KSA Generative AI Market Size, Share, Trends, Industry Analysis Report

: By Component (Software and Services), Technology, and End Use – Market Forecast 2025–2034

- Published Date:May-2025

- Pages: 94

- Format: PDF

- Report ID: PM5621

- Base Year: 2024

- Historical Data: 2020-2023

KSA Generative AI Market Overview

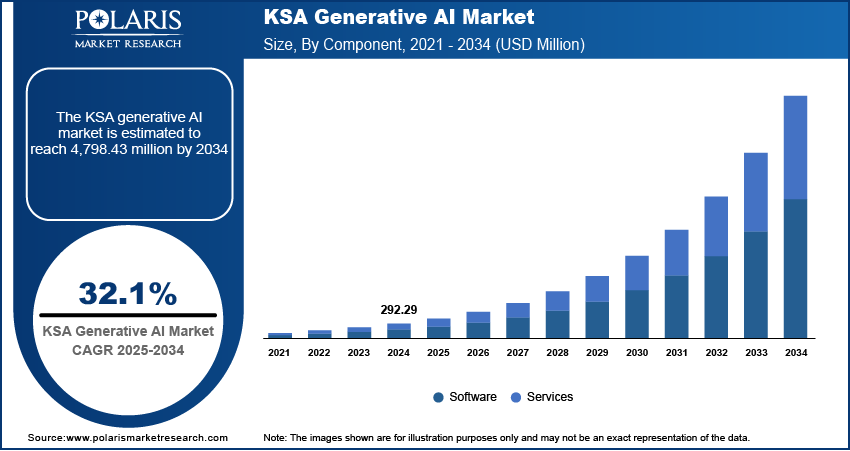

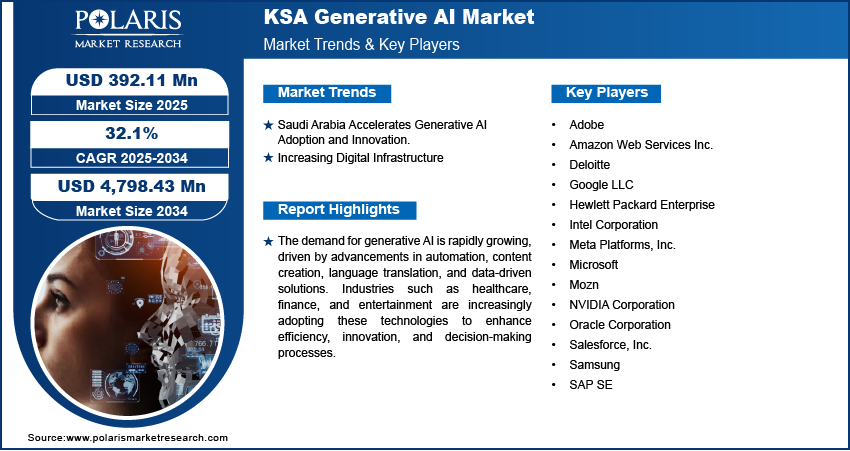

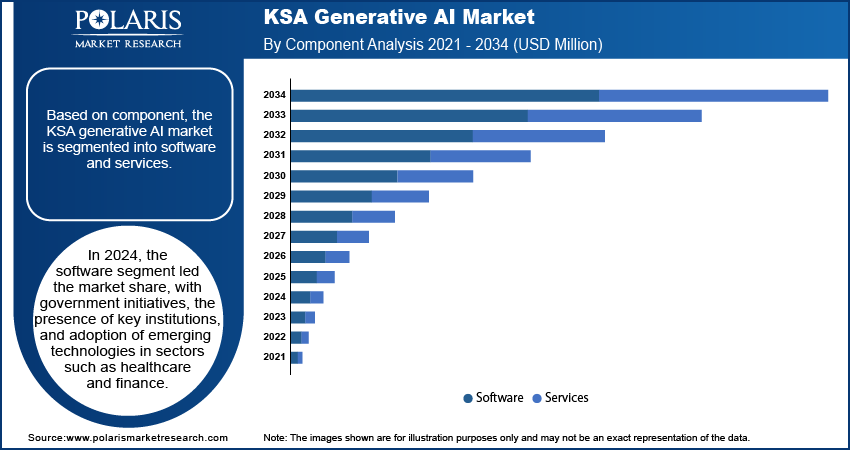

The KSA generative AI market size was valued at USD 292.29 million in 2024. The market is projected to grow from USD 392.11 million in 2025 to USD 4,798.43 million by 2034, exhibiting a CAGR of 32.1% during 2025–2034.

