Next Generation Sequencing Sample Preparation Market Size, Share, Trends, Industry Analysis Report

By Product & Service (Instruments, Consumables, Services), By Workflow, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5881

- Base Year: 2024

- Historical Data: 2020-2023

Overview

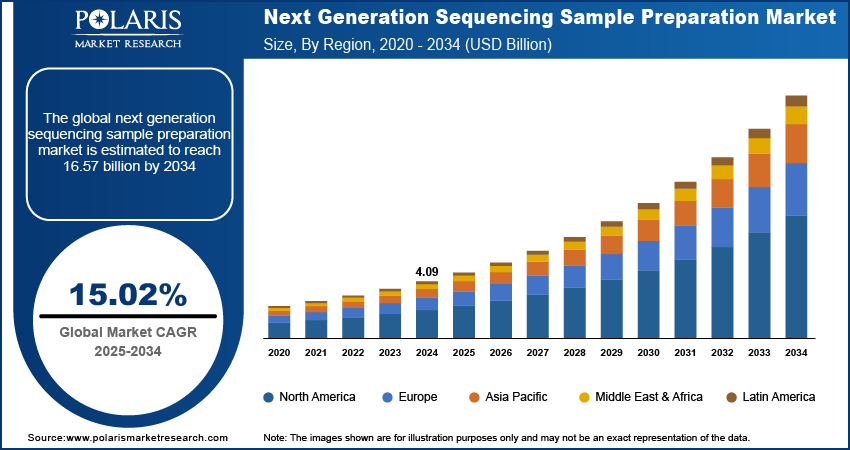

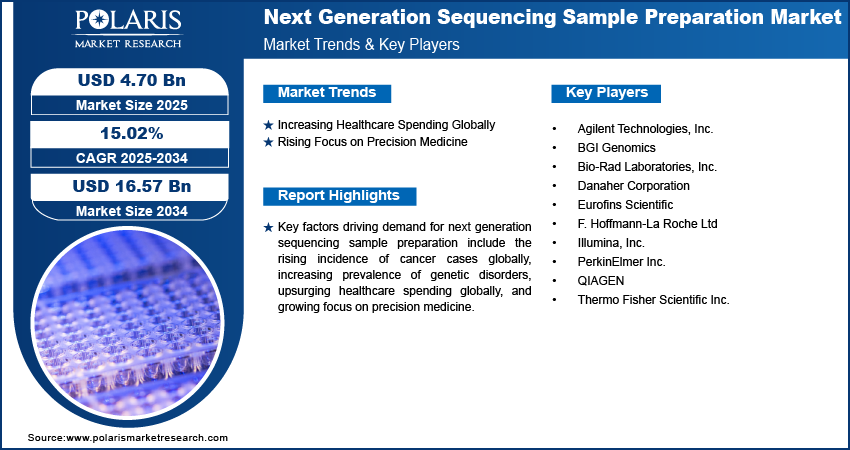

The global next generation sequencing sample preparation market size was valued at USD 4.09 billion in 2024, growing at a CAGR of 15.02% from 2025 to 2034. Key factors driving demand for next generation sequencing sample preparation include rising incidence of cancer cases globally, increasing prevalence of genetic disorders, surging healthcare spending globally, and growing focus on precision medicine.

Next generation sequencing sample preparation is a critical, multi-step process designed to convert raw biological material, such as extracted DNA or RNA, into a sequencing-ready library suitable for high-throughput analysis. The process usually begins with nucleic acid extraction, where DNA or RNA is isolated and purified to ensure high yield and quality, as the integrity of the material directly impacts sequencing accuracy and reliability.

NGS sample preparation is needed for a wide range of applications, including whole-genome sequencing, targeted gene therapy, spatial genomics & transcriptomics, epigenetics, and metagenomics, enabling researchers to study genetic variation, gene expression, disease mechanisms, and microbial diversity.

The rising incidence of cancer cases globally is driving the market growth. According to the World Health Organization, there were an estimated 20 million new cancer cases globally in 2022. This increase in cancer cases is pushing laboratories to scale up genomic testing, which is boosting investments in streamlined and automated sample preparation solutions, such as next generation sequencing sample preparation, to enhance throughput and reproducibility. Therefore, the rising incidence of cancer cases globally is driving the adoption of next generation sequencing sample preparation.

