Oleochemicals Market Size, Share, Trends, Industry Analysis Report

: By Product (Specialty Esters, Fatty Acid Methyl Ester, Glycerol Esters, Alkoxylates, Fatty Amines, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM1103

- Base Year: 2024

- Historical Data: 2020-2023

Oleochemicals Market Overview

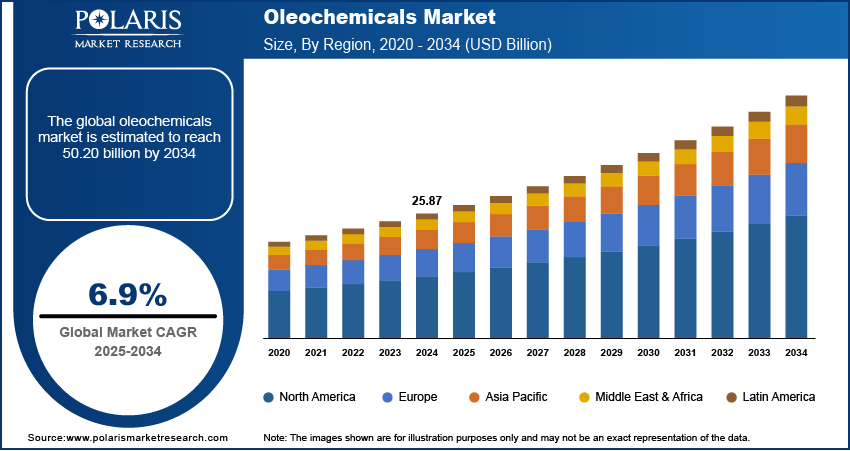

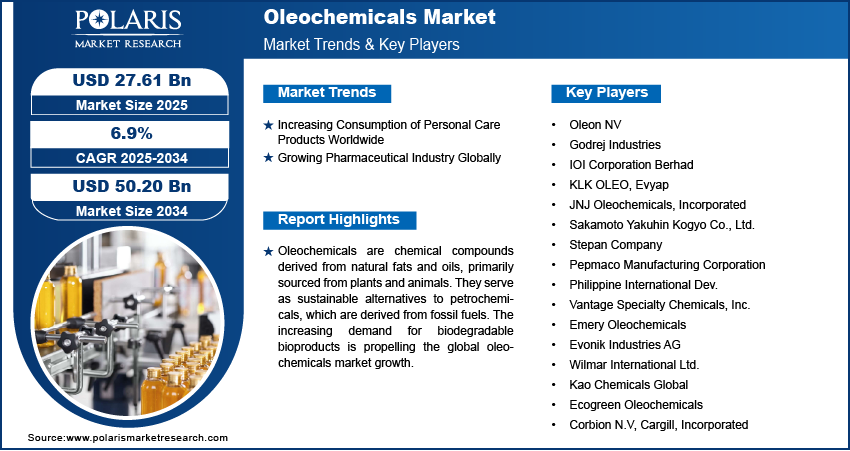

The global oleochemicals market size was valued at USD 25.87 billion in 2024. The market is projected to grow from USD 27.61 billion in 2025 to USD 50.20 billion by 2034, exhibiting a CAGR of 6.9% from 2025 to 2034.

Oleochemicals are chemical compounds derived from natural fats and oils, primarily sourced from plants and animals. They serve as sustainable alternatives to petrochemicals, which are derived from fossil fuels. The production of oleochemicals involves various chemical processes, including hydrolysis, alcoholysis, and hydrogenation, which convert caprylic triglycerides into fatty acids, fatty alcohols, esters, and glycerol derivatives.

The increasing demand for biodegradable bioproducts is propelling the global oleochemicals market growth. Oleochemicals, including fatty acids, glycerol, and esters, are key raw materials in the production of biodegradable products such as bio-lubricants, bioplastics, detergents, and personal care items. These chemicals are derived from renewable sources such as plant and animal fats and are highly compatible with eco-friendly applications. Therefore, as the adoption and popularity of biodegradable bioproducts rise, the demand for oleochemicals also increases.

