Kimchi Market Size, Share, Trends, & Industry Analysis Report

: By Type, By Distribution Channel (Departmental Store, Supermarkets/Hypermarkets, Online Retail, Others), and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM3457

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global Kimchi market was valued at USD 4.19 billion in 2024 and is expected to grow at a CAGR of 5.9% during the forecast period. The growth is driven by rising preference for fermented food and rising awareness about nutritional benefits.

The market is driven by increasing interest in fermented foods, Korean cuisine, and health-conscious eating habits. Kimchi, a traditional Korean dish made from fermented vegetables, primarily napa cabbage, and flavored with spices and seasoning like garlic, ginger, and chili, has become increasingly popular outside of Korea due to its unique taste and potential health benefits, particularly for gut health. Additionally, kimchi is gaining recognition as a powerful, natural source of probiotics as consumers worldwide are becoming more aware of the advantages of probiotics and fermented foods.

The industry is characterized by both large-scale producers and smaller, artisanal brands, each offering a variety of flavors, styles, and ingredients to appeal to a wide range of consumer preferences. Leading companies like CJ CheilJedang and Daesang Corporation dominate with a strong presence both domestically and internationally, particularly in regions with large Korean populations or growing interest in Asian cuisine. However, small and local producers are also emerging, focusing on unique, authentic recipes and premium, organic ingredients to differentiate themselves in a crowded landscape.

Rising consumer awareness of the health benefits of kimchi is boosting its increasing popularity globally. The growing focus on healthy eating, especially in the wake of the COVID-19 pandemic, has led many consumers to seek out functional foods with health-promoting properties. It makes it an appealing choice for those looking to maintain a healthy diet. According to the World Kimchi Research Institute, kimchi is recognized for its numerous health benefits, including its potential to improve metabolic health and reduce inflammation. The demand is expanding beyond its traditional region in Korea and other parts of Asia as awareness of these benefits is growing. In fact, South Korea's exports of kimchi reached USD 155.6 million in 2023, showing a 10.6% increase compared to 2022, with a significant rise in demand from the US and European countries. Data from the Korea Customs Service reveals that US imports of Korean kimchi surged by 37.4% in 2023, reflecting the growing popularity of the dish as a health food.

Industry Dynamics

Rising Popularity of Korean Cuisine

Over the past year, Korean cuisine has gained more popularity worldwide, especially the dish such as kimchi. It has surpassed its traditional origins and can now be found in many restaurants across the globe due to its strong, colorful flavors. Its unique blend of spicy, sour, and umami elements, food enthusiasts have been captivated by kimchi's intricate fusion, are adding to its widespread appeal. It is no longer confined to Korean eateries, as it has become a part of other types of food establishments, inspiring chefs to experiment with incorporating it into various recipes. This growing trend symbolizes the growing appreciation of the diverse and flavorful Korean cuisine, marking a delicious turning point in global gastronomy.

Korean cuisine offers a diverse range of delicious options like bulgogi and bibimbap that have captured the taste buds of people worldwide who are seeking unique and satisfying culinary experiences. The widespread adoption of Korean cuisine is further facilitated by its visually appealing presentation on social media, as well as the cultural impact of K-pop and K-dramas. The trend towards fermented foods, which contain probiotics that are believed to have health benefits, is in line with modern dietary habits and is contributing to the trend. Consequently, Korean food has become a popular and accessible culinary choice, with more people discovering and incorporating it into their diets.

Health Consciousness and Demand for Fermented Foods

Rising health consciousness is driving the demand for fermented foods such as kimchi, as consumers are becoming more aware of the health benefits associated with these foods. Kimchi, a staple in Korean cuisine, is a rich source of probiotics, which promote gut health and enhance digestion. It is gaining popularity worldwide as a healthy, nutrient-dense food with rising interest in gut health and the growing awareness of the importance of probiotics for immunity and overall well-being. Fermented foods are further recognized for their potential to improve immune function, lower cholesterol, and reduce inflammation, making them particularly appealing to health-conscious consumers.

Government reports and studies support this growing trend. In 2023, the South Korean Ministry of Agriculture reported a 33% increase in kimchi consumption globally, largely attributed to the rising interest in fermented ingredients health benefits. Moreover, a survey by the Korea Food Research Institute (KFRI) indicated that 71% of Korean consumers consider fermented foods an important part of a healthy diet, highlighting the integral role of foods in promoting wellness. In addition, the increasing awareness of the link between diet and chronic diseases, such as obesity and diabetes, is fuelling the demand for fermented products as a preventive measure.

More people are seeking natural, functional foods with health benefits and kimchi's reputation as a probiotic-rich, nutritious option is driving its growth globally. This trend is further supported by the expansion of products into major international retail chains and health-focused food outlets, further driving the growth.

