Olive Oil Market Share, Size, Trends & Industry Analysis Report

By Product (Virgin, Refined, Others); By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 115

- Format: PDF

- Report ID: PM2764

- Base Year: 2024

- Historical Data: 2020-2023

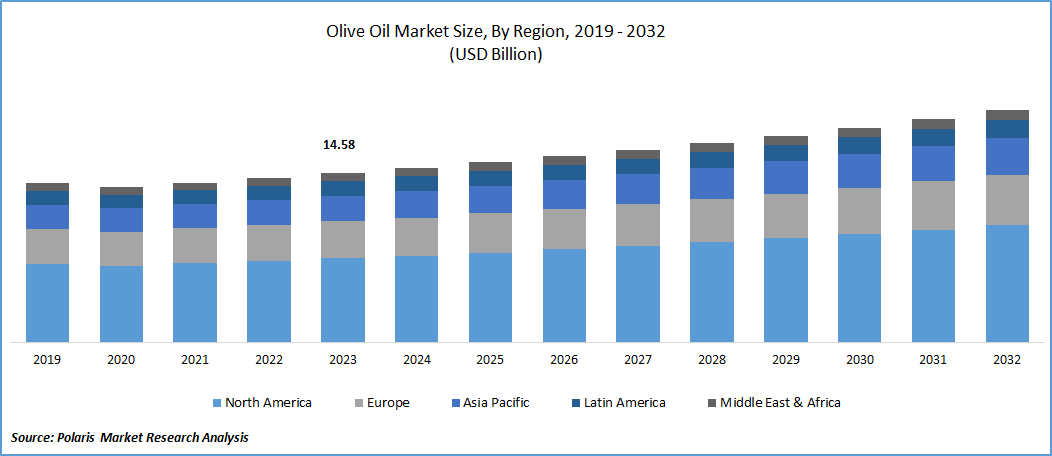

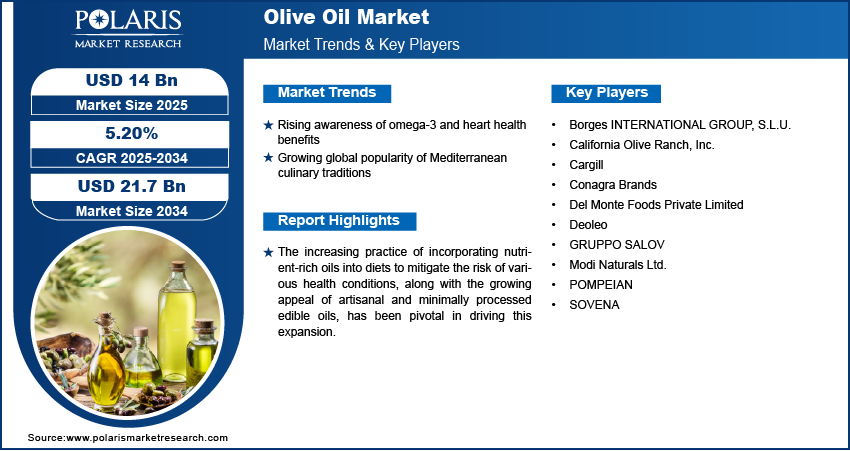

The global Olive Oil Market was valued at USD 13.3 billion in 2024 and is projected to grow at a CAGR of 5.20% from 2025 to 2034. Health benefits associated with olive oil consumption and increased use in Mediterranean-style cooking are supporting steady market demand.

The increasing practice of incorporating nutrient-rich oils into diets to mitigate the risk of various health conditions, along with the growing appeal of artisanal and minimally processed edible oils, has been pivotal in driving this expansion. Consumers are progressively opting for healthier choices, drawn to the distinct qualities and benefits offered by olive oil, thereby substantially contributing to its increased demand.

The demand for olive oil remains consistently strong, driven by various factors. Firstly, consumers show a keen interest in this product due to its numerous health benefits. Olive oil is well-known for its high content of monounsaturated fats and antioxidants, and it has been linked to a reduced risk of cardiovascular diseases, lower cholesterol levels, and overall health improvements. Additionally, it serves as an excellent source of vitamin E and boasts remarkable anti-inflammatory properties.

To Understand More About this Research: Request a Free Sample Report

The market's expansion is mainly driven by the current trend of emphasizing overall health and well-being, prompting a move towards healthier oil selections. Consumers are progressively leaning towards incorporating nutritious vegetable oils into their everyday diets due to the growing incidence of lifestyle-related health conditions.

- For instance, in February 2023, Starbucks launched three new coffee flavors highlighting olive oil as a prominent ingredient. Presently, these coffee varieties are solely accessible in Starbucks outlets throughout Italy, but there are intentions to introduce them globally in the forthcoming months.

Furthermore, the culinary adaptability and unique flavor profile of olive oil establish it as a preferred option for discerning consumers. Serving as a fundamental ingredient in a range of culinary uses, from salad dressings and marinades to sautéing and baking, olive oil elevates the taste and aroma of diverse dishes. Its exceptional qualities contribute a touch of refinement and complexity to culinary creations.

Industry Dynamics

- Growth Drivers

- Growing recognition of the health advantages of the product to drive market growth.

The increasing recognition of the health benefits associated with monounsaturated fats (MUFAs) has driven their demand among consumers. Recent clinical studies have indicated that the consumption of omega-3 enriched products may positively impact cardiovascular health and other bodily functions. The elevated omega-3 content in olive fruit oil has contributed to its popularity as consumers better understand the importance of essential fatty acids for maintaining good health. With its provision of beneficial fatty acids, antioxidants, and vitamins, olive oil has gained significant global acclaim as a healthy oil.

