NLP in Finance Market Size, Share, Trends, & Industry Analysis Report

: By Offering (Software and Services), By Application, By Technology, By Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM3563

- Base Year: 2024

- Historical Data: 2020-2023

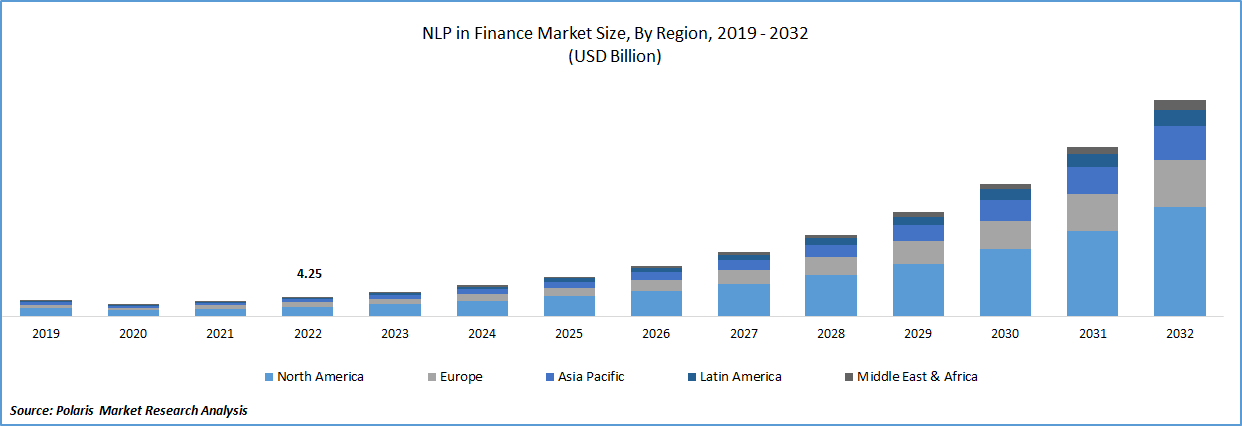

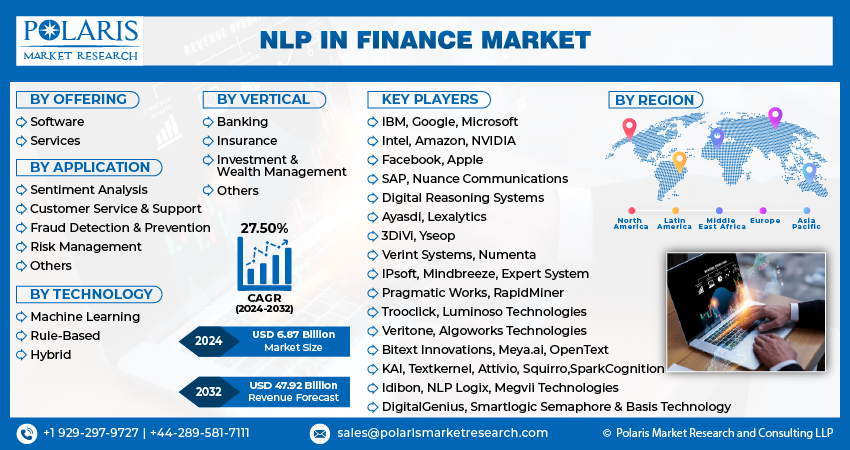

The NLP in finance market size was valued at USD 7.05 billion in 2024, exhibiting a CAGR of 27.5% during 2025–2034. The growth is driven by increasing demand for automated and efficient financial services.

Market Overview:

Natural language processing (NLP) in the finance market refers to the application of computational techniques to understand and process human language within the financial domain. It involves using algorithms and models to analyze financial news, reports, social media, and other textual data to extract meaningful insights. This includes sentiment analysis to gauge mood, topic modeling to identify key themes, and entity recognition to pinpoint relevant information. The goal is to transform unstructured text into a format that computers can understand and use for various financial applications. This is driven by the increasing availability of textual data and the need for financial institutions to gain a competitive edge by leveraging this data effectively.