Generative AI is an advanced technology that enables the creation of diverse content types, including text, images, audio, and synthetic data. It enhances the efficiency and precision of AI systems such as natural language processing and computer vision. A few benefits of generative AI include rapid product development, improved customer experiences, and greater employee productivity, driving its adoption across various industries.

The KSA generative AI market is witnessing rapid growth due to advancements in AI and deep learning, increasing demand for creative applications, and the expansion of cloud storage for seamless data access. Generative AI is being utilized in natural language processing, image generation, and generative design. This technology is poised to significantly influence industries such as entertainment, fashion, and transportation as machine learning models advance, resulting in innovative solutions and increased operational efficiencies.

To Understand More About this Research:Request a Free Sample Report

The Kingdom of Saudi Arabia is capitalizing on the trend by fostering an AI-friendly ecosystem under its Vision 2030 initiative. The government plans to invest USD 20 million in AI development by 2030, focusing on training 20,000 AI experts, supporting 300 AI startups, and deploying 5G networks to boost connectivity. These efforts aim to diversify the economy and reduce reliance on oil and gas, positioning the Kingdom as a leader in artificial intelligence.

In collaboration with Nvidia, Saudi Arabia’s AI authority, SDAIA, has launched a generative AI center-of-excellence and an AI academy. This public-private partnership emphasizes research, training, and project development, promoting neuro-linguistic models and machine learning. Such initiatives are expected to accelerate the KSA generative AI market growth. The country’s strategic investments and focus on digital transformation enable it to revolutionize its workforce and drive sustainable economic growth.

KSA Generative AI Market Dynamics

Saudi Arabia Accelerates Generative AI Adoption and Innovation

Saudi Arabia is making significant progress in adopting generative AI technologies across various sectors, driven by its Vision 2030 initiative. This strategic plan aims to diversify the economy, reduce reliance on oil revenues, and foster innovation and technology. Generative AI has the potential to create content, simulate scenarios, and enhance decision-making, which aligns perfectly with the objectives of promoting economic diversification and technological advancement.

Saudi Arabia is actively supporting AI development through initiatives that encourage innovation and entrepreneurship. The SDAIA and NTDP launched a generative AI hackathon in May 2023 during the LEAP conference to accelerate AI-focused businesses. These efforts aim to transform innovative ideas into successful ventures, thus contributing to the KSA generative AI market opportunities.

Investments in research and global collaborations strengthen Saudi Arabia’s position as an AI leader. In July 2023, the Kingdom established the International Centre for AI Research and Ethics and formed partnerships with IBM and Deloitte, emphasizing its commitment to sustainability, clean energy, and technological excellence.

Increasing Digital Infrastructure

Saudi Arabia's growing digital infrastructure is a key driver of the KSA generative AI market expansion. Increased internet connectivity and widespread smartphone adoption have created a data-rich environment, providing the large datasets necessary for training AI models. This abundance of data accelerates the development and application of generative AI solutions across sectors such as healthcare, finance, and education.

The country’s focus on improving citizens' quality of life supports the integration of generative AI. AI-driven solutions are enhancing public services, optimizing administrative processes, and personalizing resident experiences. For instance, in February 2023, the partnership between Digital Diagnostics and Tamer Healthcare emphasized the transformative role of AI in healthcare innovation.

The private sector's proactive involvement in AI innovation drives the KSA GenAI market development. Saudi Arabia’s National Strategy for Data and AI (NSDAI) and SDAIA’s accelerator programs for smart cities exemplify efforts to foster innovation, positioning generative AI as a cornerstone of sustainable urban development and economic growth.

KSA Generative AI Market Segment Analysis

Market Assessment by Component Outlook

The KSA GenAI market segmentation, based on component, includes software and services. The software segment held over 60% of the market revenue share in 2024, driven by the Kingdom's adoption of emerging technologies such as generative AI. The software is used in various sectors, including language translation, content generation, finance, and healthcare, to automate tasks and enhance innovation. Saudi Arabia has also established key institutions such as the National Center for Artificial Intelligence and launched the Saudi Venture Capital Co., investing in technology enterprises. Government initiatives and data availability continue to shape the dynamic generative AI landscape.

Market Evaluation by Technology Outlook

The market segmentation, based on technology, includes generative adversarial networks, transformers, variational auto-encoders, and diffusion networks. The diffusion networks segment is expected to register the highest CAGR of 36% during the forecast period. Diffusion models are advanced generative models renowned for creating high-quality data resembling the training input. Their unique learning process, involving noise addition and removal, enables them to excel in data augmentation, simulation, and creative content generation, making them valuable across industries. These models stand out for their ability to generate superior images while ensuring robust learning, making them a preferred choice in domains such as drug discovery, virtual reality, and content creation. For instance, MIT’s DiffDock model emphasizes their efficiency in accelerating drug discovery.

