LTE and 5G Broadcast Market Size, Share, Trends, Industry Analysis Report

: By Technology (LTE Broadcast and 5G Broadcast), End Use and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1719

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

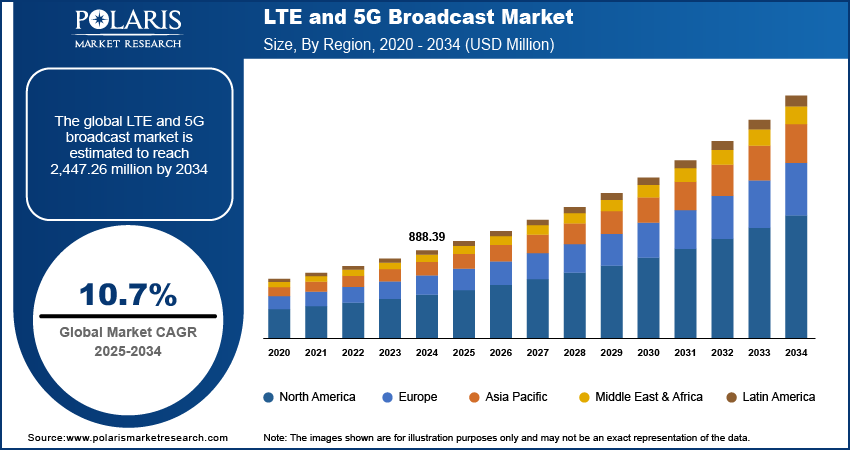

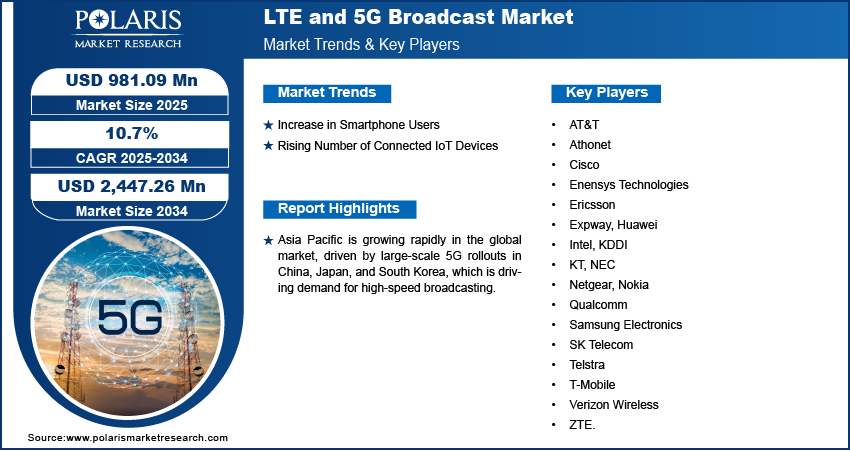

The global LTE and 5G broadcast market size was valued at USD 888.39 million in 2024, growing at a CAGR of 10.7% from 2025 to 2034. The market growth is primarily driven by the growing deployment of private 5G networks and the rising emphasis on the modernization of telecommunications globally.

