Marble Market Size, Share, Trends, & Industry Analysis Report

By Color (White, Black, Yellow), By Product, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5885

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

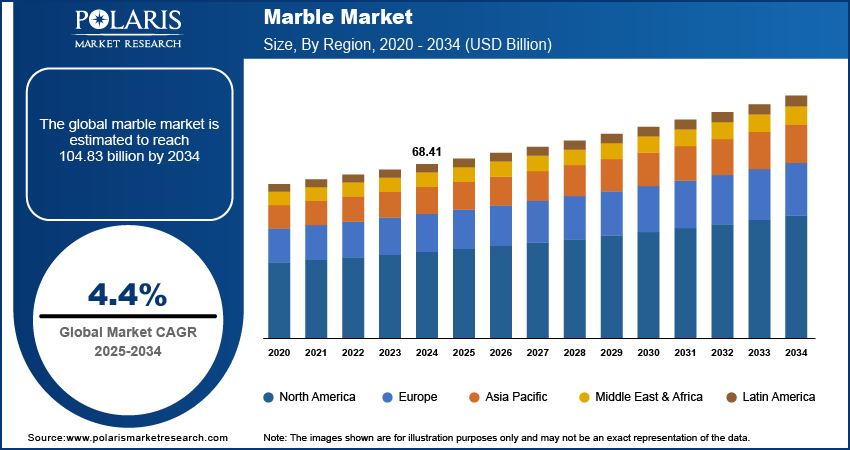

The global marble market size was valued at USD 68.41 billion in 2024, growing at a CAGR of 4.4% from 2025–2034. Rapid growth in urban construction and real estate is driving higher demand for marble.

Marble is a fine-grained metamorphic rock composed mainly of calcite or dolomite, valued for its natural veining and polished surface. It is widely used in architectural applications such as flooring, wall cladding systems, and decorative elements due to its visual appeal and surface adaptability. Manufacturers are introducing precision-based machinery, including computer numerical control machine (CNC) cutters and 3D scanning tools that meet the demand for customized dimensions and intricate patterns. Fabrication facilities are focusing on optimizing efficiency by adopting automated handling systems and compact layouts. These upgrades are helping reduce material waste and minimize manual operations. In construction and interior projects, marble remains a preferred choice for its ability to complement both classic and contemporary design schemes while offering ease of maintenance.

To Understand More About this Research: Request a Free Sample Report

Environmental considerations are increasingly shaping industry practices. Water recycling systems, energy-efficient tools, and dust suppression technologies are adopted to reduce the ecological footprint of marble processing. Regulatory compliance around safety standards, emissions, and waste disposal is pushing companies to modernize their operational frameworks. Product enhancements such as anti-stain coatings, honed textures, and non-slip finishes are expanding marble’s applications across residential and commercial settings, including kitchens, lobbies, and designer installations. These advancements are allowing producers to maintain consistent quality while managing costs across both standardized and custom project requirements.

Advancements in marble processing technologies are improving fabrication efficiency and enabling broader design customization. Manufacturers are using compact machinery and precision tools to deliver consistent product quality while reducing material wastage. These improvements are allowing suppliers to meet diverse project specifications with enhanced control over textures, edges, and surface finishes. Innovations in finishing techniques also led to the development of treated surfaces that offer better resistance to stains, scratches, and moisture exposure, making marble suitable for a wider range of functional and decorative uses.

Sustainability requirements are reshaping operations across the marble industry. Production facilities are incorporating water recycling systems, energy-efficient cutting tools, and dust management units to reduce environmental impact. Natural stone, including marble is used in green building initiatives due to its low chemical processing and long-life span. For instance, in March 2025, Skinrock launched eco-friendly natural stone veneers, including polished marble, that are thin, lightweight, and use fewer resources. They offer a sustainable option for stylish interior and exterior designs. Regulatory focus on resource efficiency and responsible sourcing is boosting the use of eco-certified materials and transparent quarrying practices. These changes are strengthening marble’s position as a dependable material that meet with evolving standards in sustainable design and environmentally conscious construction.

Industry Dynamics

Growing Demand from High-End Construction and Interior Design Projects

Marble is increasingly selected in high-end residential, hospitality, and commercial spaces for its elegant appearance and natural finish. As per the Oxford Economics, global construction is expected to grow from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, led by China, the U.S., and India, driven by urbanization and green infrastructure. Architects and designers prefer it for applications such as flooring, wall cladding, countertops, and staircases, where visual appeal and material prestige are key requirements. Its availability in a wide range of colors, patterns, and surface treatments allows seamless integration into various design themes, from classic to contemporary. This versatility is helping marble maintain relevance in premium construction and interior design projects.