To Understand More About this Research: Request a Free Sample Report

The oleochemicals market demand is driven by growing restrictions on petrochemical-based products. For instance, in July 2024, the Department of Chemicals and Petrochemicals of India enforced mandatory BIS Standards for chemicals and petrochemicals. This measure ensures that both imported and domestically produced chemicals and petrochemicals meet stringent quality parameters. As governments and industries worldwide adopt stricter regulations to reduce carbon emissions and minimize the environmental impact of petrochemical derivatives, companies are turning to oleochemicals as practical alternatives. Furthermore, oleochemicals derived from renewable resources like plant oils and animal fats offer similar functionality to petrochemicals in applications such as personal care, food additives, lubricants, and cleaning agents. This compatibility drives their adoption across industries such as consumer goods, automotive, food & beverages, which are increasingly prioritizing eco-conscious practices.

Oleochemicals Market Dynamics

Increasing Consumption of Personal Care Products Worldwide

Oleochemicals, such as fatty acids, glycerin, and fatty alcohols, are widely used in personal care items such as soaps, shampoos, lotions, and creams for their emulsifying, moisturizing, and stabilizing properties. Manufacturers are increasingly incorporating oleochemicals into their formulations with growing consumer awareness about the benefits of natural and sustainable ingredients, coupled with the demand for eco-friendly and safe personal care products. Additionally, the expansion of the beauty and wellness industry, driven by changing lifestyles and higher disposable incomes, is further fueling the demand for personal care products and, consequently, for oleochemicals. Thus, the increase in the consumption of personal care products worldwide is projected to propel the global oleochemicals market revenue.

Growing Pharmaceutical Industry Globally

The growing pharmaceutical industry globally is estimated to fuel the global oleochemicals market expansion. According to the India Brand Equity Foundation, a trust established by the Government of India in 2003, reported that the Indian pharmaceutical industry is projected to grow at a CAGR of over 10% to reach a size of US$ 130 billion by 2030. Oleochemicals, such as fatty acids, glycerin, and esters, serve as essential excipients, emulsifiers, solubilizers, and stabilizers in various pharmaceutical products, including tablets, capsules, ointments, and syrups. The expansion of healthcare access, the rise in chronic diseases, and the increasing focus on advanced drug delivery systems have amplified the need for high-quality ingredients, further boosting the adoption of oleochemicals. Hence, as the pharmaceutical industry continues to grow, the demand for oleochemicals is expected to rise.

Oleochemicals Market Segment Analysis

Oleochemicals Market Assessment Based on Product

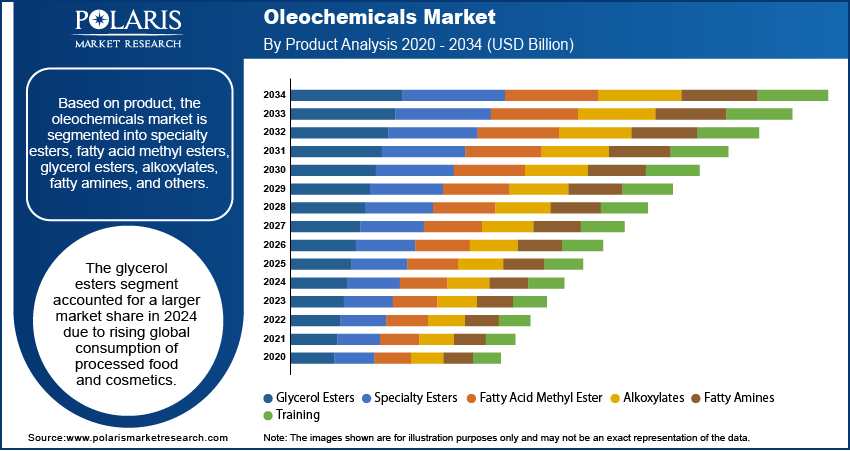

The oleochemicals market, based on product, is segmented into specialty esters, fatty acid methyl ester, glycerol esters, alkoxylates, fatty amines, and others. The glycerol esters segment accounted for a larger oleochemicals market share in 2024 due to rising global consumption of processed food and cosmetics. Glycerol esters, such as mono- and diglycerides, find extensive use in food and beverage, personal care, and pharmaceutical industries due to their role as emulsifiers, stabilizers, and thickening agents. The increasing consumer preference for clean-label and natural ingredients has boosted the demand for these compounds, particularly in processed food and skincare products. Furthermore, the compatibility of glycerol esters with stringent regulatory standards and their ability to enhance product texture and shelf life have strengthened their market position.