Several factors are driving the adoption of NLP in the finance market. The increasing volume of unstructured financial data, such as news articles, social media posts, and earnings call transcripts, necessitates advanced analytical tools like NLP. Financial institutions are using NLP to automate tasks like fraud detection, risk management, and customer service, improving efficiency and reducing costs. Furthermore, NLP enables better decision-making by providing real-time insights and predictions. The development of sophisticated AI and machine learning algorithms further enhances the capabilities of NLP by integrating NLP in healthcare and life science as well, making it an indispensable tool for the modern finance industry.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics:

Increasing Volumes of Unstructured Financial Data

The finance industry is characterized by vast amounts of unstructured data, including news articles, regulatory filings, social media posts, earnings call transcripts, and customer feedback. Extracting valuable insights from this data using traditional methods is a significant challenge. Natural language processing (NLP) offers the capability to analyze and understand this textual information efficiently and at scale. The increasing availability of such unstructured data acts as a significant driver, as organizations seek to leverage this information for competitive advantage and improved operational efficiency.

Automation of Financial Processes

Financial institutions are continuously looking for ways to automate routine and time-consuming tasks to improve efficiency, reduce costs, and minimize errors. NLP plays a crucial role in automating various financial processes, such as customer service through chatbots, fraud detection by analyzing textual patterns, and compliance management by interpreting regulatory documents. As per AWS, Artificial Intelligence Index Report 2025, Business adoption of AI accelerated significantly in 2024, with 78% of organizations reporting using AI, up from 55% the year before. This broad adoption includes financial services, where AI is being leveraged for automation. Research featured in IOS Press Ebooks in 2025 highlights the use of NLP algorithms like BERT and Transformer in compliance management, achieving a text classification accuracy of 93.4% and increasing the efficiency of automatic compliance document generation by 150 times compared to manual methods. This drive for automation across the financial sector is a key growth factor, as it offers tangible benefits in terms of operational efficiency and cost reduction.

Enhanced Risk Management and Compliance

Effective risk management and adherence to complex regulatory requirements are paramount in the finance industry. NLP provides powerful tools to analyze textual data for identifying potential risks, ensuring compliance with regulations, and detecting fraudulent activities. Consumers reported losing over USD 12.5 billion to fraud in 2024, a staggering 25% increase from the previous year, according to preliminary data from the Federal Trade Commission (FTC). Investment scams alone accounted for USD 5.7 billion in losses. The FTC also noted a surge of 66.6% in payment redirection scams in 2024. This rising tide of financial crime necessitates advanced detection tools like NLP. This critical need for robust risk management and compliance solutions is a significant driver for the demand.

Segmental Insights:

Market Assessment By Offering

The NLP in finance market is segmented by offering into software and services. Among these, the software segment currently holds the highest share. This dominance can be attributed to the critical role of software solutions in deploying and implementing natural language processing applications across various financial operations. Financial institutions rely heavily on NLP software for tasks such as data analysis, automation, and enhancing customer interactions. The established use of these software platforms for core functionalities contributes significantly to the larger share held by the software offering.

The services segment is anticipated to exhibit the highest growth rate in the forecast period. This rapid growth is fueled by the increasing complexity of NLP solutions and the growing need for specialized expertise in their deployment, customization, and maintenance. They often require external service providers for strategic guidance, implementation support, and ongoing management of their NLP initiatives as financial institutions increasingly recognize the potential of NLP. This rising demand for specialized services to effectively leverage NLP technology is expected to drive the services segment at a faster pace compared to the well-established software segment.

Market Evaluation By Application

The NLP in finance market is segmented by application into sentiment analysis, customer service & support, fraud detection & prevention, risk management, and others. The customer service & support segment accounts for the largest share in 2024 as financial institutions heavily invest in NLP-powered tools like chatbots and virtual assistants to enhance customer experience, streamline query resolution, and improve overall operational efficiency in their customer-facing operations. The widespread adoption of these applications contributes to the significant share held by the customer service & support segment.

The fraud detection & prevention segment is expected to witness the highest growth rate in the coming years. With the increasing sophistication of financial crimes and the growing volume of digital transactions and digital transaction management, the need for advanced NLP solutions to identify and prevent fraudulent activities is escalating. NLP's ability to analyze textual data for suspicious patterns and anomalies makes it a crucial tool in combating financial fraud. This rising emphasis on security and the potential of NLP to significantly improve fraud detection capabilities are key factors driving the rapid growth of this application segment.

