North America Fabry’s Disease Treatment Market Size, Share, & Industry Analysis Report By Route of Administration (Intravenous Route and Oral Route), By Therapy, By Distribution Channel, and By Country – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5764

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

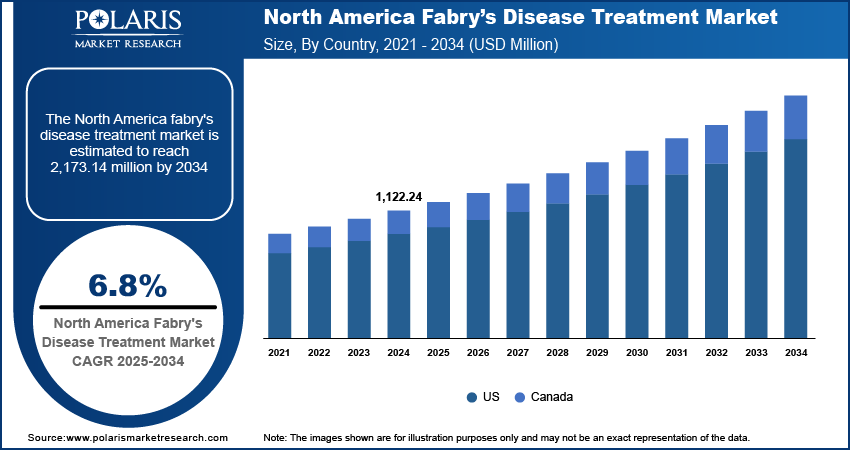

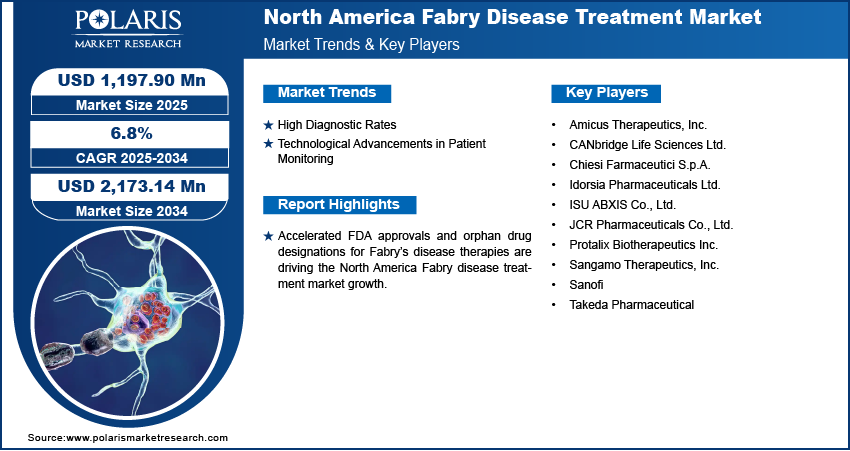

The North America Fabry’s disease treatment market size was valued at USD 1,122.24 million in 2024 and is projected to register a CAGR of 6.8% during 2025–2034. The key drivers of the North America Fabry disease treatment market include increased adoption of enzyme replacement therapies, advancements in gene and chaperone therapies, and heightened diagnostic awareness and orphan drug support.

Accelerated FDA approvals and orphan drug designations for Fabry’s disease therapies are encouraging faster market access and innovation, raising a favorable regulatory environment for both established treatments and emerging gene therapies. For instance, in October 2024, Sangamo Therapeutics operated with the FDA to plan a faster approval process for their medicine ST-920, which treats Fabry Disease. The FDA permits leveraging data from the ongoing Phase 1/2 STAAR study, eliminating the need for an additional registrational study and potentially shortening the approval timeline by about three years.

Fabry disease is a rare genetic disorder that affects the body's ability to break down specific fatty substances, leading to their expansion in various organs. The market growth is attributed to the need for managing and slowing the progression of this lifelong condition. It contains therapies that target the root cause of the disease as well as those that manage its symptoms, such as enzyme replacement therapy, Chaperone Therapy, and others. These treatments aim to improve the quality of life for patients and reduce complications that arise from damage to the heart, kidneys, and nervous system. The growing availability and adoption of next-generation enzyme replacement and oral chaperone therapies are expanding treatment options, improving patient adherence, and driving continuous product innovation across the therapeutic landscape.

Comprehensive insurance policies and public reimbursement programs in the US and Canada are facilitating wider access to high-cost therapies, helping maintain strong treatment adherence and market sustainability. Additionally, increased accessibility to genomic sequencing technologies is streamlining early and accurate diagnosis of Fabry’s disease.

