Off-Highway Vehicle Lighting Market Size, Share, Trends, Industry Analysis Report

: By Product, By Application, By End Use (Construction and Agriculture/Farming/Forestry), Vehicle, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5624

- Base Year: 2024

- Historical Data: 2020-2023

Off-Highway vehicle lighting Market Overview

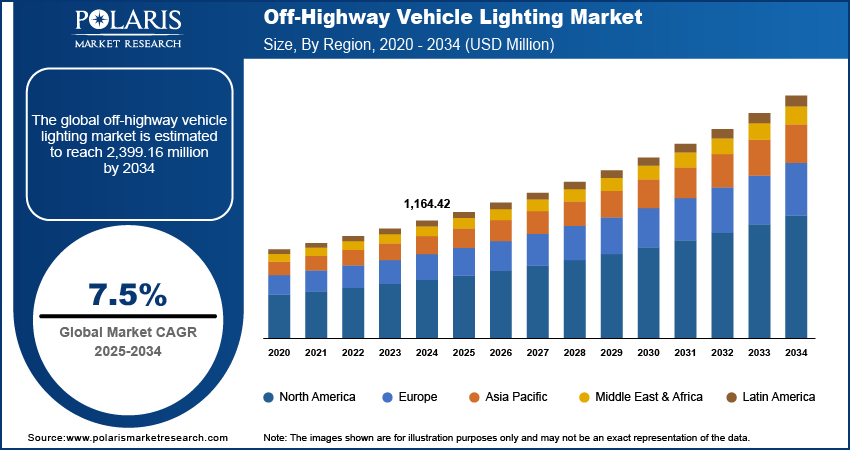

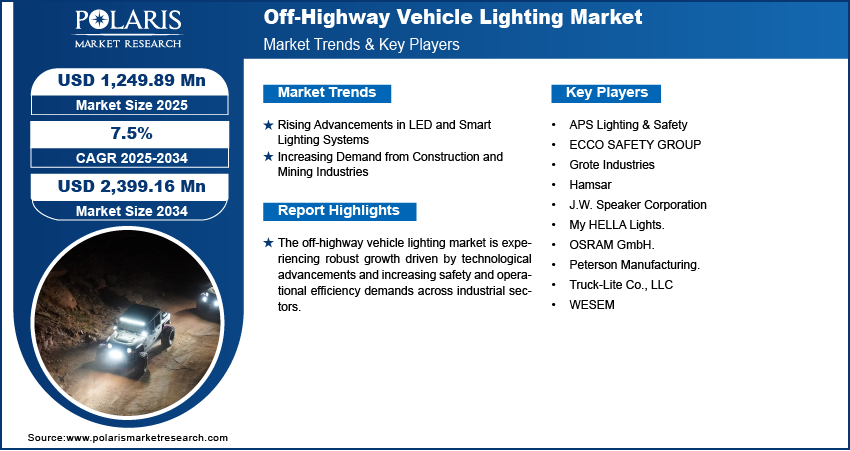

The global off-highway vehicle lighting market size was valued at USD 1,164.42 million in 2024. It is expected to grow from USD 1,249.89 million in 2025 to USD 2,399.16 million by 2034, at a CAGR of 7.5% during 2025–2034.

Off-highway vehicle lighting refers to specialized lighting systems designed for vehicles operating in rugged, off-road environments such as construction sites, mining zones, agricultural fields, and forestry areas. These lighting systems are engineered to provide high visibility, durability, and performance under harsh conditions. The growing demand for enhanced safety and operational efficiency is propelling the development of robust lighting solutions in this segment. One of the primary drivers influencing the market growth is the increasing stringency of government regulations and safety standards. For instance, a June 2021 AAMVA report provided guidelines for limited off-road vehicle use on public roads, restricting operation to roads with ≤35 mph speed limits (max 25 mph operation) and ≤100 yards travel unless the owner has adjacent property. This has encouraged OEMs and aftermarket players to incorporate high-performance, energy-efficient lighting solutions to meet these regulatory requirements. Regulatory bodies across various regions are mandating the use of advanced lighting technologies to ensure better visibility, reduce accidents, and support compliance with workplace safety norms.

