Middle East Renewable Energy Market Size, Share, Trends, Industry Analysis Report

By Product (Solar Power, Hydropower, Bioenergy, Wind Power, Others), By Application – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6360

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

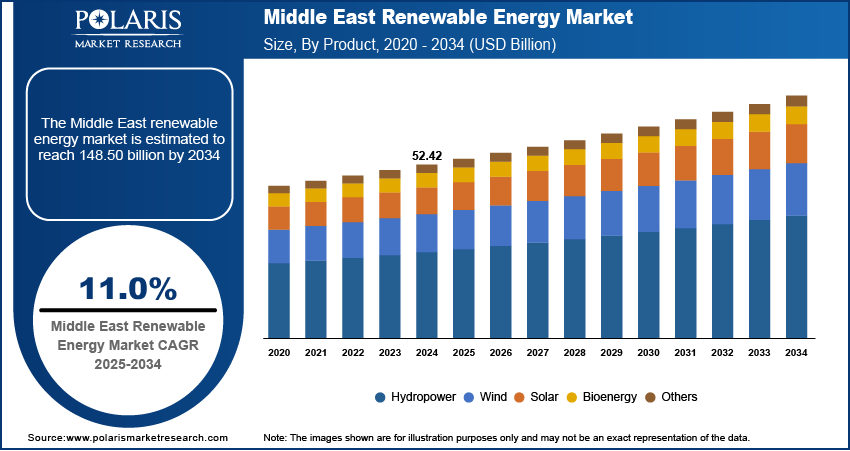

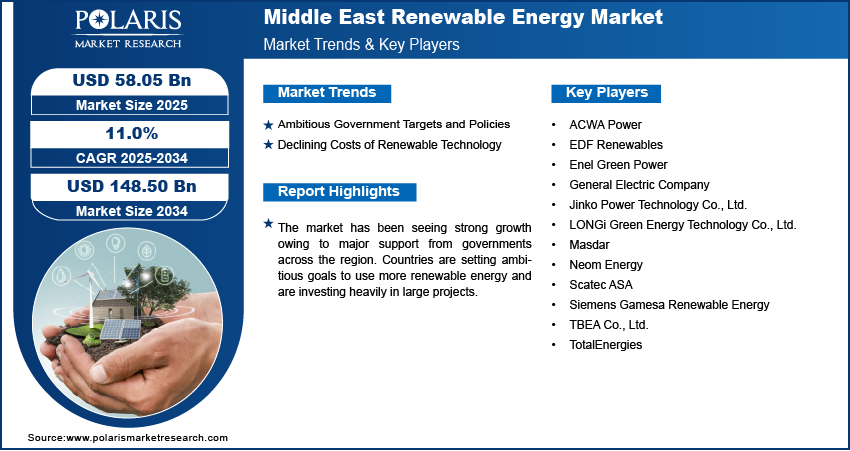

The Middle East renewable energy market size was valued at USD 52.42 billion in 2024 and is anticipated to register a CAGR of 11.0% from 2025 to 2034. Strong government support and policies aimed at sustainability and reducing carbon emissions drive the market expansion. Also, the falling costs for solar and wind power are making them a good option that is now more affordable, which boosts the industry growth.

Key Insights

- By product, the solar power segment held the largest share in 2024, include abundant solar resources, supportive government policies, falling technology costs, and strategic efforts to diversify energy portfolios and reduce carbon emissions.

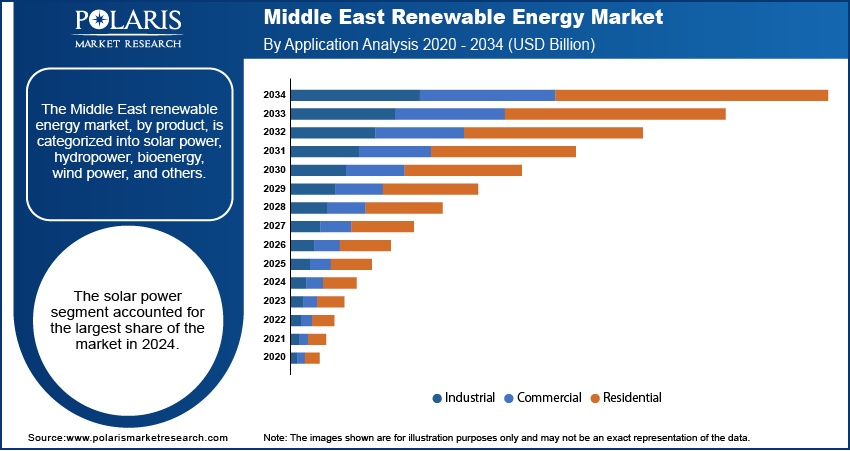

- Based on application, the industrial segment accounted for the largest share in 2024. This is because the industrial sector is the place where maximum number of industrial fans are used.