Key Insights

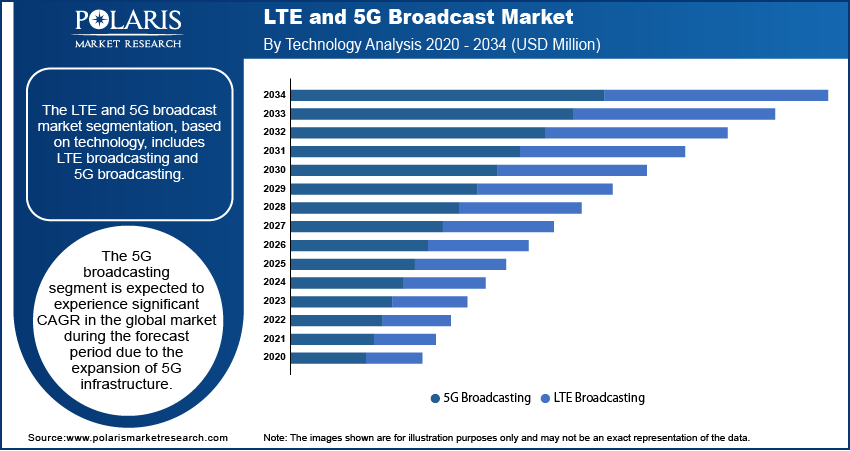

- The 5G broadcast segment is anticipated to register a significant CAGR during the projection period, primarily due to the rapid expansion of 5G infrastructure globally.

- The connected cars segment led the market in 2024. The segment’s dominance is driven by the growing adoption of advanced in-car technologies that need reliable and high-speed connectivity.

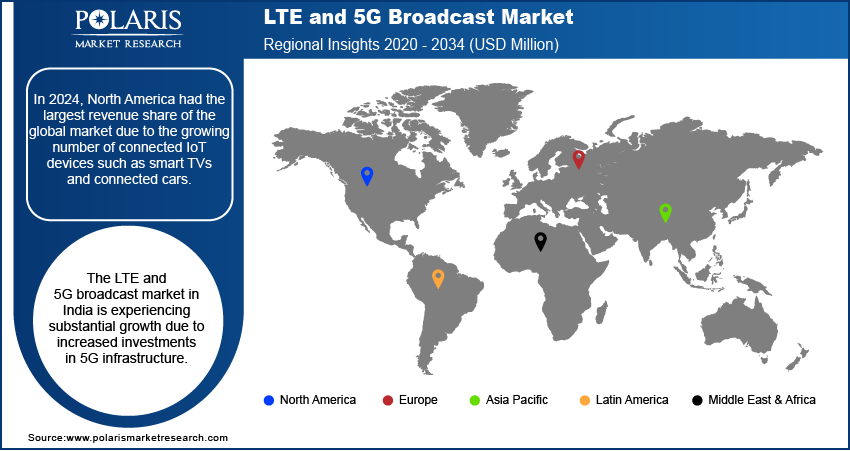

- North America dominated the market in 2024. The rising number of connected IoT-based technology devices, such as connected cars and smart TVs, drives the region’s leading market share.

- Asia Pacific is experiencing robust growth, owing to the rapid expansion of 5G infrastructure, especially in major economies such as Japan, South Korea, and China.

Industry Dynamics

- The rising number of smartphone users has led to increased demand for platforms supporting 5G broadcasting, thereby fueling the market development.

- An increase in connected devices, such as wearable tech and smart TVs, has led to increased demand for efficient and high-quality broadcast services.

- The rising deployment of these technologies in smart cities is projected to provide several market opportunities in the coming years.

- The high initial cost of manufacturing may present challenges to market expansion.

Market Statistics

2024 Market Size: USD 888.39 million

2034 Projected Market Size: USD 2,447.26 million

CAGR (2025-2034): 10.7%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

LTE is a standard for high-speed wireless communication used by mobile devices, offering faster data transfer and lower latency than previous technologies. 5G broadcast is an advanced broadcast service that uses 5G networks to deliver multimedia content to large audiences efficiently, enabling high-quality video and data transmission over wide areas with reduced network load.

Governments and regulatory bodies worldwide are accelerating the deployment of private 5G networks, which is driving the LTE and 5G broadcast market growth. Various countries have introduced initiatives to support 5G rollouts, including funding, spectrum allocation, and policy development. This industry backing helps accelerate the adoption of 5G infrastructure and encourages investment in new broadcast technologies. Additionally, governments are pushing for the modernization of telecommunications, prompting companies to adopt 5G broadcast solutions, further fueling the growth of the market.

Technological advancements in mobile network infrastructure are driving the LTE and 5G broadcast market expansion. The transition from 4G to 5G technology offers faster speeds, reduced latency, and more efficient data transmission, enabling broadcast services to handle large-scale content delivery to millions of users simultaneously. Additionally, improved infrastructure provides more stable and widespread coverage, especially in urban areas and at major events.

