Oil Storage Market Size, Share, Trends, Industry Analysis Report

: By Type (Floating Roof Tanks, Fixed Roof Tanks, Underground Storage, and Bullet Tanks), By Application, By Product, and By Region – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3112

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

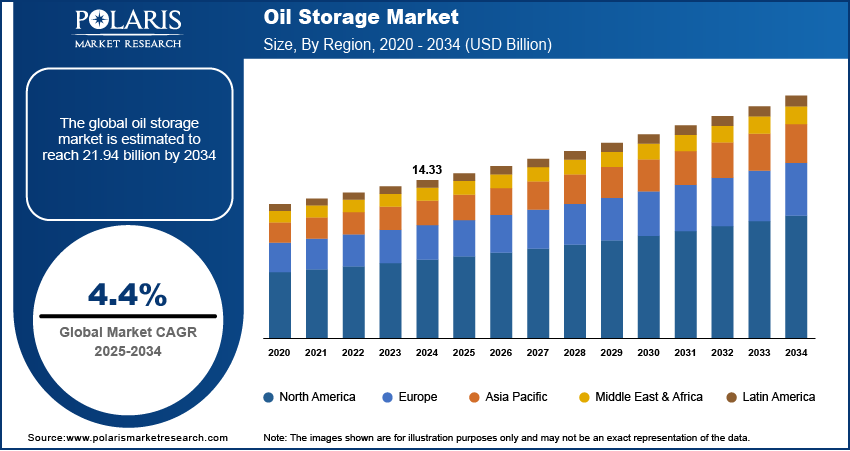

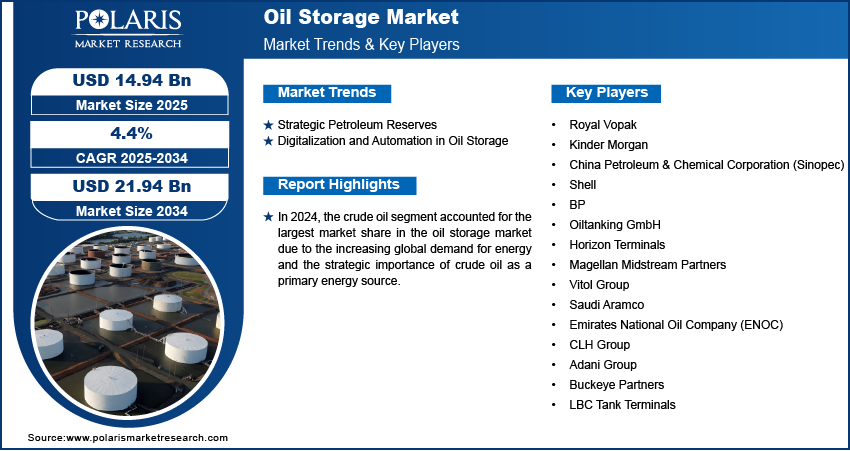

The oil storage market size was valued at USD 14.33 billion in 2024 and is expected to grow at a CAGR of 4.4% during the forecast period. The market growth is primarily fueled by rising energy consumption, the introduction of strategic storage initiatives by governments, and growing exploration and production (E&P) activities.

Key Insights

- The floating roof tanks segment accounted for the largest market share in 2024. The superior design of these tanks minimizes evaporative losses and ensures safer storage of volatile hydrocarbons.

- The crude oil segment led the market in 2024, owing to growing global energy demand and the strategic importance of crude oil as a primary energy source.

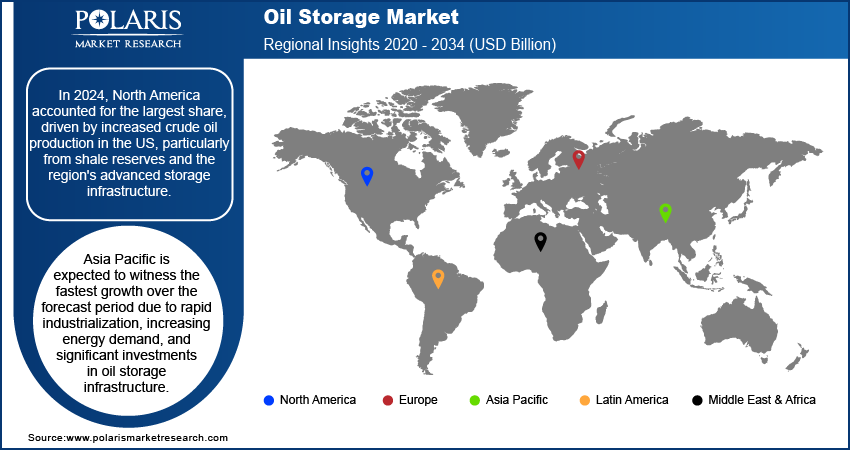

- North America accounted for the largest market share in 2024. The regional market dominance is primarily due to increased crude oil production in the US.

