Japan Antibiotics Market Size, Share, Trends, Industry Analysis Report

By Drug Class (Cephalosporin, Penicillin, Fluoroquinolone), By Type, By Action Mechanism – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6146

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

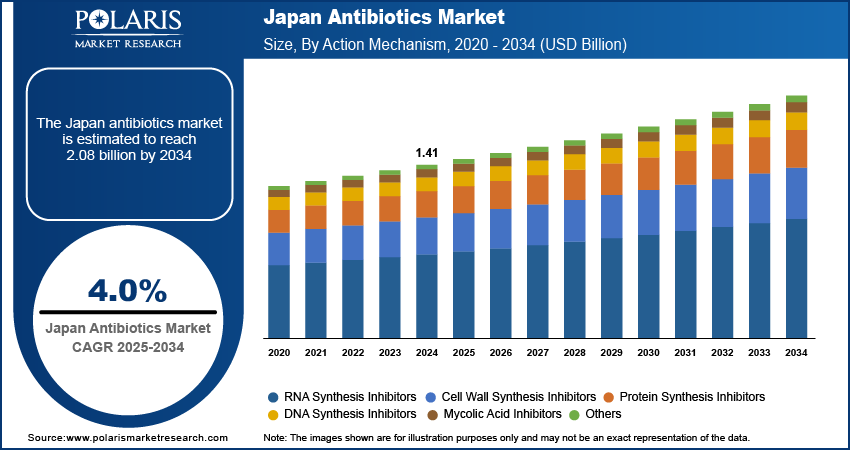

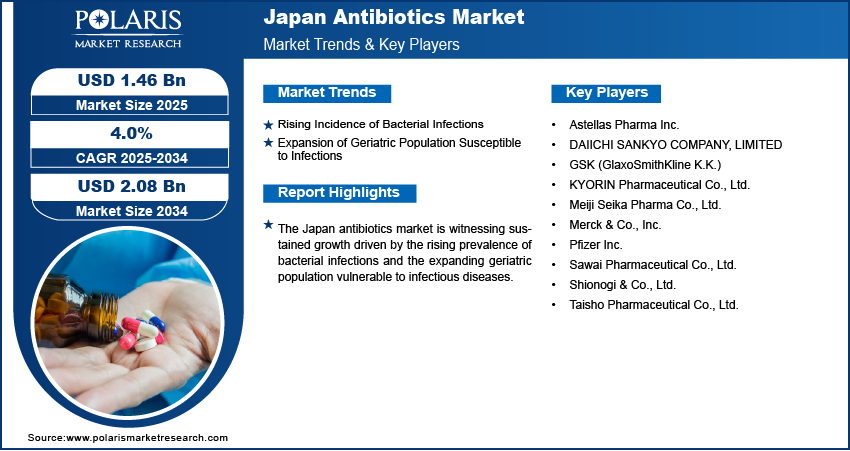

The Japan antibiotics market size was valued at USD 1.41 billion in 2024, growing at a CAGR of 4.0% from 2025 to 2034. Key factors driving demand for antibiotics in Japan include the continuous evolution of biotechnological approaches that are revolutionizing drug discovery, rising incidence of bacterial infections nationwide, and the expanding geriatric population that is increasing treatment needs.

Key Insights

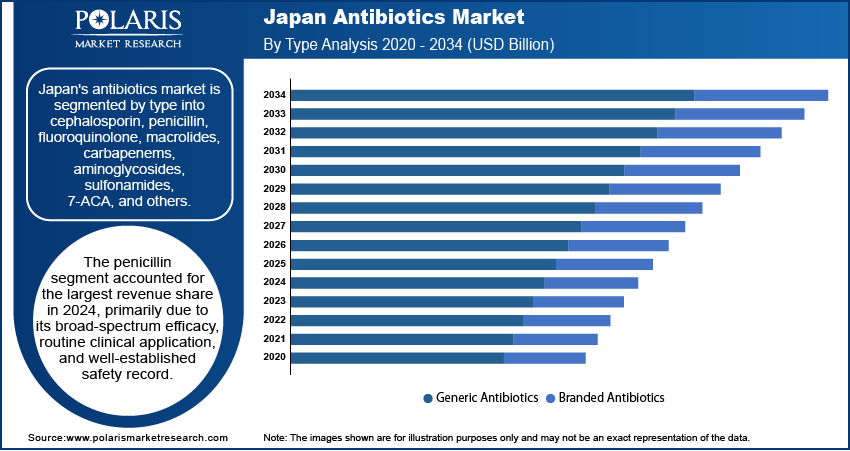

- The penicillin segment accounted for largest revenue share in 2024 primarily due to its broad-spectrum efficacy, routine clinical application, and well-established safety record.

