Mass Flow Controller Market Share, Size, Trends, Industry Analysis Report

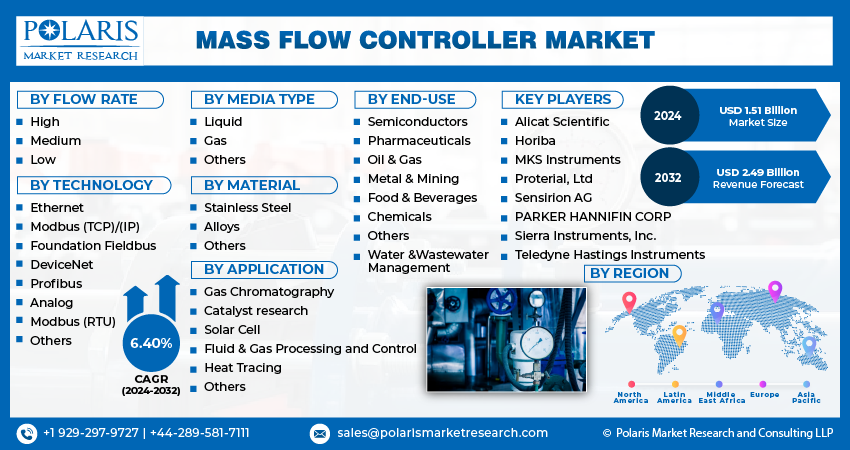

By Flow Rate (High, Medium, Low); By Technology; By Media Type; By Material, By End-use; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3923

- Base Year: 2023

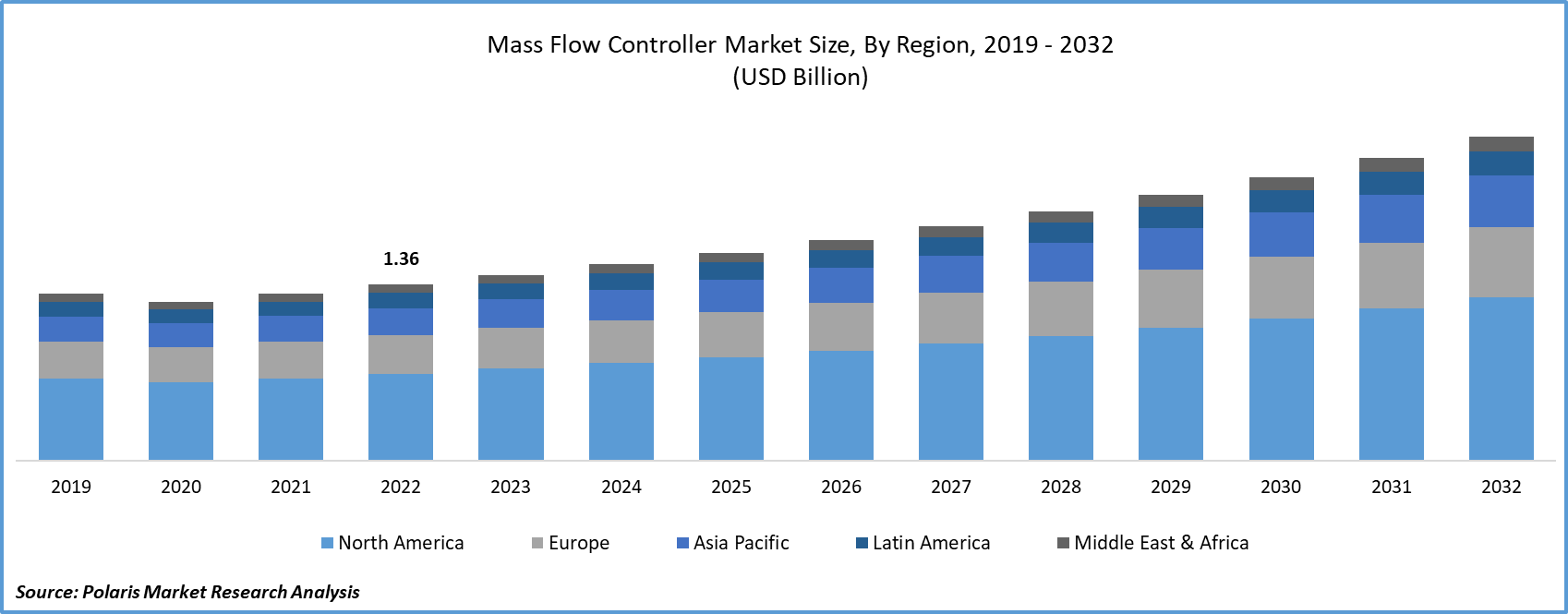

- Historical Data: 2019-2022

Report Outlook

The global mass flow controller market size and share was valued at USD 1.43 billion in 2023 and is expected to grow at a CAGR of 6.40% during the forecast period.

