MENA Gaucher Disease Treatment Market Size, Share, Trends, & Industry Analysis Report

: By Type (Type 1, Type 3, Type 2), By Therapy, By Distribution Channel, and By Country – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5790

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

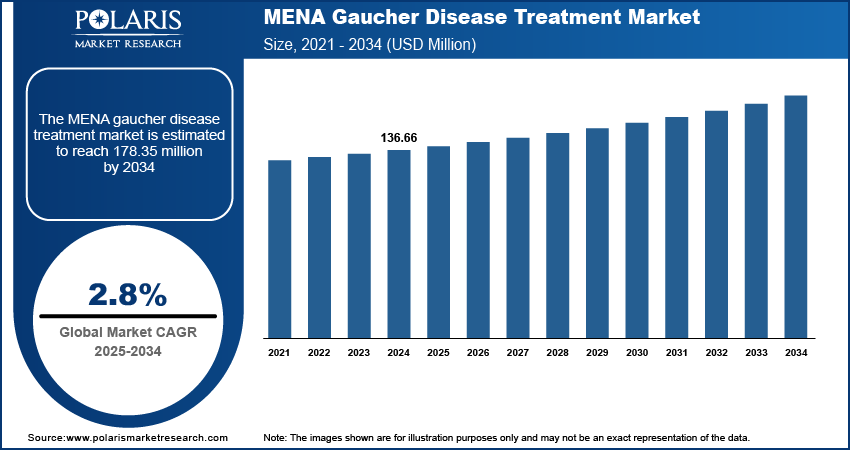

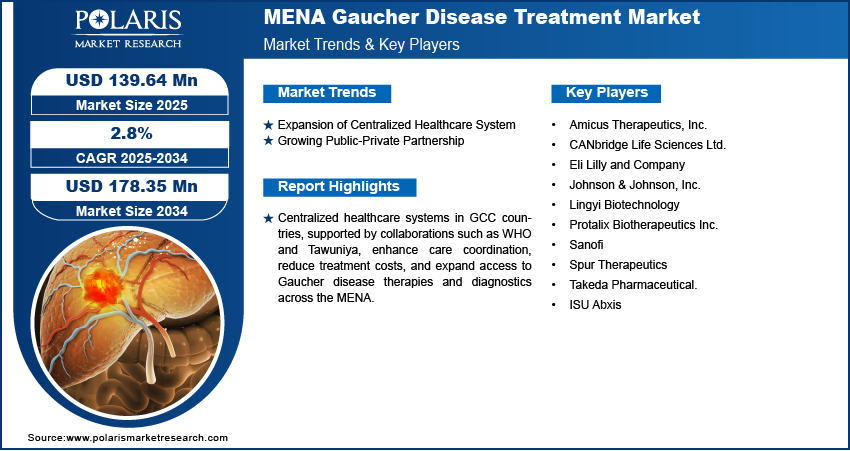

The MENA Gaucher disease treatment market was valued at USD 136.66 million in 2024 and is expected to grow at a CAGR of 2.8% during the forecast period. The growth is driven by expansion of centralized healthcare system and growing public-private partnerships.

Gaucher disease is a rare genetic disorder caused by a deficiency of the enzyme glucocerebrosidase. This leads to the buildup of fatty substances (glucocerebrosides) in organs like the spleen, liver, and bone marrow. Major symptoms of the disease include enlarged organs, bone pain, anemia, and fatigue. It is inherited in an autosomal recessive pattern. There are several types, with Type 1 being the most common. Treatment includes enzyme replacement and substrate reduction therapy.

Management of Gaucher disease focuses on alleviating symptoms, restoring the deficient glucocerebrosidase enzyme, and mitigating substrate accumulation. The basic therapeutic strategies include enzyme replacement therapy (ERT), which provides the active enzyme, and substrate reduction therapy (SRT), which lowers the levels of glucocerebroside. Additionally, supportive care is an integral aspect of treatment to address the diverse clinical manifestations associated with the disease.

