Mobile Hydraulic Power Unit Market Size, Share, Trends, Industry Analysis Report

By Type (Standard Mobile Hydraulic Power Units, Customized Mobile Hydraulic Power Units), By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 123

- Format: PDF

- Report ID: PM6264

- Base Year: 2024

- Historical Data: 2020-2023

Overview

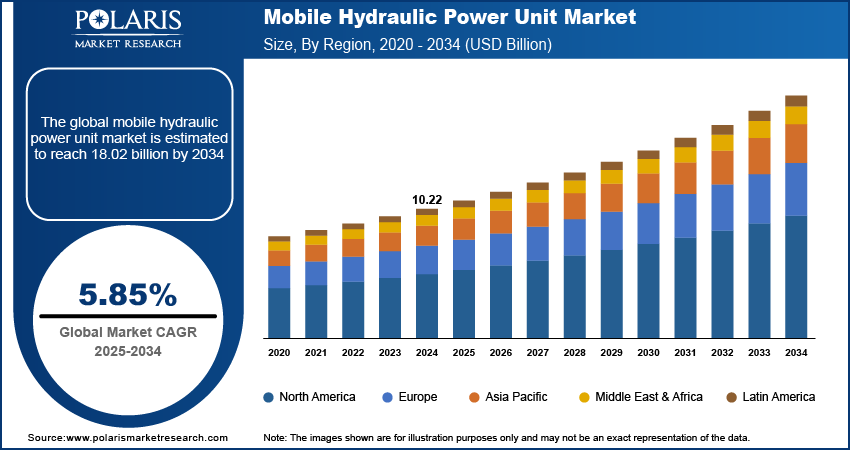

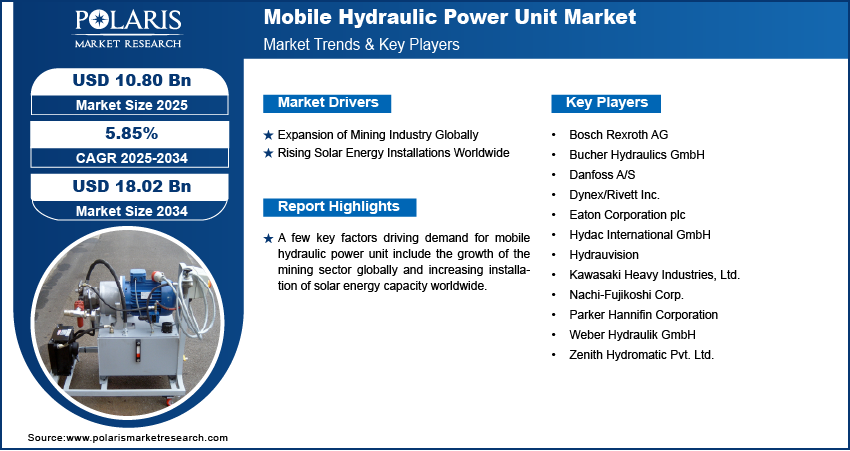

The global mobile hydraulic power unit market size was valued at USD 10.22 billion in 2024, growing at a CAGR of 5.85% from 2025 to 2034. Key factors driving demand for mobile hydraulic power unit include global growth of the mining industry coupled with rising solar energy capacity installation worldwide.

Key Insights

- The standard mobile hydraulic power unit segment dominated the market share in 2024.

- The agriculture segment is projected to grow at a rapid pace in the coming years, driven by driven by rising mechanization, adoption of advanced irrigation systems, and demand for efficient farming equipment.

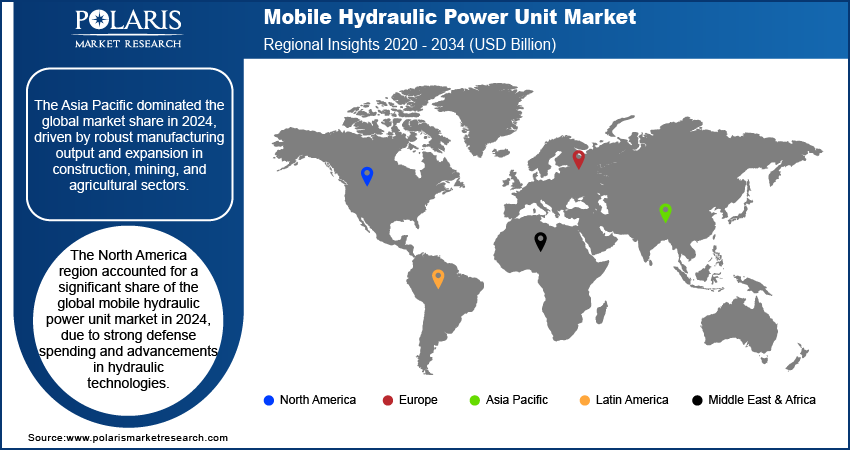

- The Asia Pacific mobile hydraulic power unit market dominated the global market share in 2024.