Market Dynamics

High Diagnostic Rates

The presence of an advanced healthcare system allows for the widespread use of genetic screening, which plays a critical role in identifying Fabry’s disease at an early stage. Early diagnosis helps prevent complications by allowing patients to begin treatment before the disease progresses. Hospitals and diagnostic services centers across the region have adopted next-generation sequencing and enzyme testing as standard tools, making it easier to screen at-risk individuals, especially those with a family history of rare diseases. For instance, the US Food and Drug Administration reports that there are over 7,000 rare diseases, collectively impacting more than 30 million individuals in the US. Early intervention leads to better clinical outcomes, improved quality of life, and increased demand for both established and emerging treatments. Hence, the high diagnostic rates are significantly influencing the growth of the North America Fabry’s disease treatment market.

Technological Advancements in Patient Monitoring

Technological advancements in patient monitoring are transforming the management of Fabry's disease in North America. The adoption of digital health platforms and wearable medical devices allows for continuous tracking of symptoms and treatment response. These tools provide healthcare professionals with real-time data on patient well-being, enabling timely adjustments to therapies when necessary. Remote monitoring also reduces the need for frequent hospital visits, which benefits both providers and patients by cutting costs and improving convenience. These innovations support proactive care strategies, helping clinicians manage chronic symptoms more effectively while minimizing the risk of long-term organ damage. Greater control over disease progression encourages physicians to adopt newer therapies and motivates pharmaceutical companies to continue developing digital support tools, collectively contributing to improved outcomes and higher patient engagement across the treatment lifecycle.

Segment Insights

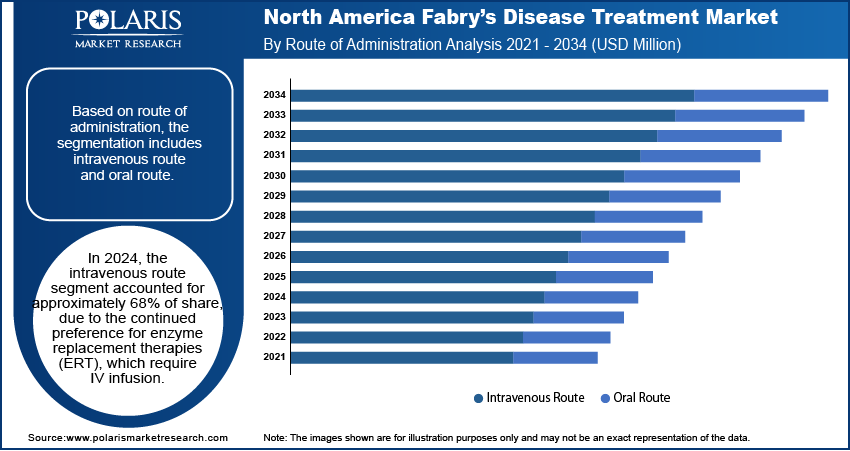

Market Assessment by Route of Administration

Based on route of administration, the segmentation includes intravenous route and oral route. In 2024, the intravenous route segment accounted for approximately 68% of share, due to the continued preference for enzyme replacement therapies (ERT), which require IV infusion. Healthcare providers rely on this method for its proven bioavailability and consistent therapeutic results. Specialized infusion centers and hospital networks in the region are well-equipped to administer IV-based therapies on a regular schedule, ensuring patient adherence and clinical supervision. The familiarity of clinicians with this delivery method and the longer history of ERT-based IV administration support its widespread adoption. Insurance coverage and reimbursement structures further ease patient access, sustaining high usage rates.

The oral route segment is projected to register a CAGR of 7.4% from 2025 to 2034, supported by the introduction of substrate reduction therapies (SRTs) that offer convenience and home-based care flexibility. Many Fabry patients prefer oral medications due to ease of administration and lower dependence on clinical infrastructure. Oral options reduce travel time, cut infusion-related complications, and encourage higher treatment compliance, particularly among younger and working populations. Pharmaceutical advancements are improving the efficacy of oral molecules, making them viable alternatives to traditional IV therapies. This growth aligns with patient-centric care models increasingly adopted by healthcare systems across North America.

Market Assessment by Therapy

Based on therapy segment, the segmentation includes enzyme replacement therapy (ERT), substrate reduction therapy (SRT), and others. In 2024, the enzyme replacement therapy (ERT) segment accounted for approximately 70% of share, driven by its established role as the first-line treatment for Fabry’s disease. Long-term clinical evidence supports ERT’s effectiveness in managing symptoms and slowing disease progression. The availability of multiple FDA-approved ERT drugs and strong insurance reimbursement frameworks has helped maintain high adoption. Many specialists continue to prefer ERT for patients showing classic symptoms or severe phenotypes due to its targeted enzyme delivery. Ongoing enhancements in infusion protocols and product formulations ensure continued clinician and patient confidence in this therapy class.

