Invisible Payment Solutions Market Size, Share, Trends, Industry Analysis Report

: By Technology (Near Field Communication (NFC), QR Codes, Biometric Authentication, Tokenization, and Others), Payment Mode, Application, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5581

- Base Year: 2024

- Historical Data: 2020-2023

Invisible Payment Solutions Market Overview

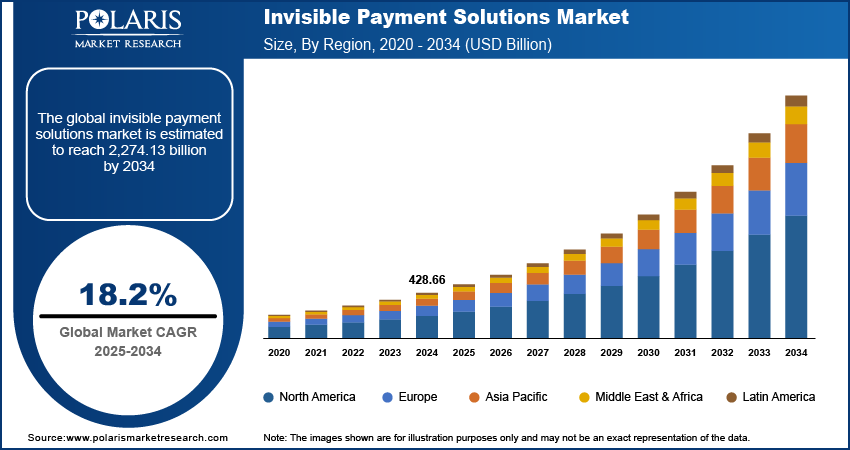

Invisible payment solutions market size was valued at USD 428.66 billion in 2024. The market is projected to grow from USD 505.73 billion in 2025 to USD 2,274.13 billion by 2034, exhibiting a CAGR of 18.2% during 2025-2034.

Invisible payment solutions refer to seamless payment systems that operate in the background of transactions without requiring active user intervention at the point of sale. These solutions leverage advanced technologies such as artificial intelligence (AI), machine learning, biometrics, and the Internet of Things (IoT) to enable automatic payments, eliminating the need for physical cards, cash, or manual input. This approach not only enhances convenience but also reduces transaction times, making it ideal for industries such as retail, transportation, and hospitality. Additionally, wearable devices and smart home systems are adopting these solutions, allowing users to pay for services such as gym access or utility bills seamlessly. The growing adoption of invisible payments is driven by consumer demand for faster, more secure, and contactless experiences.

The rising digitalization worldwide is propelling the invisible payment solutions market growth. Digitalization expands the use of subscription-based models such as one-click purchases, and embedded commerce, all of which rely on invisible payment mechanisms. Streaming platforms, ride-hailing apps, and e-commerce marketplaces leverage stored payment credentials to process transactions without requiring manual input. This trend encourages businesses across industries to adopt invisible payment solutions, ensuring smoother user experiences and higher conversion rates. The rise of digital wallets, biometric authentication, and tokenization also supports the shift toward invisible payments by improving security and trust.

To Understand More About this Research: Request a Free Sample Report

The invisible payment solutions market demand is driven by the increasing cross border transactions. Traditional cross-border transactions often involve high fees, lengthy processing times, and complex currency conversions, creating inefficiencies for global e-commerce, freelancers, and multinational corporations. Invisible payment solutions, such as blockchain-based transfers, digital wallets, and automated currency exchanges, streamline these processes by eliminating intermediaries and reducing manual steps. This effectiveness and efficiency of invisible payment solutions boost their adoption among multinational corporations and individual businesses that are highly involved in invisible payment solutions. Security and compliance challenges in cross-border transactions also contribute to the demand for invisible payment solutions. Different countries have varying regulations, fraud risks, and banking protocols, making manual payments complex. Invisible payment systems use advanced encryption, AI-driven fraud detection, and biometric verification to ensure secure transactions while complying with international financial standards. Thus, the increasing cross border transactions are propelling the market.

