Mexico Blank Apparel Market Size, Share, Trends, & Industry Analysis Report

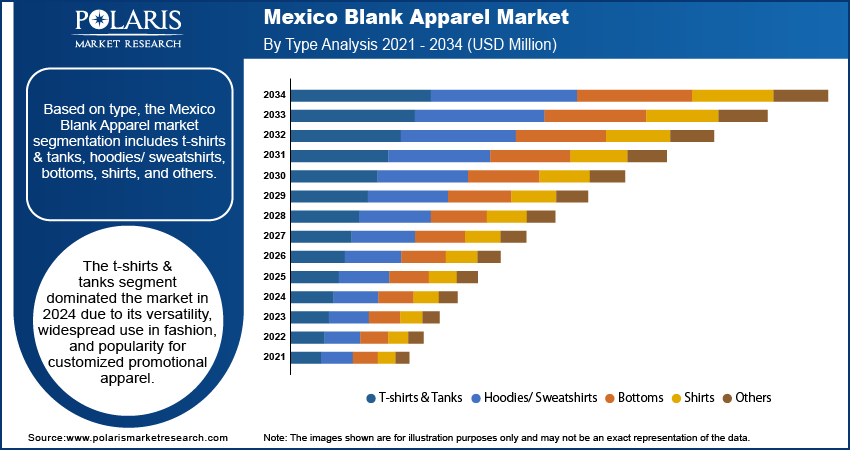

By Type (T-shirts & Tanks, Hoodies/ Sweatshirts, Bottoms, Shirts, and Others), By Distribution Channel, – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 110

- Format: pdf

- Report ID: PM6204

- Base Year: 2024

- Historical Data: 2021 - 2023

Overview

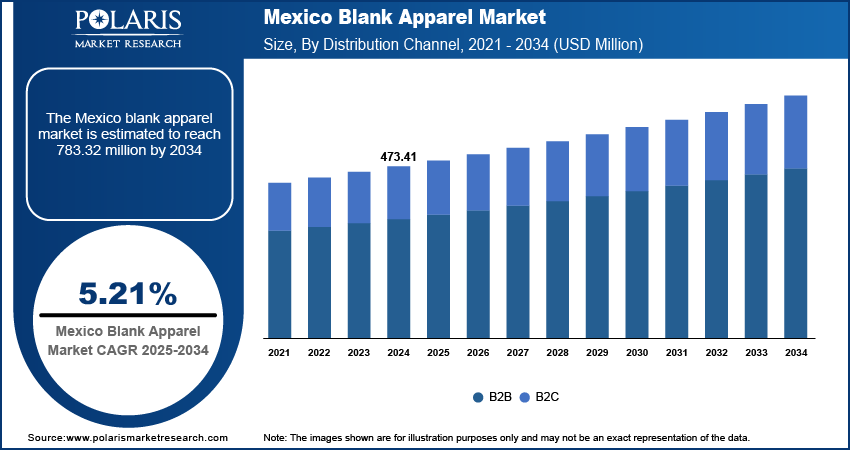

The Mexico blank apparel market size was valued at USD 473.41 million in 2024, growing at a CAGR of 5.21% from 2025 to 2034. Key factors driving demand for the blank apparel in Mexico include rising demand for custom and promotional clothing, growth of e-commerce platforms, and increasing popularity of athleisure.

Key Insight

- The t-shirts & tanks segment held 43.04% of Mexico blank apparel market in 2024 due to their high demand across both casual and promotional wear.

- The B2B segment accounted for 90.87% of Mexico blank apparel market in 2024 due to strong demand from event organizers, corporate buyers, and promotional product companies.

Industry Dynamics

- The increasing disposable income is fueling the demand for blank apparel by enhancing consumers' purchasing power and expanding their ability to spend on non-essential goods.

- The growing urbanization is boosting the adoption of blank apparel, as students and artists in urban areas buy blank garments for customization, club events, or artistic projects.

- The expanding e-commerce sector is creating a lucrative market opportunity by allowing businesses, startups, and individuals to easily source high-quality blank garments from global suppliers at competitive prices.

- High competition from international and domestic players is projected to significantly hamper the demand for Mexican blank apparel by creating a saturated market with limited growth opportunities.

AI on the Mexico Blank Apparel Market

- AI tools such as generative design help create unique apparel patterns quickly, reducing manual effort and speeding up production for Mexico’s blank apparel market.

- AI analyzes trends and sales data to predict demand, optimizing inventory and reducing overproduction for brands and manufacturers.

