Network Function Virtualization Market Size, Share, Trends, Industry Analysis Report: By Component (Solutions, Orchestration and Automation, and Services), Virtualized Network Function, Enterprise Size, Application, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 116

- Format: PDF

- Report ID: PM1474

- Base Year: 2024

- Historical Data: 2020-2023

Network Function Virtualization Market Overview

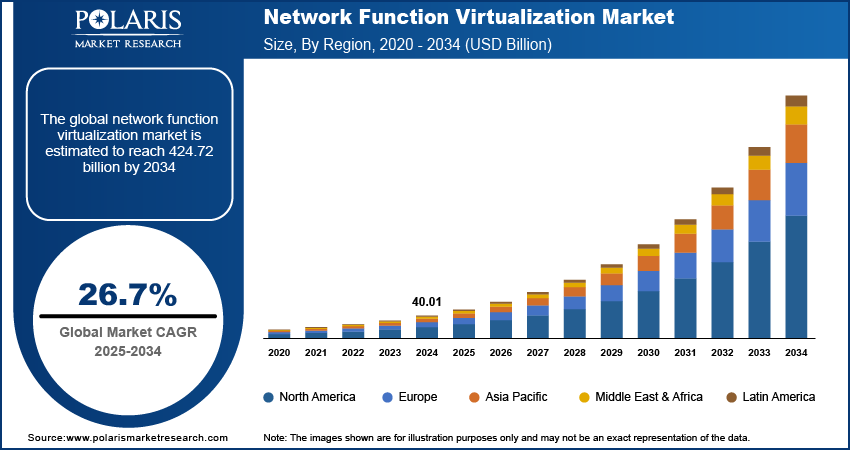

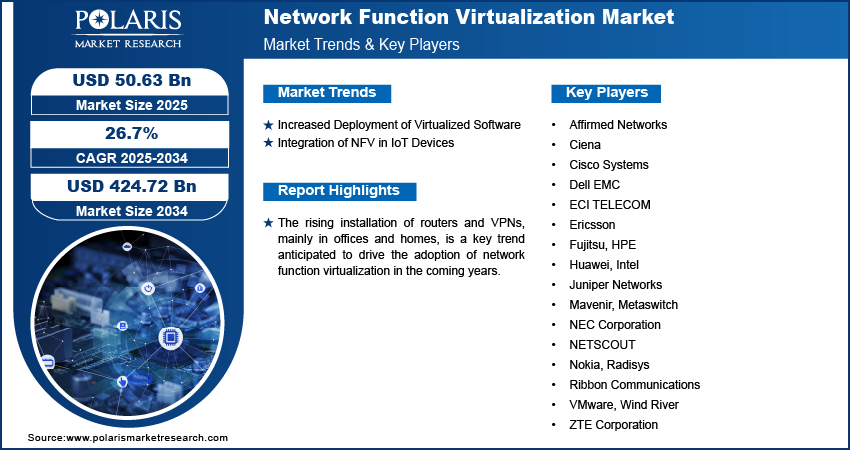

The global network function virtualization market size was valued at USD 40.01 billion in 2024. The market is expected to grow from USD 50.63 billion in 2025 to USD 424.72 billion by 2034. It is projected to exhibit a CAGR of 26.7% from 2025 to 2034.

Network function virtualization (NFV) involves decoupling functions from proprietary hardware appliances and running them as software in virtual machines. These functions include traffic control, firewalls, routers, load balancers, and others. NFV can help organizations reduce network maintenance and hardware costs, optimize service deployment, and improve network upgrades.

To Understand More About this Research: Request a Free Sample Report

The network function virtualization market demand is driven by increased applications of NFV in session border control, video servers, evolved packet core, IP multimedia subsystems, content delivery networks, monitoring, and more. The NFV market is further propelled by its benefits such as user mobility, updates, patches, portability, and ease of software management installation. In addition, increased investments in 5G services technologies, IoTs technology, cloud computing, AI, server virtualization, and the demand for data center consolidation contribute to the rapid adoption of NFV technology.

The rising installation of routers and VPNs, mainly in offices and homes, is a key trend anticipated to drive network function virtualization market expansion in the coming years. The growing distribution of virtualized software among data centers such as internet service providers (ISPs) and cloud service providers (CSPs) is projected to provide several market opportunities for market participants in the coming years.