Production Data of US and China

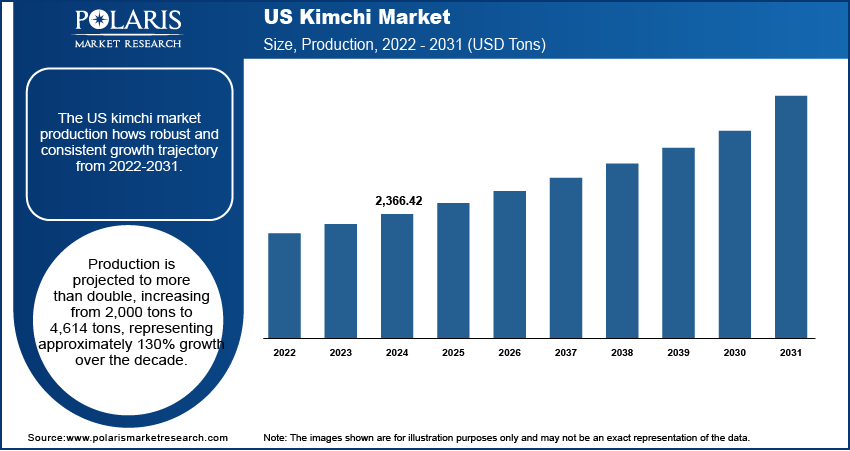

The US kimchi market production shows robust and consistent growth trajectory from 2022-2031. Production is projected to more than double, increasing from 2,000 tons to 4,614 tons, representing approximately 130% growth over the decade. The market demonstrates accelerating momentum with annual growth rates strengthening over time, indicating rising consumer acceptance of Korean fermented foods and mainstream adoption in American dietary preferences.

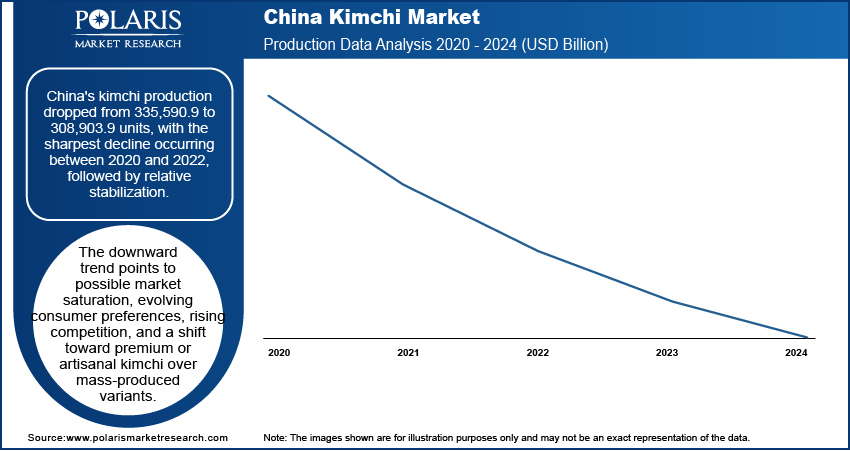

China's kimchi production shows a decline volume from 2020-2024, dropping from 335,590.9 to 308,903.9 tons. The steepest decline occurred between 2020-2022, with production stabilizing somewhat in recent years. This downward trajectory suggests market saturation, changing consumer preferences, increased competition, or potential shifts toward premium/artisanal products over mass production.

Segmental Insights

By Type Analysis

The baechu kimchi segment is projected to anticipate CAGR of 6.4% during the forecast period. This growth is attributed to its health benefit which is driving the awareness. It is rich in probiotics, which improve gut health and boost immunity. It is also low in calories while being packed with vitamins, minerals, and antioxidants. Additionally, retail availability has further played a critical role in Baechu growth. Major brands, including Bibigo and Chongga, have prioritized Baechu in their product lines, making it accessible through major supermarkets like Walmart, Costco, and Carrefour. Online sales have surged as well, with e-commerce platforms such as Amazon and Instacart reporting increased demand for this product type.

The Dongchimi segment is projected to reach USD 1.25 billion by 2034. This growth is due to its unique flavor profile, seasonal appeal, and growing popularity in global culinary trends. Dongchimi offers a lighter taste, making it especially popular during warmer months and among consumers who prefer milder flavors. Its versatility as a complement to dishes such as noodles, rice cakes, and grilled meats has increased its appeal across diverse cuisines. Additionally, seasonal demand further plays a significant role in driving the growth of the Dongchimi segment. Traditionally, Dongchimi is prepared during the late autumn or winter months in Korea when radishes are at their peak quality. However, advancements in agricultural production and logistics have enabled year-round availability of the ingredients, boosting the segment's potential for continuous growth.

