Oil Spill Management Market Size, Share & Trends Analysis Report

By Technology, By Location (Onshore, Offshore), By Technique, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jun-2023

- Pages: 119

- Format: PDF

- Report ID: PM3392

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

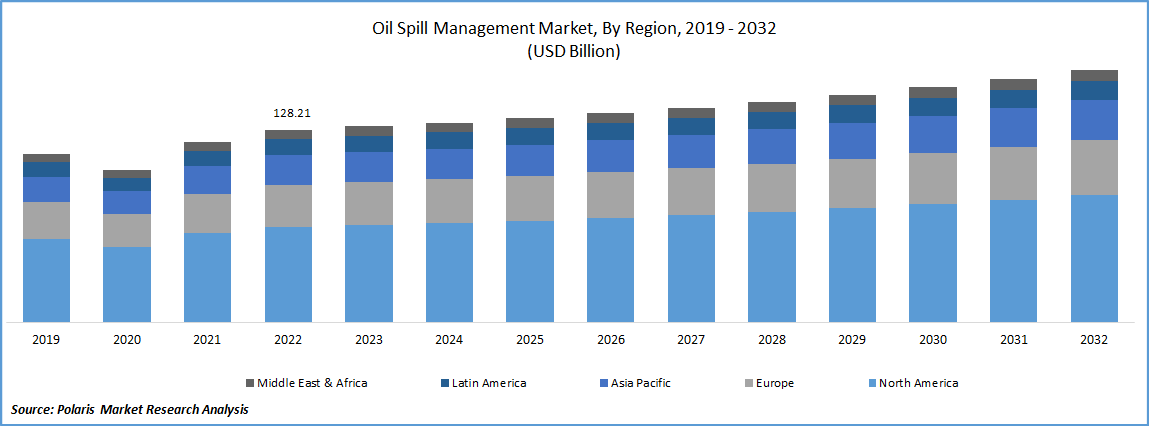

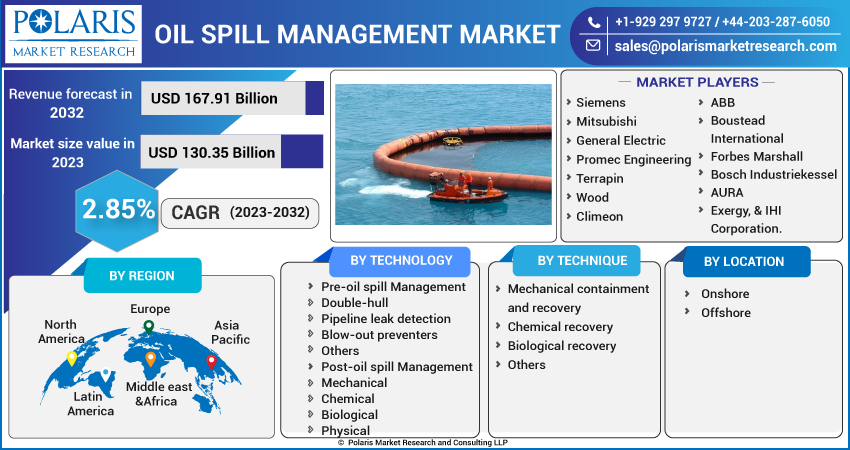

The global oil spill management market was valued at USD 128.21 billion in 2022 and is expected to grow at a CAGR of 2.85% during the forecast period.Increasing cases of oil spills across the globe, and thereby ill effects to marine ecosystem have paved the way for efficient oil spill management services. Oil spills can have significant environmental and economic impacts, including damage to marine and coastal ecosystems, loss of marine and terrestrial wildlife, and harm to the fishing and tourism industries. The severity of these impacts depends on the size and location of the spill, as well as the type of oil and the environmental conditions in the affected area. Efforts to prevent and respond to oil spills have been ongoing for many years, with advances in technology and regulations helping to reduce the frequency and severity of incidents. However, as the demand for oil and other petroleum products continues to grow, the risk of spills remains a concern.

To Understand More About this Research: Request a Free Sample Report

Increased safety measures and stricter regulations are necessary to prevent oil spills and minimize their impact when they do occur. Additionally, the development and adoption of alternative, renewable energy sources may reduce the reliance on oil and mitigate the risks associated with its extraction, transportation, and use. Increased onshore and offshore drilling activities, as well as the growth in oil and gas transportation through tankers and pipelines, can certainly contribute to an increased risk of oil spills. However, the implementation of tough government safety guidelines and regulations can help to mitigate this risk and promote effective oil spill management.

Industry Dynamics

Growth Drivers

The oil spill management industry includes a range of technologies, services, and products aimed at preventing, containing, and cleaning up oil spills. The industry has seen significant growth and innovation in recent years, driven by increasing demand for effective spill response and environmental protection measures. The development and adoption of advanced technologies, such as remote sensing, oil spill modelling, and chemical dispersants, have improved the efficiency and effectiveness of oil spill response efforts. Additionally, the use of unmanned aerial vehicles (UAVs) and other autonomous systems can help to rapidly assess and respond to spills, reducing the time and resources required to mount an effective response.

The growth in the oil spill management market is likely to be driven by a combination of factors, including increasing safety concerns and government regulations, as well as the need for more effective and efficient spill response measures. However, it is important to note that the industry is also subject to economic and geopolitical factors, which can impact demand and growth in the sector.