The MENA Gaucher disease treatment market is gaining traction as healthcare modernization accelerates and regional governments prioritize specialized care for chronic and inherited conditions. The historically limited visibility of Gaucher disease is giving way to a more proactive stance, driven by growing healthcare investments in genetic and metabolic disorders. For instance, in June 2024, Abu Dhabi's Department of Health collaborated with AstraZeneca to establish a Rare Diseases Centre of Excellence. The collaboration will leverage Abu Dhabi's healthcare infrastructure and AstraZeneca's expertise to advance rare disease management and innovation regionally and globally. Several countries within MENA are now placing rare diseases diagnostics on the policy agenda, channeling resources into specialty clinics and advanced laboratory diagnostics capable of identifying lysosomal storage disorders such as Gaucher disease, thereby driving the market growth.

Industry Dynamics

Expansion of Centralized Healthcare System

The emergence of centralized healthcare systems in Gulf Cooperation Council (GCC) countries is boosting the growth. For instance, in May 2025, the WHO Foundation collaborated with Tawuniya, in its first GCC corporate collaboration. The MoU aims to advance regional health priorities in line with WHO's mission through joint initiatives. These systems allow coordinated care pathways and funding mechanisms that facilitate the adoption of enzyme replacement therapies and comprehensive management strategies. Centralized procurement further allows for better negotiation of treatment costs, improving access for eligible patients while assuring consistency in care delivery. This centralized and collaborative approach has expanded healthcare access and diagnostics capabilities, thereby driving the growth in Middle East and North Africa region.

Growing Public-Private Partnership

The public-private partnerships in the region are growing. This PPPs are aimed to improve rare disease infrastructure which contributes to the growth opportunities. For instance, in April 2022, EVERSANA and Vector Pharma (UAE) collaborated to improve commercial services for rare diseases and specialty therapeutics across the Middle East, North Africa, and Turkey, supporting regional expansion for pharmaceutical companies. Multinational pharmaceutical firms are forming alliances with national health ministries and private hospitals to roll out awareness campaigns, conduct physician training programs, and expand distribution networks, thereby driving the industry growth.

Regional Volume and Pricing Analysis

|

Manufacturer |

Drug Name |

Dosage (IU/vial) |

Unit Price per Vial (USD) |

Annual Dose per Patient (vials/year) |

Patients (approx.) |

Total Sales Volume (vials/year) |

|

Algeria |

Imiglucerase (Cerezyme), Generic Imiglucerase |

400 IU |

500 - 1,350 |

26 |

80 - 180 |

2,080 - 4,680 |

|

Iraq |

Imiglucerase (Cerezyme), Generic Imiglucerase |

400 IU |

450 - 1,250 |

26 |

100 - 150 |

2,600 - 3,900 |

|

Iran |

Imiglucerase (Cerezyme), Generic Imiglucerase |

400 IU |

300 - 800 |

26 |

180 - 320 |

4,680 - 8,320 |

|

Saudi Arabia |

Imiglucerase (Cerezyme), Velaglucerase alfa (VPRIV), Eliglustat |

400 IU / 84 mg |

92 - 1,900 |

26 - 365 |

80 - 280 |

3,120 - 29,200 |

Algeria's shows high demand for Imiglucerase and generic alternatives to treat 80-180 patients annually. The 400 IU dosage requires 26 vials per patient yearly, generating total market volume of 2,080-4,680 vials. Competitive pricing at USD 500-1,350 per vial reflects generic availability, creating an accessible yet substantial therapeutic market worth millions annually.