The rising focus on customized interiors is driving demand for marble variants with specific finishes, edge profiles, and design patterns. Advanced fabrication tools, including CNC machines and laser-guided cutters, are enabling manufacturers to deliver products tailored to precise project needs. High-income consumers and luxury developers are prioritizing natural materials to enhance value perception, further contributing to marble’s growing presence in upscale settings. The combination of aesthetic value and design flexibility continues to reinforce marble’s role in premium construction segments.

Expansion of Urban Infrastructure and Real Estate Development

The ongoing growth in urban construction is creating sustained demand for durable and visually appealing materials, positioning marble as a preferred option in large-scale infrastructure and real estate developments. According to Knight Frank LLC, India’s real estate sector is expected to grow from USD 200 billion in 2021 to USD 1 trillion by 2030, contributing 13% to the country’s GDP by 2025. By 2047, the market could reach USD 5–7 trillion, with potential to exceed USD 10 trillion. Marble usage in flooring, cladding, and public installations is fueled by its ability to endure high foot traffic, resist surface deterioration, and require minimal maintenance. Developers are incorporating marble into commercial complexes, public buildings, and institutional projects to meet long-term performance and design expectations.

Government-led housing and infrastructure initiatives in emerging and developed economies are also contributing to market expansion. Marble is considered in façade treatments, staircases, and landscaping elements for its structural stability and polished finish. Additionally, advances in large-format slab production are helping address the needs of expansive architectural spaces. These factors are boosting the continued integration of marble across growing urban real estate portfolios and infrastructure upgrades.

Segmental Insights

Color Analysis

The global segmentation, based on color includes, white, black, yellow, red, and other colors. The white segment held the largest revenue share in 2024. This growth is due to its wide usage across residential, commercial, and institutional spaces. It is preferred for its clean appearance, natural veining, and ability to reflect light, enhancing the spatial quality of interiors. White variants such as Carrara, Makrana, and Statuario continue to be in high demand across flooring, wall cladding, and countertop installations. Its neutrality allows compatibility with various color schemes and design styles, including modern, transitional, and classical interiors. High availability, along with continuous demand from premium construction and renovation projects, is expected to sustain white marble’s market dominance over the forecast period.

The black segment is projected to grow at a robust pace in the coming years, driven by rising interest in bold and high-contrast interior designs. Its deep color tones and natural patterns are favored in luxury spaces, especially for kitchen countertops, flooring, fireplace surrounds, and bathroom walls. Black marble is often used as an accent material to create depth and contrast in contemporary layouts. Advances in polishing, protective coatings, and surface durability are helping extend its use into commercial spaces. Growing global interest in darker color palettes, especially in urban premium housing and hospitality developments, is accelerating demand for black marble across multiple regions.

Product Analysis

The global segmentation, based on product includes, tiles or slabs, blocks, and other products. The tiles or slabs segment accounted for significant share in 2024, due to their extensive application in flooring, wall cladding, kitchen surfaces, and exterior façades. As an example, in January 2025, Daltile launches featured bold marble-look tiles and stone slabs, blending luxury design with durability and easy maintenance. Their uniform dimensions and surface finishes make them suitable for large-scale installations in residential and commercial buildings. Tiles and slabs offer ease of transport, installation, and maintenance, making them a practical choice for designers and contractors. Demand is further fueled by prefabrication trends and modular construction techniques, where pre-cut slabs reduce on-site labor and speed up project timelines. Enhanced fabrication processes and polishing equipment are improving finish quality, which continues to boost growth in this segment across key markets.

The blocks segment is projected to grow at a significant pace during the assessment phase, due to their importance in custom cutting, monumental architecture, and large-scale sculptural works. These raw, unprocessed units are supplied directly from quarries and used by fabricators and artisans for carving, cutting, and surface finishing. They offer maximum flexibility for creating non-standard dimensions, which is essential for bespoke installations in luxury architecture and public art. Growth in demand is fueled by improved quarrying and logistics, enabling efficient transportation of heavy blocks to processing facilities. Their adaptability and wider utility in specialty construction projects are helping increase their share in the global marble market.

