Metallocene LDPE Market Size, Share, Trends, & Industry Analysis Report

By Polymer Type, By Application (Packaging and Non- Packaging), By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6067

- Base Year: 2024

- Historical Data: 2020-2023

Overview

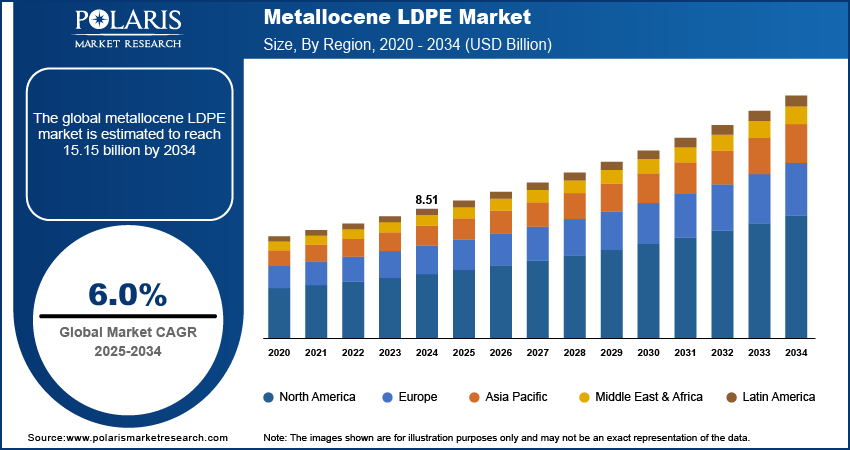

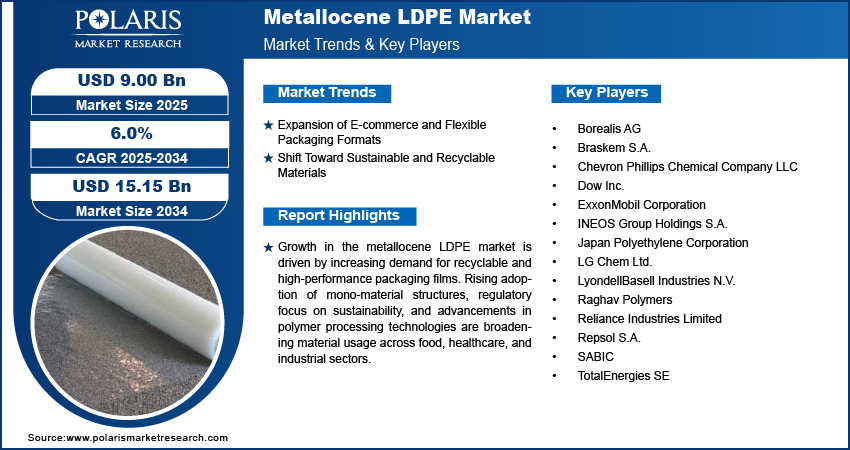

The global metallocene LDPE market size was valued at USD 8.51 billion in 2024, growing at a CAGR of 6.0% from 2025–2034. The expansion of e-commerce and rising demand for flexible packaging formats are increasing the use of recyclable and lightweight materials, driving the shift toward metallocene LDPE for its sustainability, processability and reduced material consumption.

Key Insights

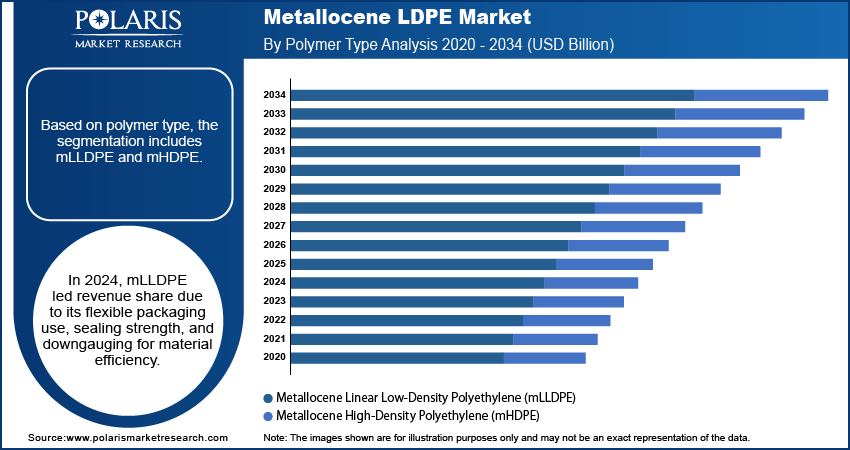

- The mLLDPE segment accounted for 62.65 % market share in 2024.