To Understand More About this Research: Request a Free Sample Report

The market expansion is attributed to the rise in electrification and automation of off-highway vehicles. The demand for intelligent and adaptive lighting systems has surged as the industry witnesses a shift toward electric powertrains and autonomous technologies. Automated vehicles require lighting solutions that illuminate the work environment and also integrate with sensors and control systems to support autonomous navigation and machine-to-machine communication. Furthermore, the electrification trend is fostering innovation in LED and smart lighting, as these systems are more compatible with electric architectures, offering benefits such as reduced energy consumption, longer service life, and enhanced controllability. For instance, in October 2022, Ford launched the next-gen Everest with Matrix LED headlamps featuring glare-free high beams, dynamic bending (15° swivel), and high-beam boost. The system uses cameras to detect other vehicles with 800m range, optimizing nighttime visibility while preventing dazzle and addressing higher nighttime crash risks. This alignment with technological advancements is reshaping the lighting ecosystem in off-highway applications.

Market Dynamics

Rising Advancements in LED and Smart Lighting Systems

Advancements in LED and smart lighting systems are transforming traditional lighting approaches into more efficient, durable, and intelligent solutions. LED technology offers significant advantages such as lower power consumption, higher brightness, longer lifespan, and better resistance to vibration and extreme environmental conditions, factors that are essential in demanding off-road applications. In November 2021, RIGID Industries launched its A2Z for the e-Mobility initiative to develop EV-optimized LED lighting, building on its Adapt E-Series light bar technology. Addressing the growing electrification of trucks and SUVs while maintaining compatibility with traditional vehicles. The integration of smart functionalities such as adaptive lighting, remote diagnostics, and automated brightness control further enhances operational safety and efficiency. These innovations align well with the evolving technological landscape of off-highway vehicles, promoting the adoption of advanced lighting systems that meet functional needs and also support sustainability and automation goals. Thus, rising advancements in LED and smart lighting systems are driving the off-highway vehicle lighting market development.

Increasing Demand from Construction and Mining Industries

The construction and mining industries heavily rely on off-road equipment that operates in challenging environments with low visibility and long working hours, necessitating the use of powerful and reliable lighting systems. According to an AGC report, there were over 919,000 construction establishments and 8 million workers in the US during the first quarter of 2023. The sector generates nearly USD 2.1 trillion annually in structures, highlighting its significant economic impact. There is a corresponding need for equipment that ensures worker safety, productivity, and minimal downtime as construction and mining activities continue to expand globally. High-performance lighting solutions are critical in supporting these objectives, enabling clear visibility in dust, fog, and nighttime conditions. Consequently, the sustained growth of these end-use industries directly contributes to the rising demand for advanced lighting systems tailored for off-highway applications. Therefore, the rising demand from construction and mining industries is boosting the off-road vehicle market opportunities.

Segment Insights

Market Assessment by Application

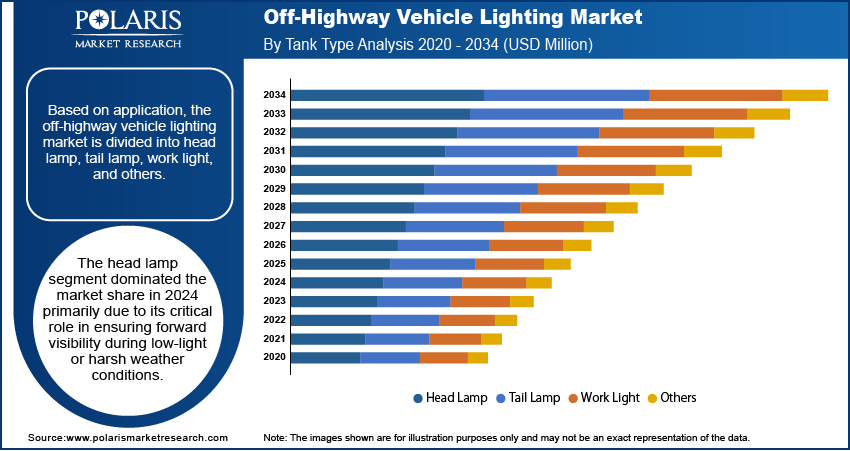

The segmentation based on application, includes head lamp, tail lamp, work light, and others. The head lamp segment dominated in 2024, primarily due to its critical role in ensuring forward visibility during low-light or harsh weather conditions. Headlamps are essential for safe vehicle navigation, particularly in off-road environments such as mining sites, construction zones, and smart agricultural land where visibility is often compromised. Their continuous use during both day and night operations especially drives demand compared to other lighting components. Furthermore, technological advancements in headlamp design, such as better beam control, enhanced brightness, and integration with vehicle automation systems, have elevated their importance. As a result, OEMs prioritize high-performance headlamps as a standard feature in off-highway vehicles, reinforcing this segment’s dominance.

