Large Molecule Drug Discovery Outsourcing Market Size, Share, & Industry Analysis Report

: By Service (Chemistry Services and Biology Services), By Workflow, By Therapeutics Area, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5755

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

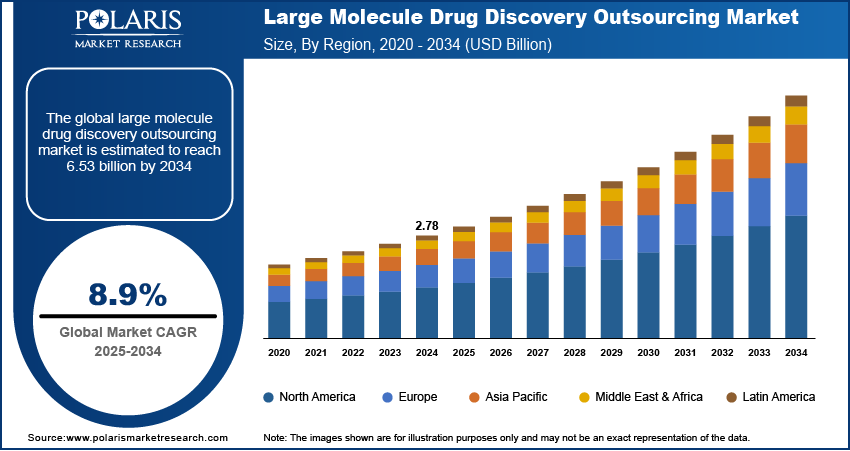

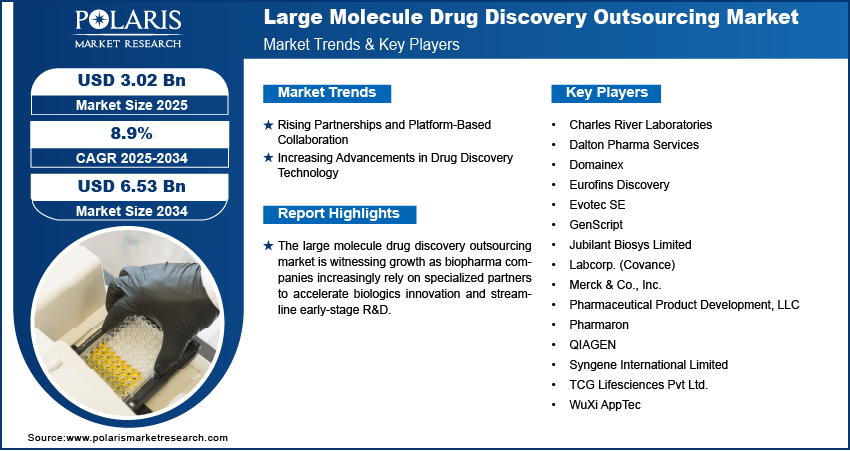

The global large molecule drug discovery outsourcing market size was valued at USD 2.78 billion in 2024, growing at a CAGR of 8.9% during 2025–2034. The growth is driven by the global expansion and emerging market opportunities for large molecule drug discovery outsourcing.

Large molecule drug discovery outsourcing refers to the process by which pharmaceutical and biotechnology companies trust the research and development of biologics, such as antibodies, proteins, and nucleic acid-based therapies, to specialized contract research organizations (CROs). The rising demand for biologics and next-generation therapies such as monoclonal antibodies, ADCs, and RNA therapies, which has transformed the drug development landscape, boosts the expansion opportunities. According to a July 2024 report published in PLOS, monoclonal antibodies (mAbs) represented a growing share of newly developed drugs, accounting for 27% of all new drug approvals by the US FDA in 2022. Companies are increasingly relying on outsourcing partners to access specialized capabilities in protein engineering, bio analytics, and cell line development, as biopharmaceuticals offer high specificity and efficacy in treating chronic and complex diseases such as cancer, autoimmune disease diagnostics, and rare genetic conditions. This shift allows companies to efficiently address the growing therapeutic demand while reducing internal workload and infrastructure investment.

To Understand More About this Research: Request a Free Sample Report

The increasing R&D investments by both large pharmaceutical companies and emerging biotech firms aim to expand their biologics pipelines. In April 2022, Catalent invested USD 350 million in its Indiana facility to expand biologics manufacturing. The upgrade includes new bioreactors, prefilled syringes, and lyophilisation capacity to support the demand for biologics production. The development of large-molecule drugs is complex and expensive, necessitating advanced technologies and expertise in DNA diagnostics technology and biologics manufacturing. Therefore, outsourcing becomes a strategic move. Outsourcing partners offer scalability, regulatory expertise, and faster turnaround times, helping clients minimize risk while optimizing discovery timelines. This rising investments in R&D, combined with the pressure to accelerate drug development, continue to strengthen the outsourcing model as an important part of innovation in the large molecule drug discovery ecosystem.

