Matting Agents Market Share, Size, Trends, Industry Analysis Report

By Material (Silica, Thermoplastic, Wax-based, and Others); By Source; By Technology; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4447

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

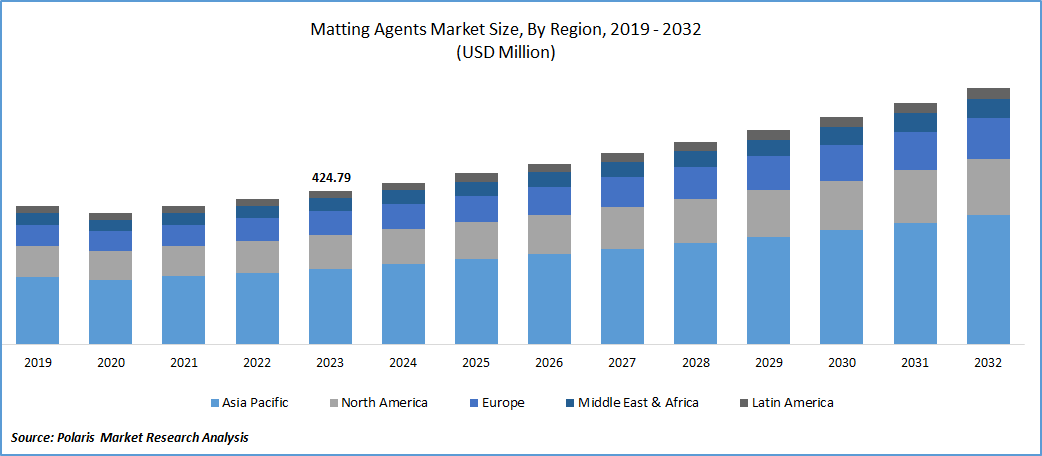

The global matting agents market was valued at USD 424.79 million in 2023 and is expected to grow at a CAGR of 5.9% during the forecast period.

An increasing demand for matte finish surfaces due to their low maintenance and scratch resistance is one of the major factors propelling the market growth. The appearance of colors in matte finish reduces the reflection thereby, creating an elegant, sophisticated, and eye-catching effect. Such muted appearance is stimulating the people to opt for matte finish in various categories such as furniture, cars, home appliances, cellphones, and electronic devices. Moreover, strong focus of industry players towards the introduction of matting agents having better absorbency and chemical stability is driving the market.

To Understand More About this Research:Request a Free Sample Report

For instance, in October 2023, Yuantong Mineral, a company based in China, announced the launch of new line of matting agent at the China Import and Export Fair event. The introduction of these products at the event will attract industry professionals thereby, supporting the market growth.

Matting agents are the compounds that are used to reduce the shine or gloss of surfaces. This property of matting agents makes them appropriate for various applications, catering to diverse consumer demands. Moreover, muted shades are becoming increasingly popular among home and car buyers thereby, creating a significant growth opportunity for the market growth. According to an article published by the Los Angeles Times in March 2023, the adoption of muted cars is suddenly increasing across the globe. Such increasing adoption is encouraging the car makers to launch and upgrade the cars.

For instance, in July 2023, Skoda Auto India announced that it has introduced new aesthetics in its previously launched car named Kushaq. One of the major updates in this car includes carbon steel shade in matte finish.

However, the stringent regulatory requirements coupled with the high VOC emissions in solvent-based technology are expected to hinder the market growth. For instance, The Clean Air Act regulates the emission of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs), and provides specific standards of performance to control emissions from solvent-based coating operations. Moreover, the expensive cost of matte finish products compared to glossy products is also limiting the matting agents market growth.

Growth Drivers

Increasing Demand for Matte Finishes from Various Industries is Expected to Drive the Market

Matte finishes are becoming popular among various industries owing to the modern, muted, and elegant look offered by them. Moreover, factors such as minimal reflection of light, subtle appearance, and ability to mask imperfections are increasing the demand for matting agents across the world. For instance, in June 2023, Unilin announced that Novalis will start the production of Unilin's patented Matte Bevel Technology. This technology offers a matte finish on a beveled edge.

Moreover, in September 2023, Speed Queen (a company offering commercial laundry solutions) announced the introduction of matte black option on its TR7/DR7 top load washer and dryer. The company has also announced that it will soon introduce the matte black option on its other models too. Such strong focus of companies from various industries towards the launch of matte-based products fuels the market growth.