Market Evaluation by Product

The global market segmentation, based on product, includes LED, halogen, HID, and incandescent. The LED segment is expected to witness the fastest growth during the forecast period due to its superior energy efficiency, durability, and adaptability. LED lights offer longer service life and greater resistance to vibration and environmental stress, making them ideal for off-road applications. Their compact size also allows for more versatile and aerodynamic lighting designs, which aligns with the increasing automation and electrification of off-highway vehicles. Additionally, the reduced maintenance requirements and lower overall operational costs associated with LED lighting systems make them an attractive choice for fleet operators. This transition from conventional lighting technologies to LED solutions is accelerating as the industry moves toward smarter and more sustainable vehicle systems.

Regional Analysis

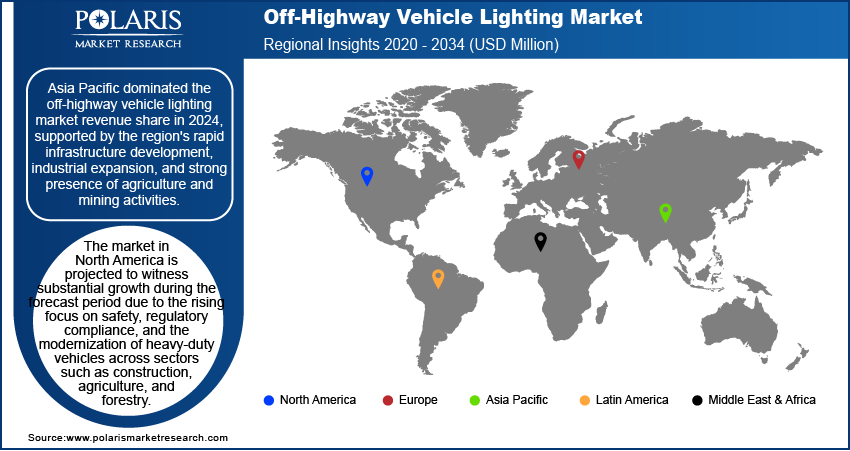

By region, the report provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market revenue share in 2024, supported by the region's rapid infrastructure development, industrial expansion, and strong presence of agriculture and mining activities. According to a report by the IBEF in April 2025, India's industrial production grew by 5.0% in January 2025, rising from 3.2% in December 2024. Countries such as China, India, and Australia are investing heavily in large-scale construction and mining projects, which drive demand for off-highway vehicles and their associated components, including advanced lighting systems. Additionally, the region benefits from a strong manufacturing base, increasing adoption of automation technologies, and favorable government policies supporting industrial growth. These factors collectively contribute to a robust demand environment, positioning Asia Pacific as the leading region for off-highway vehicle lighting.

Thesize in North America is projected to witness substantial growth during the forecast period due to the rising focus on safety, regulatory compliance, and the modernization of heavy-duty vehicles across sectors such as construction, agriculture, and forestry. The region’s emphasis on incorporating advanced technologies into vehicle fleets, such as smart lighting and energy-efficient solutions, is driving the adoption of high-performance lighting systems. Moreover, the trend toward smart fleet management, electrification, and autonomous off-highway vehicles is pushing demand for integrated LED and smart lighting applications. This evolution, coupled with steady investments in infrastructure renewal and automation, supports the strong growth outlook for off-highway vehicle lighting in North America.

Off-Highway Vehicle Lighting Market – Key Players & Competitive Analysis Report

The market features intense competition between global leaders and regional players, all competing for off-highway vehicle market share through innovation and strategic expansion. Major competitors differentiate themselves through strong R&D capabilities that drive technological advancements in LED and laser-based lighting systems. These innovations deliver critical performance advantages in brightness, energy efficiency, and durability while helping manufacturers comply with increasingly strict global safety and environmental regulations. Market leaders leverage extensive distribution networks to maintain dominance in established markets while expanding into emerging economies experiencing rapid infrastructure development. Sustainability has become a competitive factor, with top players implementing eco-friendly production methods and recyclable materials to build sustainable value chains that meet ESG objectives. Emerging technologies and digitalization are transforming the competitive environment, particularly the integration of IoT capabilities into smart lighting systems. These advanced solutions offer features such as real-time monitoring and adaptive beam control, creating new value propositions for customers. Business transformation initiatives are helping manufacturers capitalize on these technological shifts while improving operational efficiencies. Macroeconomic factors, including raw material price volatility and evolving trade policies, continue to influence competitive strategies. These activities allow companies to combine technological expertise, expand product portfolios, and strengthen geographic presence. Collaborations between lighting specialists and automotive OEMs are crucial as vehicle electrification progresses. A few key major players are APS Lighting & Safety; ECCO SAFETY GROUP; Grote Industries; Hamsar; J.W. Speaker Corporation; My HELLA Lights; OSRAM GmbH; Peterson Manufacturing; Truck-Lite Co., LLC; and WESEM.

