Jerky Snacks Market Share, Size, Trends, Industry Analysis Report

By Product (Beef, Pork, Poultry, and Others); By Distribution Channel; By Region; Segment Forecast, 2023-2032

- Published Date:Jun-2023

- Pages: 116

- Format: PDF

- Report ID: PM3426

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

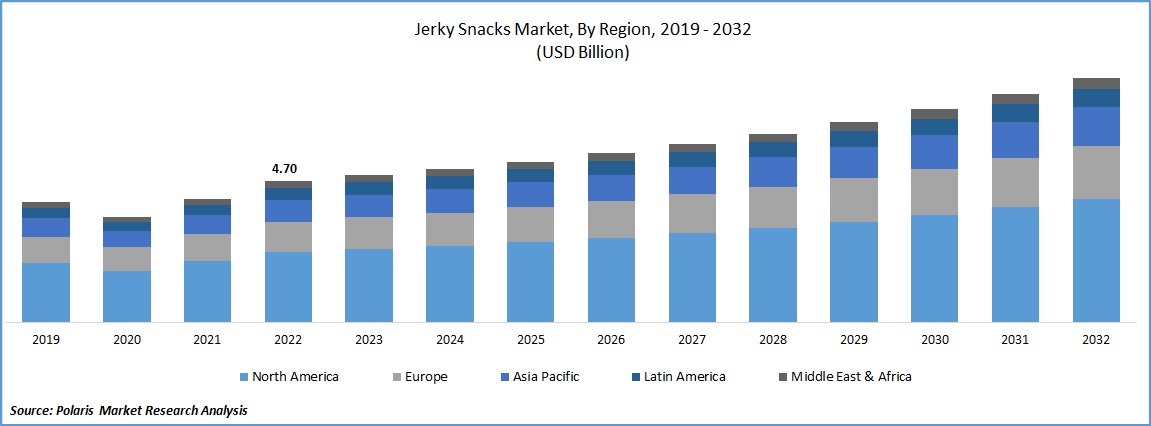

The global jerky snacks market was valued at USD 4.70 billion in 2022 and is expected to grow at a CAGR of 5.81% during the forecast period. Improving industry participant’s contribution in the product development with various new technologies and flavours is majorly helping the market to grow globally. the development of new processing and packaging technologies has allowed to produce jerky snacks with longer shelf lives and improved quality. This has enabled manufacturers to produce and distribute jerky snacks to a wider range of consumers in various parts of the world. For instance, in April 2023, as part of its collaboration with Jack Link's, PepsiCo's Doritos brand will develop a new jerky product. Two flavours are available: Original beef jerky and meat sticks in the Flamin' Hot flavour and Jack Link's Doritos Spicy Sweet Chilli flavour. This is dramatically escalating the revenue of the global market.

To Understand More About this Research: Request a Free Sample Report

Jerky snacks offer several potential benefits when consumed as part of a balanced diet. These are a good source of protein, which is essential for building and repairing tissues in the body. Snacks are a good source of several important nutrients, including iron, zinc, and vitamin B12. With the increasing popularity of vegan and plant-based diets, there is a growing demand for jerky snacks made from plant-based protein sources. These snacks offer a similar texture and flavour to traditional meat-based jerky but are suitable for those following a vegan or vegetarian lifestyle.

The pandemic has caused economic uncertainty, leading to some consumers being more cautious with their spending. This has led to some manufacturers experiencing a decrease in sales. The pandemic has disrupted supply chains, leading to shortages of some ingredients and packaging materials which have led to some manufacturers experiencing delays in production and shipping. However, consumers are turning to e-commerce to purchase their favourite snacks which resulted in significant increase in online sales of these snacks. As a result, increasing online sales has improved the global market’s growth.

Industry Dynamics

Growth Drivers

Augmenting the requirement for healthy protein based snacks and rising awareness regarding healthy lifestyle is one of the foremost factors fuelling the market’s growth. As people become more health-conscious and seek out healthier snack options, jerky snacks are emerging as a popular choice due to their high protein content and lower fat content compared to traditional snack foods. Consumers become more conscious of the source and quality of the food they consume. For example, total 6.8% of the US population involved in healthy lifestyle factors. In addition to this, more than half of Americans means almost 52% say they eat a healthy diet. Many jerky snacks are compatible with these diets as they are high in protein and low in carbohydrates, making them an ideal snack option for people following these dietary patterns. Henceforth, this factor is primarily heightening the growth of the jerky snacks market globally.