- AI-powered platforms enable mass customization, allowing businesses to offer personalized blank apparel with minimal setup costs.

- AI enhances logistics, supplier selection, and quality control, streamlining operations in Mexico’s competitive apparel sector.

Market Statistics

- 2024 Market Size: USD 473.41 Million

- 2034 Projected Market Size: USD 783.32 Million

- CAGR (2025-2034): 5.21%

Blank apparel refers to clothing items without any pre-printed designs, logos, or embellishments, serving as a base for customization. These garments include t-shirts, hoodies, sweatshirts, polo shirts, and caps made from various fabrics such as cotton, polyester, or blends. Businesses, fashion brands, and individuals use them for screen printing, embroidery, heat transfer, or other decoration methods. Blank apparel plays a crucial role in promotional merchandise, team uniforms, retail fashion, and personal projects, offering a clean canvas for creativity while maintaining a functional and comfortable design.

Mexico’s blank apparel market is expanding due to its strong textile manufacturing base, competitive production costs, and proximity to major export destinations such as the United States. The country produces a wide range of blank garments, particularly cotton and blended fabric t-shirts, that appeal to both domestic and international buyers. Growing demand from promotional product companies, corporate branding initiatives, and small-scale fashion businesses fuels market expansion. Mexico’s participation in trade agreements, such as the USMCA, enhances export opportunities and strengthens its position in the North America market. Additionally, increasing e-commerce adoption within Mexico further boosts domestic sales of blank clothing.

Drivers & Opportunities

Increasing Disposable Income: Increasing disposable income is fueling the demand for blank apparel by enhancing consumers' purchasing power and expanding their ability to spend on non-essential goods. Individuals with more disposable income are allocating a portion of their extra income to clothing, including blank apparel, which serves as a versatile and cost-effective option for customization, branding, or personal use. Higher disposable income in Mexico is also encouraging businesses, schools, and organizations to invest in blank apparel for uniforms, promotional events, or merchandise, contributing to market growth. According to a report published by the International Energy Agency, the disposable income per capita in Mexico is projected to reach $16,541 in 2030 from $15,608 in 2025. Rising income in Mexico is also leading to greater fashion experimentation, with consumers buying multiple blank pieces to create personalized styles or support DIY projects, further driving demand.

Growing Urbanization: The concentration of colleges and creative industries in urban areas is boosting demand for blank apparel, as students and artists buy blank garments for customization, club events, or artistic projects. Urbanization is also promoting athleisure and casual dress codes, increasing the need for comfortable, blank basics that fit multiple occasions. Therefore, as cities expand in Mexico, the demand for blank apparel also rises as they play a key role in layered, logo-free outfits favored by fashion-conscious consumers. For instance, according to the World Bank Group, the urban population in Mexico reached 82% of the total country population in 2024 from 80% in 2019. The density of urban populations is also supporting the growth of print-on-demand businesses, which rely on blank apparel to fulfill customized orders quickly. Furthermore, sustainability concerns in cities are leading eco-aware consumers to choose high-quality blank apparel over fast fashion, viewing it as a long-term investment.

Segmental Insights

Type Analysis

Based on type, the segmentation includes t-shirts & tanks, hoodies/ sweatshirts, bottoms, shirts, and others. The t-shirts & tanks segment held 43.04% of Mexico blank apparel market in 2024 due to their versatility, affordability, and high demand across both casual and promotional wear segments. People in Mexico increasingly preferred these products for everyday use due to their comfort, lightweight fabrics, and suitability for the country’s warm climate. Businesses also adopted them widely for branding purposes, as they offer an effective and cost-efficient medium for screen printing, embroidery, and other customization techniques. The growing influence of urban fashion trends, coupled with the expansion of e-commerce platforms, further boosted sales in this category. Rising participation in events, racquet sports, and corporate activities also fueled bulk orders, contributing to the dominance of t-shirts and tanks in the market.