For Specific Research Requirements, Speak to Research Analyst

Report Segmentation

The market is primarily segmented technology, technique, location, and region.

|

By Technology |

By Technique |

By Location |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Pre-oil spill segment held largest share in the global market in 2022

In 2022, pre-oil spill management segment accounted for the largest share. The concern regarding harmful environmental impacts from hull-breach incidents is certainly an important issue and has led to increased efforts to standardize tanker design and enhance tanker protection against collisions and natural disasters. One such measure has been the adoption of double-hull technology, which can significantly reduce the risk of oil spills in the event of a hull breach.

Double-hull tankers feature an additional layer of protection between the cargo and the ocean, reducing the risk of oil spills from collisions or other types of accidents. This technology has become increasingly popular in recent years, driven in part by stricter regulations and guidelines from international organizations and governments aimed at improving environmental protection and preventing oil spills.

The adoption of double-hull technology is expected to continue to grow in the coming years, as more companies seek to improve their environmental performance and mitigate the risks associated with oil spills. However, it is worth noting that there are also other factors that can impact the growth of this technology, such as economic factors and the availability of alternative transport options.

Mechanical segment registered the highest growth over the study period. Containment booms, sorbents, & skimmers are mostly used technologies for cleaning up oil spills. Containment booms are floating barriers that can be used to contain and redirect oil slicks, while sorbents can absorb oil from the water surface and skimmers can remove oil from the water. These technologies are particularly useful for large-scale spills in deep-sea areas, where the volume of oil can be significant and the potential environmental impacts can be substantial. However, the effectiveness of these technologies can vary depending on a range of factors, including the type and viscosity of the spilled oil, the weather and sea conditions, and the location of the spill.

Chemical segment is dominating the global market in 2022

In 2022, the chemical segment garnered the largest share. The use of gelling and dispersant agents is another approach commonly used in oil spill response efforts. Dispersants are chemical agents that are applied directly to the oil slick, where they help to break down the oil into smaller droplets that can disperse more readily into the water column. This can help to reduce the amount of oil that reaches the shoreline and can also help to minimize the environmental impacts of the spill.

Biological recovery registered robust growth rate over the study period. It includes naturally occurring microorganisms to break down the spilled oil. These microorganisms, including bacteria and fungi, can metabolize the hydrocarbons in the oil, converting them into less harmful substances such as carbon dioxide and fatty acids. This recovery process is commonly used in areas where spilled oil has reached the shore, where the use of mechanical equipment may not be practical or effective. The process involves adding nutrients to the affected area to stimulate the growth of the microorganisms and accelerate the breakdown of the spilled oil.

Onshore segment held largest share in the global market in 2022

In 2022, offshore registered significant growth rate. This is primarily due to rising need for oil-spill technology in harsher environments, remote locations, & deep-water areas are expected to drive the demand for these products over the next several years. These challenging environments present unique and complex challenges for oil spill response, and require specialized technologies and equipment to effectively contain and clean up spills.

For example, in deep-water environments, response efforts may require the use of remotely operated vehicles (ROVs), specialized containment and recovery systems, and advanced sensing technologies to detect and track oil spills. In harsh or remote locations, response efforts may require the use of portable or modular equipment that can be quickly deployed and adapted to the specific circumstances of the spill.

Onshore segment garnered largest revenue share. Oil and gas blowouts and pipeline failures can have significant impacts on the environment and pose a risk to human health and safety. Blowouts can occur when the pressure in a well exceeds the capacity of the equipment used to control it, resulting in an uncontrolled release of oil, gas, and other fluids. Pipeline failures can occur due to a range of factors, including corrosion, material defects, and external damage from weather events or excavation activities.

North America accounted for the largest revenue share in 2022

In the fiscal year 2022, North America is expected to lead the global market with a major share. Growth in the region is attributed to rise in oil & gas spills in its surrounding, frequent energy needs, and oil exploration activities in the country causing slippage to the local environments. Few notable examples in the recent history include, Deepwater Horizon oil spill, Exxon Valdez oil spill, Santa Barbara oil spill, & Colonial Pipeline spill. In line with this, the US government and the oil and gas industry have implemented a range of measures to prevent and respond to oil spills, including increased safety regulations, advanced technologies for spill response, and enhanced monitoring and reporting requirements.

APAC registered significant growth rate over the study period. Asian government provides financial incentives for exploration and production activities. These initiatives may include tax benefits, subsidies, and other forms of financial aid that encourage investment in the industry.

Competitive Insight

The global players include Siemens, Mitsubishi, General Electric, Promec Engineering, Terrapin, Wood, Climeon, ABB, Boustead International, Forbes Marshall, Bosch Industriekessel, AURA, Exergy, & IHI Corporation.

Recent Developments

- In January 2020, Dr. Jianbing Li's research could potentially lead to ground-breaking solutions for tackling oil spills, such as the development of new materials or technologies for detecting and containing spills in challenging environments. This could have significant implications for the oil and gas industry, as well as for environmental protection and conservation efforts.

Oil Spill Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 130.35 billion |

|

Revenue forecast in 2032 |

USD 167.91 billion |

|

CAGR |

2.85% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Component, Organization Size, Source, Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Siemens, Mitsubishi, General Electric, Promec Engineering, Terrapin, Wood, Climeon, ABB, Boustead International, Forbes Marshall, Bosch Industriekessel, AURA, Exergy, & IHI Corporation. |

FAQ's

The oil spill management market report covering key segments are technology, technique, location, and region.

Oil Spill Management Market Size Worth $167.91 Billion By 2032.

The global oil spill management market is expected to grow at a CAGR of 2.85% during the forecast period.

North America is leading the global market.

key driving factors in oil spill management market are increasing deepwater drilling activities.