- Asia Pacific is anticipated to register the highest CAGR during the projection period. Growing energy demand and significant investments in oil storage infrastructure drive regional market growth.

Industry Dynamics

- The rising prioritization of energy security and supply stability by governments has created increased need for strategic petroleum reserves (SPRs), fueling market demand.

- The growing integration of digitalization and automation to optimize storage operations and enhance safety measures fuels market expansion.

- Expansion of refining and petrochemical industries is projected to provide several market opportunities in the coming years.

- Volatility in oil prices may hinder market growth.

Market Statistics

2024 Market Size: USD 14.33 billion

2034 Projected Market Size: USD 21.94 billion

CAGR (2025-2034): 4.4%

North America: Largest Market in 2024

AI Impact on Oil Storage Market

- AI ensures operational safety by analyzing sensor and IoT data to monitor tank levels, temperature, and pressure in real time.

- Machine learning models predict demand fluctuations and optimize storage utilization to reduce costs.

- AI-powered predictive maintenance identifies early signs of corrosion, leakage, or equipment failure. This early detection helps minimize downtime.

- Advanced analytics support strategic inventory planning and enable operators to align storage decisions with market price trends and trading opportunities.

To Understand More About this Research: Request a Free Sample Report

The market is primarily driven by the growing need for strategic petroleum reserves (SPRs). Countries are expanding their reserve capacities to shield their economies from potential oil supply disruptions.

The oil storage market focuses on the storage of crude oil, refined petroleum products, and other liquid fuels, enabling efficient supply chain management and stabilization. This industry is critical for ensuring energy security and balancing demand-supply dynamics globally. Increasing energy consumption and strategic storing initiatives by governments, the demand for advanced oil storage infrastructure has risen significantly.

The increasing exploration and production (E&P) activities, particularly in offshore regions, are driving the demand for oil storage facilities. Moreover, technological advancements in storage systems, such as floating roof tanks and underground caverns, are further supporting market growth. The surge in oil trading activities, driven by fluctuating crude oil prices, also contributes to the oil storage market expansion, highlighting its pivotal role in the global energy ecosystem.

Market Dynamics

Strategic Petroleum Reserves

The market is driven by the growing need for strategic petroleum reserves (SPRs) as governments prioritize energy security, and supply stability. SPRs serve as a safeguard against geopolitical tensions, natural disasters, and unexpected demand surges, ensuring a steady oil supply. Countries such as the United States, China, and India are expanding their reserve capacities, increasing demand for oil storage facilities.

For example, according to the US Energy Information Administration (EIA), the US Strategic Petroleum Reserve (SPR) held approximately 354.7 million barrels of crude oil at the end of December 2023, rising to around 387.2 million barrels by October 2024. This expansion reflects a broader global trend of increasing storage capacities to enhance energy security. As nations strengthen their oil reserves, the demand for storage infrastructure, including underground caverns, tank farms, and floating storage units, continues to grow.

Digitalization and Automation in Oil Storage

The integration of digitalization and automation is a transformative trend shaping the market growth. Advanced technologies, such as IoT sensor, artificial intelligence, and blockchain, are employed to optimize storage operations and enhance safety measures. IoT-enabled sensors provide real-time monitoring of tank conditions, detecting potential issues such as leaks or pressure anomalies. AI-driven analytics further aid in inventory management by predicting demand patterns and optimizing supply chains. Blockchain technology ensures transparency and security in oil trading and inventory tracking, reducing fraud risks. Companies are also implementing automated systems to enhance operational efficiency, such as robotic inspections for storage tanks.