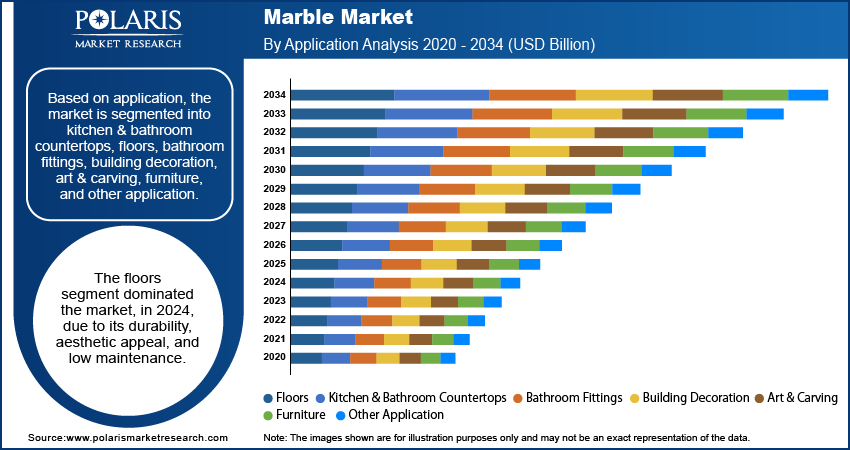

Application Analysis

The global segmentation, based on application includes, kitchen & bathroom countertops, floors, bathroom fittings, building decoration, art & carving, furniture, and other application. The floors segment dominated the market, in 2024, due to its durability, aesthetic appeal, and low maintenance. It is extensively used in commercial buildings, luxury homes, hotels, and government facilities. Marble floors offer a polished, elegant surface that enhances room brightness and creates a high-end look. The material’s natural cooling properties also make it suitable for warm climates. Availability in a range of colors, textures, and finishes further boost its use in varied architectural themes. High foot traffic resistance and long product life make marble a preferred flooring choice for developers and end-users seeking lasting value and minimal upkeep.

The kitchen & bathroom countertops segment is estimated to hold a substantial market share in 2034, due to increasing demand for natural, durable, and visually appealing surface materials. Marble provides a smooth, heat-resistant surface ideal for cooking and washing areas. New surface treatments and sealants enhanced its resistance to stains and moisture, which was a previous limitation in wet environments. Designers are integrating marble countertops in high-end residential units for their luxurious finish and tactile quality. For instance, in Februaruy 2025, LX Hausys launched “Splendor,” a marble-inspired quartz countertop collection, blending the elegance of marble with the durability of quartz for modern interior applications. The segment is also benefitting from home renovation trends and rising urban housing development, particularly in North America, Europe, and Asia Pacific, where consumers are investing in quality interior solutions.

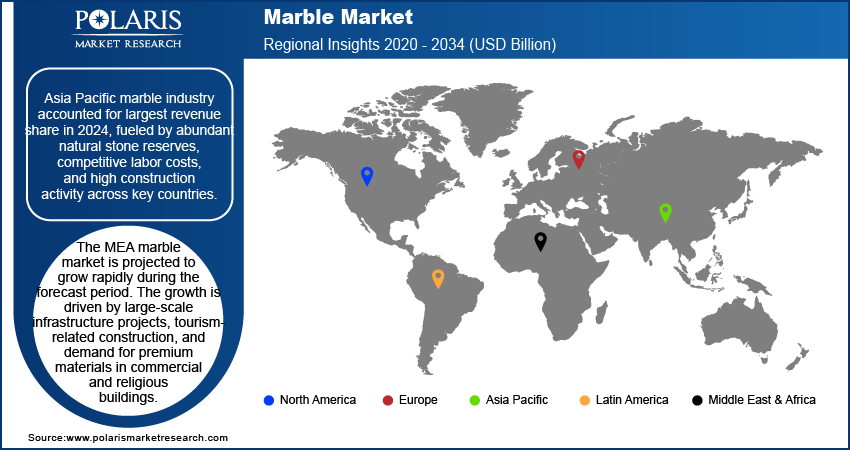

Regional Analysis

Asia Pacific marble industry accounted for largest revenue share in 2024, fueled by abundant natural stone reserves, competitive labor costs, and high construction activity across key countries. India and China remain the leading contributors, driven by robust quarrying operations, local demand, and strong export channels. India exports a wide range of marble varieties to Europe, the Middle East, and North America, while China supports regional consumption through its infrastructure and residential development. Processing clusters in Rajasthan, Guangdong, and other industrial hubs are equipped with advanced machinery for slab cutting, surface finishing, and customization. Increasing demand from real estate, urban redevelopment, and public infrastructure continues to drive marble consumption across flooring, cladding, countertops, and architectural elements.

India Marble Market Insight

The India dominated the regional market, in 2024. The country benefits from extensive marble reserves, primarily in Rajasthan, driven by active mining policies and affordable production ecosystems. Key marble processing centers are located in Kishangarh, Udaipur, and Makrana, offering slabs, tiles, and blocks for both domestic and international markets. Export growth is fueled by efficient port logistics, international quality certifications, and increasing orders from the US, UAE, and European countries. Domestically, demand is fueled by government-led infrastructure projects, premium housing, and the Smart Cities Mission. Over 8,000 projects worth USD 19.06 billion are developed across 100 smart cities in India, with over 90% already completed. This large-scale urban transformation is driving demand for high-quality construction materials, including premium marble, in public infrastructure, commercial spaces, and smart housing projects.