The widespread popularity of ethnic Mediterranean cuisines on a global scale has played a substantial role in the surging demand for olive fruit oil. Its extensive use in various cuisines, including Italian, Greek, and Spanish, has further bolstered its appeal. Additionally, the increase in travel and tourism, along with consumers' willingness to explore new flavors, textures, and exotic cuisines, has provided strong support for the market's performance.

Report Segmentation

The market is primarily segmented based on packaging, type, application, distribution channel, and region.

|

By Packaging |

By Type |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The Refined segment held the largest revenue share in 2024

Refined olive oil offers a more subdued flavor compared to extra virgin olive oil, making it well-suited for various cooking techniques and culinary uses. Its mild taste doesn't overshadow the natural flavors of other ingredients, allowing it to be utilized in sautéing, frying, baking, as well as in salad dressings or marinades.

During the evaluation period, the virgin olive oil segment is anticipated to experience the most rapid growth. Retaining the natural flavors and aromas of olives, virgin olive oil provides a rich and distinctive taste. Its fruity, peppery, and occasionally grassy notes enhance the overall flavor profile of dishes, whether employed for dipping, drizzling, or dressing salads. The distinct taste and aroma of virgin olive oil significantly contribute to its widespread popularity among food enthusiasts and connoisseurs.

By Application Analysis

- The Food & Beverage segment accounted for the highest market share during the forecast period

Olive oil is abundant in heart-healthy monounsaturated fats. Regular consumption of olive oil has been linked to various health advantages, such as a lower risk of heart disease, improved cholesterol levels, and reduced inflammation. As consumers prioritize healthier food choices, incorporating olive oil into food and beverage items aligns with their preference for nutritious ingredients.

The pharmaceuticals segment is expected to experience the fastest CAGR throughout the forecast period. Olive oil's recognition in the pharmaceutical industry is attributed to its function as an excipient—a non-active ingredient that enhances the delivery, stability, and efficacy of active pharmaceutical ingredients (APIs). Its compatibility with various drugs makes it an excellent carrier or solvent in both oral and topical formulations. Olive oil's capacity to dissolve lipophilic compounds and enhance drug bioavailability contributes significantly to its attractiveness in pharmaceutical applications.

Regional Insights

- Europe dominated the largest market in 2024

For generations, olive oil has played an integral role in the Mediterranean diet, especially in countries such as Italy, Greece, and Spain. The culinary customs and cultural legacy of the region have cultivated a profound preference for olive oil in both cooking and gastronomy, resulting in its enduring popularity. European nations are widely acknowledged for producing top-quality olive oil, often distinguished by rigorous quality standards and certifications. The diverse soil compositions, climatic conditions, and varieties of olive cultivars throughout Europe contribute to the creation of a broad spectrum of olive oils, each showcasing distinctive flavor profiles and characteristics. This extensive selection caters to consumers in search of specific flavors or qualities in their preferred olive oil.

North America is currently undergoing a pronounced shift towards health and wellness. This has led to an increased awareness of the health benefits linked to the consumption of olive oil. Moreover, a growing inclination towards plant-based diets and sustainable practices has contributed to a surge in the demand for olive oil. Being a plant-derived product, olive oil aligns with the principles of plant-based eating and sustainable food choices. Consumers who prioritize ethical and environmentally friendly options often choose olive oil as a healthier and more sustainable substitute for other cooking oils, thereby further boosting its consumption in North America.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Borges INTERNATIONAL GROUP, S.L.U.

- California Olive Ranch, Inc.

- Cargill

- Conagra Brands

- Del Monte Foods Private Limited

- Deoleo

- GRUPPO SALOV

- Modi Naturals Ltd.

- POMPEIAN

- SOVENA

Recent Developments

- In March 2025, Wildly Virgin launched four premium small-batch olive oils from Portugal’s 2024 harvest, showcasing unique regional flavors and artisanal craftsmanship, available online and through select North American retailers.

- In July 2022, Genosa, a Spanish company, has revealed the introduction of olive oil enriched with soluble phenol-rich hydroxytyrosol, providing various health benefits and numerous potential applications.

- In June 2022, Certified Origins, a European company focused on delivering fresh and authentic extra virgin olive oils (EVOOs), has introduced a range of carbon-neutral Italian EVOOs under its flagship brand, Bellucci. With a mission to provide high-quality and healthy foods worldwide, the company exclusively sources this premium Italian EVOO from Tuscany, Apulia, and Sicily for international markets.

- In February 2022, Curation Foods, Inc., through its Olive Oil & Vinegars brand, has released a new batch of Olio Nuovo Extra Virgin Olive Oil. This seasonal oil is known for its fresh and robust flavor.

Olive Oil Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 14 billion |

|

Revenue forecast in 2034 |

USD 21.7 billion |

|

CAGR |

5.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Packaging, By Type, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Olive Oil market size is expected to reach USD 21.7 billion by 2034

The top market players in Olive Oil Market Borges INTERNATIONAL GROUP, S.L.U., California Olive Ranch, Inc., Cargill, Conagra Brands

Europe Is contribute notably towards the Olive Oil Market?

The expected to grow at a CAGR of 5.20% during the forecast period billion by 2034

Olive Oil Market report covering key segments are packaging, type, application, distribution channel, and region.