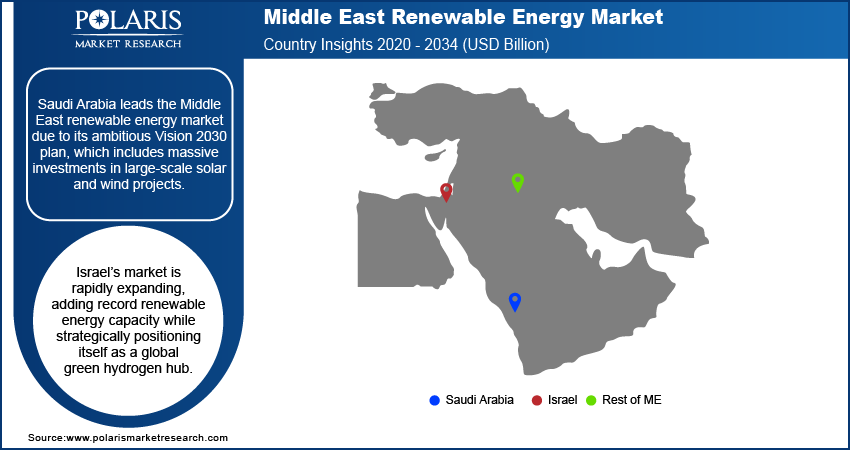

- In terms of country, Saudi Arabia is the largest country due to the fact that the country is leveraging its substantial natural resources to diversify its economy away from oil, making it a key force in the region's energy transition.

Industry Dynamics

- Strong government support is a major driver, with countries setting ambitious targets and introducing strategic frameworks to diversify their economies and reduce carbon footprints. These policies include direct investments in large-scale projects and incentives that attract private capital.

- Falling costs of key technologies, especially for solar and wind energy, have made them much more competitive than traditional power sources. This economic viability is a huge factor, encouraging widespread adoption and making clean energy an increasingly attractive investment.

- Rapid population growth and ongoing urbanization across the region have led to a significant increase in domestic electricity demand. Renewable energy sources are becoming a crucial solution to meet these rising energy needs while also ensuring long-term energy security.

Market Statistics

- 2024 Market Size: USD 52.42 billion

- 2034 Projected Market Size: USD 148.50 billion

- CAGR (2025–2034): 11.0%

- Saudi Arabia: Largest Market in 2024

AI Impact on Middle East Renewable Energy Market

- AI tools optimize resource allocation and distribution by analyzing energy usage patterns and industry trends.

- In the solar energy industry, AI can be used to adjust panel angles based on real-time sunlight conditions. It helps increase energy capture. In wind farms, the technology helps adjust the position of turbines for optimal wind flow.

- Under the Vision 2030, Saudi Arabia is a regional leader in AI for energy. Major projects across the country, such as the NEOM sustainable city and the Sakaka solar plant, use AI technology to enhance efficiency and manage renewable and green hydrogen production.

The Middle East renewable energy market focuses on using clean power sources such as solar and wind to generate electricity. This transition helps the region move away from relying on traditional fossil fuels and meet a growing demand for energy. The market includes a variety of projects, from large solar farms to smaller-scale home solar systems or rooftop installations, all aimed at diversifying the energy mix.

One important driver is the rapid growth of the green hydrogen sector, which is being seen as a new way to use the region's vast renewable energy resources. Another factor is the increased focus on water-energy linkages, where renewable power is used for energy-intensive processes such as desalination to secure water supplies.

The push toward using renewable energy for water security boosts the market expansion. Many countries in the region are using clean energy to power desalination plants, which turn saltwater into fresh water for drinking and farming. This helps them manage water scarcity. For example, according to a report from the World Health Organization, more than half of the world's desalinated water comes from the region. Projects that combine solar power with desalination are becoming more common as a way to ensure a stable supply of both water and energy.