The substrate reduction therapy segment is expected to register a CAGR of 7.3% from 2025 to 2034, due to its evolving position as a viable alternative or adjunct to ERT. Patients who experience infusion fatigue or adverse reactions to IV therapies often opt for oral SRTs, which offer similar outcomes with more convenience. Improved understanding of Fabry’s disease genetics and pathophysiology has led to personalized therapy models, where SRTs play a key role in addressing specific patient subtypes. Regulatory approvals of newer SRTs in North America and increased physician familiarity are contributing to broader adoption across clinical settings.

Market Evaluation by Distribution Channel

Based on distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and online pharmacies. In 2024, the hospitals segment accounted for approximately 45% of the share, supported by their integration into specialized care centers and infusion clinics. Many Fabry’s disease therapies, particularly ERTs, require controlled storage, preparation, and administration, all of which are handled more efficiently in hospital settings. Hospitals also play a major role in diagnosis, therapeutic planning, and multidisciplinary management, making them a preferred channel for dispensing high-cost rare disease treatments. Coordinated care models further encourage patients to receive therapies within hospital networks, reinforcing this distribution channel’s dominance.

The retail pharmacies segment is expected to record a CAGR of 7.4% from 2025 to 2034, due to the increasing availability of oral therapies such as SRTs. These drugs do not require clinical supervision for administration, allowing them to be filled and managed through retail chains. Retail pharmacies offer greater accessibility, flexible hours, and medication counseling, which align well with patient needs for long-term disease management. Strategic collaborations between drug manufacturers and pharmacy chains are also improving distribution efficiency, helping ensure the timely availability of Fabry-specific medications across suburban and rural areas.

Country Analysis

US Fabry’s Disease Treatment Market

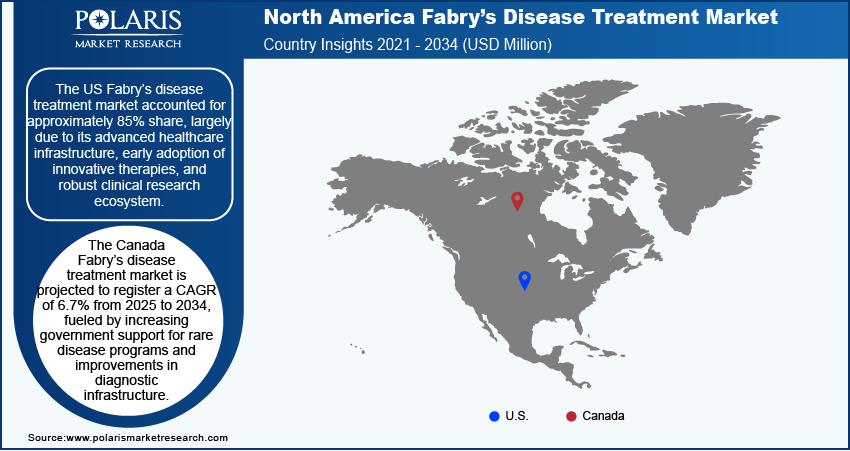

The Fabry’s disease treatment market in the US accounted for approximately 85% share in North American market in 2024, largely due to its advanced healthcare infrastructure, early adoption of innovative therapies, and robust clinical research ecosystem. Leading medical institutions in the US continue to drive clinical trials for emerging enzyme replacement and substrate reduction therapies, contributing to the introduction of advanced treatment options. In October 2023, 4D Molecular Therapeutics reached an agreement with the US Food and Drug Administration (FDA) to lift the clinical hold on its Phase 1/2 INGLAXA trial in the US for 4D-310, a next-generation AAV-based therapy for Fabry disease cardiomyopathy. Moreover, favorable reimbursement policies under both public and private insurance systems enhance patient access to high-cost therapies, while genetic testing programs support early diagnosis and timely treatment initiation. High awareness among physicians, availability of specialized care centers, and active patient advocacy groups help improve treatment adherence and disease management outcomes. It also benefits from the presence of major pharmaceutical players that actively invest in expanding their rare disease portfolios. Continued investments in precision medicine and the expansion of digital health tools are expected to streamline disease tracking and patient care.