The next generation sequencing sample preparation demand is driven by the rising prevalence of genetic disorders. Researchers and clinicians increasingly rely on next generation sequencing technologies to identify, diagnose, and understand complex genetic disorders. NGS needs precise and efficient sample preparation, leading to high adoption of next generation sequencing sample preparation. Additionally, the growing number of genetic disorder cases is further pushing diagnostic labs and research institutions to adopt scalable and efficient NGS sample preparation solutions, driving market expansion.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Increasing Healthcare Spending Globally

Governments and private institutions are allocating more funds to precision medicine and research, fueling the adoption next generation sequencing and its sample preparation for diagnostics, drug development, and personalized therapies. As per the Economic Survey, in the total health expenditure of India between FY15 and FY22, the share of government health expenditure has increased from 29.0% to 48.0%. Expanded budgets are also allowing laboratories to upgrade infrastructure, adopt automated sample preparation systems, and implement high-throughput sequencing workflows to improve efficiency and scalability. Additionally, rising healthcare expenditure is supporting widespread genetic testing programs, population-scale genomics projects, and biomarker discovery, all of which rely on high-quality next generation sequencing sample preparation. Therefore, the increasing global healthcare spending is propelling industry expansion.

Rising Focus on Precision Medicine

Precision medicine increases the need to optimize DNA/RNA extraction, next generation sequencing library preparation, and target enrichment workflows to support large-scale genomic profiling, which next generation sequencing sample preparation provides. The push for precision medicine is also boosting the adoption of automated and standardized sample preparation solutions, ensuring reproducibility and scalability in clinical and research settings. Therefore, the growing emphasis on precision medicine contributes to the next generation sequencing sample preparation as a foundational step in enabling data-driven, patient-specific healthcare.

NGS Sample Preparation Market Segmental Insights

Product & Service Analysis

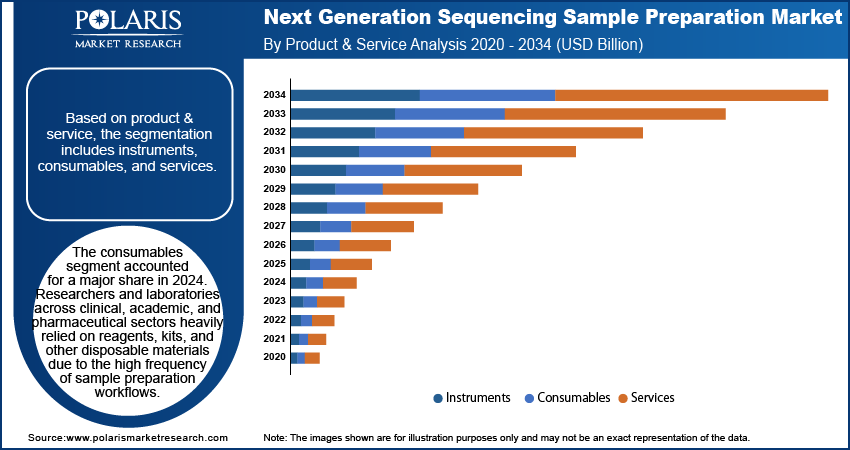

Based on product & service, the segmentation includes instruments, consumables, and services. The consumables segment accounted for a major share in 2024. Researchers and laboratories across clinical, academic, and pharmaceutical sectors heavily relied on reagents, kits, and other disposable materials due to the high frequency of sample preparation workflows. Consumables offered convenience, consistency, and compatibility with a broad range of sequencing platforms, which significantly improved processing efficiency and data quality. The growing demand for high-throughput sequencing applications, including cancer genomics, rare disease diagnostics, and microbial profiling, further propelled the consumption of library preparation kits, DNA/RNA isolation reagents, and indexing kits.

The instruments segment is projected to grow at a robust pace in the coming years, owing to the increasing automation of genomic workflows. Automated liquid handling systems, nucleic acid extractors, and library preparation platforms are witnessing high adoption, especially among clinical diagnostic labs and contract research organizations that demand scalable, reproducible results. Moreover, the continued expansion of precision medicine initiatives and population-scale genomic programs is projected to fuel investments in sample preparation instrumentation during the forecast period.

Workflow Analysis

In terms of workflow, the segmentation includes nucleic acid extraction, library preparation & amplification, target enrichment, and library quantification/QC. The library preparation & amplification segment held the largest market share in 2024 due to its crucial role in enabling accurate and high-throughput sequencing. Researchers and clinicians across genomics, oncology, and infectious disease diagnostics increasingly rely on efficient library preparation protocols to ensure optimal sequencing output, especially for complex samples such as cell-free DNA, formalin-fixed paraffin-embedded (FFPE) tissues, and degraded RNA. The widespread adoption of automation and commercially available kits that streamline fragmentation further boosted the demand for library preparation & amplification. Additionally, technological innovations such as enzymatic fragmentation and transposase-based approaches have shortened turnaround times and improved sample quality, making library preparation & amplification workflow crucial for both clinical and research applications.