Invisible Payment Solutions Market Dynamics

Increasing Penetration of Smartphones

The usage of smartphones is rising worldwide, driving the adoption of the digital payment solutions. According to the Groupe Speciale Mobile Association (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population, or some 4.3 billion people, owns a smartphone. Smartphones have increased the adoption of digital wallets, banking apps, and mobile-based platforms that support invisible payment solutions. Moreover, smartphone manufacturers are continuously enhancing their devices with features such as Near Field Communication (NFC), facial recognition, and fingerprint sensors. These capabilities provide a secure foundation for invisible payments, encouraging user trust and adoption. Smartphones further boost the adoption of ride-hailing platforms, food delivery services, and subscription-based apps, which increases the demand for invisible payment solutions as these solutions are critical in processing transactions in ride-hailing platforms and other delivery services. Hence, the demand for invisible payment solutions is increasing with the growing adoption of smartphones.

Growing Popularity of E-commerce

E-commerce businesses are under pressure to provide seamless and secure payment experiences to consumers. Invisible payment solutions, such as one-click purchases, mobile wallets, and biometric authentication, provide solutions for seamless and secure payment by eliminating the need for manual data entry and reducing checkout times and cart abandonment rates. This efficiency of invisible payment solutions drives their adoption and integration into e-commerce platforms. Security concerns in e-commerce have also contributed to the adoption of invisible payment solutions as these solutions add an extra layer of security, ensuring that only authorized users can complete transactions and protect sensitive data. Therefore, as the popularity of e-commerce platforms increases, the demand for invisible payment solutions also spurs.

Invisible Payment Solutions Market Segment Analysis

Invisible Payment Solutions Market Evaluation by Technology

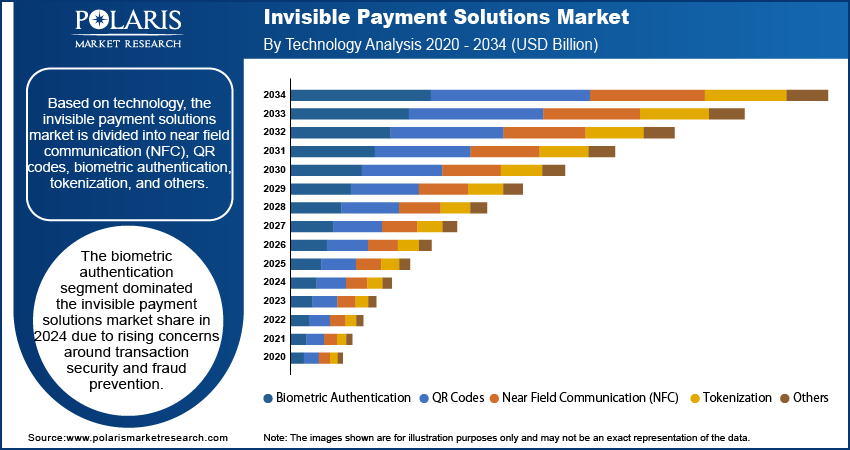

Based on technology, the invisible payment solutions market is divided into near field communication (NFC), QR codes, biometric authentication, tokenization, and others. The biometric authentication segment dominated the invisible payment solutions market share in 2024 due to rising concerns around transaction security and fraud prevention. Biometric systems such as fingerprint scanning, facial recognition, and iris detection offer a high level of accuracy and personalization, significantly reducing the risk of unauthorized access. Financial institutions and fintech companies are increasingly investing in biometric solutions to enhance user verification processes, especially for mobile and wearable payment devices. The growing integration of biometrics in smartphones and smartwatches, coupled with advancements in AI-powered authentication systems, contributes the segment’s dominance.

The near field communication (NFC) segment is expected to grow in the coming years owing to the widespread adoption of contactless payments across retail, transportation, and hospitality industries. Consumers increasingly preferred NFC-enabled solutions due to their speed, convenience, and enhanced security features. Major smartphone manufacturers continued integrating NFC chips into devices, which encouraged more businesses to upgrade their point-of-sale terminals to support tap-to-pay functionality. Additionally, the proliferation of digital wallets such as Apple Pay, Google Pay, and Samsung Pay contributed significantly to NFC’s growth, as these platforms rely heavily on NFC technology for seamless and secure transactions.