Drivers and Trends

Ambitious Government Targets and Policies: Governments in the Middle East are the primary force behind the growth of the renewable energy market, driven by a need to diversify their economies and move away from a heavy dependence on oil and gas exports. These nations are setting bold, long-term goals and creating comprehensive national strategies to build a new energy infrastructure. These plans include large-scale projects, data centers, and incentives that make it easier for private companies to invest in clean energy, creating a stable environment for the industry to flourish. The region's commitment to these targets is evident in the development of multiple renewable energy programs and large-scale, state-backed projects.

These government-led initiatives are directly influencing the pace of development. According to the Saudi Press Agency (SPA), the Kingdom of Saudi Arabia will tender new renewable energy projects with a capacity of 20 gigawatts annually from 2024. The goal is to reach between 100 and 130 gigawatts by 2030, which will contribute to a 50% renewable energy mix for electricity production. Such clear and ambitious planning from national governments is a major factor driving the market's growth and attracting investment.

Declining Costs of Renewable Technology: The falling cost of renewable energy technology, particularly for solar photovoltaic (PV) and wind power, is another significant driver. As technology improves and production scales up, the cost of generating electricity from these sources is becoming more competitive with traditional fossil fuels. This trend has made renewable energy projects more economically viable and has lowered the financial risk for investors and developers. The cost reduction allows for the development of massive utility-scale projects that can produce electricity at very low prices, which is helping to change the overall energy landscape.

The economic benefits of this cost reduction are clear from recent project data. A report from the Saudi General Authority for Statistics, titled Renewable Energy Statistics Bulletin 2024, highlighted that a new solar project in the country registered one of the lowest energy purchase costs ever at 3.9 halalas per kilowatt-hour. This demonstrates the increasing affordability of renewable energy and its ability to compete directly on price. The continued decrease in technology costs and project bids drives market growth by making renewable power an attractive and affordable option for meeting the region's increasing energy demand.

Segmental Insights

Product Analysis

Based on product, the segmentation includes solar power, hydropower, bioenergy, wind power, and others. The solar power segment held the largest share in 2024. This is primarily due to the region's exceptional natural advantages, including some of the highest solar irradiance levels in the world and vast, open desert landscapes ideal for large-scale installations. Countries have leveraged these conditions by developing monumental solar farms and complexes, often with record-low energy costs, which has made solar energy highly competitive with traditional fossil fuels. This strategic focus, coupled with significant state-backed investments and ambitious national targets, has contributed to the solar power segment's position as the leading source of clean energy, essential for diversifying economies and meeting a continuously rising energy demand.

The wind power segment is anticipated to register the highest growth rate during the forecast period. The high growth of wind power is a result of strategic investments in technology and infrastructure in areas with favorable wind corridors, particularly along coastal and mountainous regions. As a natural complement to solar, which is limited to daylight hours, wind energy helps create a more balanced and reliable power grid. Governments and private developers are increasingly recognizing this potential and are making substantial investments in major wind turbines, which are expected to contribute significantly to the total renewable energy capacity. This rapid expansion positions wind power as a key driver of diversification and a crucial component in the future energy mix.

Application Analysis

Based on application, the segmentation includes commercial, residential, and industrial. The industrial segment held the largest share in 2024. These industries require vast amounts of power to operate, and as sustainability targets become more important, companies are increasingly turning to renewable sources to meet their needs. The shift is motivated by a desire to reduce operational costs, lower carbon emissions, and improve energy security. Large-scale solar and wind projects are being developed to directly power industrial facilities or provide clean electricity to the grid, which in turn supports these major economic sectors. This trend is central to national strategies aimed at economic diversification and creating a sustainable future.

The commercial sector is anticipated to register the highest growth rate during the forecast period. This rapid expansion is a result of several factors, including the increasing availability of smaller-scale technologies and supportive government policies aimed at empowering individuals and businesses to generate their own power. Initiatives that promote rooftop solar installations for homes and small businesses are gaining popularity, driven by the desire to reduce electricity bills and contribute to environmental goals. As distributed energy solutions become more affordable and accessible, this trend is expected to continue. The growth in this segment indicates a broader, societal-level adoption of renewable energy, moving beyond just large-scale, state-sponsored projects.