- The mHDPE segment is projected to grow at the fastest rate over the forecast period, driven by increasing demand for rigid containers, closures, and industrial-grade packaging with high load-bearing capacity.

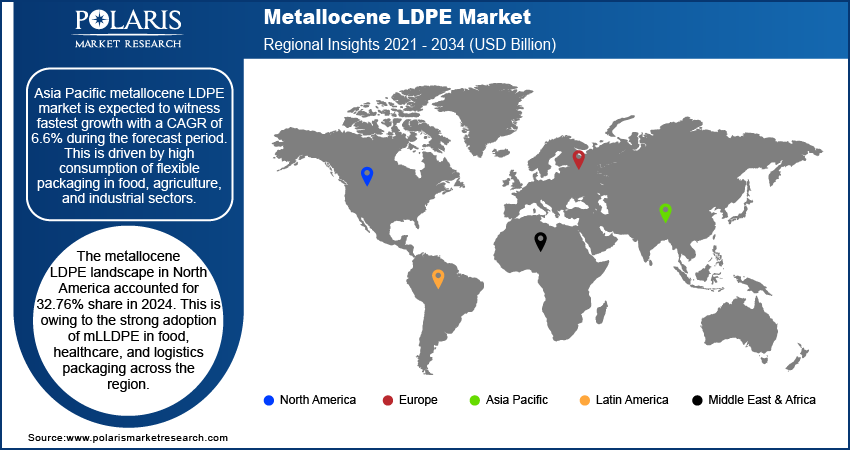

- The Asia Pacific metallocene LDPE market is expected to witness fastest growth with a 6.6% CAGR of the global market in 2024.

- China metallocene LDPE market held significant share of the Asia Pacific market in 2024, fueled by large-scale polymer processing capacity, domestic consumption growth, and rising investment in recyclable film production.

- The market in Middle East & Africa (MEA) is projected to grow at a substantial CAGR from 2025-2034, owing to increasing adoption in food packaging, medical films, and agricultural applications.

Industry Dynamics

- Saudi Arabia market is expanding steadily, due to investments in local packaging production, industrial diversification efforts and demand for high-performance polymer materials in food-grade and pharmaceutical packaging.

- Expansion of e-commerce and the growing adoption of flexible packaging formats are driving the use of metallocene LDPE due to its high seal performance, durability and downgauging potential that meets shipping and shelf-readiness requirements.

- Rising focus on sustainable and recyclable materials is accelerating the transition to mono-material packaging structures, where mLLDPE supports recyclability and reduces multilayer plastic waste.

- Rising investments in recyclable and closed-loop packaging systems are creating opportunities for mLLDPE films that support mono-material structures and meet extended producer responsibility (EPR) targets across regulated markets.

- Volatility in raw material prices and limited processing compatibility with certain conventional extrusion systems restrict wider adoption among small-scale film packaging manufacturers and packaging producers.

Market Statistics

- 2024 Market Size: 8.51 billion

- 2034 Projected Market Size: 9.00 billion

- CAGR (2025-2034): 6.0%

- North America: Largest market in 2024

Metallocene low-density polyethylene (mLLDPE) is a high-performance polymer widely used in flexible packaging, industrial films and medical-grade applications. It is produced using metallocene catalysts that enable precise control over polymer structure, resulting in enhanced mechanical strength, clarity, puncture resistance and sealing performance. mLLDPE is increasingly adopted in sectors such as food and beverage packaging, personal care products, agricultural films, and pharmaceutical blister packs. For example, in April 2025, LyondellBasell introduced a new grade of mLLDPE film resin aimed at downgauging packaging thickness without compromising strength or barrier performance.

The rising demand for lightweight and durable packaging materials is accelerating the use of mLLDPE across multiple end-use industries. Manufacturers are shifting toward metallocene-based formulations to meet stricter sustainability goals, reduce material consumption and support recyclability. Growing pressure to comply with extended producer responsibility (EPR) regulations and reduce multilayer plastic waste is promoting the use of mono-material films made from mLLDPE. Key performance attributes such as processability, optical clarity, toughness and seal integrity are making mLLDPE a preferred choice for packaging manufacturers and packaging producers focused on cost efficiency and environmental compliance.