Industry Dynamics

Rising Partnerships and Platform-Based Collaboration

Companies increasingly adopt collaborative models to navigate the complexities of biologics development. For instance, in September 2024, BioPharma Services entered into late-stage patient trials and integrated HEALWELL’s AI platform to improve its capabilities as a full-service CRO. These alliances allow biopharma firms to combine their internal capabilities with the technological expertise and infrastructure of specialized CROs. Stakeholders can streamline early-stage development, reduce redundancy, and accelerate timelines by leveraging shared platforms, such as AI-based discovery tools, antibody libraries, and high-throughput screening systems. This collaborative approach also boosts risk-sharing and resource optimization, making it a strategic pathway to improve innovation and pipeline productivity in a competitive landscape. Hence, rising partnerships and platform-based collaborations are driving the growth opportunities.

Increasing Advancements in Drug Discovery Technology

Increasing advancements in drug discovery technologies are transforming the efficiency and accuracy of large molecule research, further fueling demand for outsourcing. Innovations such as CRISPR-based screening, next-generation sequencing, and advanced bioinformatics tools have advanced the precision and speed of identifying and validating biological targets. According to a March 2024 report from IGI, in November 2023, the UK approved Casgevy, the first CRISPR therapy, for SCD and TDT, followed by US FDA approval for SCD. Phase 3 trials showed that 25 of 27 TDT patients no longer required transfusions, with effects lasting over 3 years. CROs equipped with these advanced technologies offer clients an advantage by reducing experimental failure rates and improving target validation processes. Outsourcing to technologically advanced partners becomes an important option for companies seeking to stay at the forefront of innovation while managing cost and resource constraints effectively, as these refined tools become more essential to biological drug discovery.

Segmental Insights

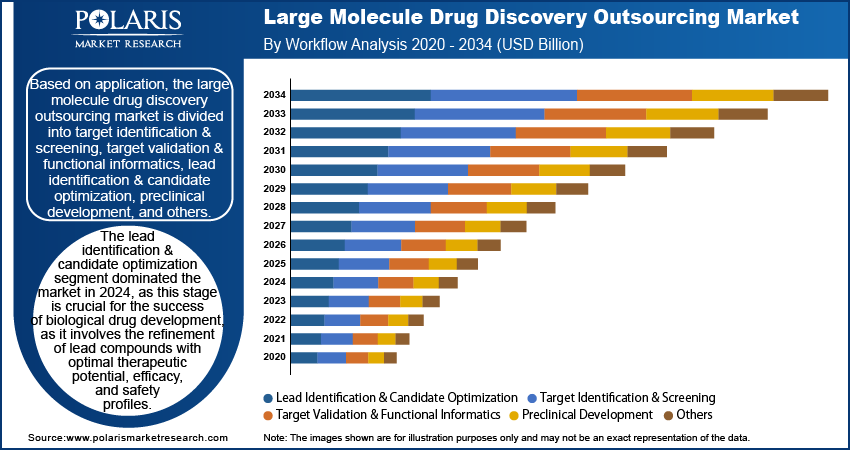

By Workflow Analysis

The segmentation, based on workflow, includes target identification & screening, target validation & functional informatics, lead identification & candidate optimization, preclinical development, and others. The lead identification & candidate optimization segment dominated the market in 2024, as this stage is crucial for the success of biological drug development, as it involves the refinement of lead compounds with optimal therapeutic potential, efficacy, and safety profiles. The increasing demand for precision-engineered biologics and monoclonal antibodies has encouraged companies to outsource this phase to CROs with specialized technologies in molecular modeling, high-throughput screening, and protein engineering. Outsourcing at this stage assures accelerated timelines and greater success rates, making it a strategic focus for drug developers aiming to streamline early-phase discovery.

By Service Analysis

The global large molecule drug discovery outsourcing market segmentation, based on service, includes chemistry services and biology services. The chemistry services segment is expected to witness substantial growth during the forecast period, driven by its crucial role in the structural optimization and stability assessment of large molecules. Although large molecule development is primarily biology-driven, chemistry services remain crucial for the formulation, conjugation, and stability profiling of biologics. The increasing complexity of therapeutic proteins and antibody-drug conjugates requires advanced chemistry capabilities, which many drug developers aim to obtain externally due to resource constraints. Outsourcing allows access to advanced chemical technologies and analytical support, helping companies improve the overall quality and performance of large molecule.