Network Function Virtualization Market Dynamics

Increased Deployment of Virtualized Software

The adoption of virtual applications technology has increased significantly with the ever-growing demand for digital infrastructure that incorporates cloud and private systems. Virtualized software is optimized for operations on virtual infrastructure, which offers IT infrastructure more agility and security by reducing the need for additional hardware. Also, it simplifies data center management and enables faster provisioning of applications and resources. Thus, the increased deployment of virtualized software among enterprises drives the network function virtualization market expansion.

Integration of NFV in IoT Devices

IoT devices generate large amounts of data that must be processed and transmitted in real time. These devices necessitate a robust, scalable, and flexible infrastructure. NFV, which uses virtual machines in place of physical network appliances, offers the agility needed to support the massive volume of devices and data generated by IoT ecosystems. This agility enhances the seamless operations of IoT systems, further driving the network function virtualization market development.

Network Function Virtualization Market Segment Insights

Network Function Virtualization Market Outlook by Component Insights

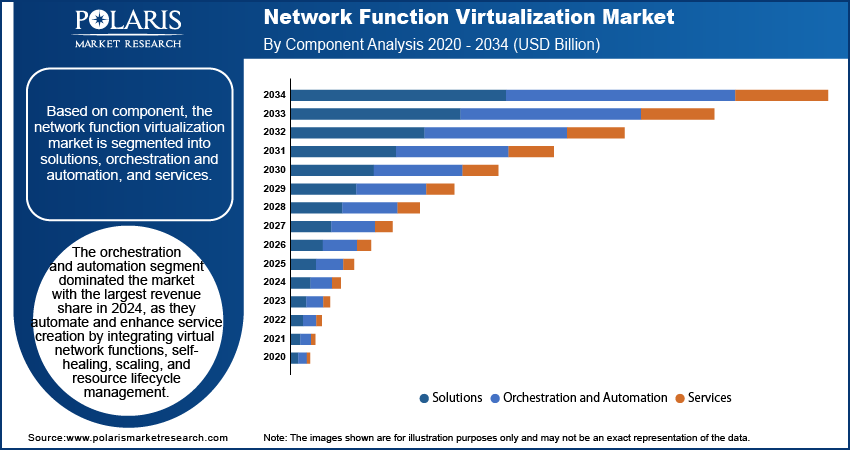

The network function virtualization market, based on component, is segmented into solutions, orchestration and automation, and services. The orchestration and automation segment dominated the market with the largest revenue share in 2024, as they automate and enhance service creation by integrating virtual network functions, self-healing, scaling, and resource lifecycle management. These capabilities directly address operational challenges and provide flexible solutions for traffic management, helping operators improve efficiency. In addition, orchestration enables the use of multiple applications on a single system appliance, which reduces operational costs and drives the segment growth.

Network Function Virtualization Market Outlook by Enterprise Size Insights

The NFV market, based on enterprise size, is bifurcated into SMEs and large enterprises. The large enterprises segment led the market with a revenue share of 63.5% in 2024. Large enterprises require robust network infrastructure for managing resources and increasing productivity. NFV enables these organizations to reduce device costs and power consumption by giving them the capability to consolidate devices and leverage the economics of scale or large organizations. The high adoption of network functions and virtualization across large enterprises fuels the segment’s dominance in the NFV market.