Segment Insights

Market Assessment by Type

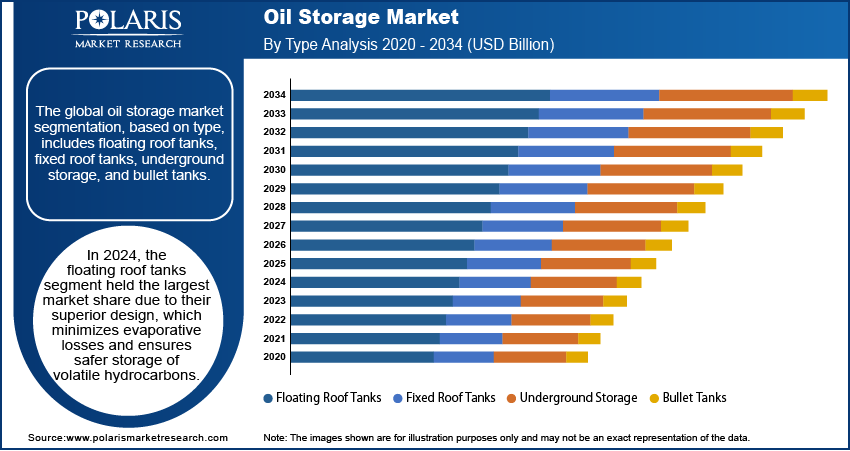

The global oil storage market segmentation, based on type, includes floating roof tanks, fixed roof tanks, underground storage, and bullet tanks. In 2024, the floating roof tanks segment held the largest share due to their superior design, which minimizes evaporative losses and ensures safer storage of volatile hydrocarbons. These tanks are widely adopted in oil and gas industries for storing crude oil and refined products, as they effectively reduce the risk of fire and contamination by preventing direct exposure to air. Rising environmental regulations and the need for cost-efficient storage solutions further propelled the demand for floating roof tanks. Additionally, advancements in material technologies and construction techniques enhanced their durability and operational efficiency, solidifying their dominance in the segmental growth.

Market Evaluation by Product

The oil storage market is segmented by product into crude oil, refined petroleum products, and liquefied natural gas (LNG). In 2024, the crude oil segment accounted for the largest market share due to the increasing global demand for energy and the strategic importance of crude oil as a primary energy source. Rising production levels, particularly in key oil-producing regions, necessitated expanded storage capacities to manage supply fluctuations and ensure energy security. Additionally, the growing adoption of crude oil as feedstock for petrochemical industries and refining processes further drove demand for storage solutions. Enhanced storage infrastructure investments, including advanced tank technologies for safety and efficiency, also contributed to the segment's growth.

Regional Analysis

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America oil storage market is accounted for the largest revenue share. This is driven by increased crude oil production in the US, particularly from shale reserves and the region's advanced storage infrastructure. For instance, according to the December 2024 US Energy Information Administration Latest Short-Term Energy Outlook (STEO), crude oil production in the US Lower 48 (L48) states, excluding Alaska and offshore production, reached a record high of 11.3 million barrels per day (b/d) in November 2024. The US Strategic Petroleum Reserve (SPR) played a significant role in ensuring energy security, while investments in expanding storage capacities further supported market growth. Additionally, rising energy exports, including crude oil and refined products, amplified the need for efficient storage solutions. Favorable government policies and advancements in tank technologies, prioritizing safety and environmental compliance, also contributed to region’s growth.

Asia Pacific is expected to witness the fastest CAGR over the forecast period due to rapid industrialization, increasing energy demand, and significant investments in oil storage infrastructure. Growing economies such as China and India are driving crude oil imports to meet their expanding industrial and transportation needs, which is further boosting the demand for advanced storage facilities. For instance, according to the Petroleum Planning & Analysis Cell, India's crude oil imports reached 18.8 million metric tons in in February 2024, reflecting a marginal increase of 0.4% during February FY 2023-24 compared to the same period in FY 2022-23. This growth is attributed to the rising energy demands of the industrial and transportation sectors, particularly in growing economies such as India. The continued reliance on imported crude oil highlights the need for expanding advanced storage facilities to support the country's energy requirements. Additionally, government initiatives to build strategic petroleum reserves and the rising adoption of renewable energy sources alongside conventional fuels further contribute to the region's growth. Expanding refining capacities and technological advancements in storage solutions also boost the market development in Asia Pacific.

Key Market Players & Competitive Analysis Report

The competitive landscape reflects the dynamic and interconnected nature of the global energy industry. Key players in the oil storage market adopt strategies such as partnerships, mergers, and collaborations to enhance their storage capacities and optimize operations. Companies continuously invest in infrastructure development to meet the increasing demand for crude oil, refined products, and liquefied natural gas storage. Strategic alliances between stakeholders across the supply chain, including producers, storage providers, and trading firms, play a pivotal role in driving efficiency and profitability.