Application Analysis

In terms of application, the segmentation includes oncology, clinical investigation, reproductive health, HLA Typing/immune system monitoring, metagenomics, epidemiology & drug development, agrigenomics & forensics, and consumer genomics. The oncology segment held the largest share in 2024 due to the ability of next generation sequencing sample preparation to uncover somatic mutations, identify tumor-specific biomarkers, and guide targeted therapies. The growing prevalence of cancer worldwide and the rising adoption of precision oncology drove the demand for sequencing-based workflows in tumor profiling, liquid biopsy analysis, and companion diagnostics. Hospitals, academic institutions, and commercial labs invested heavily in sample preparation technologies to detect low-frequency variants from limited or degraded cancer samples. Furthermore, regulatory approvals of sequencing-based tests for cancers such as non-small cell lung carcinoma and breast cancer fueled the next generation sequencing sample preparation clinical adoption.

The consumer genomics segment is estimated to grow at a robust pace in the coming years, owing to the increasing popularity of consumer genetic testing for ancestry, wellness traits, nutrition, and predisposition to certain diseases. Consumers are now seeking greater insights into their genetic profiles, prompting firms to improve sample preparation methods tailored for saliva and buccal swab samples. The shift toward personalized healthcare is projected to fuel demand for next generation sequencing sample preparation in consumer genomics.

End Use Analysis

Based on end use, the segmentation includes academic research, clinical research, hospitals & clinics, pharma & biotech entities, and others. The pharma & biotech entities segment accounted for a major share in 2024. These organizations drove substantial demand for sequencing sample preparation due to their extensive use of NGS technologies in drug discovery, biomarker identification, and companion diagnostics. The increased shift toward precision medicine, along with the rising integration of genomic data in therapeutic development pipelines, further fueled the adoption of next generation sequencing sample preparation across pharma & biotech entities. Furthermore, strategic collaborations between sequencing technology providers and biopharma companies strengthened access to customized preparation workflows, contributing to the segment’s dominance.

NGS Sample Preparation Market Regional Analysis

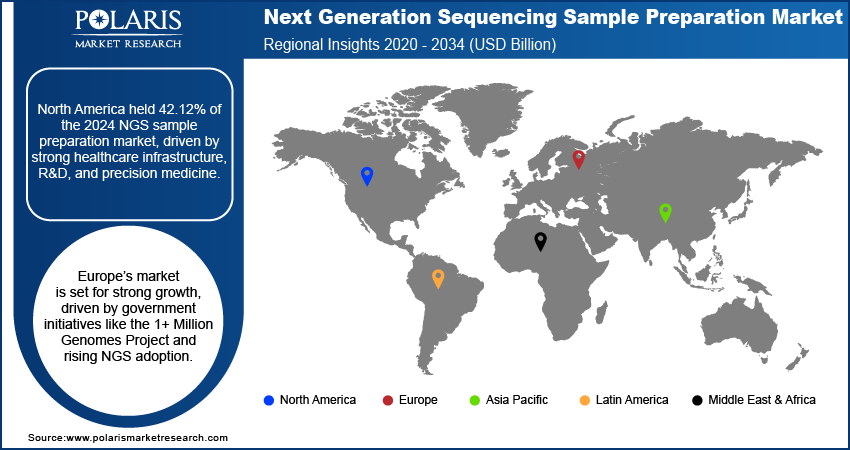

The North America next generation sequencing sample preparation market accounted for 42.12% of global market share in 2024. This dominance is attributed to advanced healthcare infrastructure, high R&D investments, and the increased adoption of precision medicine. The region has a high prevalence of chronic diseases, such as cancer and genetic disorders, which necessitated advanced genomic diagnostics, leading to increased adoption of next generation sequencing sample preparation. Additionally, strong government and private funding for genomics research, along with the presence of major biotech and pharmaceutical companies, contributed to market dominance. The growing focus on personalized medicine, biomarker discovery, and infectious disease surveillance in North America further fueled the market growth in 2024.

U.S. Next Generation Sequencing Sample Preparation Market Insight

The U.S. accounted for a major share in North America in 2024 due to its mature genomics research ecosystem, high healthcare expenditure, and technological advancements. The American Medical Association, in its article, stated that health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion or $14,570 per capita. The wide base of rare disease patients also led to the market expansion in the country. Additionally, the presence of major companies such as Illumina, Thermo Fisher, and academic institutions conducting large-scale sequencing projects ensured the country's dominance in the market.