The specialty esters segment is expected to grow at a rapid pace in the coming years, owing to their superior performance and versatility across diverse industries such as personal care, automotive, and others. In personal care, specialty esters act as excellent emollients and provide a silky texture to skincare and haircare products. Similarly, the eco-friendly profile and biodegradability of specialty esters encourage their adoption in automotive and industrial applications such as lubricants and coatings.

Oleochemicals Market Evaluation Based on Application

The oleochemicals market, based on application, is segmented into personal care & cosmetics, consumer goods, food processing, textiles, paints & inks, healthcare & pharmaceuticals, polymer & plastic additives, and others. The personal care & cosmetics segment dominated the market in 2024 due to the rising demand for natural and sustainable ingredients in beauty and hygiene products. The growing consumer awareness of product safety, coupled with a shift toward eco-friendly and cruelty-free formulations, has spurred the adoption of bio-based raw materials such as oleochemicals in personal care & cosmetics. Fatty acids, glycerin, and specialty esters are integral to the production of skincare, haircare, and makeup products, offering moisturizing, emulsifying, and stabilizing properties. The increasing disposable income in emerging markets and the expanding middle-class population have further fueled the consumption of premium and organic personal care products. Additionally, the rapid growth of e-commerce platforms has made these products more accessible to a global audience, amplifying their demand and contributing to the segment's dominant position in the market.

Oleochemicals Market Regional Analysis

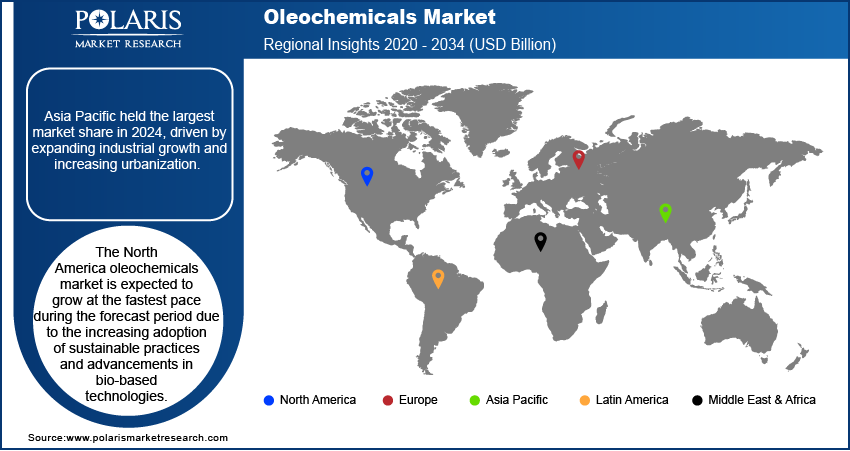

By region, the study provides the oleochemicals market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest oleochemicals market share in 2024, driven by expanding industrial growth and increasing urbanization. Countries such as China, India, and Indonesia have emerged as key contributors to this dominance, with China leading the region due to its extensive manufacturing capacity, abundant raw material availability, and expanding middle-class population. The region’s dominance is further strengthened by the rising demand for personal care products, processed foods, and pharmaceuticals, all of which rely heavily on oleochemicals. Additionally, supportive government policies promoting the use of renewable resources and growing investments in sustainable industries have boosted market growth. The region’s vast agricultural output, particularly palm and coconut oil production in Indonesia and Malaysia, provides a steady supply of raw materials for manufacturing oleochemicals, ensuring it maintains its leadership position in the market.

The North America oleochemicals market is expected to grow at the fastest pace after Asia Pacific during the forecast period due to the increasing adoption of sustainable practices and advancements in bio-based technologies. The region's focus on reducing dependency on petrochemical-based products and adhering to strict environmental regulations has accelerated the shift toward bio-based alternatives such as oleochemicals. The healthcare, personal care, and food processing industries in North America are witnessing the growing incorporation of bio-based materials, further supporting the regional market expansion.

Oleochemicals Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the oleochemicals market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The oleochemicals market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Oleon NV; Godrej Industries; IOI Corporation Berhad; KLK OLEO; Evyap; JNJ Oleochemicals, Incorporated; Sakamoto Yakuhin Kogyo Co., Ltd.; Stepan Company; Pepmaco Manufacturing Corporation; Philippine International Dev.; Vantage Specialty Chemicals, Inc.; Emery Oleochemicals; Evonik Industries AG; Wilmar International Ltd.; Kao Chemicals Global; Ecogreen Oleochemicals; Corbion N.V; and Cargill, Incorporated.

