Logistics Robot Market Size, Share, Trends, Industry Analysis Report

: By Product [Automated Storage and Retrieval Systems (AS/RS), Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Articulated Robotic Arms, and Others], Component, Application, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5606

- Base Year: 2024

- Historical Data: 2020-2023

Logistics Robot Market Overview

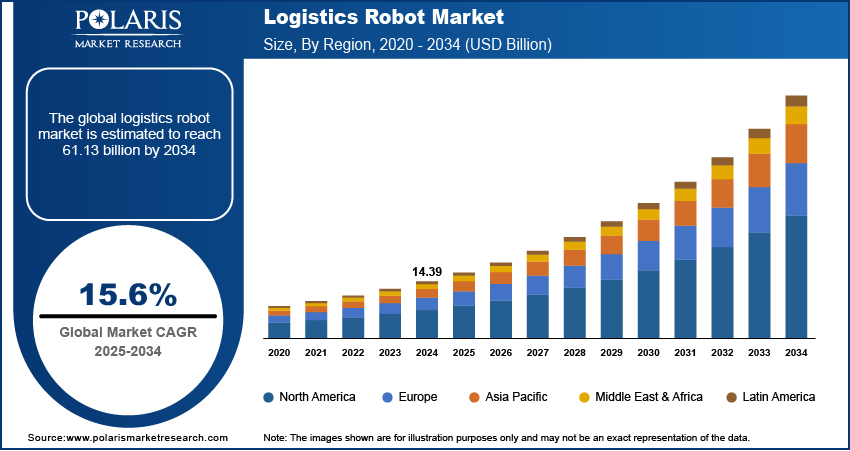

Logistics robot market size was valued at USD 14.39 billion in 2024. The market is projected to grow from USD 16.61 billion in 2025 to USD 61.13 billion by 2034, exhibiting a CAGR of 15.6% during 2025–2034.

A logistics robot is a type of autonomous or semi-autonomous machine designed to automate tasks within the logistics and supply chain sectors. These robots are equipped with advanced technologies such as artificial intelligence (AI), machine learning, and radar sensors to navigate and interact with their environment efficiently. Logistics robots are used to streamline operations in warehouses, distribution centers, and manufacturing facilities by performing tasks such as picking, sorting, packing, and transporting goods. Logistics robots enhance operational efficiency by increasing productivity, reducing labor costs, and improving accuracy. They work around the clock without breaks, making them ideal for high-volume operations. Additionally, logistics robots, including security robots, help in safety enhancement by reducing the risk of workplace accidents associated with manual handling of heavy loads or repetitive tasks.

The growing e-commerce industry across the globe is propelling the logistics robot market growth. According to data published by the International Trade Administration, global B2C ecommerce revenue is expected to grow to USD$ 5.5 trillion by 2027. Logistics robots streamline picking, sorting, and packaging, allowing warehouses to process thousands of orders efficiently and with minimal errors, enhancing overall transportation analytics. This drives companies operating in the e-commerce industry to rapidly adopt autonomous logistics robots to deliver orders quickly and accurately to meet customer expectations. E-commerce sales also involve frequent SKU changes, unpredictable order volumes, and rapid product turnover. Robotics offer the adaptability needed to handle these variations without disrupting workflow, thereby boosting their adoption. Additionally, robotic solutions enable better space utilization in urban micro-fulfillment centers, which are crucial in the e-commerce industry for meeting same-day delivery expectations.

To Understand More About this Research: Request a Free Sample Report

The logistics robot market demand is driven by the rising international trade globally. As per the data published by the United Nations Conference on Trade and Development, global trade hit a record $33 trillion in 2024, expanding 3.7% from the previous year. Increased international trade compels companies to manage larger inventories, longer shipping distances, and stricter delivery timelines. Logistics robots help these companies by automating warehousing, sorting, and transportation tasks, enabling them to handle higher order volumes efficiently. These robots reduce reliance on manual labor, minimize errors, and speed up processes, ensuring that goods move rapidly from factories to ports and ultimately to global customers. Additionally, international trade experiences challenges such as customs clearance, multi-modal transportation, and varying regulations, which require precise and adaptable logistics solutions. Logistics robots equipped with advanced sensors and AI navigate these complexities by optimizing storage, tracking shipments in real time, and ensuring compliance with international standards. Hence, with rising international trade globally, the demand for logistics robots is also increasing.