- The India mobile hydraulic power unit market is growing due to accelerated infrastructure projects, increasing industrialization, and rising investments in renewable energy installations.

- The market in North America is projected to grow at a fast pace from 2025-2034, propelled by strong defense spending, and upgrades in industrial machinery.

- Countries such as China and Japan are playing a key role in regional growth, driven by large-scale industrial projects, rapid urbanization, and increasing adoption of mobile hydraulic systems across construction and manufacturing sectors.

Industry Dynamics

- Expansion of mining industry worldwide is fueling the market growth due to the high demand for mobile hydraulic power units in excavation, material handling, and mineral processing operations.

- Increasing installation of solar energy capacity worldwide is fueling the market growth by creating demand for hydraulic systems in renewable energy equipment, including solar panel positioning and wind turbine maintenance.

- The rapid incorporation of innovative technologies such as IoT and sensors is expected to create lucrative opportunities during the forecast period.

- The significant capital required for procuring and installing mobile HPUs discourage adoption among small and medium enterprises, thereby restricting market growth.

Market Statistics

- 2024 Market Size: USD 10.22 Billion

- 2034 Projected Market Size: USD 18.02 Billion

- CAGR (2025–2034): 5.85%

- Asia Pacific: Largest Market Share

AI Impact on Mobile Hydraulic Power Unit Market

- AI enhances performance optimization in mobile hydraulic power units by analyzing load demands, operating conditions, and usage patterns to deliver tailored power output and energy efficiency.

- Integration of AI enables adaptive pressure and flow control, automatically adjusting hydraulic parameters in real time based on equipment requirements and environmental conditions.

- AI-powered diagnostics assist in detecting wear, fluid degradation, and system anomalies early, enabling predictive maintenance and reducing unplanned equipment downtime.

- AI improves operator interaction by enabling smart interfaces, automated alerts, and real-time feedback, enhancing safety, operational precision, and overall productivity in field applications.

Mobile hydraulic power units (HPUs) are self-contained systems designed to generate and control hydraulic energy for operating machinery in mobile applications. These units integrate pumps, motors, reservoirs, valves, and pressure regulators to deliver high-pressure fluid power for precise motion control andheavy-duty operations in field environments. They are widely used in construction equipment, mining machinery, agricultural vehicles, forestry equipment, and mobile cranes, where on-site power and portability are necessary. Mobile HPUs are designed for durability, ease of transport, and quick deployment, featuring compact layouts, noise reduction systems, and fuel-efficient motors. The market continues to expand as industries adopt mobile hydraulic solutions for flexible, high-performance, and reliable on-site operations.

The rising global military budgets are driving demand for mobile hydraulic power units due to the need for advanced defense equipment, including armored vehicles, naval ships, and aircraft systems that require high-performance hydraulic solutions for operations such as weapon control, flight actuation, and heavy-load handling. According to the Stockholm International Peace Research Institute (SIPRI), worldwide defense expenditure surged over USD 2718 billion in 2024, reflecting an increase of 9.4% from 2023. This sustained investment is boosting procurement of mobile hydraulic systems to enhance operational efficiency and defense capabilities.

Rapid urbanization and the development of large-scale industrial projects are fueling the mobile hydraulic power unit market due to growing demand for construction, mining, and material-handling equipment that rely on efficient hydraulic systems. According to the United Nations, the urban population represented 57% of the global population and is projected to reach 68% by 2050. This trend is increasing the deployment of mobile hydraulic power units to support heavy machinery, improve operational efficiency, and ensure timely completion of urban infrastructure and industrial projects.

Drivers & Opportunities

Expansion of Mining Industry Globally: The Growth in the global mining industry is fueling demand for mobile hydraulic power units due to the increasing need for efficient, high-performance hydraulic systems in heavy machinery, drilling equipment, and material handling operations. According to the World Economic Forum, globally the autonomous mining equipment market is projected to grow from USD 3.1 billion in 2020 to USD 6.2 billion in 2026. The expanding mining sector is driving adoption of mobile hydraulic solutions that ensure reliable power delivery, enhance operational efficiency, and support continuous equipment performance in challenging environments.