Country Analysis

The Saudi Arabia renewable energy market held the largest share in 2024, primarily driven by its ambitious Vision 2030 plan. The country is making substantial investments to diversify its energy mix and reduce its dependence on fossil fuels. This strategic shift has resulted in the development of massive-scale solar power projects, taking advantage of the country's high solar exposure. With a focus on both solar and wind energy, Saudi Arabia is actively working to establish itself as a global leader in clean energy production, which is attracting significant international investment and helping to create new economic sectors.

UAE Renewable Energy Market Overview

The UAE is a pioneer in the Middle East industry. The country is known for its long-term vision and significant investments in major projects. It has a strong track record of developing large solar parks that have become benchmarks for efficiency and low cost. The UAE's approach includes utility-scale projects and a focus on research, technology, and sustainable urban development. This balanced strategy ensures that the nation is well-positioned to meet its future energy needs while also supporting innovation and environmental goals.

Israel Renewable Energy Market Trends

The renewable energy market in Israel is largely focused on solar power due to its abundant sunshine, especially in the southern desert regions. The country's strategy is driven by a need to improve energy security and diversify its power mix. This has led to the development of utility-scale solar farms and a strong emphasis on smart grid technologies to manage the intermittent nature of renewable sources. Israel is also a center for innovation, with local companies creating advanced solutions for energy storage and solar technology. The government has set clear goals and is implementing policies to support these efforts, making renewable energy a central part of its national energy plan.

Key Players and Competitive Insights

The competitive landscape of the Middle East renewable energy market is shaped by a mix of local and international companies, all working to meet the region's ambitious sustainability goals. Key players such as ACWA Power, Masdar, EDF Renewables, Neom Energy, Scatec, TotalEnergies, and Siemens Gamesa Renewable Energy are all vying for projects. The competition is intense, with companies focused on securing large-scale government contracts and partnerships for major solar and wind projects. Many players are also seeking new technologies such as green hydrogen to get a competitive edge. The market dynamics are largely driven by a combination of technological innovation, project financing, and strong relationships with government bodies in the region. Companies that can offer cost-effective and innovative solutions for large-scale developments are well-positioned to succeed.

A few prominent companies in the industry include ACWA Power; Masdar; Neom Energy; TotalEnergies; EDF Renewables; Jinko Power Technology Co., Ltd.; LONGi Green Energy Technology Co., Ltd.; Enel Green Power; Scatec ASA; Siemens Gamesa Renewable Energy; TBEA Co., Ltd.; and General Electric Company.

Key Players

- ACWA Power

- EDF Renewables

- Enel Green Power

- General Electric Company

- Jinko Power Technology Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.

- Masdar

- Neom Energy

- Scatec ASA

- Siemens Gamesa Renewable Energy

- TBEA Co., Ltd.

- TotalEnergies

Middle East Renewable Energy Industry Developments

January 2025: Masdar began construction on a 1.5 GW solar photovoltaic project in Saudi Arabia. This initiative is part of a joint venture under the nation’s National Renewable Energy Program, aiming to boost renewable energy capacity and support the country’s clean energy goals.

Middle East Renewable Energy Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Solar Power

- Hydropower

- Bioenergy

- Wind Power

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Residential

- Industrial

By Country Outlook (Revenue – USD Billion, 2020–2034)

- Saudi Arabia

- UAE

- Israel

- Rest of Middle East

Middle East Renewable Energy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 52.42 billion |

|

Market Size in 2025 |

USD 58.05 billion |

|

Revenue Forecast by 2034 |

USD 148.50 billion |

|

CAGR |

11.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 52.42 billion in 2024 and is projected to grow to USD 148.50 billion by 2034.

The market is projected to register a CAGR of 11.0% during the forecast period.

Saudi Arabia held the largest share of the market.

A few key players in the market include ACWA Power; Masdar; Neom Energy; TotalEnergies; EDF Renewables; Jinko Power Technology Co., Ltd.; LONGi Green Energy Technology Co., Ltd.; Enel Green Power; Scatec ASA; Siemens Gamesa Renewable Energy; TBEA Co., Ltd.; and General Electric Company.

The solar power segment accounted for the largest share of the market in 2024.

The commercial and residential segment is expected to witness the fastest growth during the forecast period.