- The RNA synthesis inhibitors segment is expected to witness fastest growth during the forecast period fueled by an increasing focus on tackling antibiotic-resistant bacteria and the pressing need for new antimicrobial mechanisms.

Industry Dynamics

- The growing rates of bacterial infection cases in Japan create an urgent need for effective antimicrobial treatments, which fuels antibiotic demand.

- Japan's expanding elderly population is increasing antibiotic usage, as older adults face higher infection risks due to weakened immunity and chronic health issues.

- The growing concerns regarding antibiotic resistance in the country render existing treatments less effective. High R&D costs and strict regulations hinder the development of new antibiotics.

- Government funding and technological advancements support next-generation antibiotic innovation.

Market Statistics

- 2024 Market Size: USD 1.41 Billion

- 2034 Projected Market Size: USD 2.08 Billion

- CAGR (2025–2034): 4.0%

To Understand More About this Research: Request a Free Sample Report

Antibiotics are pharmacological agents used to prevent and treat bacterial infections by inhibiting the growth or destroying harmful microorganisms. The Japan antibiotics market is experiencing notable momentum, driven by the continuous evolution of biotechnological approaches that are reshaping drug discovery processes. In October 2023, the Japanese government committed USD 1.8 million to GARDP to support the development of treatments for drug-resistant infections in adults, children, and newborns, while improving treatment accessibility. The integration of genomic tools, high-throughput screening, and bioinformatics has greatly enhanced the ability to identify novel antibiotic candidates with improved specificity and efficacy. These advancements accelerate the development pipeline and enable researchers to explore unique microbial sources, thereby addressing the growing challenge of antibiotic resistance in a scientifically progressive manner.

Drivers and Opportunities

Rising Incidence of Bacterial Infections: The rising cases of bacterial infections in Japan drive the demand for antibiotics, as they directly correlate with an increasing need for effective antimicrobial therapies. In June 2024, Japan reported 1,060 STSS cases, a rare and deadly bacterial infection, with 62% caused by Group A Streptococcus, along with 222 Group G and 114 Group B cases. Factors such as urbanization, high population density, and greater exposure to healthcare environments have contributed to a higher incidence of infections, particularly respiratory, urinary tract, and skin-related conditions. The recurrent nature of certain infections and the emergence of resistant pressures have further emphasized the need for a robust arsenal of antibiotic treatments. This ongoing clinical demand highlights the importance of antibiotic availability, driving pharmaceutical development and market expansion to meet healthcare needs effectively.

Expansion of Geriatric Population Susceptible to Infections: The expansion of Japan’s geriatric population is boosting the Japan antibiotics market opportunities. Older adults are more vulnerable to infections due to weakened immune function and chronic health conditions. According to 2024 World Health Organization data, Japan's population aged 65 and older represents 30% of its total population. This demographic group often experiences higher hospitalization rates, invasive procedures, and long-term care dependency, all of which increase the risk of bacterial exposure. Consequently, antibiotics remain a critical component of treatment regimens for elderly patients, especially in managing complications such as pneumonia or bloodstream infections. The growing aging population thus acts as a consistent demand source, further supporting the market's sustained growth trajectory.

Segmental Insights

Drug Class Analysis

Based on drug class, the Japan antibiotics market is segmented into cephalosporin, penicillin, fluoroquinolone, macrolides, carbapenems, aminoglycosides, sulfonamides, 7-ACA, and others. The penicillin segment accounted for the largest revenue share in 2024, primarily due to its broad-spectrum efficacy, routine clinical application, and well-established safety record. Penicillin remains widely prescribed throughout Japan’s healthcare system, particularly in primary care settings, as an important therapy for various bacterial infections. Its affordability, minimal side effects, and effectiveness against commonly encountered pathogens contribute to its sustained high usage. Furthermore, the consistent preference for penicillin in the treatment of respiratory tract infections, dermatological conditions, and specific sexually transmitted infections reinforces its leading position in the Japanese market. Its reliable pharmacological profile and widespread availability across medical facilities nationwide further drive its adoption.