Invisible Payment Solutions Market Assessment by Payment Mode

The invisible payment solutions market segmentation, based on payment mode, includes mobile wallets, contactless cards, wearable devices, biometric payments, and others. The mobile wallet segment dominated the market share in 2024 due to the increasing penetration of smartphones and the growing preference for digital payment methods among consumers. Major mobile wallet platforms such as Apple Pay, Google Pay, and Samsung Pay have gained attraction on the convenience of making payments with a simple tap or swipe, eliminating the need for physical cards or cash. The rapid adoption of mobile wallets is fueled by the rising number of smartphone users and the widespread availability of mobile banking services. In addition, the integration of loyalty programs, promotions, and secure payment features such as tokenization contributed to the growing appeal of mobile wallets.

Invisible Payment Solutions Market Regional Analysis

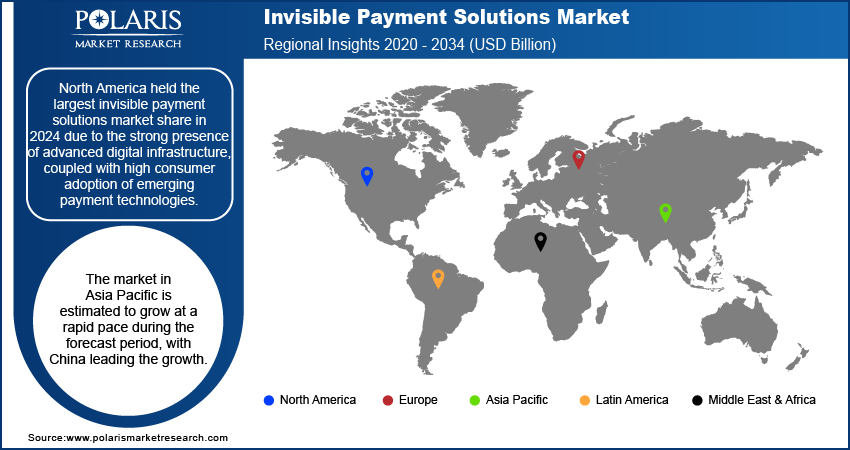

By region, the study provides the invisible payment solutions market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to the strong presence of advanced digital infrastructure, coupled with high consumer adoption of emerging payment technologies. The widespread availability of smartphones, high-speed internet, and NFC-enabled payment terminals contributed to the invisible payment solutions market expansion in North America. Pew Research Center published a report in November 2024 stating that about 91% of Americans own a smartphone. Major tech and financial companies based in the region, such as Apple, Google, PayPal, and Visa, continuously innovated and expanded their invisible payment offerings in the region. Additionally, the region benefited from a mature fintech ecosystem and supportive regulatory frameworks that encouraged secure and seamless transactions. Retailers and service providers in the US rapidly digitized their payment systems to meet consumer demand for speed, security, and convenience, which propelled invisible payment solutions market revenue.

The invisible payment solutions market in Asia Pacific is estimated to grow at a rapid pace during the forecast period, with China leading the growth. The country’s dominance rises from its massive digital payment ecosystem, spearheaded by Alipay and WeChat Pay, which leverage QR code-based transactions to serve both urban and rural populations. Rapid digitalization, government initiatives promoting cashless economies, and the proliferation of super-apps embedding payment functionalities are driving market growth in the region. Countries such as Indonesia and Vietnam are also gaining momentum in the market, supported by rising e-commerce penetration and fintech innovation.