Report Segmentation

The market is primarily segmented based on material, source, technology, application, and region.

|

By Material |

By Source |

By Technology |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Material Analysis

The Silica Segment Dominated the Market in 2023

The silica segment accounted for the largest market share in 2023. This share is owing to the high demand for silica matting agents for architectural, automotive, and wood coatings. Moreover, several benefits such as high matting efficiency, easy Dispersibility, lower viscosity, and better stir-in capability are anticipated to increase the adoption of silica-based matting agents during the forecast timeframe. Furthermore, increasing use of silica-based matting agents in automotive paints and coatings to enhance the appearance of the car will contribute to the segmental growth in the future. For instance, silica-based matting agents named SYLOID MX 307 Silica and SYLOID MX 309 Silica from W. R. Grace & Co. are used in automotive parts.

By Source Analysis

Organic Segment is Expected to Gain Significant Attention in the Future

The organic segment is expected to witness considerable growth during the forecast period. The organic matting agents such as waxes are known for their ease of incorporation and better dispersion properties. Moreover, their versatility and ability to produce consistent and uniform matte finishes in various coating applications will contribute to the segmental growth. Further, the growing demand for environment friendly products that exhibit lower VOC levels is expected to fuel the segmental growth in the projected years.

By Technology Analysis

Water-Borne Segment Accounted for the Largest Market Share in 2023

The dominance of this segment is majorly due to the environmental benefits associated with it. For instance, water-borne products are non-toxic, non-flammable, and releases less volatile organic compounds (VOCs) as compared to solvent-based products. Thus, minimal regulatory restrictions associated with water-borne products stimulates the manufacturers to adopt this technology thereby, spurring the segment’s growth.

By Application Analysis

The Coatings Segment is Expected to Continue its Dominance Throughout the Forecast Period

The coatings segment held the largest market share. Among coatings, the architectural coatings recorded the largest revenue in 2023. The properties of matting agents such as temperature resistance and reduced reflections are driving the growth of architectural coatings segment. Moreover, the growth of construction industry and rising demand for matte finish among developed and developing economies are further contributing to the segmental share. For instance, according to a blog by DANA STEEL, the use of Matte Finish Pre-Painted Galvanized Iron (PPGI) can provide several benefits to African construction industry. These benefits include corrosion resistance, durability, longevity, and ability to hide blemishes and scratches. The matte finish PPGI can withstand the harsh and diverse climatic conditions of Africa, which ultimately increases the demand for matting agents.

Regional Insights

Asia Pacific Accounted for the Largest Market Share in 2023

Asia Pacific region held the largest market share. This share is attributed to the significant growth of construction industry in this region over the past few years. Moreover, the demand for matte finish from automobiles and consumer electronics sector is also increasing in this region. This increased demand from various sectors is stimulating the companies to focus primarily on this region by adopting various strategies such as strengthening of distribution channel in untapped markets, production capacity expansion, and new product launches.

For instance, in September 2023, Nippon Paint (Japan-based Company) announced the launch of its Aqua Bodelac Matt which is recommended for doors, timber trims, and skirting boards. Such launches of matte finish products will further boost the demand for matting agents in this region.

The market in Europe region will grow rapidly. The growing construction sector in Western Europe coupled with the increasing preference for matte finish over glossy finish are the major factors contributing to the growth of this region. For instance, according to the data published by Eurostat, in 2022, the share of the gross value added (GVA) from construction sector in European Union (EU) increased to 5.5% of the total GVA, compared to 5.4% in 2021. Such growth of construction sector will ultimately increase the demand for matting agents in this region.

Key Market Players & Competitive Insights

The market is fragmented as many companies are manufacturing and distributing matting agents across the world. The companies are focused on strengthening their positions in the market by adopting numerous strategies such as development and launch of new products, production capacity expansion, and partnerships.

Some of the major players operating in the global market include:

- Arkema

- Axalta Coating Systems, LLC

- BASF SE

- Deuteron GmbH

- Evonik Industries AG

- Honeywell International Inc.

- Imerys

- PPG Industries

- PQ Corporation

- The Lubrizol Corporation

- W. R. Grace & Co.

Recent Developments

- In November 2021, Evonik expanded its product portfolio of ACEMATT matting agent by the introduction of three new products named ACEMATT OK 390 & ACEMATT HK 390. These matting agents can be used in both water & solvent-based systems.

Matting Agents Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 448.24 million |

|

Revenue forecast in 2032 |

USD 710.38 million |

|

CAGR |

5.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, By Source, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Matting Agents Market report covering key segments are material, source, technology, application, and region.

Matting Agents Market Size Worth $ 710.38 Million By 2032.

The global matting agents market is expected to grow at a CAGR of 5.9% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Matting Agents Market are Increasing demand for matte finishes from various industries is expected to drive the market.