The growing complexity of global supply chains and increasing preference for high-speed packaging lines are driving the demand for polymers with consistent quality and easy processability. Metallocene LDPE supports these needs by enabling faster production cycles and reduced downtime in extrusion and form-fill-seal operations. Packaging manufacturers are increasingly choosing mLLDPE to ensure compatibility with high-speed lines, maintain sealing integrity under varying conditions and meet evolving regulatory standards on food contact and pharmaceutical-grade materials. Additionally, the rising adoption of smart packaging and advanced labeling technologies is creating opportunities for mLLDPE grades that offer superior printability and surface smoothness.

Drivers & Opportunities/Trends

Expansion of E-commerce and Flexible Packaging Formats: The expansion of e-commerce and rising preference for flexible packaging formats are driving the adoption of metallocene LDPE in primary and secondary packaging applications. According to the US Census Bureau, e-commerce sales totaled USD 300.2 billion in Q1 2025, showing minimal change from the previous quarter. Compared to Q1 2024, sales rose by 6.1% and represented 16.2% of total retail sales. The material offers superior sealing strength, puncture resistance, and load stability, which are essential for secure product handling during transit. Increasing deployment of automated packaging lines across fulfillment centers is creating demand for polymers that enable high-speed processing and consistent film performance. mLLDPE supports downgauging without compromising durability, which helps reduce material costs and optimize package weight for last-mile distribution. These factors are driving its use across courier bags, liners and stretch films in logistics chains.

Shift Toward Sustainable and Recyclable Materials: Strict regulatory policies and increasing industry focus on circular economy models are accelerating the shift toward recyclable and low-impact materials in packaging. As an example, in March 2025, Borealis introduced a new high-performance recycled linear low-density polyethylene (rLLDPE) grade designed for flexible packaging applications. This aims to enhance mechanical properties and recyclability to meet sustainability targets in the packaging sector. Metallocene LDPE enables the production of mono-material film structures to meet recycling standards while maintaining mechanical integrity and barrier properties. Packaging manufacturers are replacing conventional resins with mLLDPE to meet extended producer responsibility requirements and reduce multilayer plastic waste. The ability to reduce material thickness without compromising performance further supports sustainability targets and cost efficiency. These factors fuel the demand for mLLDPE suitable solution for businesses aiming to comply with environmental regulations and improve recyclability across product categories.

Segmental Insights

Polymer Type Analysis

Based on polymer type, the segmentation includes metallocene linear low-density polyethylene (mLLDPE) and metallocene high-density polyethylene (mHDPE). The mLLDPE segment dominated the market in 2024, due to its extensive use in films for food packaging, agriculture, and industrial applications. The material offers good flexibility, sealing strength, and puncture resistance, which supports its use in high-speed film production. Its downgauging capability reduces material usage without compromising performance. These properties drive the demand for mLLDPE to improve efficiency and meeting sustainability goals in the packaging industry.

The mHDPE segment is expected to grow at the fastest rate during the forecast period. This is driven by its high strength and chemical resistance support its use in rigid containers, closures, and medical-grade products. The segment is growing adoption in automotive and industrial packaging due to its load-bearing capacity and long service life. mHDPE is further adopted in personal care and healthcare packaging as manufacturers seek durable and recyclable materials. These factors are driving strong demand across high-performance rigid packaging applications.

Application Analysis

By application, the segmentation includes packaging and non-packaging. The packaging segment dominated the market in 2024, driven by high demand from food, pharmaceutical, and consumer goods industries. mLLDPE is used in flexible films that require clarity, sealing strength, and downgauging potential. Its compatibility with recyclable mono-material structures supports sustainability targets. Packaging producers prefer mLLDPE for its consistent quality in automated production environments. These advantages drive its role across flexible packaging supply chains.

The non-packaging segment is projected to grow at the fastest pace through 2034. The segment includes applications in agriculture, healthcare, and industrial insulation. mLLDPE is used in greenhouse films, sterile medical wraps, and cable insulation due to its UV resistance and chemical stability. Increasing demand for medical-grade films and protective sheeting is expanding its use in non-packaging sectors. These functional requirements are creating strong growth opportunities for mLLDPE beyond traditional packaging formats.

