (WSTS GmbH), the discrete semiconductor market observed a y-o-y decline of approximately 0.3% from 2019 to 2020. Given that discrete semiconductors are integral components in intelligent power modules, the industry for intelligent power modules witnessed a downturn during the COVID-19 pandemic.

From the demand perspective, various industries encountered difficulties due to travel restrictions and adherence to social distancing measures. The International Energy Agency (IEA) reported that supply chain interruptions and lockdown measures resulted in delays in the construction of renewable energy projects. Additionally, the consumption of renewable energy witnessed a decline due to restrictions on business activities and travel.

Industry Dynamics

Growth Drivers

Rising Adoption of Electric Vehicles and Increasing Emphasis on Energy Efficiency in Various Industries

The surge in electric vehicle sales and the shift toward renewable energy sources necessitate power devices that can efficiently manage and control electrical power. Intelligent power modules fulfill this requirement by offering enhanced system efficiency. They simplify the design process by integrating switching components with protective and control features, streamlining the overall system architecture. This simplification is particularly crucial in applications such as electric vehicles and renewable energy systems, where efficiency and reliability are paramount.

Report Segmentation

The market is primarily segmented based on power device, voltage rating, application, and region.

|

By Power Device |

By Voltage Rating |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Power Device Analysis

IGBT Segment Accounted for the Largest Market Share in 2023

IGBT segment accounted for the largest share. It is due to its ability of IGBTs to withstand overloads & its applicability in burgeoning end-users, particularly the automotive sector, which is experiencing a notable increase in Electric Vehicle (EV) adoption. Additionally, IGBTs are employed in consumer applications, including induction cookers & air conditioners. Various market players manufacture IGBT-based modules, making them readily available in the market. The advantages of IGBTs, including lower electromagnetic interference and thermal impedance when compared to MOSFETs, contribute to their popularity and widespread adoption.

MOFSET segment will grow rapidly. MOSFETs, or metal-oxide-semiconductor field-effect transistors, are particularly well-suited for applications characterized by low current, low voltage, and high switching frequency. The notable growth in this segment can be attributed to the MOSFETs' capacity to deliver superior performance, especially in applications requiring high switching frequencies. MOSFETs exhibit advantages in scenarios where precise control over low currents and voltages is essential, making them suitable for various electronic devices and circuits. Their ability to efficiently handle high switching frequencies is a key factor driving their growth. In applications demanding rapid switching, MOSFETs offer superior performance, contributing to their increasing adoption and market demand.

Introducing innovative MOSFET technologies or enhanced versions of existing products can attract attention in the market, driving demand and contributing to the overall growth of the MOSFET segment. The continuous development and introduction of new MOSFET products align with the evolving needs of industries relying on low current, low voltage, and high-frequency applications, further fueling the projected growth.

By Voltage Rating Analysis

600 V to 1,199 V Segment Held the Significant Market Share in 2023

600 V to 1,199 V segment held the significant market share. Growth is attributed to the broad spectrum of applications falling within this voltage rating range, including significant use cases in major home appliances and industrial drives. Additionally, the widespread availability of modules within this voltage range contributes to the segment's expansion. For instance, Infineon Technologies presents the IFCM20T65GD, a 650 V TRENCHSTOP IGBT-based intelligent module designed for the industrial drives & home appliances. This specific module exemplifies the prevalent trend in the intelligent power module market, where a significant number of intelligent power modules cater to applications within voltage range.

1,200 V and above segment is expected to gain substantial growth rate. Growth is fueled by the increasing demand for high-voltage intelligent power modules in diverse applications, including automotive, industrial automation, and Heating, Ventilation, and Air Conditioning (HVAC). Notably, Semiconductor Components (onsemi)'s NFVA23512NP2T intelligent power module, with a voltage rating of 1,200 V, is specifically designed for hybrid and electric vehicles, exemplifying the trend in high-voltage applications.

The surge in adoption of automation in various industries and the increasing uptake of renewable energy contribute significantly to the growth of this segment. High-voltage intelligent power modules play a vital role in addressing the specific requirements of applications in automotive, industrial automation, and HVAC, driving the demand for modules with a voltage rating of 1,200 V and above. This trend is likely to persist and contribute to the segment's accelerated growth over the forecast period.

By Application Analysis

Automotive Segment Held the Significant Market Share in 2023

Automotive segment held the significant market share. As per the International Energy Agency (IEA), the proportion of electric car sales in the overall car sales witnessed a 10% increase from 2020 to 2022. This surge in electric car adoption, encompassing both hybrid electric and fully electric vehicles, is a key driver behind the notable growth of this segment.

The adoption of intelligent power modules is pivotal in various automotive applications, including but not limited to the oil pumps, compressors, & charging systems for electric vehicles. With the automotive industry increasingly embracing electric and hybrid technologies, the demand for these modules continues to grow, contributing significantly to the segment's dominance and expected rapid expansion in the coming years.

Regional Insights

Asia Pacific Dominated the Global Market in 2023

APAC dominated the global market. According to Ideal Power, Inc.'s 2022 annual report, Asia Pacific stands at the forefront in global power semiconductor consumption. This is due to China's position as the foremost market globally for automotive and passenger vehicles. As reported by the l'Association des Constructeurs Européens d'Automobiles (ACEA), China accounted for approximately 34% of the global production of passenger cars in 2022. Furthermore, the region boasts a substantial installed capacity of renewable energy.

Intelligent power modules find significant applications in both the automotive and renewable energy sectors. The robust growth of the market is propelled by the region's high levels of automobile manufacturing activity and considerable installed capacity of renewable energy.

North America will grow with substantial pace. The advanced technological infrastructure and high level of electronics manufacturing activity in the region play a pivotal role in driving market growth. Additionally, government initiatives and investments by companies aimed at boosting semiconductor and electronics manufacturing are expected to positively influence the market in the region. Notably, following the signing of the U.S. government's CHIPS and Science Act of 2022 in August, companies announced investments totaling over USD 166 billion within a year. This substantial commitment to semiconductor and electronics manufacturing initiatives is likely to further propel the growth.

Key Market Players & Competitive Insights

The market is characterized by the presence of key players operating on a global scale, contributing significantly to the substantial growth of the market. These players are employing strategies such as the introduction of new products to establish a competitive advantage.

Some of the major players operating in the global market include:

- Alpha and Omega Semiconductor

- Cissoid

- Fuji Electric Co., Ltd.

- Ideal Power, Inc.

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- ROHM CO., LTD.

- Semiconductor Components Industries, LLC (onsemi)

- Semikron Danfoss

- Sensitron Semiconductor

- STMicroelectronics

Recent Developments

- In August 2023, Fuji Electric unveiled the P633C Series, a 3rd generation of small intelligent modules. These modules are specifically engineered to reduce the power consumption of devices, including machine tools and home appliances, that are integrated with them.

Intelligent Power Modules Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.34 billion |

|

Revenue forecast in 2032 |

USD 7.71 billion |

|

CAGR |

11.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Power Device, By Voltage Rating, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Intelligent Power Module Market report covering key segments are power device, voltage rating, application, and region.

Intelligent Power Module Market Size Worth $ 7.71 Billion By 2032.

The global intelligent power module market is expected to grow at a CAGR of 11.0% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Intelligent Power Module Market are Compact Design and Integration