Technological advancements have further intensified competition, with players integrating digital tools to streamline inventory management and ensure operational safety. Innovations such as IoT-based monitoring, AI-driven analytics, and automated maintenance systems offer a competitive edge by reducing costs and minimizing risks. Additionally, increasing focus on sustainability, with companies exploring renewable energy integration and environmentally friendly storage solutions. Market participants are expanding their footprints in emerging economies as global energy demand rises. The competitive intensity is further heightened by fluctuating oil prices and geopolitical developments, pushing companies to adopt flexible and adaptive strategies.

Royal Dutch Shell, commonly referred to as Shell, is a global energy and petrochemical industry specializing in oil and gas, chemicals, and energy solutions. The company operates as one of the mobility networks; Shell serves approximately 33 million customers daily across more than 47,000 retail stations worldwide. The company has over 54,000 public electric vehicle (EV) charging infrastructure at Shell stations, on-street locations, and key destinations. The company's main operations include oil and natural gas exploration, liquefied natural gas (LNG), gas-to-liquids (GTL) technology, methane emissions management, deep-water exploration, and the development of shale oil and gas. Additionally, Shell is involved in renewable energy, carbon capture and storage (CCS), and nature-based solutions.

Kinder Morgan excels through its integrated infrastructure and advanced storage facilities across North America. The company focuses on enhancing operational efficiency and safety through digital solutions. Recent expansions in the Gulf Coast region, coupled with investments in renewable fuel storage, highlight its expansion. These strategies reinforce Kinder Morgan’s leadership in the evolving oil storage industry.

Key Companies

- Royal Vopak

- Kinder Morgan

- China Petroleum & Chemical Corporation (Sinopec)

- Shell

- BP

- Oiltanking GmbH

- Horizon Terminals

- Magellan Midstream Partners

- Vitol Group

- Saudi Aramco

- Emirates National Oil Company (ENOC)

- CLH Group

- Adani Group

- Buckeye Partners

- LBC Tank Terminals

Oil Storage Industry Developments

January 2025, MRPL collaborated with ISPRL to utilize its crude oil storage caverns. The agreement reduces MRPL’s infrastructure costs, ensures supply security, and offers operational flexibility by storing diverse crude grades while optimizing capital expenditure for other operational needs.

May 2024: General Petroleum, a lubricant manufacturer based in the UAE, upgraded its facilities by expanding its base oil storage capacity. This enhancement is designed to optimize operations and support increased production levels in response to market demand.

September 2024: Shell and LBC collaborated to enhance sustainability initiatives by optimizing the storage and handling of pyrolysis oil at their Rotterdam facility.

March 2022: Adani Ports and Special Economic Zone Ltd partnered with Indian Oil Corporation Ltd to boost crude oil operations at Mundra. IOCL will expand its Crude Oil Tank Farm at APSEZ’s Mundra Port, increasing its capacity to handle and blend an additional 10 mmtpa of crude oil.

Oil Storage Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Floating Roof Tanks

- Fixed Roof Tanks

- Underground Storage

- Bullet Tanks

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Commercial Usage

- Strategic Reserves

- Industrial Applications

By Product Outlook (Revenue, USD Billion, 2020 - 2034)

- Crude Oil

- Refined Petroleum Products

- Liquefied Natural Gas (LNG)

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.33 billion |

|

Market Size Value in 2025 |

USD 14.94 billion |

|

Revenue Forecast in 2034 |

USD 21.94 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global oil storage market size was valued at USD 14.33 billion in 2024 and is projected to grow to USD 21.94 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

In 2024, North America accounted for the largest share, driven by increased crude oil production in the US, particularly from shale reserves, and the region's advanced storage infrastructure.

Some of the key players in the market are Royal Vopak, Kinder Morgan, China Petroleum & Chemical Corporation (Sinopec), Shell, BP, Oiltanking GmbH, Horizon Terminals, Magellan Midstream Partners, Vitol Group, Saudi Aramco, Emirates National Oil Company (ENOC), CLH Group, Adani Group, Buckeye Partners, LBC Tank Terminals.

In 2024, the floating roof tanks segment held the largest market share due to their superior design, which minimizes evaporative losses and ensures safer storage of volatile hydrocarbons.

In 2024, the crude oil segment accounted for the largest market share in the oil storage market due to the increasing global demand for energy and the strategic importance of crude oil as a primary energy source.