By Distribution Channel Analysis

The supermarkets/ hypermarkets segment accounted for 38.91% market share in 2024 as supermarkets and hypermarkets play a crucial role in the kimchi distribution, particularly in South Korea, where they are the primary outlets. Chains like Emart, Homeplus, and Lotte Mart are major players, providing a broad range of these products to meet the needs of both domestic and international customers. Supermarkets and hypermarkets serve as convenient and accessible points for consumers to purchase this product in various forms, including traditional, organic, and modern, ready-to-eat options. The influence of supermarkets and hypermarkets is significant. According to recent data, Emart, the largest retailer in South Korea, reported a 21.8% increase in food sales during the first quarter of 2020, with products like kimchi being in high demand as people shifted to home-cooking during the COVID-19 pandemic. Similarly, Homeplus saw increased sales of fresh food and fermented products as consumers sought to stock up on long-lasting and nutritious items. This indicates that supermarkets and hypermarkets are pivotal in driving its sales, especially in times when consumers prioritize convenience and hygiene, such as during the pandemic, thereby driving the segment growth.

The departmental stores segment is projected to reach USD 2.12 billion by 2034 as they serve as key points of sale for both domestic consumers and international buyers looking to purchase traditional Korean products. Major department stores like Lotte, Shinsegae, and Hyundai offer a wide range of brands and types, often in premium packaging or in larger quantities for families. The impact of department stores is notable in terms of visibility, sales growth, and product differentiation. During times of increased consumer demand for fermented foods, such as during the COVID-19 pandemic when more people ate at home, department stores experienced significant increases in sales of food products, including kimchi. For example, Lotte Department Store reported a 28% growth in food sales in 2020, driven by a surge in home meal replacements (HMRs) and fermented products. This suggests that as more consumers turned to department stores for their grocery needs, sales of traditional foods were also boosted. Furthermore, department stores creating specialized marketing and promotional events, such as Korean food festivals promote kimchi as an essential part of the Korean culinary experience. These events lead to increased awareness and demand, particularly in international markets where Korean food culture is gaining popularity.

Regional Analysis

Kimchi Market in Asia Pacific

Asia Pacific kimchi market accounted for 71.54% global market share in 2024 driven by strong cultural ties, expanding health awareness, and rapid production innovation. Countries such as South Korea, Japan, China, India, and Australia have emerged as major contributors to the region’s landscape, each playing a unique role in its growth. According to the Cultural Heritage Administration in Seoul, approximately 95 percent of Koreans consume kimchi at least once a day, with more than 60 percent incorporating it into their breakfast, lunch, and dinner. This substantial consumption pattern contributes significantly to the growth in Asia Pacific. The appeal extends beyond South Korea, with strong demand observed in other countries in the Asia Pacific (APAC) region, including Japan, China, and Taiwan. Key suppliers in the APAC region, such as Dongwon F&B, Elaia Holdings, and Pulmuone, play pivotal roles in meeting this demand. Additionally, the increasing demand for healthy and natural foods and the growing popularity of Korean cuisine is further driving the growth in the region.