Invisible Payment Solutions Key Market Players & Competitive Analysis Report

The competitive landscape of the invisible payment solutions market is characterized by intense rivalry, driven by prominent players focusing on strategic mergers, acquisitions, partnerships, and collaborations to strengthen their market position and expand their product portfolios. Mergers and acquisitions have become a foundation for growth, enabling companies to consolidate their resources, eliminate competition, and access new customer bases. Partnerships and collaborations further play a crucial role in shaping the competitive dynamics as companies seek to leverage each other's expertise and infrastructure. Furthermore, companies are investing heavily in marketing and branding efforts to enhance visibility and customer engagement.

The invisible payment solutions market is fragmented, with the presence of numerous global and regional market players. Major players in the market are AffiniPay LLC; Billtrust; BlueSnap; Mastercard; Nexi S.p.A; Paymentus; PayPal Holdings, Inc.; Shift4; Stripe, Inc.; USIO; and Visa.

Nexi S.p.A., headquartered in Milan, Italy, is a major European financial technology company specializing in digital payment solutions. Established in 1939 and formerly known as Istituto Centrale delle Banche Popolari Italiane, Nexi has evolved into a powerhouse in the payment systems industry, offering a wide range of services to banks, small and medium-sized enterprises (SMEs), large corporations, institutions, and public administrations. The company operates across more than 25 countries, contributing to its position as a key player in Europe’s transition toward cashless transactions. Nexi’s portfolio includes innovative payment processing solutions and acceptance solutions such as POS terminals, mobile and smartwatch payments, corporate banking services, and advanced fraud prevention mechanisms.

BlueSnap founded in 2001 and headquartered in Waltham, Massachusetts, is a global company in payment technology solutions. The company provides an all-in-one Payment Orchestration Platform designed to simplify and optimize payment processes for businesses across B2B and B2C sectors. BlueSnap’s platform supports online and mobile sales, subscriptions, invoice payments, and manual orders through a virtual terminal. BlueSnap’s modular platform is personalized to meet the diverse needs of its clients, including global marketplaces, software publishers, and online retailers. The solution integrates seamlessly with existing systems through APIs or can function as a standalone hosted application. It encompasses features such as multi-currency authorization, fraud prevention powered by Kount, chargeback management, intelligent payment routing, tokenization, and compliance tools.

Key Companies in Invisible Payment Solutions Market

- AffiniPay LLC

- Billtrust

- BlueSnap

- Mastercard

- Nexi S.p.A

- Paymentus

- PayPal Holdings, Inc.

- Shift4

- Stripe, Inc.

- USIO

- Visa

Invisible Payment Solutions Market Developments

February 2024: Conad Dao, a cooperative distributing Conad stores, set up the first 'cashierless store' of its chain in Verona, equipping it with Nexi's Invisible Payments solution.

Invisible Payment Solutions Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020-2034)

- Near Field Communication (NFC)

- QR Codes

- Biometric Authentication

- Tokenization

- Others

By Payment Mode Outlook (Revenue, USD Billion, 2020-2034)

- Mobile Wallets

- Contactless Cards

- Wearable Devices

- Biometric Payments

- Others

By Application Outlook (Revenue, USD Billion, 2020-2034)

- Point of Sale (POS) Systems

- E-commerce Platforms

- In-App Purchases

- Peer-to-Peer (P2P) Transfers

- Others

By Industry Vertical Outlook (Revenue, USD Billion, 2020-2034)

- Retail

- Hospitality

- Transportation

- Healthcare

- Others

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Invisible Payment Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 428.66 Billion |

|

Market Size Value in 2025 |

USD 505.73 Billion |

|

Revenue Forecast by 2034 |

USD 2,274.13 Billion |

|

CAGR |

18.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global invisible payment solutions market size was valued at USD 428.66 billion in 2024 and is projected to grow to USD 2,274.13 billion by 2034.

The global market is projected to register a CAGR of 18.2% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are AffiniPay LLC; Billtrust; BlueSnap; Mastercard; Nexi S.p.A; Paymentus; PayPal Holdings, Inc.; Shift4; Stripe, Inc.; USIO; and Visa.

The biometric authentication segment dominated the invisible payment solutions market share in 2024.

The near field communication (NFC) segment is expected to grow at the fastest pace in the coming years.