Rising Solar Energy Installations Worldwide: The rising installation of solar energy capacity is driving demand for hydraulic power units due to the growing need for reliable fluid power systems in solar panel tracking, cleaning, and maintenance equipment. According to the International Renewable Energy Agency (IRENA), global installed solar energy capacity reached over 1866 GW in 2024, marking a significant rise from 863 GW in 2021. This expansion in solar infrastructure is boosting adoption of high-performance hydraulic solutions

Segmental Insights

Type Analysis

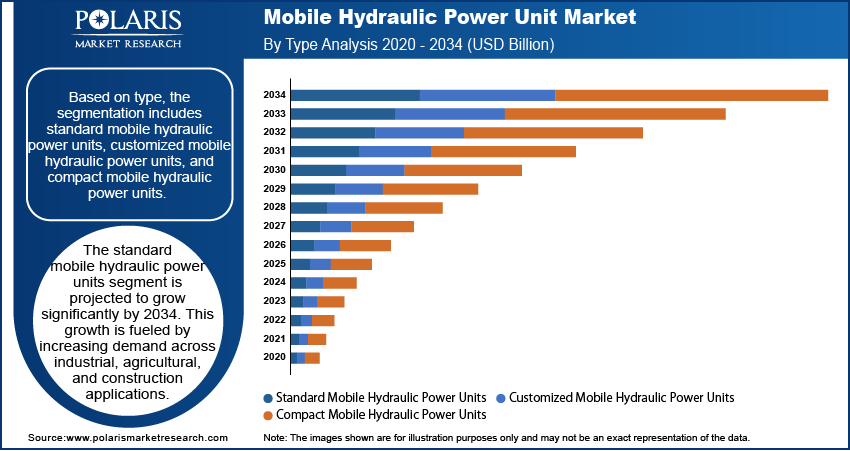

Based on type, the market is segmented into standard mobile hydraulic power units, customized mobile hydraulic power units, and compact mobile hydraulic power units. The standard mobile hydraulic power units segment accounted for the largest market share in 2024, driven by their widespread adoption in construction machinery, agricultural equipment, and material handling vehicles. These units provide reliable power output, ease of maintenance, and compatibility with a variety of hydraulic applications, making them the preferred choice for organizations seeking robust and cost-effective solutions. The segment’s prominence is fortified by established manufacturing processes and strong distribution networks that ensure ready availability across industrial and mobile equipment sectors.

The customized mobile hydraulic power units segment is projected to grow at the fastest pace through 2034, driven by rising demand for application-specific solutions tailored to unique operational requirements in sectors such as mining, oil & gas, and heavy construction. Manufacturers are offering bespoke configurations, including variable pressure outputs, modular designs, and enhanced mobility features, to meet client-specific needs. Investments in research and development, coupled with adoption of advanced materials and control systems, are enabling these customized units to deliver higher efficiency, safety, and durability under challenging field conditions.

End User Analysis

Based on end user, the market is categorized into construction, agriculture, oil & gas, energy & power generation, aerospace & defense, and others. The construction segment accounted for the largest market share, driven by the extensive use of mobile hydraulic power units in machinery such as excavators, loaders, cranes, and concrete pumps. These units provide reliable hydraulic force, operational flexibility, and durability across diverse site conditions, enabling efficient lifting, digging, and material handling operations. For instance, hydraulics innovators planned to unveil advanced power units, noise suppression systems, and load-sensing technologies at iVT Expo 2025, aiming to boost efficiency and reliability in mobile off-highway vehicles used in construction and agriculture.

The agriculture segment is projected to register the fastest growth through 2034, fueled by the increasing use of mobile HPUs in tractors, harvesters, irrigation systems, and other mechanized farm equipment. Technological advancements, such as modular designs and energy-efficient pumps, are accelerating adoption among agricultural enterprises seeking enhanced performance and reduced maintenance requirements.

Regional Analysis

Asia Pacific dominated the global mobile hydraulic power unit market in 2024, driven by rapid industrialization, urban infrastructure expansion, and growing investments in construction, mining, and agricultural machinery. Countries including China, India, Japan, and South Korea are adopting advanced mobile hydraulic systems to enhance operational efficiency and meet rising equipment automation demands. The availability of cost-effective manufacturing and local component suppliers is boosting the region’s leadership in mobile hydraulic power unit adoption.

India Mobile Hydraulic Power Unit Market Insights

Growth in India’s real estate sector is driving the mobile hydraulic power unit market due to increased demand for construction machinery and equipment that rely on hydraulic systems for lifting, excavation, and material handling. According to Cushman & Wakefield, India’s real estate sector drew investments totaling USD 2.77 billion in the second quarter of 2024. This trend is fueling adoption of mobile hydraulic power units to improve efficiency, safety, and productivity in large-scale building and infrastructure projects.

Europe Mobile Hydraulic Power Unit Market Assessments

The market in Europe is projected to hold a substantial revenue share in 2034 driven by the region’s established industrial sectors and high adoption of mobile machinery in construction and agriculture. Countries such as Germany, France, and Italy are prioritizing energy-efficient mobile hydraulic solutions to enhance operational productivity and reduce maintenance and operational costs. Additionally, the continuous automation upgrades across manufacturing plants and construction equipment are fueling demand for advanced mobile hydraulic units that provide precise control, reliability, and integration with modern industrial systems. The combination of mature industrial infrastructure and progressive technology adoption continues to support steady market expansion in Europe.