Logistics Robot Market Dynamics

Rising Production of Automobiles Globally

Automakers require seamless coordination between assembly lines, parts suppliers, and distribution centers. Logistics robots streamline these processes by automating the movement of components, subassemblies, and finished vehicles. The increasing complexity of modern vehicles, with more electronic and customized components, propels the demand for flexible logistics robots with different part sizes, weights, and handling requirements. Additionally, the automotive industry relies on just-in-time (JIT) manufacturing, where delays in parts delivery disrupt entire production lines. Logistics robots enhance supply chain reliability by autonomously transporting materials between warehouses and assembly stations with precision and consistency. According to the European Automobile Manufacturers Association, 85.4 million motor vehicles were produced around the world in 2022, an increase of 5.7% compared to 2021. Thus, as the manufacturing of automobiles across the globe increases, the demand for logistics robots also spurs.

Growing Labor Shortage Worldwide

Industries such as warehousing, manufacturing, and transportation are facing labor shortage challenges, making manual logistics increasingly unsustainable. As per the data published by The Conference Board Inc. in August 2024, the US economy alone needs 4.6 million additional workers per year to maintain current levels of supply, demand, and population balance. Logistics robots fill this gap by performing repetitive, physically demanding tasks, such as lifting heavy goods, sorting packages, and transporting materials without fatigue or the need for breaks. Additionally, labor shortages drive up wages and training costs, pushing companies to invest in logistics robotics for long-term savings and efficiency. Unlike human workers, robots do not require salaries, benefits, or onboarding time, offering a cost-effective solution for high-volume logistics operations. They also reduce turnover-related disruptions, as automated systems provide consistent performance regardless of workforce fluctuations. Therefore, the adoption of logistics robots is increasing with the growing labor shortage worldwide.

Logistics Robot Market Segmental Analysis

Market Evaluation by Product

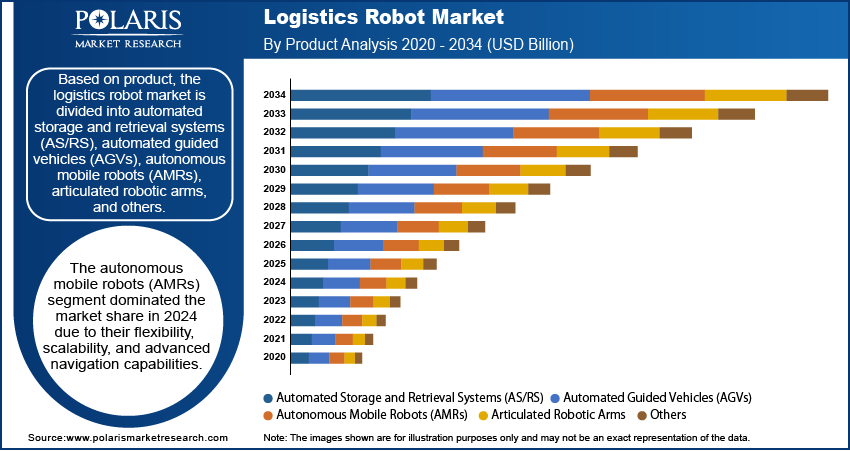

Based on product, the market is divided into automated storage and retrieval systems (AS/RS), automated guided vehicles (AGVs), autonomous mobile robots (AMRs), articulated robotic arms, and others. The autonomous mobile robots (AMRs) segment dominated the global logistics robot market share in 2024 due to their flexibility, scalability, and advanced navigation capabilities. These robots, equipped with sophisticated sensors and artificial intelligence, efficiently adapt to dynamic warehouse environments without fixed infrastructure such as magnetic strips or tracks. E-commerce giants and third-party logistics providers widely adopted AMRs to address the upsurging demand for fast, accurate order fulfillment and last-mile delivery optimization. The ability of AMRs to seamlessly integrate with warehouse management systems and reduce labor dependency further contributed to their dominance. Moreover, the growing preference for micro-fulfillment centers in urban areas favored AMRs, as they easily maneuver through compact spaces and handle a wide range of material handling tasks.

The automated storage and retrieval systems (AS/RS) segment is projected to grow at the fastest pace during the forecast period, owing to the rising need for space optimization and inventory accuracy. Manufacturers and logistics providers are prioritizing high-density storage solutions that reduce operational costs and improve throughput. AS/RS technologies offer unmatched efficiency in retrieving and storing goods, especially in high-volume distribution centers. The integration of these robots with real-time data analytics and warehouse automation platforms allows for predictive maintenance, better resource planning, and enhanced inventory visibility. Industries such as pharmaceuticals, food and beverage, and retail are investing heavily in AS/RS to meet stringent regulatory standards and consumer expectations.