Market Evaluation By Technology

The NLP in finance market is segmented by technology into machine learning, rule-based, and hybrid. Currently, the machine learning segment holds the largest share. This dominance is due to the increasing sophistication and effectiveness of machine learning algorithms in handling complex financial data and extracting nuanced insights. The ability of machine learning platform based NLP solutions to learn from vast datasets and adapt to evolving patterns makes them highly valuable for a wide range of applications, contributing to their significant presence.

The hybrid segment is anticipated to experience the highest growth rate in the foreseeable future. This growth is driven by the increasing recognition of the benefits of combining the strengths of both machine learning and rule-based approaches. Hybrid solutions offer a balance between the adaptability and learning capabilities of machine learning and the transparency and explainability of rule-based systems. This synergy allows financial institutions to develop more robust and reliable NLP applications, particularly in highly regulated areas where interpretability is crucial, thus fueling the rapid growth of the hybrid technology segment.

Market Evaluation By Vertical

The NLP in finance market is segmented by vertical into banking, insurance, investment & wealth management, and others. At present, the banking segment accounts for the largest share. This significant share is primarily driven by the extensive adoption of natural language processing solutions across various banking operations, including customer service, fraud detection, compliance, and loan processing. The long-standing presence of established financial institutions in the banking sector and their substantial investments in technology contribute to the dominant share of this vertical.

The investment & wealth management segment is projected to exhibit the highest growth rate in the coming years. This rapid expansion is fueled by the increasing demand for sophisticated NLP tools to analyze trends, understand investor sentiment, automate advisory services, and enhance client communication. The growing complexity of investment strategies and the need for personalized wealth management solutions are driving the adoption of NLP technologies at a faster pace within this vertical compared to other segments.

Regional Analysis

The NLP in finance market demonstrates varied adoption and growth across different geographical regions. North America and Europe have been early adopters of natural language processing in finance, driven by the presence of major financial institutions and technological advancements. The Asia Pacific region is emerging as a significant with rapid adoption, fueled by increasing digital transformation and a growing financial services sector. Latin America and the Middle East & Africa are also showing increasing interest in leveraging NLP for financial applications, although their current penetration is relatively lower compared to the other regions.

North America holds the largest share. This can be attributed to the strong presence of established financial institutions, significant investments in research and development, and a mature technological infrastructure in the region. The early adoption of advanced technologies like artificial intelligence and machine learning, which are integral to NLP solutions, has further solidified North America's leading position in terms of size and implementation of NLP in various financial applications.

The Asia Pacific region is anticipated to exhibit the highest growth rate over the forecast period. This rapid growth is driven by factors such as the increasing digitalization of financial services, a large and growing base of tech-savvy consumers, and supportive government initiatives promoting fintech innovation across countries like China, India, and Southeast Asian nations. The immense potential and the increasing focus on leveraging advanced technologies to enhance financial services are expected to make Asia Pacific the fastest-growing region for NLP adoption in finance.

Key Players and Competitive Insights

Some major players in the NLP in Finance market include Microsoft Corporation, Alphabet Inc. (Google), Amazon Web Services, Inc. (Amazon), International Business Machines Corporation (IBM), Oracle Corporation, SAS Institute Inc., Qualtrics International Inc., Expert System S.p.A., Basis Technology Corp., and IPsoft Inc.

The competitive landscape is characterized by a mix of large technology corporations and specialized software providers. The major players are continuously innovating and expanding their offerings to cater to the specific needs of the financial industry. Competition is driven by factors such as the accuracy and efficiency of NLP algorithms, the breadth of applications supported, the ability to handle industry-specific language and regulations, and the scalability and integration capabilities of their solutions. Companies are focusing on developing more sophisticated models, enhancing their finance cloud based services, and forming strategic partnerships to strengthen their position.

List of Key Companies in NLP in Finance Industry:

- Alphabet Inc. (Google)

- Amazon Web Services, Inc. (Amazon)

- Basis Technology Corp.

- Expert System S.p.A.

- International Business Machines Corporation (IBM)

- IPsoft Inc.

- Microsoft Corporation

- Oracle Corporation

- Qualtrics International Inc.

- SAS Institute Inc.

NLP in Finance Industry Developments

- February 2023, Oracle launched its Banking Cloud Services, a suite of modular, cloud-native applications on Oracle Cloud Infrastructure. Designed for financial institutions, it enables secure and scalable digital transformation for banks of all sizes.