The Mass Flow Controller Market is undergoing substantial growth, primarily driven by the increasing demand from the semiconductor sector and the growing requirement for mass flow controllers in renewable energy applications, both playing pivotal roles in its expansion. A Mass Flow Controller is a specialized device used for precise fluid, gas, and liquid flow rate control, with its design tailored to the specific type of gas or liquid and the desired flow rate range. These controllers automatically regulate flow rates while remaining resilient to fluctuations in gas pressure. They typically consist of a mass flow sensor, inlet and outlet ports, and a proportional control valve. Mass Flow Controllers are widely utilized in industries such as chemicals, semiconductors, metals, and mining.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Amniotic Membrane key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

A mass flow controller is a compact device designed to measure and control the liquid or gas flow rate. It involves electronically setting the flow rate of the compound to be supplied. An internal sensor is used to measure the amount of liquid or gas that flows through the device. A comparison is then made between the measurement value and the setpoint value. To achieve that both the set value and measured value are equal, a control value will vary the opening and closing of the flow passage.

There are two main types of mass flow controllers in the mass flow controller market. These are thermal mass flow controllers and Coriolis-based mass flow controllers. Thermal mass flow controllers use the heat capacity of the liquid or gas to control the flow rate. Coriolis-based mass flow controllers are often used to measure and control liquid flow due to their higher accuracy and ability to take quick measurements. The rising adoption of mass flow controllers within the semiconductor industry is one of the major factors driving market sales.

To Understand More About this Research: Request a Free Sample Report

- For instance, Sierra Instruments' RedySmart mass flow controllers are crucial for managing gas flow in bioreactors, facilitating the scaling of vaccine production from laboratory testing to pilot phases and full-scale manufacturing. Nevertheless, the substantial capital investment requirements and challenges associated with physical limitations pose obstacles to market expansion. Factors including tuning difficulties and significant fluctuations in differential pressure present challenges for high-pressure applications, potentially restraining market growth.

The market for Mass Flow Controllers is experiencing significant growth, driven by the rising demand from the semiconductor industry and the increasing need for mass flow controllers in renewable energy applications. These factors are contributing to the expansion of the market. Additionally, technological advancements have fueled the demand for intelligent smart flow meters, which is positively impacting market growth. Mass flow controllers play a crucial role in maintaining the quality of various medical devices, and many leading industry players have seized the opportunity to tackle the serious challenges posed by the coronavirus pandemic.

It is a rapidly advancing tool, and businesses are continuously uncovering its complete potential. Automation is currently utilized to some extent by a minimum of 67% of global enterprises. Mass flow controllers streamline the regulation of flow rates, thereby diminishing the impact of human errors on critical processes.

Industry Dynamics

Growth Drivers

- The escalating adoption of mass flow controllers within the semiconductor manufacturing sector will Facilitate Market Growth

The mass flow controller is a crucial piece of equipment in the semiconductor manufacturing industry. Its quality and efficiency are of utmost importance and can determine the success or failure of the entire manufacturing process. Mass flow controllers are utilized for various applications in the semiconductor industry, including layer deposition, painting, vacuum sputtering, wafer cleaning, physical vapor deposition, plasma coating and etching, semiconductor chip making, thermal spraying, thin film deposition, surface treatment, chemical vapor deposition. These controllers are responsible for measuring and regulating the flow of gases and liquids used in the processes mentioned above. To this day, the semiconductor industry has yet to find a substitute for mass flow controllers, which has resulted in a constant demand for them, driving market growth.

Report Segmentation

The market is primarily segmented based on flow rate, technology, media type, material, end-use, application, and region.

|

By Flow Rate |

By Technology |

By Media Type |

By Material |

By End-Use |

By Application |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Media Type Analysis

- The Liquid segment held the largest revenue share in 2022

The liquid segment held the largest share of market revenue in the global MFC market in 2022. This is attributed to the numerous advantages of liquid MFCs, which operate independently of fluid properties and can handle various unknown fluids. Liquid MFCs are favored for their high dosing precision, contributing to reduced ingredient wastage. Additionally, they are cost-effective and maintenance-free, as they lack moving parts. Furthermore, increasing demand from diverse industries, including Food & Beverage (F&B), pharmaceuticals, and chemical processing, is projected to fuel revenue growth within this segment during the forecast period.