Action Mechanism Analysis

The Japan antibiotics market segmentation, based on action mechanism, includes cell wall synthesis inhibitors, protein synthesis inhibitors, DNA synthesis inhibitors, RNA synthesis inhibitors, mycolic acid inhibitors, and others. The RNA synthesis inhibitors segment is expected to witness the fastest growth during the forecast period, fueled by an increasing focus on tackling antibiotic-resistant bacteria and the pressing need for new antimicrobial mechanisms. These inhibitors disrupt bacterial transcription, providing a novel therapeutic pathway for infections that no longer respond to conventional treatments, such as cell wall or protein synthesis inhibitors. RNA synthesis inhibitors are emerging as a major area of innovation, driven by the growing awareness of antimicrobial resistance in Japan and an increased push for the development of next-generation antibiotics.

Key Players & Competitive Analysis

The Japan antibiotics market faces economic and geopolitical shifts, with emerging markets driving revenue opportunities through strategic investments in novel therapies. The country's focus on sustainable value chains and technological advancements positions it as a leader in addressing antibiotic resistance. Competitive intelligence reveals that domestic players, such as Shionogi, leverage future development strategies to target latent demand for pediatric and neonatal treatments, while global competitors prioritize expansion opportunities in Asia. Industry trends show increasing revenue growth from partnerships with research institutions, supported by Japan's pledge to GARDP. However, supply chain disruptions and regulatory hurdles pose significant challenges to small and medium-sized businesses. Expert insights highlight the untapped potential in emerging market segments, such as outpatient oral antibiotics, urging innovation to maintain Japan's competitive edge.

A few major companies operating in the Japan antibiotics market include Astellas Pharma Inc.; DAIICHI SANKYO COMPANY, LIMITED; GSK (GlaxoSmithKline K.K.); KYORIN Pharmaceutical Co., Ltd.; Meiji Seika Pharma Co., Ltd.; Merck & Co., Inc.; Pfizer Inc.; Sawai Pharmaceutical Co., Ltd.; Shionogi & Co., Ltd.; and Taisho Pharmaceutical Co., Ltd.

Key Players

- Astellas Pharma Inc.

- DAIICHI SANKYO COMPANY, LIMITED

- GSK (GlaxoSmithKline K.K.)

- KYORIN Pharmaceutical Co., Ltd.

- Meiji Seika Pharma Co., Ltd.

- Merck & Co., Inc.

- Pfizer Inc.

- Sawai Pharmaceutical Co., Ltd.

- Shionogi & Co., Ltd.

- Taisho Pharmaceutical Co., Ltd.

Japan Antibiotics Industry Developments

December 2023: Shionogi launched Fetroja (cefiderocol) in Japan, a novel siderophore cephalosporin antibiotic for carbapenem-resistant infections. It targets resistant Gram-negative bacteria, including Pseudomonas aeruginosa and Acinetobacter species.

Japan Antibiotics Market Segmentation

By Drug Class Outlook (Revenue, USD Billion, 2020–2034)

- Cephalosporin

- Penicillin

- Fluoroquinolone

- Macrolides

- Carbapenems

- Aminoglycosides

- Sulfonamides

- 7-ACA

- Others

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Branded Antibiotics

- Generic Antibiotics

By Action Mechanism Outlook (Revenue, USD Billion, 2020–2034)

- Cell Wall Synthesis Inhibitors

- Protein Synthesis Inhibitors

- DNA Synthesis Inhibitors

- RNA Synthesis Inhibitors

- Mycolic Acid Inhibitors

- Others

Japan Antibiotics Segment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.41 Billion |

|

Market Size in 2025 |

USD 1.46 Billion |

|

Revenue Forecast by 2034 |

USD 2.08 Billion |

|

CAGR |

4.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.41 billion in 2024 and is projected to grow to USD 2.08 billion by 2034.

The market is projected to register a CAGR of 4.0% during the forecast period.

A few of the key players in the market are Astellas Pharma Inc.; DAIICHI SANKYO COMPANY, LIMITED; GSK (GlaxoSmithKline K.K.); KYORIN Pharmaceutical Co., Ltd.; Meiji Seika Pharma Co., Ltd.; Merck & Co., Inc.; Pfizer Inc.; Sawai Pharmaceutical Co., Ltd.; Shionogi & Co., Ltd.; and Taisho Pharmaceutical Co., Ltd.

The penicillin segment accounted for the largest revenue share in 2024.

The RNA synthesis inhibitors segment is expected to witness fastest growth during the forecast period.