By Therapeutics Area Analysis

The segmentation, based on therapeutics area, includes respiratory system, pain and anesthesia, oncology, ophthalmology, hematology, and others. The oncology segment is expected to register a significant CAGR during the forecast period, attributed to the rising global burden of cancer and the expanding channel of targeted biologics such as immunotherapies and monoclonal antibodies. Oncology remains a high-priority focus for pharmaceutical innovation, with biologics offering promising outcomes through mechanisms such as immune checkpoint inhibition and tumor-specific targeting. The complexity of oncology drug development drives companies to collaborate with CROs that offer expertise in tumor biology, bioassay development, and biomarker analysis. This outsourcing approach supports the rapid development and validation of biologics tailored for oncology applications.

By End Use Analysis

The segmentation, based on end use, includes pharmaceutical & biotechnology companies and academic institutes. The academic institutes segment growth is fueled by their increasing involvement in early-stage biologics research and discovery. Academic institutions are becoming valuable contributors to biologics innovation with the growing focus on translational research and public-private partnerships. These organizations often collaborate with CROs to bridge the gap between basic research and preclinical development, leveraging external capabilities for advanced analytics and bio manufacturing. Outsourcing allows academic teams to advance discoveries without the infrastructure burden, accelerating the journey from lab findings to therapeutic prospects.

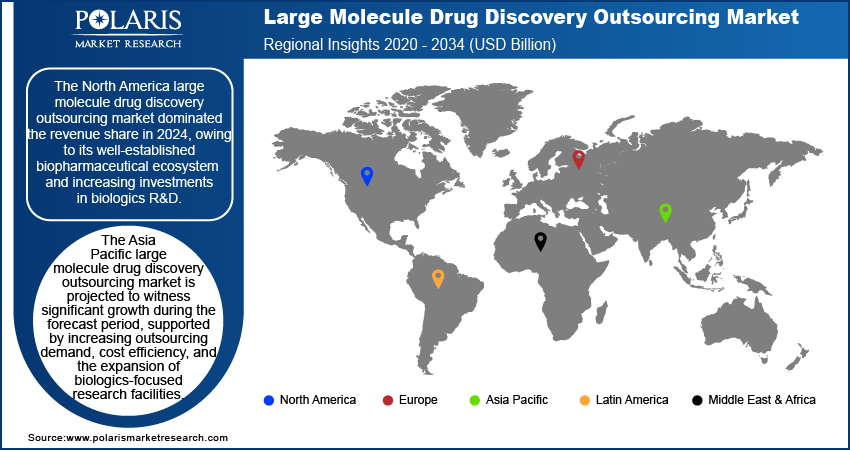

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America large molecule drug discovery outsourcing market dominated the revenue share in 2024, owing to its well-established biopharmaceutical ecosystem and increasing investments in biologics R&D. The region’s dominance is further supported by the presence of major CROs, advanced infrastructure, and a strong regulatory framework that supports biologics innovation. Additionally, the high demand for targeted therapies and biosimilars, along with collaborations between academia, biotech firms, and pharmaceutical companies, contributes to the growth opportunities. For instance, in February 2022, Insilico Medicine reached Phase 1 trials for an AI-discovered IPF drug, completing the process in under 30 months at lower costs than traditional methods. Marking a notable advancement in AI-driven drug development. Government funding and favorable policies for biopharmaceutical research further solidify the region’s position as the global hub for large molecule drug discovery outsourcing.

The US large molecule drug discovery outsourcing market held the largest share in North Ameica,, primarily due to increasing investments in biopharmaceutical R&D from both private and public sectors. The country benefits from a large number of innovative biotech firms and big pharma companies actively seeking next-generation biologics. Additionally, its research institutions and CROs provide end-to-end capabilities in complex modalities such as antibody-drug conjugates and gene therapies. The growth is further supported by favorable FDA regulatory policies that boost the outsourced development of advanced biologics.

The Asia Pacific large molecule drug discovery outsourcing market is projected to witness a significant growth rate during the forecast period, supported by increasing outsourcing demand, cost efficiency, and the expansion of biologics-focused research facilities. Additionally, rising investments in biotechnology infrastructure and clinical trial activity are accelerating the region’s growth in global biologics R&D.

The China large molecule drug discovery outsourcing market is experiencing growth, fueled by developed biopharma hubs that bring together CROs, academic institutions, and manufacturing facilities. The availability of highly trained scientists and engineers at competitive costs allows efficient biologics development for global clients. These factors, combined with the increasing adoption of international quality standards, position China as a rapidly maturing destination for outsourced biologics research.

