Cell Dissociation Market Share, Size, Trends, Industry Analysis Report

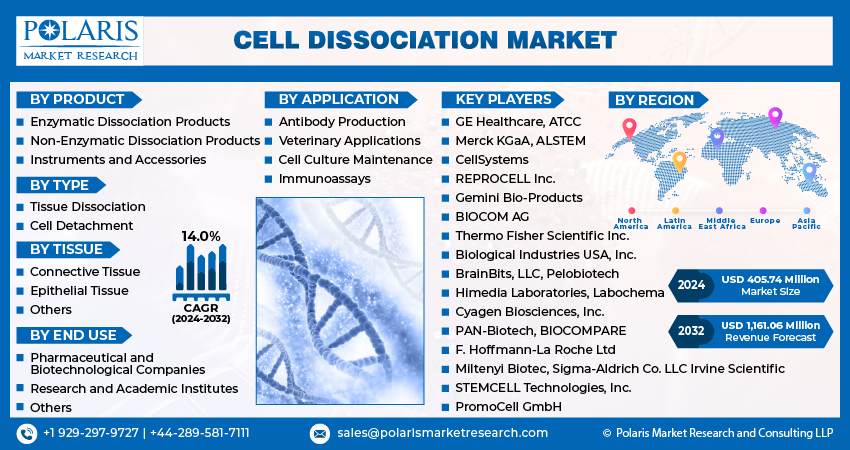

By Product (Enzymatic Dissociation Products, Non-Enzymatic Dissociation Products, Instruments and Accessories); By Type; By Tissue; By Application; By End Use; By Regions; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3222

- Base Year: 2023

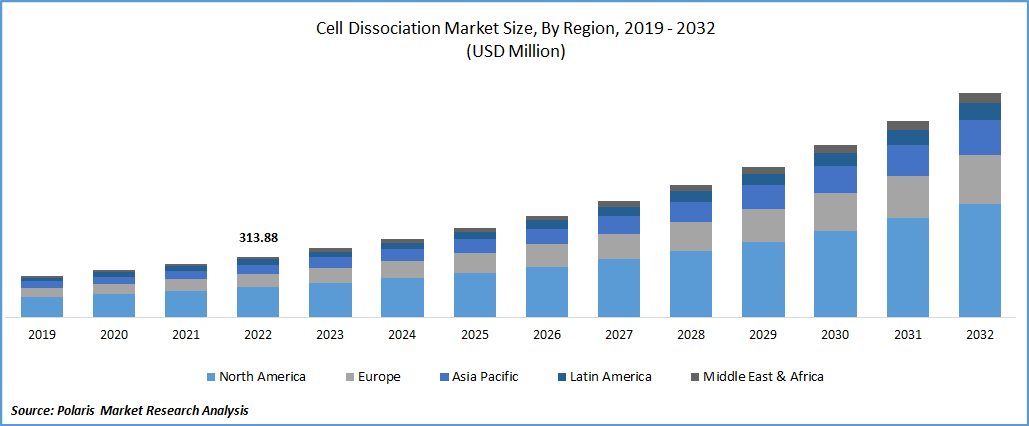

- Historical Data: 2019-2022

Report Outlook

The global cell dissociation market was valued at USD 356.76 million in 2023 and is expected to grow at a CAGR of 14.0% during the forecast period. Cell dissociation refers to breaking down cell-to-cell adhesions to obtain single cells or cell aggregates from tissues or cell cultures. This technique is crucial in many research fields, including cell biology, biotechnology, and regenerative medicine. Cell dissociation can be achieved through mechanical methods such as pipetting, scraping, or shaking or enzymatic methods that use enzymes such as trypsin or collagenase to break down the cell-to-cell junctions.

Know more about this report: Request for sample pages

The market provides various products, such as enzymes, kits, and instruments, designed to facilitate the process of cell dissociation. These products are used in academic and research institutions, pharmaceutical and biotech companies, and clinical research organizations. The increasing demand for cell-based therapies, regenerative medicine, and advancements in cell culture technologies are driving the growth of the market.