Kimchi Market in North America

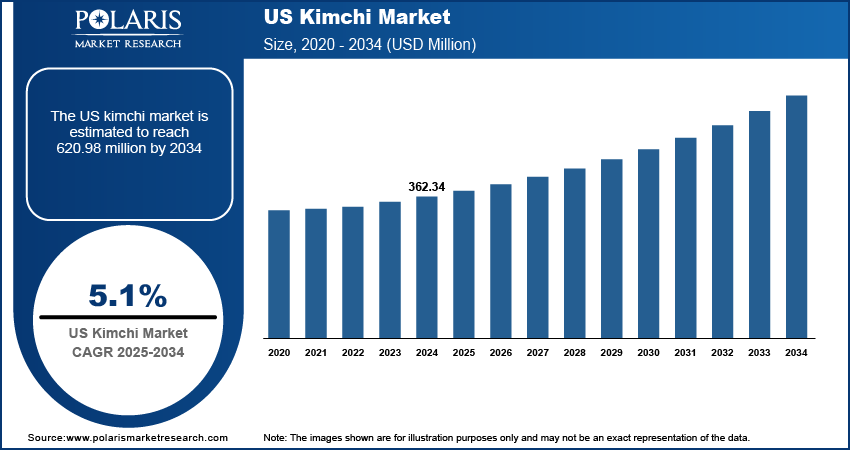

The North America kimchi market is projected to reach USD 835.83 million by 2034. This growth is fueled by a combination of health-conscious consumers, cultural influences, and innovative product offerings. The rising awareness of gut health and the benefits of fermented foods has played a central role in this growth. Probiotic-rich foods have gained popularity due to their ability to support digestion and strengthen the immune system. Consumers in the region are now increasingly prioritizing products that combine nutritional benefits with unique flavors. Millennials and Gen Z, in particular, have driven this trend, favoring plant-based, minimally processed options that align with wellness-focused lifestyles. It has become a staple in the diets of these health-conscious individuals. A survey conducted by the International Food Information Council in 2023 found that 74% of Americans actively sought healthier foods and believed that foods and beverages have a significant or moderate impact on their overall well-being, a factor that has boosted demand. The expanding availability in retail outlets and restaurants has further contributed to the growth. Large grocery chains such as Whole Foods, Kroger, and Walmart have increased their offerings of fresh and packaged product, making it more accessible to mainstream consumers. For instance, in July 2024, Cleveland Kitchen announced selling its latest product, the 24oz Kimchi Pickle Chip, through 1,050 stores and Walmart stores in the US. Therefore, due to aforementioned factor the demand is growing in the region.

Kimchi Market in Europe

The Europe kimchi market accounted for 10.61% share in 2024, driven by rising interest in Asian cuisines and increasing sustainability-conscious consumers. The region’s cultural diversity and evolving culinary preferences have amplified the demand for traditional and fusion Asian dishes, with kimchi emerging as a versatile and trendy food. Countries such as Germany, France, and the United Kingdom, with large urban populations and dynamic restaurant scenes, have witnessed a surge in Korean restaurants and fusion food establishments. Additionally, major global players are introducing new products in the region, which is propelling the growth in Europe. For instance, in January 2024, South Korea's Daesang Corp. launched two new global products, "Do-it-yourself Kimchi Paste" and "Kimchi Spread” in the US and Europe, further boosting the product presence in the region.

Key Players & Competitive Analysis Report

The market is competitive owing to the presence of various prominent players. Players have adopted strategies such as acquisition, launch, expansion, and partnership, and are engaging in the development of new products with high speed and improved features to enhance their product portfolio and hold a strong position in the market. Also, these companies have a global presence and offer a wide range of products for various purpose. They have strong distribution networks, a reputation for product quality and reliability, and often engage in research and development to introduce innovative technologies, making them formidable competitors.

Key players in industry include Choi's Kimchi, Sinto Gourmet, Cosmos Food Co., Real Pickles, Mama O’S Premium Kimchi, Dongwon F&B Co Ltd, CJ CheilJedang Corp., Daesang Corporation, Sunja’s Kimchi, Pulmuone Foods, Eden Foods, Tazaki Foods, Narichan, Cleveland Kitchen, Bombucha.

Key Players

- Bombucha

- Choi's Kimchi

- CJ CheilJedang Corp

- Cleveland Kitchen

- Cosmos Food Co.

- Daesang Corporation

- Dongwon F&B Co Ltd

- Eden Foods

- Mama O'S Premium Kimchi, Inc.

- Narichan

- Pulmuone Foods

- Real Pickles

- Sinto Gourmet

- Sunja’s Kimchi

- Tazaki Foods

Industry Developments

November 2024: Narichan introduced a new ready-to-drink (RTD) kimchi beverage, aiming to expand beyond traditional kimchi products and enhance its export potential.

May 2024: Dongwon F&B launched a new series of ready-meal bibimbap flavors under its Yangban brand. The offerings include three varieties of steamed rice with toppings: bulgogi (grilled marinated beef), tuna and kimchi, and jjajang (black bean sauce). The launch taps into the rising demand for convenient, pre-cooked meals.

September 2023: Daesang Corp. has launched a pop-up store for its kimchi brand called Jongga in London, UK to expands its business.

August 2023: Dongwon F&B Co. expanded its overseas operations through acquisitions of foreign food makers and retailers, with the goal of tripling its current 5 percent share of overseas business within the next three years.

Kimchi Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Baechu Kimchi

- Dongchimi

- Kkakdugi

- Pa Kimchi

- Oi Sobagi

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Departmental stores

- Supermarkets/ Hypermarkets

- Online Retail

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Kimchi Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.19 Billion |

|

Market Size in 2025 |

USD 4.37 Billion |

|

Revenue Forecast by 2034 |

USD 7.33 Billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.19 billion in 2024 and is projected to grow to USD 7.33 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Choi's Kimchi, Sinto Gourmet, Cosmos Food Co., Real Pickles, Mama O’S Premium Kimchi, Dongwon F&B Co Ltd, CJ CheilJedang Corp., Daesang Corporation, Sunja’s Kimchi, Pulmuone Foods, Eden Foods, Tazaki Foods, Narichan, Cleveland Kitchen, Bombucha.

The Baechu Kimchi segment dominated the market share in 2024.

The departmental store segment is expected to witness the fastest growth during the forecast period.