MEA Marble Market

The MEA marble market is projected to grow rapidly during the forecast period. The growth is driven by large-scale infrastructure projects, tourism-related construction, and demand for premium materials in commercial and religious buildings. In line with its Vision 2030 strategy, Saudi Arabia announced over USD 1.3 trillion toward infrastructure upgrades, with a focus on urban development, transport hubs, and luxury hospitality. These initiatives are significantly boosting the demand for marble in structural cladding, flooring, and public interiors. The UAE, Qatar, and Egypt are also actively expanding civic infrastructure where natural stones are preferred for their durability and visual appeal. Climate resilience, low maintenance, and high surface polish make marble suitable for both indoor and outdoor applications. Regional demand is met through imports, driven by favorable trade relations and improved supply chain logistics across the Gulf region and North Africa.

Europe Marble Market Overview

Europe marble market growth is fueled by deep-rooted use of natural stone in heritage preservation, interior design, and modern architectural projects. Italy, Spain, and Greece are among the top producers and exporters, offering high-quality varieties such as Carrara, Calacatta, and Thassos. These materials are used in high-end residential applications, public monuments, museums, and institutional projects. Renovation activities across historical sites, combined with sustainable construction practices, are sustaining regional demand. European manufacturers also benefit from refined quarrying techniques and advanced surface treatment technologies that allow for precise customization. Rising environmental awareness is contributing to a preference for low-emission, natural materials, positioning marble as a key element in green building initiatives and certified design frameworks across the region. As per the European Environment Agency (EEA), buildings in the EU use about 42% of all energy and cause 35% of emissions. The EU is required to double its renovation rate and cut building energy use by at least 60% to meet climate goals. Thus, this shift boosts demand for energy-efficient, sustainable materials while driving innovation in eco-friendly marbles.

Key Players & Competitive Analysis Report

The marble industry is moderately fragmented and competitive, shaped by consistent demand across residential, commercial, and infrastructure projects. Leading manufacturers are focusing on expanding quarrying operations, upgrading processing technology, and strengthening global distribution channels to meet growing demand for precise dimensions, custom surface finishes, and reliable supply timelines. Companies are investing in modern fabrication equipment and automated production lines to improve throughput and product quality. Efforts to adopt sustainable quarrying methods, reduce water usage, and meet regulatory standards are contributing to improved compliance in environmentally sensitive markets. Suppliers are also forming collaborations with construction firms, interior designers, and project developers to secure long-term supply agreements and tailored installations.

Key companies in the marble industry include Antolini Luigi & C SpA, BC Marble Products Ltd, Levantina y Asociados de Minerales S.A, Fox Marble, Kangli Stone Group, Best Cheer Stone, Kingstone Mining Holdings Limited, China Kingstone Mining Holdings Limited, Daltile, Hellenic Granite Co., Topalidis SA, Santucci Group Srl.

Key Players

- Antolini Luigi & C SpA

- BC Marble Products Ltd

- Best Cheer Stone

- China Kingstone Mining Holdings Limited

- Daltile

- Fox Marble

- Hellenic Granite Co.

- Kangli Stone Group

- Kingstone Mining Holdings Limited

- Levantina y Asociados de Minerales S.A

- Santucci Group Srl

- Topalidis SA

Industry Developments

May 2025: Dulcet Tile showcased new designs in its essentials marble mosaic collection, featuring fresh patterns and colors. The update highlights the brand’s focus on modern, elegant stone tiles.

February 2025: Sachsenküchen launched two new stone-look kitchen finishes, Marble White and Marble Brown, in its Stana Stone range. These stylish, easy-to-clean surfaces add a modern touch to kitchen designs.

September 2023: Polycor’s acquired ROCAMAT to expands its footprint in the global marble and limestone industry, enhancing access to premium European stone and strengthening its position in architectural and restoration markets.

Marble Market Segmentation

By Color Outlook (Revenue, USD Billion, 2020–2034)

- White

- Black

- Yellow

- Red

- Other Colors

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Tiles or Slabs

- Blocks

- Other Products

By Application Type Outlook (Revenue, USD Billion, 2020–2034)

- Kitchen & Bathroom Countertops

- Floors

- Bathroom Fittings

- Building Decoration

- Art & Carving

- Furniture

- Other Application

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Marble Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 68.41 Billion |

|

Market Size in 2025 |

USD 71.33 Billion |

|

Revenue Forecast by 2034 |

USD 104.83 Billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 68.41 billion in 2024 and is projected to grow to USD 104.83 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Antolini Luigi & C SpA, BC Marble Products Ltd, Levantina y Asociados de Minerales S.A, Fox Marble, Kangli Stone Group, Best Cheer Stone, Kingstone Mining Holdings Limited, China Kingstone Mining Holdings Limited, Daltile, Hellenic Granite Co., Topalidis SA, Santucci Group Srl.

The floors segment dominated the market, in 2024.

The black segment is projected to grow at a robust pace during the forecast period.