This market has experienced significant growth in recent years, driven by the increasing demand for cell-based therapies and regenerative medicine. The need for single cells or cell aggregates for research and development in cell biology, biotechnology, and drug discovery has also contributed to the market's growth.

Furthermore, the rise in the prevalence of chronic diseases has led to an increase in the number of clinical trials and research studies involving cell-based therapies. These studies require the dissociation of cells from various tissues and organs, further fueling the demand for cell dissociation products.

In addition, advancements in cell culture technologies have led to the development of new and innovative products, such as enzymes and kits, that are more efficient and effective in cell dissociation. These products are increasingly being adopted in academic and research institutions, pharmaceutical and biotech companies, and clinical research organizations. In inclusive, the market is expected to continue growing in the coming years, driven by the increasing demand for cell-based therapies and regenerative medicine and the ongoing advancements in cell culture technologies.

Due to cell culture technologies' significant role in identifying new therapeutic and diagnostic options for the illness, COVID-19 has increased demand for products derived from cell culture. For instance, cultivating methods provide crucial instruments for producing viral particles for vaccine development, increasing the market's growth potential. The primary factor promoting the growth of the business is the increased emphasis on creating cell-based therapeutics. Clinical trial expansion, FDA approvals, and key participants' strategic moves encourage market expansion. For instance, Sanofi and Innate Pharma SA increased their cooperation with Sanofi in December 2022 for natural killer cell therapeutics in cancer.

In addition, several significant collaborations and product launches in the cell dissociation offer promising growth opportunities. For instance, in September 2022, Century Therapeutics and Bristol Myers Squibb announced a research collaboration and license agreement to develop and commercialize up to four programs derived from induced pluripotent stem cells (iPSCs) for hematologic malignancies and solid tumors. Furthermore, the launch of innovative products also presents attractive prospects for growth in the forecast period. For example, in November 2021, LevitasBio introduced its Optimized Tissue Dissociation Reagents, specifically designed for the LeviCell workflows. From end to end, it can handle a wide range of human and model tissue types, including heart, brain, tumor, liver, lung, and kidney.

Industry Dynamics

Growth Drivers

The technological advancements, rising demand for cell-based assays and therapies, increasing investment in research and development, and growing adoption of regenerative medicine.

Cell-based assays are widely used in drug discovery and development, disease modeling, and other research applications. The dissociation of cells is a crucial step in cell-based assays, and as the demand for these assays increases, the need for cell dissociation products also increases. Developing new and advanced cell dissociation techniques and products drives the market's growth. For example, introducing enzymatic cell dissociation methods has significantly improved cell dissociation efficiency and reduced cell damage.

The rising incidence of chronic diseases, such as cancer, diabetes, and neurological disorders, drives the demand for cell-based therapies. Cell dissociation plays a critical role in the isolation of cells for cell therapy, and as the demand for cell therapy increases, the need for cell dissociation products also increases. Governments and private organizations are investing heavily in researching and developing new therapies and drugs. This investment drives the demand for cell dissociation products as they are essential in developing these therapies.

The adoption of regenerative medicine is growing, and cell dissociation is an integral part of the isolation and manipulation of cells for regenerative therapies. The growing awareness of regenerative medicine is driving the growth of the cell dissociation market.

Report Segmentation

The market is primarily segmented based on product, type, tissue, application, end use, and region.

|

By Product |

By Type |

By Tissue |

By Application |

By End Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

The enzymatic dissociation products segment is anticipated the largest market share in 2022

The enzymatic dissociation method had the largest market share in the global industry in 2022. This technique utilizes enzymes to digest tissue fragments and release cells. A variety of enzymes, either alone or in combination, can be used for this process. Enzymatic dissociation is a remarkably efficient and effective approach for isolating mononuclear cells from the brain and spinal cord.