Canada Fabry’s Disease Treatment Market

The Fabry’s disease treatment market in Canada is projected to record a CAGR of 6.7% during 2025–2034, fueled by increasing government support for rare disease programs and improvements in diagnostic infrastructure. National rare disease frameworks are gradually being implemented to streamline access to therapies and improve patient outcomes. For instance, in 2024, Canada launched its Rare Disease Strategy, consisting of the Canadian Rare Disease Network (CRDN), the National Strategy for Drugs for Rare Diseases, and an empowered patient community. The government committed approximately USD 730 million over two years (2022–2023) to the National Strategy, along with an additional USD 365 million to improve access to new therapies and ensure fair treatment access while enhancing early diagnosis and screening for rare diseases. The growing adoption of newborn screening initiatives helps identify cases earlier, leading to faster treatment interventions. Canadian healthcare institutions collaborate with international research networks, which support clinical development and broader access to new therapeutic agents. Patients benefit from universal healthcare coverage, and provinces are progressively approving funding for newer oral therapies. Efforts to expand specialized centers of excellence in rare disease care also contribute to improved access and follow-up treatment. Advancements in telemedicine and outreach programs in rural communities are playing a key role in expanding Fabry’s disease care beyond urban centers, supporting the market’s steady expansion.

Key Players & Competitive Analysis Report

The North America Fabry’s disease treatment market is experiencing strong growth, fueled by rising diagnosis rates, favorable rare disease policies, and expanding research infrastructure. Increasing investments by global and regional biopharma companies are driving market expansion through strategic alliances and partnerships aimed at improving therapy accessibility and affordability. Mergers and collaborations with local distributors and specialty care providers are enhancing product reach and post-merger integration efficiency. Companies are also focusing on localized manufacturing and leveraging advancements in gene therapy and biomarker-based diagnostics to enable more personalized treatment approaches.

The launch of next-generation oral therapies and enhanced intravenous enzyme replacement treatments is improving patient outcomes and adherence. Supportive regulatory frameworks and reimbursement policies in the US and Canada are further boosting adoption. Joint initiatives focused on awareness campaigns and early screening programs are helping address under diagnosis, highlighting North America’s position as a leading market for Fabry disease treatment.

List of Key Companies with Approved Drugs

- Chiesi Farmaceutici S.p.A.

- JCR Pharmaceuticals Co., Ltd.

- Protalix BioTherapeutics Inc.

- Sanofi

- Takeda Pharmaceutical

List of Companies with Drugs Under Clinical Trial Phase

- Amicus Therapeutics, Inc.

- Idorsia Pharmaceuticals Ltd.

- Idorsia Pharmaceuticals Ltd.

- ISU ABXIS Co., Ltd.

- Sangamo Therapeutics, Inc.

Fabry’s Disease Treatment Industry Development

In March 2024, CENTOGENE extended its collaboration with Takeda to improve access to genetic testing for patients having lysosomal storage disorders (LSDs). This partnership aims to advance genetic diagnostics, ensuring timely and accurate testing for effective disease management.

North America Fabry’s Disease Treatment Market Segmentation

By Route of Administration Outlook (Revenue USD Million, 2020–2034)

- Intravenous Route

- Oral Route

By Therapy Outlook (Revenue USD Million, 2020–2034)

- Enzyme Replacement Therapy (ERT)

- Substrate Reduction Therapy (SRT)

- Others

By Distribution Channel Outlook (Revenue USD Million, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Country Outlook (Revenue USD Million, 2020–2034)

- US

- Canada

North America Fabry’s Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,122.24 million |

|

Market Size Value in 2025 |

USD 1,197.90 million |

|

Revenue Forecast by 2034 |

USD 2,173.14 million |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The North America market size was valued at USD 1,122.24 million in 2024 and is projected to grow to USD 2,173.14 million by 2034.

The North America market is projected to register a CAGR of 6.8% during the forecast period.

The US Fabry’s disease treatment market accounted for approximately 85% share, largely due to its advanced healthcare infrastructure, early adoption of innovative therapies, and robust clinical research ecosystem.

A few of the key players are Amicus Therapeutics, Inc.; CANbridge Life Sciences Ltd.; Chiesi Farmaceutici S.p.A.; Idorsia Pharmaceuticals Ltd.; ISU ABXIS Co., Ltd.; JCR Pharmaceuticals Co., Ltd.; Protalix Biotherapeutics Inc.; Sangamo Therapeutics, Inc.; Sanofi; and Takeda Pharmaceutical.

In 2024, the intravenous route segment accounted for approximately 68% share, due to the continued preference for enzyme replacement therapies (ERT), which require IV infusion

In 2024, the enzyme replacement therapy (ERT) segment accounted for approximately 70% of the share, driven by its established role as the first-line treatment for Fabry’s disease.