End User Analysis

Based on end user channel, the segmentation includes food and beverage, agriculture, consumer goods, healthcare, electrical and electronics, automotive, and industrial manufacturing. The food and beverage segment accounted for the highest market share in 2024. This is due to its high consumption of packaged food products that offer strong sealing and barrier properties, as mLLDPE is used in wraps, pouches, and liners that maintain product safety and extend shelf life. For instance, in August 2022, SABIC expanded production capacity at its Korea Nexlene Plant to enhance supply of advanced polyolefin materials, including metallocene LLDPE. This expansion supports growing demand for high-performance packaging that extends shelf life and helps reduce food wastage through better barrier properties and durability. The material supports downgauging and recyclability, which meet industry regulations and brand sustainability goals to support its continued dominance in food packaging operations.

The healthcare segment is projected to grow at the fastest pace during the forecast period. This segment benefits from rising demand for safe and sterile packaging materials in hospitals and pharmaceutical distribution. mLLDPE is used in blister packs, medical films, and IV packaging due to its low extractables and strong seal performance. It is compatible with gamma and e-beam sterilization methods, which supports its use in regulated environments. These attributes are driving strong adoption across medical packaging and diagnostics.

Regional Analysis

Asia Pacific metallocene LDPE market is expected to witness fastest growth with a CAGR of 6.6% during the forecast period. This is driven by high consumption of flexible packaging in food, agriculture, and industrial sectors. Rising demand for downgauged films in countries such as China, India, Japan, and South Korea to meet performance and sustainability criteria. This is due to the presence of well-established manufacturing infrastructure, expansion of organized retail, and growth in e-commerce that fuels the demand for high-volume adoption of metallocene-based resins. In addition, domestic film manufacturers are adopting mLLDPE for mono-material applications to meet recyclability standards supported by lower production costs and strong demand from export-oriented packaging industries.

China Metallocene LDPE Market Insight

China held significant regional share in Asia Pacific metallocene LDPE landscape in 2024, due to high production and consumption of flexible packaging films across various industries. In February 2025, ExxonMobil started operations at its new linear low-density polyethylene (LLDPE) unit in Huizhou, China, as part of a major petrochemical complex. This new capacity is expected to strengthen domestic supply of advanced LLDPE grades, including metallocene variants to meet growing demand in flexible packaging and industrial applications. Moreover, the rapid growth in food processing, personal care, and e-commerce sectors is driving large-scale demand for downgauged and recyclable film solutions. Furthermore, the presence of domestic packaging manufacturers that are adopting mLLDPE to meet efficiency, regulatory and sustainability targets along with government initiatives to reduce plastic waste is accelerating the shift toward mono-material packaging.

Middle East & Africa (MEA) Metallocene LDPE Market

The market in Middle East & Africa (MEA) is projected to grow at a significant CAGR from 2025-2034. This growth is witnessed due to growing investments in food processing, medical packaging and regional manufacturing hubs for high-performance polymer films. Also, the growing focus by prominent countries such as Saudi Arabia and the UAE in this region to expand flexible packaging capacity under industrial diversification plans drives the mLLDPE industry. In addition, the rising shift toward sustainable and recyclable materials is creating opportunities for metallocene LDPE adoption across consumer and industrial applications. For instance, in June 2025, a Saudi Arabian producer offered metallocene linear low-density polyethylene (mLLDPE) of EXCEED 6318BJ grade in Morocco for June 2025 shipment. The material is priced at approximately USD 1,175 per tonne, reflecting increasing regional supply and rising demand for high-performance polyethylene.

Saudi Arabia Metallocene LDPE Market Overview

The market in Saudi Arabia is expanding due to the country’s investments in downstream petrochemical processing and flexible packaging industries under its Vision 2030 plan. The demand for metallocene LLDPE is increasing due to its widespread adoption in food-grade films, agricultural covers and pharmaceutical packaging. Moreover, the growing focus on regulatory initiatives on reducing plastic waste and supporting domestic manufacturing are further bosoting the adoption of high-performance and recyclable polymer grades.

North America Metallocene LDPE Market

The metallocene LDPE landscape in North America accounted for 32.76% share in 2024. This is owing to the strong adoption of mLLDPE in food, healthcare, and logistics packaging across the region. The Center for Medicare and Medicaid Services reported that US health spending grew by 7.5% in 2023, reaching USD 4.867 trillion. This accounted for 17.6% of the country’s GDP and amounted to USD 14,570 per person. This trend is driving demand for metallocene LDPE in pharmaceutical films and sterile medical packaging, owing to its superior strength and optical clarity. Moreover, the well-established packaging infrastructure with high regulatory standards for recyclability and food safety in the US and Canada drives the market growth. In addition, the rising focus on circular economy targets and brand-level sustainability goals is driving demand for mono-material flexible packaging. Furthermore, the healthcare sector in the US is contributing to strong demand for sterile-grade and chemically stable polymers, which in turn fuels the consumption of mLLDPE across the country.