Market Dynamics

Increase in Smartphone Users

The increase in the number of smartphone users has created a higher demand for platforms that support 5G broadcasting. For instance, according to the Indian Ministry of Statistics and Programme Implementation, in India alone, 96.1% of the country’s total population uses smartphones, showcasing an increase in the number of smartphone users. Therefore, the growing number of smartphone users is driving the LTE and 5G broadcast market development.

Rising Number of Connected IoT Devices

The rise in connected devices, such as smart TVs and wearable tech, has increased the demand for efficient and high-quality broadcast services. For instance, according to Samsung, the US alone has 30 million smart TVs, highlighting the large volume of connected IoT devices. LTE and 5G networks enable the massive data transfer needed for live streaming, real-time broadcasting, and content delivery across various IoT devices. Thus, the increase in IoT devices is significantly boosting the LTE and 5G broadcast market revenue.

Market Segment Insights

LTE and 5G Broadcast Market Assessment Based on Technology

The LTE and 5G broadcast market, based on technology, is segmented into LTE broadcast and 5G broadcast. The 5G broadcast segment is expected to experience a significant CAGR in the global market from 2025 to 2034. This growth is primarily driven by the rapid expansion of 5G infrastructure worldwide. As more countries and telecom providers invest in building 5G networks, the demand for 5G broadcasting services is increasing. 5G technology offers faster speeds, lower latency, and greater capacity, making it ideal for high-quality, real-time broadcasting.

LTE and 5G Broadcast Market Evaluation Based on End Use

The LTE and 5G broadcast market, based on end use, is segmented into video on demand, mobile TV, connected cars, emergency alerts, stadiums, e-newspapers and e-magazines, radio, and data feed & notifications. The connected cars segment dominated the LTE and 5G broadcast market in 2024 due to the increasing adoption of advanced in-car technologies that require high-speed and reliable connectivity. Connected cars rely on LTE and 5G networks for real-time data transmission, including navigation, entertainment, and communication services. 5G networks offer faster speeds and lower latency, making them particularly well-suited for supporting the growing demand for seamless, real-time services in vehicles.

Regional Analysis

By region, the study provides the LTE and 5G broadcast market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the global market due to the growing number of connected IoT based technology devices such as smart TVs and connected cars. For instance, according to the US Bureau of Economic Analysis, average consumer spending on consumer electronics increased by 0.4% in October 2024 compared to the previous month. This increase in consumer spending highlights the region's growing interest in IoT devices, driving the demand for advanced broadcast technologies like LTE and 5G, thereby fueling the LTE and 5G broadcast market growth in the North America region.

The Asia Pacific LTE and 5G broadcast market is experiencing significant growth, primarily driven by the rapid expansion of 5G infrastructure. Countries like China, Japan, and South Korea are leading the charge with large-scale 5G network rollouts. As 5G technology expands, the demand for high-speed broadcasting is increasing, thereby driving market growth in the region.

The market for LTE and 5G broadcast in India is experiencing substantial growth due to increased investments in 5G infrastructure. Government and private companies are making significant efforts to expand 5G networks across the country. The government has launched initiatives to boost 5G deployment, while telecom companies are investing heavily in upgrading infrastructure. These investments are improving network coverage, speed, and reliability, which, in turn, is supporting the growing demand for high-quality streaming, gaming, and real-time applications.

Key Players and Competitive Insights

The LTE and 5G broadcast market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the LTE and 5G broadcast market include AT&T, Athonet, Cisco, Enensys Technologies, Ericsson, Expway, Huawei, Intel, KDDI, KT, NEC, Netgear, Nokia, Qualcomm, Samsung Electronics, SK Telecom, Telstra, T-Mobile, Verizon Wireless, and ZTE.