The Europe large molecule drug discovery outsourcing market is projected to witness substantial growth during the forecast period, driven by strong academic and industry collaborations and supportive funding for biologics innovation. The region benefits from a rich base of pharmaceutical companies and CROs with deep expertise in biologics development. Continued focus on personalized medicine and biosimilar development is expected to boost outsourcing activity across Europe during 2025–2034.

The UK large molecule drug discovery outsourcing market has emerged as a major player, supported by its innovative research facilities and expertise in complex biologics development. The country benefits from regulatory alignment with both EMA and FDA standards, facilitating global drug development programs. Strong academic and industry collaborations, particularly in cell/gene therapies and antibody engineering, improve its outsourcing capabilities.

Key Players & Competitive Analysis Report

The large molecule drug discovery outsourcing landscape is shaped by strategic investments and emerging technologies, with developed markets such as the US and UK leading in revenue opportunity due to advanced infrastructure and regulatory expertise. Meanwhile, emerging markets such as China are gaining traction through sustainable value chains, cost-efficient talent, and government-backed biopharma hubs. Competitive intelligence reveals that major players are leveraging disruptions and trends, such as AI-driven biologics discovery and next-gen modalities, to strengthen their positioning. Revenue growth is further driven by latent demand for complex therapies, prompting CROs to expand capabilities in antibody engineering and cell/gene therapies. Economic and geopolitical shifts, such as supply chain realignments, are affecting vendor strategies, with partnerships and expansion opportunities becoming critical for market penetration. Industry trends highlight a shift toward integrated service offerings, combining discovery and preclinical development under a single provider. A few key players are Charles River Laboratories; Dalton Pharma Services; Domainex; Eurofins Discovery; Evotec SE; GenScript; Jubilant Biosys Limited; Labcorp. (Covance); Merck & Co., Inc.; Pharmaceutical Product Development, LLC (PPD, part of Thermo Fisher); Pharmaron; QIAGEN; Syngene International Limited; TCG Lifesciences Pvt Ltd.; and WuXi AppTec.

Key Players

- Charles River Laboratories

- Dalton Pharma Services

- Domainex

- Eurofins Discovery

- Evotec SE

- GenScript

- Jubilant Biosys Limited

- Labcorp. (Covance)

- Merck & Co., Inc.

- Pharmaceutical Product Development, LLC (PPD, part of Thermo Fisher)

- Pharmaron

- QIAGEN

- Syngene International Limited

- TCG Lifesciences Pvt Ltd.

- WuXi AppTec

Industry Developments

October 2024: Accenture Ventures invested in 1910 Genetics, a biotech firm using AI and lab automation for drug discovery. The partnership aims to enhance target identification, cut costs, and improve therapy affordability for biopharma clients.

May 2023: Aurigene Pharmaceutical Services, a Dr. Reddy's subsidiary, made a USD 40M investment to build an R&D and pilot-scale facility in Hyderabad for developing therapeutic proteins, antibodies, and viral vectors to support global biotech firms.

Large Molecule Drug Discovery Outsourcing Market Segmentation

By Workflow Outlook (Revenue, USD Billion, 2020–2034)

- Target Identification & Screening

- Target Validation & Functional Informatics

- Lead Identification & Candidate Optimization

- Preclinical Development

- Others

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Chemistry Services

- Biology Services

By Therapeutics Area Outlook (Revenue, USD Billion, 2020–2034)

- Respiratory system

- Pain and Anesthesia

- Oncology

- Ophthalmology

- Hematology

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology

- Academic Institutes

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Large Molecule Drug Discovery Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.78 billion |

|

Market Size in 2025 |

USD 3.02 billion |

|

Revenue Forecast by 2034 |

USD 6.53 billion |

|

CAGR |

8.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.78 billion in 2024 and is projected to grow to USD 6.53 billion by 2034.

The global market is projected to register a CAGR of 8.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Charles River Laboratories; Dalton Pharma Services; Domainex; Eurofins Discovery; Evotec SE; GenScript; Jubilant Biosys Limited; Labcorp. (Covance); Merck & Co., Inc.; Pharmaceutical Product Development, LLC (PPD, part of Thermo Fisher); Pharmaron; QIAGEN; Syngene International Limited; TCG Lifesciences Pvt Ltd.; and WuXi AppTec.

The lead identification & candidate optimization segment dominated the market in 2024.

The chemistry services segment is expected to witness the fastest growth during the forecast period.