The hoodies/ sweatshirts segment is expected to grow at a CAGR of 5.94% from 2025 to 2034, owing to the rising population of youth. Younger individuals are embracing hoodies as a year-round fashion clothing, combining comfort with a streetwear aesthetic that aligns with global style trends. The rising penetration of international and domestic apparel brands, along with the popularity of influencer-led promotions on social media, is also expanding the visibility and desirability of hoodies. Additionally, advancements in fabric, such as lightweight fleece and sustainable materials, are projected to attract environmentally conscious shoppers, supporting long-term growth in the hoodie and sweatshirt segment.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes B2B and B2C. The B2B segment accounted for 90.87% of Mexico blank apparel market in 2024 due to strong demand from corporate buyers, promotional product companies, event organizers, and retailers sourcing in bulk. Businesses increasingly purchased blank garments for branding, employee uniforms, merchandising, and marketing campaigns, as these products offer cost-effective customization options through printing, embroidery, and heat transfers. The growing promotional merchandise industry in Mexico, supported by frequent trade shows, sports events, and corporate activities, significantly boosted bulk orders of blank apparel. Wholesale distributors strengthened their supply networks, enabling faster deliveries and competitive pricing, which encouraged more companies to secure long-term procurement contracts. The continued expansion of small and medium-sized businesses also fueled B2B sales, as entrepreneurs relied on bulk apparel purchases to support their custom printing and retail operations.

The B2C segment is expected to grow at a CAGR of 6.51% from 2025 to 2034, owing to rising disposable incomes, growing fashion awareness, and the expansion of online retail platforms. Direct-to-consumer brands are also gaining popularity by offering customizable designs, sustainable fabric options, and competitive pricing without middlemen. E-commerce marketplaces, social media shops, and brand-owned websites are making blank apparel easily accessible, while targeted marketing campaigns are encouraging impulse purchases. Additionally, urban youth culture and the influence of global streetwear trends are projected to enhance the appeal of B2C purchases further, as individuals seek unique, versatile apparel that aligns with personal style preferences.

Key Players & Competitive Analysis Report

The Mexico blank apparel market features a dynamic competitive landscape shaped by both international and regional players. Key competitors include U.S.-based firms such as Los Angeles Apparel Inc., Independent Trading Company, and Next Level Apparel, known for quality basics and strong distribution networks. Brands such as Spectra USA, LANE SEVEN APPAREL, and Soffe emphasize performance and youth-oriented blank apparels. Australia’s AS Colour brings minimalist designs with a focus on sustainability. Mexican manufacturers like Vertical Knits, S.A. de C.V. and SiATEX leverage local production advantages, offering cost-effective, vertically integrated solutions. Together, these companies compete on quality, pricing, sustainability, and speed-to-market, with increasing emphasis on ethical manufacturing and customization. The blend of local expertise and global reach defines the evolving competitiveness of Mexico’s blank apparel market.

Major companies operating in the Mexico Blank apparel industry include Spectra USA; Los Angeles Apparel Inc.; LANE SEVEN APPAREL; Independent Trading Company; Soffe; Vertical Knits, S.A. de C.V.; House of Blanks; Next Level Apparel; AS Colour; and SiATEX.

Key Companies

- AS Colour

- House of Blanks

- Independent Trading Company

- LANE SEVEN APPAREL

- Los Angeles Apparel Inc.

- Next Level Apparel

- SiATEX

- Soffe

- Vertical Knits S.A. de C.V.

- Spectra USA

Industry Developments

May 2025, Lane Seven Apparel launched two new colors, Sandshell and Sports Green for its LS14001YH Premium Youth Pullover Hoodie. Crafted from 3-End fleece, the hoodie was designed to endure seasonal wear and tear.

January 2023, Next Level Apparel expanded internationally by acquiring Stedman. The move strengthened its presence and product portfolio, while enabling Stedman to enter the U.S. market under shared ownership with Blue Point Capital Partners' backing.

Mexico Blank Apparel Market Segmentation

By Type Outlook (Revenue, USD Million, 2021–2034)

- T-shirts & Tanks

- Hoodies/ Sweatshirts

- Bottoms

- Shirts

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2021–2034)

- B2B

- B2C

- Online

- Offline

Mexico Blank Apparel Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 473.41 Million |

|

Market Size in 2025 |

USD 495.95 Million |

|

Revenue Forecast by 2034 |

USD 783.32 Million |

|

CAGR |

5.21% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 473.41 million in 2024 and is projected to grow to USD 783.32 million by 2034.

The market is projected to register a CAGR of 5.21% during the forecast period.

A few of the key players in the market are Spectra USA; Los Angeles Apparel Inc.; LANE SEVEN APPAREL; Independent Trading Company; Soffe; Vertical Knits, S.A. de C.V.; House of Blanks; Next Level Apparel; AS Colour; and SiATEX.

The t-shirts & tanks segment dominated the market share in 2024.

The B2C segment is expected to witness the fastest growth during the forecast period.