The growth of e-commerce and the widespread use of smartphones are further factors contributing to the market's progress. For example, almost 91% consumer makes online purchases with the help of their smartphone. These factors prompted many small and medium-sized businesses to create online platforms in order to increase their distribution options. Small businesses in particular have benefited from the online distribution channel for manufacturers. Businesses target millennial customers, one of the categories with the largest density, which results in a high level of product acceptance in the market.

Report Segmentation

The market is primarily segmented based product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Beef Segment Held Largest share in the Global Market in 2022

In fiscal year 2022, the beef segment dominates the market with major share as it is a widely available and popular meat that is consumed in many parts of the world. These snacks have a unique flavour and texture that appeal to many consumers. The dominance of beef jerky snacks in the jerky snacks market can be attributed to their unique taste and texture, long shelf life, convenience, and nutritional value, as well as the availability of a wide range of flavours and varieties.

To leverages the benefits of the beef jerky snacks, large number of businesses are largely contributing to the market. For example, in January 2022, Baja Vida, has been unveiled by the Baja Jerky. Likewise many other companies are also helping the market to grow and maintain its supremacy in the upcoming years.

Online Segment is the Fastest Growing Segment During the Forecast Period

Online segment is expected to expand at the fastest CAGR during the forecast period. The rise of e-commerce and online retail platforms has made it easier for consumers to purchase jerky snacks online. Consumers can now order jerky snacks from the comfort of their homes or on-the-go through their mobile devices. This convenience has contributed to the growth of the online segment. For example, in April 2022, the Certified Piedmontese store on Amazon, which sells the entire line of Grass Fed Grass Finished beef snacks produced by the company, has just been opened. Also, Jerky.com, People’s Choice Beef Jerky, Amazon, and Dickson’s Farmstand are some of the popular online sellers in the industry. Online retailers often offer fast and efficient delivery options, which another factor is contributing to the growth of the online segment.

North America is Accounting the Largest Share in the Global Market in 2022

In the fiscal year 2022, North America is expected to lead the global market with major share. US is a large market with a significant population and a high per capita income, which creates a large and affluent consumer base for jerky snacks. The US has a strong meat industry and a diverse range of meat products, including beef, pork, turkey, and chicken, which makes it easier for manufacturers to produce a wide range of jerky snack products.

This diversity also provides consumers with a variety of flavour and protein options to choose from. Escalating consumption of jerky snacks and products due to rising awareness regarding healthy lifestyle is one of the prominent factors driving the growth of market in the North America. For example, according to the US Census and NHCS, around 50% or over 160 million people of the total United States population eat beef jerky and meat snacks frequently. Subsequently, this factor is driving the growth of market in the region and is poised to maintain its dominance in the forthcoming years.

Asia Pacific is projected to grow at the fastest CAGR during the assessment period. Growing population is boosting demand for meat snacks across Asia Pacific, which is further boosting the sales of jerky snacks. China is the one of the largest consumer of meat market worldwide. The Chinese consumed nearly 100 million tons of meat in 2021 which is around 27 percent of the world's total consumption. With the growing demand for high-protein, low-fat foods, the consumption of meat food is steadily increasing in the region. Consumers who are looking for convenient, on-the-go snacks that are high in protein and low in carbohydrates have been driving the demand for jerky snacks. As a result, the market has been experiencing significant growth in the Asia Pacific.

Competitive Insight

The global Jerky Snacks market involves JACK LINK'S, Oberto Snacks, Hershey Company, General Mills, Frito-Lay, Old Trapper Beef Jerky, Chef's Cut Real Jerky, Tillamook Country Smoker, Conagra Brands, and Meatsnacks Group

Recent Developments

- In April 2023, Doki, a start-up company established in Delhi, sells meaty chips and jerky in a variety of regional and international flavours, such as teriyaki, gochujang, and smoky masala.

Jerky Snacks Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.89 billion |

|

Revenue forecast in 2032 |

USD 8.14 billion |

|

CAGR |

5.81% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

JACK LINK'S, Oberto Snacks Inc., The Hershey Company, General Mills Inc, Frito-Lay North America, Inc., Old Trapper Beef Jerky, Chef's Cut Real Jerky, Tillamook Country Smoker, Conagra Brands, Inc., and The Meatsnacks Group |

FAQ's

The global jerky snacks market size is expected to reach USD 8.14 billion by 2032.

Key players in the jerky snacks market are JACK LINK'S, Oberto Snacks, Hershey Company, General Mills, Frito-Lay, Old Trapper Beef Jerky, Chef's Cut Real Jerky.

North America contribute notably towards the global jerky snacks market.

The global jerky snacks market is expected to grow at a CAGR of 5.81% during the forecast period.

The jerky snacks market report covering key segments are product, distribution channel, and region.