Europe Next Generation Sequencing Sample Preparation Market Trends

The market in Europe is projected to grow at a robust pace in the coming years, owing to the increasing government initiatives, such as the EU’s 1+ Million Genomes Project, and growing adoption of next generation sequencing in clinical diagnostics. The region's emphasis on personalized medicine, cancer genomics, and prenatal testing is also driving the need for high-quality sample preparation solutions. Collaborations between academia, hospitals, and biotech firms are fueling innovation in the industry. A few countries such as the UK, France, Germany, and Scandinavia are key contributors to the market due to their strong genomics research programs.

Germany Next Generation Sequencing Sample Preparation Market Overview

The Germany next generation sequencing sample preparation industry is driven by strong academic research, an established diagnostics sector, and government funding for genomics. The country’s focus on cancer research and rare disease diagnostics is further boosting demand. The presence of key players such as Qiagen and Siemens Healthineers, along with increasing partnerships between hospitals and sequencing centers, is also supporting market expansion in the country.

Asia Pacific Next Generation Sequencing Sample Preparation Market Analysis

The market in Asia Pacific is projected to hold a substantial share by 2034 due to rising healthcare investments, expanding genomics research, and increasing prevalence of genetic diseases. Countries such as China, Japan, India, and South Korea are among the major contributors to the market, largely due to government initiatives and the growth of their biotech sectors. The cost-effectiveness of sequencing technologies, increasing cancer research, and infectious disease surveillance is further driving the adoption of next generation sequencing sample preparation in the region. Additionally, improving healthcare infrastructure and rising awareness of personalized medicine are contributing to industry expansion.

Key Players & Competitive Analysis

The next generation sequencing sample preparation industry is highly competitive, driven by increasing demand for precision medicine, oncology research, and clinical diagnostics. A few major players such as Illumina, Inc. and Thermo Fisher Scientific Inc. dominate the industry with integrated workflows, offering end-to-end solutions from library preparation to sequencing. Illumina’s Nextera and DNA Prep kits are widely adopted due to their compatibility with Illumina sequencers, while Thermo Fisher’s Ion AmpliSeq technology excels in targeted sequencing, particularly in oncology and inherited disease research. Innovation remains a critical force in the industry, with companies competing to develop ultra-low-input protocols, single-cell solutions, and AI-driven workflow optimization.

A few major companies operating in the next generation sequencing sample preparation industry include Agilent Technologies, Inc.; BGI Genomics; Bio-Rad Laboratories, Inc.; Danaher Corporation; Eurofins Scientific; F. Hoffmann-La Roche Ltd; Illumina, Inc.; PerkinElmer Inc.; QIAGEN; and Thermo Fisher Scientific Inc.

NGS Sample Preparation Market Key Players

- Agilent Technologies, Inc.

- BGI Genomics

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- Illumina, Inc.

- PerkinElmer Inc.

- QIAGEN

- Thermo Fisher Scientific Inc.

Industry Developments

February 2025: F. Hoffmann-La Roche Ltd announced the launch of sequencing by expansion (SBX) technology, a new category of next-generation sequencing, to decode complex diseases such as cancer, immune disorders, and neurodegenerative conditions.

June 2024: Beckman Coulter Life Sciences, a subsidiary of Danaher Corporation, introduced its Biomek Echo One System to accelerate high-throughput genomic sample preparation workflows to deliver results faster.

Next Generation Sequencing Sample Preparation Market Segmentation

By Product & Service Outlook (Revenue, USD Billion, 2020–2034)

- Instruments

- Consumables

- Services

By Workflow Outlook (Revenue, USD Billion, 2020–2034)

- Nucleic Acid Extraction

- Library Preparation & Amplification

- Target Enrichment

- Library Quantification/QC

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Clinical Investigation

- Reproductive Health

- HLA Typing/Immune System Monitoring

- Metagenomics

- Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomics

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Next Generation Sequencing Sample Preparation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.09 Billion |

|

Market Size in 2025 |

USD 4.70 Billion |

|

Revenue Forecast by 2034 |

USD 16.57 Billion |

|

CAGR |

15.02% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market is projected to register a CAGR of 15.02% during the forecast period.

The global market size was valued at USD 4.09 billion in 2024 and is projected to grow to USD 16.57 billion by 2034.

North America dominated the market share in 2024.

A few of the key players in the market are Agilent Technologies, Inc.; BGI Genomics; Bio-Rad Laboratories, Inc.; Danaher Corporation; Eurofins Scientific; F. Hoffmann-La Roche Ltd; Illumina, Inc.; PerkinElmer Inc.; QIAGEN; and Thermo Fisher Scientific Inc.

The consumables segment dominated the market share in 2024.

The consumer genomics segment is expected to witness the fastest growth during the forecast period.