Key Players & Competitive Analysis Report

The metallocene LDPE industry is moderately consolidated, with key players focusing on polymer innovation, downgauging efficiency, and recyclable film development. Manufacturers are prioritizing the production of high-performance grades that support mono-material packaging, food safety compliance, and automated processing. The industry is focusing on capacity expansion, collaboration with packaging manufacturers and development of application-specific grades for food, healthcare and industrial sectors. Investments in sustainable resin technology and compatibility with high-speed packaging equipment are driving product differentiation. Regulatory compliance and technical support services remain essential for strengthening customer retention and competitive positioning across global packaging value chains.

Major companies operating in the metallocene LDPE industry include ExxonMobil Corporation, LyondellBasell Industries N.V., Dow Inc., SABIC, Borealis AG, INEOS Group Holdings S.A., LG Chem Ltd., Braskem S.A., TotalEnergies SE, Chevron Phillips Chemical Company LLC, Japan Polyethylene Corporation, Raghav Polymers, Reliance Industries Limited, and Repsol S.A.

Key Players

- Borealis AG

- Braskem S.A.

- Chevron Phillips Chemical Company LLC

- Dow Inc.

- ExxonMobil Corporation

- INEOS Group Holdings S.A.

- Japan Polyethylene Corporation

- LG Chem Ltd.

- LyondellBasell Industries N.V.

- Raghav Polymers

- Reliance Industries Limited

- Repsol S.A.

- SABIC

- TotalEnergies SE

Industry Developments

- May 2025: Univation Technologies introduced a world-scale UNIPOL PE Process design with an annual capacity of 800,000 tonnes, aimed at meeting the rising global demand for high-performance polyethylene. This development supports the production of advanced grades such as metallocene LDPE, which are used in flexible packaging and specialty film applications.

- October 2024: SABIC’s collaborated with Polivouga and Nueva Pescanova to develop flexible food packaging using certified bio-renewable HDPE and SUPEER mLLDPE, derived from used cooking oil collected at Lamb Weston’s Idaho facility. This initiative aims to boost the use of sustainable mLLDPE grades in food packaging to support circular economy goals.

Metallocene LDPE Market Segmentation

By Polymer Type Outlook (Revenue, USD Billion, 2020–2034)

- Metallocene Linear Low-Density Polyethylene (mLLDPE)

- Metallocene High-Density Polyethylene (mHDPE)

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Packaging

- Food Packaging

- Industrial Packaging

- Agricultural Films

- Stretch & Shrink Films

- Non-Packaging

- Wires & Cables

- Automotive Parts

- Housewares

- Medical Applications

By End User Channel Outlook (Revenue, USD Billion, 2020–2034)

- Food & Beverage

- Agriculture

- Consumer Goods

- Healthcare

- Electrical & Electronics

- Automotive

- Industrial Manufacturing

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Metallocene LDPE Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.51 Billion |

|

Market Size in 2025 |

USD 9.00 Billion |

|

Revenue Forecast by 2034 |

USD 15.15 Billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.51 billion in 2024 and is projected to grow to USD 15.15 billion by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

North America dominated the market in 2024, holding 32.76% share.

A few of the key players in the market are ExxonMobil Corporation, LyondellBasell Industries N.V., Dow Inc., SABIC, Borealis AG, INEOS Group Holdings S.A., LG Chem Ltd., Braskem S.A., TotalEnergies SE, Chevron Phillips Chemical Company LLC, Japan Polyethylene Corporation, Raghav Polymers, Reliance Industries Limited, and Repsol S.A

The mLLDPE segment dominated the market in 2024, holding 62.65% share. This dominance is attributed to its extensive use in downgauged films for food, agricultural, and industrial packaging applications due to its flexibility, sealing strength, and puncture resistance.

The healthcare segment is expected to witness the fastest growth during the forecast period, driven by increasing demand for sterile packaging, pharmaceutical films, and diagnostic wraps that require chemically stable and clean-sealing polymers.