ECCO Safety Group (ESG), founded in 1972 and headquartered in Boise, Idaho, is into emergency lighting and audible warning equipment for commercial and off-highway vehicles. The company specializes in providing high-performance lighting solutions, such as backup alarms, work lamps, warning lights, camera systems, sirens, speakers, and lightbars. ESG serves over 500 original equipment manufacturers (OEMs) and thousands of private label, fleet, and aftermarket customers across industries such as construction, material handling, utilities, and public safety. SG has built a diversified portfolio of brands such as ECCO, Code 3, Britax, Delta Design, Premier Hazard, Hazard Systems, and Lucas with nearly 1,000 employees worldwide and operations spanning 12 locations across the US, Europe, Australia, and Asia. Its products are designed to enhance visibility and safety in demanding environments. SG's commitment to innovation and quality has positioned it as a trusted partner for off-highway vehicle lighting solutions. ECCO Safety Group continues to meet the evolving needs of industries that rely on durable and efficient lighting systems for operational safety and productivity by leveraging advanced technologies and maintaining a customer-centric approach.

J.W. Speaker Corporation, founded in 1935, is a family-owned business specializing in innovative vehicular lighting solutions for Original Equipment Manufacturers (OEMs) and aftermarket customers. The company is recognized globally for its high-performance LED lighting products tailored for various industries, such as automotive, construction, agriculture, industrial, marine, and off-highway vehicles, based in Germantown, Wisconsin. The company employs state-of-the-art technologies such as HID and LED to create durable and efficient products that enhance visibility and safety in demanding environments such as mining and material handling. J.W. Speaker ensures quality by managing nearly all components and processes in-house, known for its vertically integrated operations. The company continues to innovate to meet the evolving needs of off-highway vehicle manufacturers with a strong emphasis on research and development. Managed by Tim and Jamie Speaker, the third-generation owners, J.W. Speaker remains committed to delivering value through cutting-edge designs that prioritize performance and aesthetics while supporting global mobility and transport sectors.

List of Key Companies in Off-Highway Vehicle Lighting Market

- APS Lighting & Safety

- ECCO SAFETY GROUP

- Grote Industries

- Hamsar

- J.W. Speaker Corporation

- My HELLA Lights.

- OSRAM GmbH.

- Peterson Manufacturing.

- Truck-Lite Co., LLC

- WESEM

Off-Highway Vehicle Lighting Industry Developments

December 2023: OLEDWorks announced a new automotive lighting brand at CES 2024, showcasing advanced OLED technology for vehicle applications. The exhibit aimed to demonstrate innovations in lighting communication and autonomous mobility solutions.

July 2023: Marelli launched its h-Digi microLED front-lighting module in series production, developed with ams OSRAM. The system features 40,000 pixels for adaptive beam patterns, weather-specific lighting, glare-free high beams, and road projection of safety alerts, packaged in a compact, energy-efficient design.

Off-Highway Vehicle Lighting Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- LED

- Halogen

- HID

- Incandescent

By Application Outlook (Revenue, USD Million, 2020–2034)

- Head Lamp

- Tail Lamp

- Work Light

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Construction

- Agriculture/Farming/Forestry

By Vehicle Outlook (Revenue, USD Million, 2020–2034)

- Excavator

- Loader

- Crane

- Dump Truck

- Tractor

- Other

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Off-Highway Vehicle Lighting Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,164.42 million |

|

Market Size Value in 2025 |

USD 1,249.89 million |

|

Revenue Forecast in 2034 |

USD 2,399.16 million |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,164.42 million in 2024 and is projected to grow to USD 2,399.16 million by 2034.

The global market is projected to register a CAGR of 7.5% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are APS Lighting & Safety; ECCO SAFETY GROUP; Grote Industries; Hamsar; J.W. Speaker Corporation; My HELLA Lights; OSRAM GmbH; Peterson Manufacturing; Truck-Lite Co., LLC; and WESEM.

The head lamp segment dominated the market share in 2024.

The LED segment is expected to witness the fastest growth during the forecast period.