Diffusion models offer advantages over GANs and VAEs, including enhanced training stability and the ability to learn intricate patterns without issues such as mode collapse. Researchers and organizations advancing diffusion models are shaping generative AI, driving innovation, and expanding practical applications.

KSA Generative AI Market – Key Players and Competitive Analysis Report

The competitive landscape of the KSA generative AI market is characterized by a mix of KSA leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Key players such as Oracle Corporation, SAP SE, and others in the market leverage their robust research and development (R&D) capabilities along with extensive distribution networks to offer advanced KSA generative AI solutions tailored for various applications. These major companies focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions. At the same time, smaller regional firms are entering the market with specialized KSA generative AI solutions targeting local market demands, often focusing on customized and cost-effective applications. The competitive strategies in the market include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market presence and cater to the growing demand for advanced grid solutions. A few key major players are Amazon Web Services, Adobe, Microsoft Corporation, Meta, Hewlett Packard Enterprise, SAP SE, Intel, Oracle Corporation, Salesforce, NVIDIA, Google, Mozn, Deloitte, and Samsung.

Adobe develops digital media and marketing solutions, including Creative Cloud, Acrobat, and generative AI tools such as Adobe Firefly, enhancing workflows for creative professionals, businesses, and various industries. In June 2023, Adobe partnered with Omnicom Group, leveraging joint generative AI capabilities to empower shared clients to craft on-brand content for improved marketing outcomes.

Hewlett Packard Enterprise provides intelligent edge-to-cloud IT solutions across HPC & AI, Compute, Storage, Intelligent Edge, and Financial Services, empowering clients with advanced analytics, agility, and innovative technology. In June 2023, Hewlett Packard Enterprise launched HPE GreenLake for Large Language Models, an AI cloud service enabling enterprises to privately train and deploy large-scale AI models using HPE's supercomputing platform and partnering with Aleph Alpha for field-proven LLM capabilities.

List of Key Companies in KSA GenAI Market

- Adobe

- Amazon Web Services Inc.

- Deloitte

- Google LLC

- Hewlett Packard Enterprise

- Intel Corporation

- Meta Platforms, Inc.

- Microsoft

- Mozn

- NVIDIA Corporation

- Oracle Corporation

- Salesforce, Inc.

- Samsung

- SAP SE

KSA Generative AI Industry Developments

In August 2023, Samsung launched a generative artificial intelligence service tailored for enterprises to enhance corporate data security. While generative AI offers advantages in terms of operational efficiency, concerns have arisen about its potential downsides, particularly related to cybersecurity threats and the accidental exposure of sensitive information.

In August 2023, NVIDIA and Dell Technologies partnered to develop comprehensive generative AI solutions, alleviating challenges in establishing AI-focused IT infrastructure.

In June 2023, Accenture and Microsoft collaborated to accelerate the adoption of generative AI for business transformation. They're co-developing AI-powered solutions across industries, leveraging Microsoft's Azure OpenAI Service and cloud infrastructure. The collaboration aims to harness the disruptive power of generative AI and drive responsible innovation at scale.

KSA Generative AI Market Segmentation

By Component Outlook (Revenue, USD Million, 2021–2034)

- Software

- Services

By Technology Outlook (Revenue, USD Million, 2021–2034)

- Generative Adversarial Networks

- Transformers

- Variational Auto-Encoders

- Diffusion Networks

By End Use Outlook (Revenue, USD Million, 2021–2034)

- Media & Entertainment

- BFSI

- IT & Telecommunication

- Healthcare

- Automotive & Transportation

- Government Services

- Tourism

- Real Estate and Construction

- Enterprise Productivity

- Industrial Engineering

- Education

- Others

KSA Generative AI Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 292.29 million |

|

Market Size Value in 2025 |

USD 392.11 million |

|

Revenue Forecast by 2034 |

USD 4,798.43 million |

|

CAGR |

32.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 292.29 million in 2024 and is projected to grow to USD 4,798.43 million by 2034.

The market is projected to register a CAGR of 32.1% during the forecast period.

A few key players in the market are Amazon Web Services, Adobe, Microsoft Corporation, Meta, Hewlett Packard Enterprise, SAP SE, Intel, Oracle Corporation, Salesforce, NVIDIA, Google, Mozn, Deloitte, and Samsung

The software segment dominated the market in 2024.

The diffusion networks segment is anticipated to grow during the forecast period.