Network Function Virtualization Market Regional Analysis

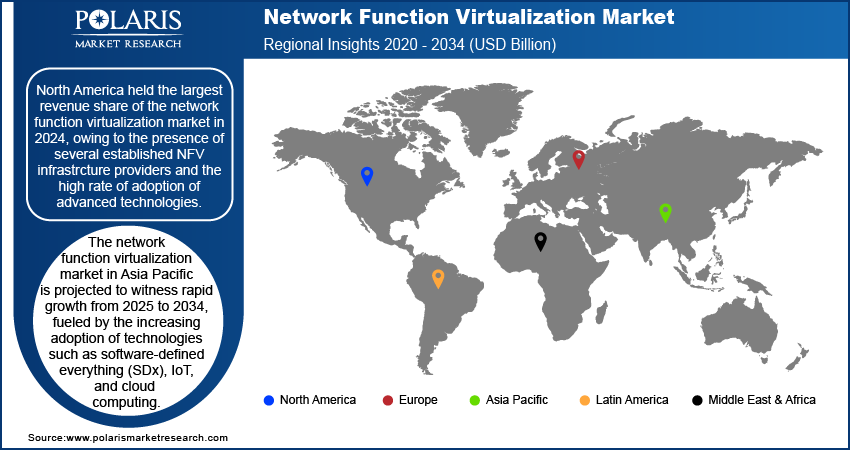

By region, the market report offers network function virtualization market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America held the largest market revenue share in 2024, owing to the presence of several established NFV infrastructure providers and the high adoption rate of advanced technologies. The growing 5G distribution and the rapid industrialization in major economies such as the US and Canada further fuel the network function virtualization market expansion in the region.

The network function virtualization (NFV) market in Asia Pacific is projected to witness rapid growth from 2025 to 2034, fueled by the increasing adoption of technologies such as software-defined everything (SDx), IoT, and cloud computing. The presence of favorable government initiatives and policies and the increased demand for data storage and security are further expected to drive the regional market growth.

Network Function Virtualization Market – Key Players and Competitive Insights

The top players in the network function virtualization market are focusing on research and development to enhance their products and services offerings and drive market demand. Also, they are adopting various strategic initiatives, including collaborations, mergers and acquisitions, new product launches, and increased investments, to improve their global footprint. To expand and survive in a more competitive environment, market participants must offer innovative solutions.

In recent years, the market for network function virtualization has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that cater to diverse needs. Affirmed Networks, Ciena, Cisco Systems, Dell EMC, ECI TELECOM, Ericsson, Fujitsu, HPE, Huawei, Intel, Juniper Networks, Mavenir, Metaswitch, NEC Corporation, NETSCOUT, Nokia, Radisys, Ribbon Communications, VMware, Wind River, and ZTE Corporation are a few of the leading players in the market.

Network Function Virtualization Industry Developments

November 2023: Broadcom Inc., a key provider of semiconductor and infrastructure software solutions, announced the acquisition of VMware, Inc. Broadcom stated the acquisition aligns with its goal of making private and hybrid cloud storage environments more secure and resilient.

September 2023: Red Hat, Inc., a global provider of open source solutions, collaborated with Intel to launch a new industrial edge platform. According to Red Hat, the new platform offers a new approach for building and operating industrial controls.

List of Key Players in Network Function Virtualization Market

- Affirmed Networks

- Ciena

- Cisco Systems

- Dell EMC

- ECI TELECOM

- Ericsson

- Fujitsu

- HPE

- Huawei

- Intel

- Juniper Networks

- Mavenir

- Metaswitch

- NEC Corporation

- NETSCOUT

- Nokia

- Radisys

- Ribbon Communications

- VMware

- Wind River

- ZTE Corporation

Network Function Virtualization Market Segmentation

By Component Outlook

- Solutions

- Orchestration and Automation

- Services

By Virtualized Network Function

- Compute

- Storage

- Network

By Enterprise Size Outlook

- SMEs

- Large Enterprises

By Application Outlook

By End Users Outlook

- Service Providers

- Data Centers

- Enterprises

- BFSI

- Manufacturing

- Government and Defense

- Healthcare

- Retail

- Education

- IT-Enabled Services

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Network Function Virtualization Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 40.01 billion |

|

Market Size Value in 2025 |

USD 50.63 billion |

|

Revenue Forecast by 2034 |

USD 424.72 billion |

|

CAGR |

26.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The NFV market was valued at USD 40.01 billion in 2024 and is projected to grow to USD 424.72 billion by 2034.

The market is projected to register a CAGR of 26.7% from 2025 to 2034.

North America accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Affirmed Networks, Ciena, Cisco Systems, Dell EMC, ECI TELECOM, Ericsson, Fujitsu, HPE, Huawei, Intel, Juniper Networks, Mavenir, Metaswitch, NEC Corporation, NETSCOUT, Nokia, Radisys, Ribbon Communications, VMware, Wind River, and ZTE Corporation.

The orchestration and automation segment accounted for the largest market share in 2024.

The large enterprises segment led the market in 2024.