Market Insight by Component

In terms of component, the logistics robot market is segregated into hardware, software, and services. The hardware segment dominated the market share in 2024 due to the increasing deployment of robotic systems across warehouses, distribution centers, and fulfillment hubs. Companies heavily invested in sensors, actuators, controllers, and robotic arms to boost operational efficiency, reduce manual labor, and improve order accuracy. The growing demand for automated material handling and real-time inventory tracking pushed organizations to upgrade their existing infrastructure with advanced hardware components. Additionally, the rapid expansion of e-commerce and the pressure to meet same-day delivery expectations encouraged businesses to integrate more hardware automation equipment to accelerate logistics operations.

The software segment is expected to grow at a robust pace in the coming years, owing to the rising emphasis on intelligent automation, data analytics, and seamless system integration. Businesses increasingly rely on advanced software platforms to orchestrate complex workflows, manage fleets of mobile robots, and optimize warehouse layouts. These solutions enable real-time decision-making, predictive maintenance, and adaptive routing, which are essential in dynamic and high-volume logistics environments. The integration of AI and machine learning algorithms into robotic software enhances task scheduling, load balancing, and demand forecasting. Therefore, as organizations shift toward fully connected and autonomous supply chains, the role of software becomes more critical in maximizing return on investment from robotic deployments.

Logistics Robot Market Regional Analysis

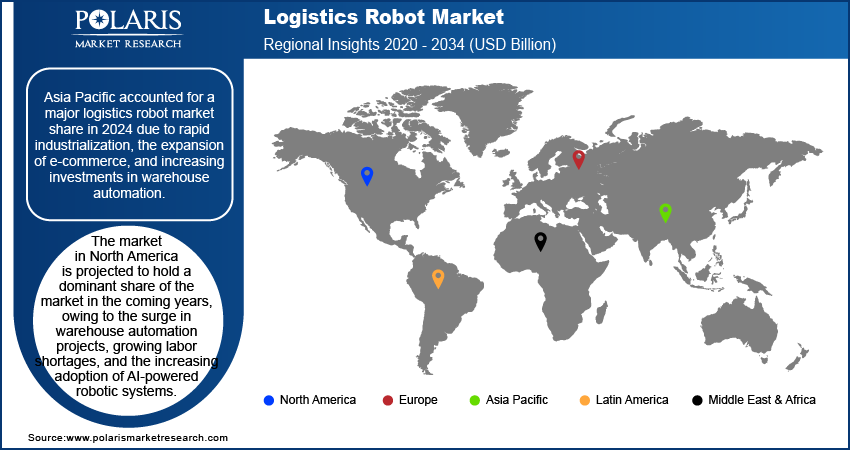

By region, the report provides logistics robot market insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to rapid industrialization, the expansion of e-commerce, and increasing investments in warehouse automation. Countries across the region accelerated their adoption of robotic technologies to address rising labor costs, space constraints, and growing consumer demand for faster deliveries. China led the region and dominated the global market due to its strong manufacturing base, aggressive digital transformation strategies, and government-backed initiatives such as “Made in China 2025.” Major Chinese logistics and retail companies, including JD.com and Alibaba, deployed large fleets of autonomous robotics to streamline operations, enhance delivery speeds, and reduce operational costs. The region also benefited from a dense network of suppliers, component manufacturers, and system integrators that enabled faster deployment and cost-effective scaling of automation solutions. Moreover, the rising production of automobiles in the region supported the logistics robot market dominance as these robots are used for the internal transportation of materials, automating tasks such as packaging, part feeding, and machine tending in automobile manufacturing. For instance, the European Automobile Manufacturers Association published a report stating that Greater China alone produced 32% of the total vehicles produced globally in 2023.

The market in North America is projected to hold a dominant share of the market in the coming years, owing to the surge in warehouse automation projects, growing labor shortages, and the increasing adoption of AI-powered robotic systems. The US is estimated to lead the regional market growth, supported by strong technological infrastructure, high capital investments, and the presence of major logistics and retail companies such as Amazon and Walmart. These companies continue to expand automated fulfillment centers to meet escalating demand for same-day and next-day delivery services, thereby boosting demand for logistics robots. The region is also witnessing rising demand for scalable, interoperable solutions that integrate robotics with warehouse management and enterprise systems. Additionally, favorable regulatory environments and a growing focus on supply chain resilience are encouraging companies in the region to adopt advanced logistic robots across transportation hubs and distribution centers.