By Flow Rate Analysis

- The Low segment accounted for the highest market share during the forecast period

This is attributed to the high precision and stability offered by Mass Flow Controllers with low flow rates. In semiconductor manufacturing, it is crucial to precisely regulate the flow of deposition media at very low flow rates during the doping process. Ongoing technological advancements in low flow control, including the development of Microelectromechanical Systems (MEMS) and other advanced technologies, enable more precise and accurate control of low flow rates. Additionally, the increasing adoption of automation and process control systems in industries that necessitate precise low-flow control, such as medical device manufacturing and pharmaceuticals, is poised to drive revenue growth within this segment during the forecast period.

By Technology Analysis

- The Analog segment accounted for the highest market share during the forecast period

In the Mass Flow Controller Market, the analog segment is anticipated to exhibit a moderate revenue growth rate throughout the forecast period. Analog Mass Flow Controllers are utilized for the continuous management and measurement of fluid or gas flow through analog signals. Analog connectivity remains widely employed in Mass Flow Controllers, particularly in scenarios where real-time flow rate control is indispensable and digital communication protocols are not obligatory. Notably, Mass Flow Controllers designed for gas chromatography frequently incorporate analog connectivity, given the critical need for precise control of gas flow rates in accurate analysis. Analog controllers are typically more cost-effective than their digital counterparts and are favored for applications where cost efficiency takes precedence. Moreover, they are the choice in situations valuing simplicity and user-friendliness, as they do not necessitate intricate programming or software.

Regional Insights

- North America dominated the largest market in 2022

This is attributed to the presence of prominent players across various industries, including semiconductors, pharmaceuticals, and biotechnology, all of which are significant consumers of MFCs. Furthermore, substantial collaborations and acquisitions involving major market players are key drivers of revenue growth in this region. For instance, in August 2022, The Royal Court of Jersey greenlit the scheme of arrangement to execute MKS Instruments' planned acquisition of Atotech for USD 5 billion. The agreement for MKS Instruments (MKSI) to acquire Atotech (ATC) was reached in July 2021.

The European market is set to experience the swiftest revenue growth in the global Mass Flow Controller market throughout the forecast period. This growth can be attributed to the rising number of drug pipelines and ongoing drug and vaccine development projects in the region. Major industrial manufacturers are intensifying their investments in Research & Development (R&D) initiatives and introducing advanced, state-of-the-art products. For instance, in January 2023, Brooks Instrument, a renowned global provider of advanced solutions for flow, pressure, and vapor delivery, expanded its product documentation by introducing three new certifications for its SLA Series and SLA Series Biotech MFCs and meters, further enhancing the company's extensive product portfolio.

The Asia Pacific market is anticipated to contribute a significantly substantial share of revenue to the global Mass Flow Controller market throughout the forecast period. This is attributed to the region's growing population, emerging economies, and the increasing adoption of Mass Flow Controllers across various end-use industries. Leading organizations are introducing their latest products in this region, which is expected to drive the adoption of Mass Flow Controllers in the coming years. For instance, in August 2021, Azbil Corporation introduced its digital mass flow controller model, featuring rapid response and high precision, offering clear insights into control status at a glance.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Alicat Scientific

- Horiba

- MKS Instruments

- PARKER HANNIFIN CORP

- Proterial, Ltd

- Sensirion AG

- Sierra Instruments, Inc.

- Teledyne Hastings Instruments

Recent Developments

- In March 2023, Sensirion introduced its latest Mass Flow Controller, the SFC6000. This device, known for its compactness and lightweight design, presents an attractive price-performance ratio and stands out with an exceptionally short delivery time of only eight weeks. It proves to be an excellent choice for optimizing flow control in semiconductor industry equipment, analytical instruments, and industrial automation. Notably, in contrast to certain other manufacturers that require 30 to 53 weeks for delivery, SFC6000 samples can be acquired in as little as two to four weeks.

- In April 2022, Bronkhorst introduced the FLEXI-FLOW series, a range that combines rapid and stable chip sensors with dependable and precise bypass technology. These versatile mass flow controllers are engineered to measure a variety of parameters, encompassing both flow and temperature.

Mass Flow Controller Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.51 billion |

|

Revenue Forecast in 2032 |

USD 2.49 billion |

|

CAGR |

6.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Flow Rate, By Technology, By Media Type, By Material, By End-use, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Mass Flow Controller market report with a phone call or email, as and when needed.

Gain profound insights into the 2024 mass flow controller market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Lateral Flow Assay Market Size, Share 2024 Research Report

Synthetic Biology Market Size, Share 2024 Research Report

Inspection Machines Market Size, Share 2024 Research Report

Cell Dissociation Market Size, Share 2024 Research Report

Substance Abuse Treatment Market Size, Share 2024 Research Report