North America Mobile Hydraulic Power Unit Market Trends

North America is projected to register the fastest growth over the forecast period, driven by the widespread adoption of automated and smart mobile equipment across construction, mining, and defense applications. The emphasis on enhancing operational productivity and ensuring workplace safety is boosting demand for high-performance, portable hydraulic power units that offer reliable and efficient power delivery. Additionally, the growing deployment of mobile hydraulic units to support large-scale infrastructure projects and industrial operations is further boosting market expansion in the region.

The U.S. Mobile Hydraulic Power Unit Market Overview

Rising military spending in the U.S. is driving the mobile hydraulic power unit market due to higher demand for advanced defense vehicles, naval ships, and aircraft systems that require reliable hydraulic solutions for functions such as weapon control, flight actuation, and heavy-load handling. According to the Stockholm International Peace Research Institute (SIPRI), U.S. defense expenditure reached USD 916.01 billion in 2023, up from USD 734.34 billion in 2019, marking a 24.7% increase over four years. This sustained investment is boosting procurement of mobile hydraulic power units to enhance operational efficiency and fortify defense capabilities.

Key Players & Competitive Analysis

The mobile hydraulic power unit (HPU) market is moderately competitive, with key players such as Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation plc, Nachi-Fujikoshi Corp., Hydac International GmbH, Bucher Hydraulics GmbH, Kawasaki Heavy Industries, Ltd., and Dynex/Rivett Inc. These companies focus on developing compact, energy-efficient, and robust hydraulic units designed for construction machinery, agricultural equipment, mining vehicles, and mobile industrial applications. The competitive dynamics are further shaped by strategic launches aimed at enhancing manufacturing capabilities and boosting the market presence in high-growth regions.

A few major companies operating in the mobile hydraulic power unit industry include Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation plc, Nachi-Fujikoshi Corp., Hydac International GmbH, Bucher Hydraulics GmbH, Kawasaki Heavy Industries, Ltd., Dynex/Rivett Inc., Hydrauvision, Weber Hydraulik GmbH, Zenith Hydromatic Pvt. Ltd., and Danfoss A/S.

Key Players

- Bosch Rexroth AG

- Bucher Hydraulics GmbH

- Danfoss A/S

- Dynex/Rivett Inc.

- Eaton Corporation plc

- Hydac International GmbH

- Hydrauvision

- Kawasaki Heavy Industries, Ltd.

- Nachi-Fujikoshi Corp.

- Parker Hannifin Corporation

- Weber Hydraulik GmbH

- Zenith Hydromatic Pvt. Ltd.

Mobile Hydraulic Power Unit Industry Developments

December 2024: Weber Rescue Systems launched the SMART-COMPACT XL mobile hydraulic power unit designed to boost efficiency and performance in rescue operations. The unit provides real-time monitoring of battery status, pressure levels, maintenance needs, and offers anti-theft protection.

September 2023: Hydrauvision developed the HPU P-3300, its largest mobile hydraulic power unit, to drive large offshore installations, enhancing performance and meeting the latest emission standards.

Mobile Hydraulic Power Unit Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Standard Mobile Hydraulic Power Units

- Customized Mobile Hydraulic Power Units

- Compact Mobile Hydraulic Power Units

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Agriculture

- Oil & Gas

- Energy & Power Generation

- Aerospace & Defense

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mobile Hydraulic Power Unit Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.22 Billion |

|

Market Size in 2025 |

USD 10.80 Billion |

|

Revenue Forecast by 2034 |

USD 18.02 Billion |

|

CAGR |

5.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 10.22 billion in 2024 and is projected to grow to USD 18.02 billion by 2034.

The global market is projected to register a CAGR of 5.85% during the forecast period.

Asia Pacific dominated the market in 2024 due to rapid industrialization, large-scale infrastructure projects, and growth in construction and mining activities.

A few of the key players in the market are Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation plc, Nachi-Fujikoshi Corp., Hydac International GmbH, Bucher Hydraulics GmbH, Kawasaki Heavy Industries, Ltd., Dynex/Rivett Inc., Hydrauvision, Weber Hydraulik GmbH, Zenith Hydromatic Pvt. Ltd., and Danfoss A/S.

The standard mobile hydraulic power unit segment dominated the market revenue share in 2024 due to its versatile applications across construction, agriculture, and industrial machinery.

The agriculture segment is projected to witness the fastest growth during the forecast period driven by rising mechanization and demand for efficient irrigation and farming equipment.