The tissue dissociation segment is anticipated the highest market share in 2022

In 2022, the tissue dissociation segment held the highest share of the industry. This segment is expected to continue growing steadily and maintain its dominant position in the global market. The growth is anticipated by biopharmaceutical and pharmaceutical organizations focusing on monoclonal antibody development and treatment customization.

On the other hand, the cell detachment segment is also expected to exhibit a higher growth rate in the forecast period. This segment plays a significant role in culturing adherent cells, with trypsinization being the widely used technique. The growth of this segment is attributed to several factors, including the rising investments in launching innovative products for cell culture and strategic activities by major players in the industry.

The demand in North America is expected to witness significant growth over the forecast period

North America has a significant growth in the Cell Dissociation market, primarily due to the increasing incidences of cancers and chronic diseases in the region. The growing popularity of research and development in the life sciences by industry and academia, coupled with the presence of major key players, is expected further to fuel the market's growth during the forecast period.

The region's high market share is attributed to several factors, including the rise in government investment initiatives, the increasing prevalence of chronic diseases such as cancer, and the presence of high-quality clinical and laboratory research infrastructure. For instance, in 2020, the Globocan report recorded approximately 2,281,658 new cancer cases and nearly 612,390 deaths in the United States alone. The rising prevalence of chronic and infectious diseases and the growing focus on cell-based therapeutics are expected to expand the market's growth prospects in the region.

The market in the Asia Pacific region is expected to grow rapidly during the forecast period, mainly due to the increasing demand for novel therapeutics. Rising government investments in research and development and rapid infrastructural development further support this growth. Additionally, several regional companies are receiving funding to develop treatments for chronic diseases such as cancer, further boosting the market growth.

Competitive Insight

The market includes some company players such as GE Healthcare, ATCC, Merck KGaA, ALSTEM, CellSystems, REPROCELL Inc., Gemini Bio-Products, Biological Industries USA, Inc., BIOCOM AG, Thermo Fisher Scientific Inc., BrainBits, LLC, Pelobiotech, Himedia Laboratories, Labochema, Cyagen Biosciences, Inc., PAN-Biotech, BIOCOMPARE, F. Hoffmann-La Roche Ltd, Miltenyi Biotec, Sigma-Aldrich Co. LLC Irvine Scientific, STEMCELL Technologies, Inc., and PromoCell GmbH, etc.

Recent Developments

- In 2020, on CliniMACS Prodigy, Biotec introduced closed adherent and automated cell culture solutions.

- In 2020, for the use of STEMCELLs in cell culture applications, STEMCELL Technologies partnered with CollPlant.

- In 2021, Diamyd Medical selected Danaher's Cytiva FlexFactory platform for manufacturing precision medicine type-1 diabetes vaccines as part of their partnership.

- In 2021, Danaher (Cytiva) joined forces with the Government of Telangana in India to enhance the biopharmaceutical industry in the region by establishing new laboratories.

Cell Dissociation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 405.74 million |

|

Revenue forecast in 2032 |

USD 1,161.06 million |

|

CAGR |

14.0% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Type, By Tissue, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

GE Healthcare, ATCC, Merck KGaA, ALSTEM, CellSystems, REPROCELL Inc., Biological Industries USA, Inc., BIOCOM AG, Thermo Fisher Scientific Inc., BrainBits, LLC, Pelobiotech, Himedia Laboratories, Labochema, PAN-Biotech, BIOCOMPARE, Gemini Bio-Products, F. Hoffmann-La Roche Ltd, STEMCELL Technologies, Inc., Miltenyi Biotec, Cyagen Biosciences, Inc., Irvine Scientific, and Sigma-Aldrich Co. LLC and PromoCell GmbH, etc. |

FAQ's

The cell dissociation market report covering key segments are product, type, tissue, application, end use, and region.

Cell Dissociation Market Size Worth $1,161.06 Million By 2032.

The global cell dissociation market expected to grow at a CAGR of 14.0% during the forecast period.

North America is leading the global market.

key driving factors in cell dissociation market rising focus on the development of cell-based therapeutics.