Logistics Robot Market – Key Players & Competitive Analysis Report

The logistics robot industry is characterized by a dynamic, competitive landscape driven by strategic mergers, acquisitions, partnerships, and an expanding product portfolio. Major companies are leveraging these strategies to enhance their technological capabilities, expand market reach, and boost their positions in the rapidly evolving sector. Smaller firms, on the other hand, often rely on alliances with larger corporations or tech startups to co-develop specialized logistics robots tailored for niche applications such as cold chain logistics or last-mile delivery. This collaborative approach allows them to stay competitive without the extensive R&D budgets of their larger counterparts. Additionally, companies are diversifying their product portfolios by introducing modular, customizable robots capable of handling multiple tasks, from inventory management to order fulfillment, thereby addressing the growing demand for flexible automation systems.

The logistics robot market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are BEUMER Group; Boston Dynamics; Dematic; Geek+; GreyOrange; Honeywell International Inc.; Kawasaki Heavy Industries, Ltd.; Kion Group Ag; KNAPP AG; Locus Robotics; Reflex Robotics; SSI Schaefer; and Swisslog Holding AG.

Geek+ is a global company in intelligent logistics, specializing in AI-driven robotic solutions for warehouse automation and supply chain management. Founded in 2015 and headquartered in Beijing, Geek+ has revolutionized logistics operations by deploying Autonomous Mobile Robots (AMRs) that enhance efficiency, reliability, and flexibility. The company serves diverse industries such as e-commerce, retail, manufacturing, pharmaceuticals, and automotive, partnering with major brands, including Nike, Toyota, and Walmart. The company has sold over 41,000 robots globally and operates offices across the US, Europe, Asia, and other regions. Geek+ offers a comprehensive range of solutions tailored to modern logistics challenges. These include AMRs for picking, sorting, moving, and collaborative tasks.

Reflex Robotics is an innovative robotics company specializing in the development of affordable, general-purpose humanoid robots designed to automate repetitive tasks in warehouses and factories. Founded by MIT alumni with experience at leading companies such as Tesla, Boston Dynamics, and Amazon, Reflex Robotics focuses on creating versatile solutions for logistics challenges. The flagship product of the company includes the Reflex Robot, which is an advanced solution capable of achieving operational readiness within 60 minutes of deployment. These robots become fully autonomous by learning from human demonstrations, enabling seamless transitions between tasks such as tote transfers, product picking, shelf replenishment, and quality assurance.

List of Key Companies in Logistics Robot Market

- BEUMER Group

- Boston Dynamics

- Dematic

- Geek+

- GreyOrange

- Honeywell International Inc.

- Kawasaki Heavy Industries, Ltd.

- Kion Group Ag

- KNAPP AG

- Locus Robotics

- Reflex Robotics

- SSI Schaefer

- Swisslog Holding AG

Logistics Robot Industry Developments

September 2024: GXO Logistics, Inc., one of the world’s largest pure-play contract logistics provider, announced a new agreement with Reflex Robotics to deploy its robotic solutions into their warehouse operation.

October 2023: CEVA Logistics, a world leader in third-party logistics, announced to deploy robots from Boston Dynamics at its recently opened 135,000-square-foot, state-of-the-art transload facility.

October 2021: Geek+, a global AMR leader, announced the launch of RoboShuttle RS8-DA, an 8-meter high flexible arm robot, to revolutionize warehouse storage.

Logistics Robot Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Articulated Robotic Arms

- Others

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Palletizing and De-palletizing

- Pick and Place

- Loading and Unloading

- Packaging and Co-packing

- Shipment and Delivery

- Others

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- E-commerce

- Healthcare

- Retail

- Food & Beverages

- Automotive

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Logistics Robot Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 14.39 Billion |

|

Market Forecast in 2025 |

USD 16.61 Billion |

|

Revenue Forecast in 2034 |

USD 61.13 Billion |

|

CAGR |

15.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 14.39 billion in 2024 and is projected to grow to USD 61.13 billion by 2034.

The global market is projected to register a CAGR of 15.6% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are BEUMER Group; Boston Dynamics; Dematic; Geek+; GreyOrange; Honeywell International Inc.; Kawasaki Heavy Industries, Ltd.; Kion Group Ag; KNAPP AG; Locus Robotics; Reflex Robotics; SSI Schaefer; and Swisslog Holding AG.

The autonomous mobile robots (AMRs) segment dominated the market revenue share in 2024.

The software segment is expected to grow at the fastest pace in the coming years.