Segmental Insights

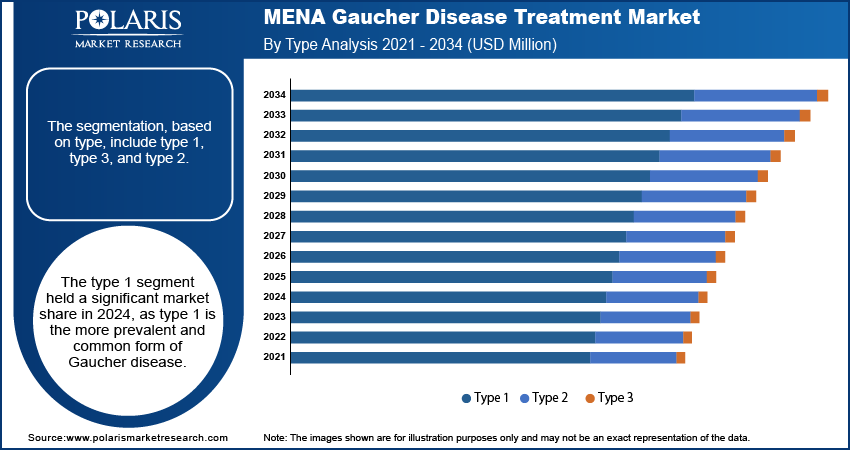

By Type Analysis

The segmentation based on type include type 1, type 3, type 2. The type 1 segment dominated with USD 104.09 million in 2024. Type 1 Gaucher disease is the most common and treatable form, which is driving demand for early diagnosis and long-term treatment in MENA countries. More patients are being diagnosed early with rising awareness and better access to genetic screening in countries like the UAE and Saudi Arabia. Additionally, government-backed rare disease programs and partnerships with global biotech firms are further helping to improve treatment availability. Moreover, the presence of a younger population and increasing healthcare spending across MENA are boosting the growth in this segment.

The type 2 segment is projected reach USD 2.91 million by 2034. Type 2 Gaucher disease is rare and more severe, often affecting infants. The disease is gaining attention in MENA due to increasing investment in rare pediatric disease research. Regional health authorities are beginning to prioritize early intervention and neonatal screening, especially in high-income countries like Qatar and the UAE. The rise in specialized children’s hospitals and collaborations with global research institutions are further pushing the healthcare system to address unmet needs in Type 2 cases, thereby driving the segment growth.

By Therapy Analysis

The segmentation based on therapy include enzyme replacement therapy (ERT), substrate reduction therapy (SRT), and other. The substrate reduction therapy segment accounted 25.76% share in 2024 as SRT is gaining popularity in MENA as an alternative for patients who cannot tolerate enzyme replacement therapy (ERT). Its oral administration method appeals to both doctors and patients for convenience. Rising awareness of treatment choices and increasing import of novel therapies in Gulf countries support this trend. Moreover, the push for pharmaceutical innovation and the faster approval of orphan drugs by regional regulatory bodies have made it easier for SRT products to enter MENA region, especially in urban centers, thereby driving the segment growth.

By Distribution Channel Analysis

The segmentation based on distribution channel include hospital pharmacies, retail pharmacies, online pharmacies. The retail pharmacies segment accounted 68.40% share in 2024 as retail pharmacies in MENA are expanding their role in managing rare diseases such Gaucher. Retail pharmacies are becoming major access points for prescription therapies as more patients seek treatment closer to home, especially in urban hubs like Riyadh, Dubai, and Cairo. Government support for improving community pharmacy infrastructure and encouraging private healthcare investment is boosting this expansion of retail pharmacies, thereby driving the segment growth.

Country Analysis

Gaucher Disease Treatment Market in Saudi Arabia

Saudi Arabia Gaucher disease treatment market accounted for 21.62% market share in 2024 due to the country’s strong healthcare infrastructure, rising government focus on rare diseases, and growing investment in genomic medicine support early diagnosis and treatment. The Ministry of Health has increased funding for rare disease programs, while partnerships with international biotech firms are supporting to bring advanced therapies to the country. Additionally, awareness campaigns and family-based genetic screening in populations with high consanguinity are expanding in the country, due to which more cases with rare disease such as Gaucher are been identified, thereby driving the industry growth.

Gaucher Disease Treatment Market in Turkey

The Turkey Gaucher disease treatment market is expected to reach USD 24.79 million by 2034 due to its large population, expanding pharmaceutical sector, and strong medical education system. The country is investing in rare disease centers and encouraging research in genetic disorders through universities and public-private partnerships. National health insurance in Turkey also covers a portion of rare disease treatments, making therapies more accessible. Turkey acts as a regional hub for treatment and clinical trials and virtual clinical trials with a well-established network of hospitals and pharmacies. Efforts to modernize healthcare and introduce orphan drug policies are further boosting the industry growth in the country.

Gaucher Disease Treatment Market in Iran

The Iran Gaucher disease treatment market accounted for 13.95% share in 2024, driven by a domestic pharmaceutical production and government-supported genetic healthcare. Iran has developed local capacity for producing biosimilars and basic enzyme therapies, which makes treatment more affordable. The government is actively promoting early diagnosis through national screening programs and supports rare disease awareness via public health initiatives. High rates of consanguineous marriages increase the prevalence of genetic conditions, prompting a greater need for specialized care and treatment, thereby driving the growth of the industry in the country.