Huawei is an international organization specializing in information and communications technology (ICT) infrastructure and smart devices. The company's solutions serve a user base of over three million individuals worldwide, with a presence in over 170 countries and regions. Huawei's core business spans a wide range of products and services, including mobile network equipment, enterprise networking solutions, consumer devices, and cloud computing. The company's consumer business includes a diverse portfolio of smartphones, tablets, and wearables. Additionally, Huawei has developed its operating system, HarmonyOS, which has been deployed on over 220 million Huawei devices and has a growing ecosystem of over 2.2 million developers. In the enterprise and cloud computing space, Huawei offers a wide range of solutions, including cloud services, enterprise intelligence, and industry-specific applications. The company has established partnerships with over 2,000 cloud service providers and has deployed its cloud services in more than 170 countries and regions. Huawei's 5G RAN solutions offer advanced hardware and software for optimal network performance, addressing deployment challenges and improving user experience. Innovations include Massive MIMO, SuperBAND, simplified deployment solutions, and antenna technology.

Qualcomm Technologies, headquartered in San Diego, California, has been operating in wireless technology since its establishment in 1985. Initially focused on CDMA technology, it now offers solutions in 5G, IoT, and other advanced communication technologies. Qualcomm operates on a fabless manufacturing model, emphasizing research and development while outsourcing production. Its innovations, including the Snapdragon system-on-chip and Gobi modems, have shaped mobile communications and supported advancements in AI, machine learning, and edge computing. The advent of 5G has amplified Qualcomm's role in improving data speeds, reducing latency, and expanding IoT applications across industries such as automotive, healthcare, and smart cities. The company's technologies enable seamless device connectivity and support the vision of an interconnected "Internet of Everything." Strategic partnerships and a licensing program with over 190 companies worldwide further extend Qualcomm's influence, fostering innovation and growth within the wireless ecosystem. Its commitment to developing advanced solutions continues to shape the future of communication and connected systems.

List of Key Companies

- AT&T

- Athonet

- Cisco

- Enensys Technologies

- Ericsson

- Expway

- Huawei

- Intel

- KDDI

- KT

- NEC

- Netgear

- Nokia

- Qualcomm

- Samsung Electronics

- SK Telecom

- Telstra

- T-Mobile

- Verizon Wireless

- ZTE

LTE and 5G Broadcast Market Development

In Febraury 2021, The second-generation Qualcomm 5G Fixed Wireless Access platform was announced, featuring 10 Gigabit 5G connectivity, extended-range support, and plug-and-play installation for homes and businesses, enabling faster internet services.

In September 2020, The industry's first 5G NR broadcast demonstration was launched by ZTE, enabling end-to-end 5G HD video broadcast services over the 700MHz spectrum, supporting simultaneous user access without additional resource usage

LTE and 5G Broadcast Market Segmentation

By Technology Outlook (Revenue – USD Million, 2020–2034)

- LTE Broadcast

- 5G Broadcast

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Video on demand (VOD)

- Mobile TV

- Connected Cars

- Emergency Alerts

- Stadiums

- E-Newspapers And E-Magazines

- Radio

- Data Feed & Notifications

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

LTE and 5G Broadcast Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 888.39 million |

|

Market Size Value in 2025 |

USD 981.09 million |

|

Revenue Forecast by 2034 |

USD 2,447.26 million |

|

CAGR |

10.7% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market was valued at USD 888.39 million in 2024 and is projected to grow to USD 2,447.26 million by 2034.

• The global market is projected to register a CAGR of 10.7% from 2025 to 2034.

• North America had the largest share of the global market in 2024.

• A few of the key players in the market are AT&T, Athonet, Cisco, Enensys Technologies, Ericsson, Expway, Huawei, Intel, KDDI, KT, NEC, Netgear, Nokia, Qualcomm, Samsung Electronics, SK Telecom, Telstra, T-Mobile, Verizon Wireless, and ZTE.

• The 5G broadcast segment is expected to experience significant CAGR during the forecast period due to the expansion of 5G infrastructure.

• The connected cars segment dominated the market in 2024 due to the increasing adoption of advanced in-car technologies that require high-speed and reliable connectivity.