Evonik Industries AG is a prominent global player in the specialty chemicals sector, headquartered in Essen, Germany. Established in 2007 as a result of the restructuring of the RAG Group, Evonik has evolved into one of the largest specialty chemicals companies worldwide, with operations spanning over 100 countries and employing approximately 37,000 people. The company operates through three main business segments: Nutrition & Care, Performance Materials, and Resource Efficiency. Its diverse product portfolio includes surfactants, polymers, resins, and additives that cater to various industries such as agriculture, automotive, pharmaceuticals, and personal care. The company has positioned itself as a leader in oleochemicals, offering sustainable alternatives to traditional petrochemical products. Evonik produces a range of products, including fatty acids, fatty alcohols, and esters, through its oleochemical segment that are essential for applications in personal care products, food processing, and industrial uses.

Ecogreen Oleochemicals is a major global manufacturer of natural fatty alcohols and other oleochemical products, with a strong commitment to sustainability and innovation. Established in 1997 and formerly known as Salim Oleochemicals, the company has its production facilities primarily located in Indonesia, where it operates two major plants. The company specializes in a diverse range of products, including short-chain fatty acids, glycerine, specialty esters, primary fatty amines, and alcohol ethoxylates, catering to various industries such as personal care, food processing, and pharmaceuticals. In October 2023, Ecogreens Oleochemicals Ltd. announced the expansion of its fatty alcohol facility in Batam, Indonesia, by 180,000 tons per year.

List of Key Companies in the Oleochemicals Market

- Oleon NV

- Godrej Industries

- IOI Corporation Berhad

- KLK OLEO

- Evyap

- JNJ Oleochemicals, Incorporated

- Sakamoto Yakuhin Kogyo Co., Ltd.

- Stepan Company

- Pepmaco Manufacturing Corporation

- Philippine International Dev.

- Vantage Specialty Chemicals, Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Wilmar International Ltd.

- Kao Chemicals Global

- Ecogreen Oleochemicals

- Corbion N.V

- Cargill, Incorporated

Oleochemicals Industry Developments

January 2024: Godrej Industries Limited, a manufacturer and marketer of consumer goods and other related products, signed a non-binding Memorandum of Understanding (MoU) with the Gujarat government to invest USD 72.73 million (INR 600 crores) over four years to increase the production capacity of oleochemicals.

June 2023: Oleon NV, a company that specializes in converting vegetable oils and animal fats into oleochemical products, opened a new oleochemical plant in Belgium to produce enzymatic esters for the food and cosmetics industries.

Oleochemicals Market Segmentation

By Product Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Specialty Esters

- Fatty Acid Methyl Ester

- Glycerol Esters

- Alkoxylates

- Fatty Amines

- Others

By Application Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Personal Care & Cosmetics

- Consumer Goods

- Food Processing

- Textiles

- Paints & Inks

- Healthcare & Pharmaceuticals

- Polymer & Plastic Additives

- Others

By Regional Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Oleochemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.87 billion |

|

Market Size Value in 2025 |

USD 27.61 billion |

|

Revenue Forecast by 2034 |

USD 50.20 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in kilotons, Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global oleochemicals market size was valued at USD 25.87 billion in 2024 and is projected to grow to USD 50.20 billion by 2034.

The global market is projected to register a CAGR of 6.9% from 2025 to 2034.

Asia Pacific had the largest share of the global market in 2024.

A few of the key players in the market are Oleon NV; Godrej Industries; IOI Corporation Berhad; KLK OLEO; Evyap; JNJ Oleochemicals, Incorporated; Sakamoto Yakuhin Kogyo Co., Ltd.; Stepan Company; Pepmaco Manufacturing Corporation; Philippine International Dev.; Vantage Specialty Chemicals, Inc.; Emery Oleochemicals; Evonik Industries AG; Wilmar International Ltd.; Kao Chemicals Global; Ecogreen Oleochemicals; Corbion N.V; and Cargill, Incorporated.

The specialty ester segment is projected to witness rapid growth in the coming years.

The personal care & cosmetics segment dominated the market in 2024.