Gaucher Disease Treatment Market in Morocco

The Morocco Gaucher disease treatment market accounted for 3.41% share in 2024 as Morocco is gradually expanding its rare disease capabilities, including for Gaucher disease. The government is working to improve genetic testing services and integrate them into the public healthcare system. Increasing awareness among healthcare professionals is improving early detection. Collaborations with international NGOs and global pharma companies are supporting to introduce enzyme and substrate therapies to Moroccan hospitals. Additionally, national health strategies now include rare disease registries and pilot programs, particularly in urban centers like Rabat and Casablanca, through which the number of cases with rare cases is expected to rise with better and specialized diagnostics capabilities and registry, thereby driving the industry growth.

Gaucher Disease Treatment Market in Libya

The Libya Gaucher disease treatment market accounted for 3.65% share in 2024 driven by increasing efforts by international health organizations and local medical institutions are improving access to basic diagnostics and treatments for genetic diseases. Some families are seeking treatment abroad, reflecting demand that exceeds domestic capabilities. The investment in the healthcare services especially in pediatric and genetic services is expected to fuel the growth of the industry in the future. Additionally, awareness among healthcare providers is rising which is expected to fuel the growth during the forecast period.

Key Players & Competitive Analysis Report

Companies focus on strategic licensing, collaborations, and regional expansion to secure market share and enhance their product pipelines. Several investigational molecules are aimed at addressing central nervous system manifestations, with a growing preference for small-molecule oral agents that modulate glycosphingolipid biosynthesis. Research and development efforts are primarily directed towards therapies that lessen the need for frequent infusions and improve accessibility in underserved areas. Market participants actively pursue regulatory designations like orphan drug status to accelerate the development process and gain market exclusivity. The development of biosimilars introduces additional competition, particularly in regions with cost-sensitive healthcare systems. As the understanding of Gaucher disease pathology advances, therapeutic approaches increasingly incorporate biomarker-driven strategies and personalized care. This dynamic environment fosters continuous innovation and intensifies competition across all segments of the Gaucher disease treatment market.

Key Players

- Amicus Therapeutics, Inc.

- CANbridge Life Sciences Ltd.

- Eli Lilly and Company

- ISU Abxis

- Johnson & Johnson, Inc.

- Lingyi Biotechnology

- Protalix Biotherapeutics Inc.

- Sanofi

- Spur Therapeutics

- Takeda Pharmaceutical

Industry Developments

December 2024: ISU Abxis launched its Gaucher disease treatment, Abcertin, in the MENA market after signing an exclusive licensing deal with Saudi Arabia’s Tabuk Pharmaceuticals during CPHI Middle East 2024, aiming to expand access to rare disease therapies.

MENA Gaucher Disease Treatment Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Type 1

- Type 3

- Type 2

By Therapy Outlook (Revenue, USD Million, 2020–2034)

- Enzyme Replacement Therapy (ERT)

- Substrate Reduction Therapy (SRT)

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Country Outlook (Revenue, USD Million, 2020–2034)

- Algeria

- Iraq

- Iran

- Saudi Arabia

- Morocco

- Libya

- Egypt

- Turkey

- Rest of MENA

MENA Gaucher Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 136.66 Million |

|

Market Size in 2025 |

USD 139.64 Million |

|

Revenue Forecast by 2034 |

USD 178.35 Million |

|

CAGR |

2.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 136.66 million in 2024 and is projected to grow to USD 178.35 million by 2034.

The market is projected to register a CAGR of 2.8% during the forecast period.

Saudi Arabia dominated the market share in 2024.

A few of the key players in the market are Amicus Therapeutics, Inc.; CANbridge Life Sciences Ltd.; Eli Lilly and Company; Johnson & Johnson, Inc.; Lingyi Biotechnology; Protalix Biotherapeutics Inc.; Sanofi; Spur Therapeutics; Takeda Pharmaceutical; and ISU Abxis.

The type 1 segment dominated the market share in 2024.

The substrate reduction therapy segment is expected to witness the fastest growth during the forecast period.