- April 2024, ExtractAlpha launched the Japan News Signal, an analytics tool utilizing Nikkei’s Flash News data to generate insights for the Japanese stock market. The product targets data-driven investment strategies.

NLP in Finance Market Segmentation

By Offering Outlook (Revenue – USD Billion, 2020–2034)

- Software

- Rule-based NLP Software

- Regular Expression (Regex)

- Finite State Machines (FSMs)

- Named Entity Recognition (NER)

- Part-of-speech (POS) Tagging

- Statistical NLP Software

- Naive Bayes

- Logistic Regression

- Support Vector Machines (SVMs)

- Recurrent Neural Networks (RNNs),

- Hybrid NLP software

- Latent Dirichlet Allocation (LDA) • Hidden Markov Models (HMMs)

- Conditional Random Fields (CRFs)

- Services

- Professional Services

- Training and Consulting

- System Integration and Implementation

- Support and Maintenance

- Managed Services

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Sentiment Analysis

- Brand Monitoring

- Customer Feedback Analysis

- Brand Reputation Management

- Customer Service & Support

- Chatbots

- Interactive Voice Response (IVR)

- Email Response

- Fraud Detection & Prevention

- Payment Fraud Detection

- Account Takeover Detection

- Identity Theft Detection

- Risk Management

- Credit Risk Analysis

- Market Risk Analysis

- Operational Risk Analysis

- Others

- Algorithmic Trading

- Trade Surveillance

- Regulatory Compliance

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Machine Learning

- Natural Language Processing (NLP) Algorithms

- Deep Learning Algorithms

- Others (e.g., Random Forest, SVM)

- Rule-Based

- Pattern Matching

- Keyword-Based

- Hybrid

- Supervised Machine Learning

- Semi-Supervised Machine Learning

By Vertical Outlook (Revenue – USD Billion, 2020–2034)

- Banking

- Retail Banking

- Corporate Banking

- Investment Banking

- Insurance

- Life Insurance

- Property & Casualty Insurance

- Investment & Wealth Management

- Asset Management

- Wealth Management

- Others

- Accounting & Bookkeeping

- Financial Planning & Analysis to

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

NLP in Finance Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.05 billion |

|

Market Size Value in 2025 |

USD 8.97 billion |

|

Revenue Forecast by 2034 |

USD 79.90 billion |

|

CAGR |

27.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The NLP in finance market has been segmented into detailed segments of offering, application, technology, and vertical. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A successful growth and marketing strategy for the NLP in finance market hinges on highlighting tangible benefits such as enhanced efficiency, improved risk management, and superior customer experiences. Companies should emphasize industry-specific solutions and demonstrate a deep understanding of financial regulations and compliance requirements. Targeted marketing efforts should focus on educating financial institutions about the power of NLP through case studies and showcasing successful implementations. Building strategic partnerships with established financial technology providers and offering scalable, secure, and easily integrable solutions will be crucial for penetration and long-term growth. Furthermore, continuous innovation and adaptation to the evolving needs of the finance sector are essential to maintain a competitive edge.

FAQ's

The global market size was valued at USD 7.05 billion in 2024 and is projected to grow to USD 79.90 billion by 2034.

The market is projected to register a CAGR of 27.5% during the forecast period, 2024-2034.

North America had the largest share.

Some major players include Microsoft Corporation, Alphabet Inc. (Google), Amazon Web Services, Inc. (Amazon), International Business Machines Corporation (IBM), Oracle Corporation, SAS Institute Inc., Qualtrics International Inc., Expert System S.p.A., Basis Technology Corp., and IPsoft Inc.

The software segment accounted for the larger share of the market in 2024.

Following are some of the trends: ? Growing Adoption of Large Language Models (LLMs): The advancements in LLMs are significantly enhancing the capabilities of NLP in finance, allowing for more sophisticated analysis and understanding of financial text. ? Increased Focus on Real-time Insights: Financial institutions are increasingly leveraging NLP to process and analyze data in real-time, enabling quicker and more informed decision-making based on the latest information.

Natural language processing (NLP) in finance refers to the use of artificial intelligence techniques to enable computers to understand, interpret, and process human language within the financial domain. This involves analyzing text and speech data related to finance, such as news articles, financial reports, social media, customer communications, and regulatory filings, to extract meaningful information, identify patterns, and automate various tasks. By applying NLP, financial institutions can gain valuable market insights, improve operational efficiency, enhance customer service, and manage risks more effectively.