Oncology Information Systems Market Size, Share, Trends, & Industry Analysis Report

: By Product & Services (Software and Professional Services), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 128

- Format: PDF

- Report ID: PM1926

- Base Year: 2024

- Historical Data: 2020-2023

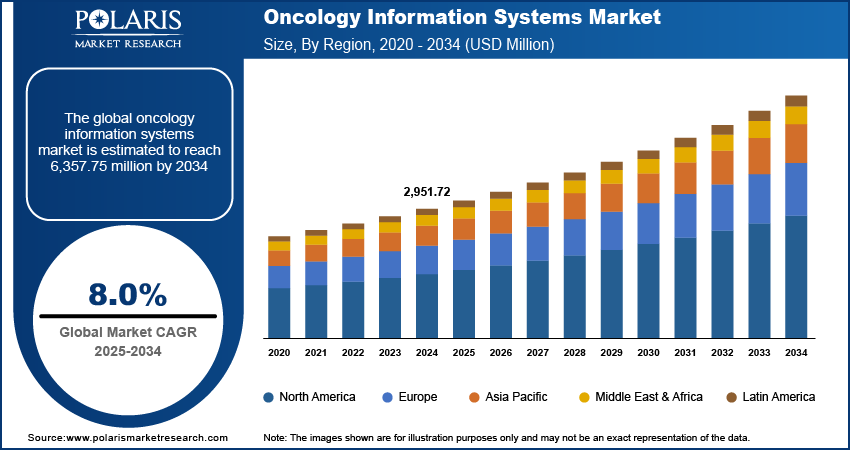

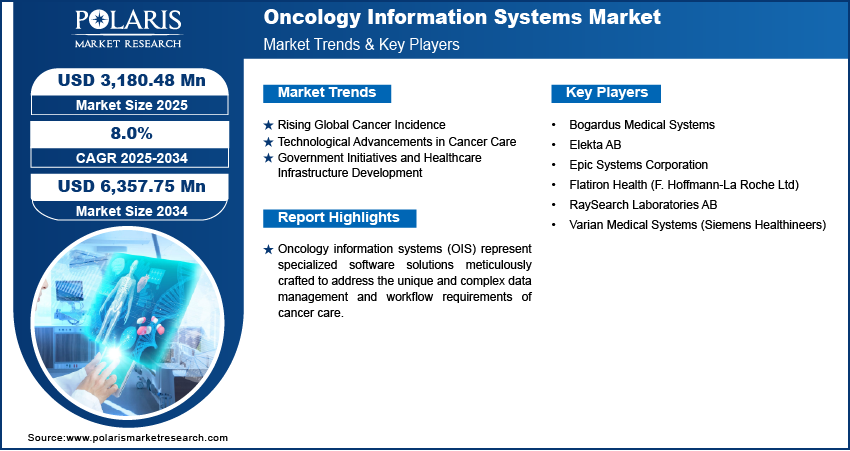

The oncology information systems market size was valued at USD 2,951.72 million in 2024. The market is projected to grow from USD 3,180.48 million in 2025 to USD 6,357.75 million by 2034, exhibiting a CAGR of 8.0% during 2025–2034.

The oncology information systems market is driven by rising cancer prevalence, demand for integrated healthcare IT, advancements in treatment planning, improved patient data management, and government initiatives supporting electronic health record adoption.

Market Overview

Oncology information systems (OIS) are specialized software solutions designed to manage the complex data and workflows associated with cancer care. These systems integrate information from various oncology departments, including medical, surgical, and radiation oncology, to streamline processes and improve the quality of care for cancer patients. OIS manages patient records, treatment plans, clinical workflows, and scheduling, enhancing precision and consistency across oncology departments. The increasing global incidence of cancer, coupled with the growing demand for advanced cancer care solutions, is a significant driver for the adoption of OIS. Healthcare providers are increasingly relying on OIS to enhance treatment planning, improve communication among oncology teams, and ultimately improve patient outcomes.

To Understand More About this Research: Request a Free Sample Report

Several factors are driving the growth. The rising prevalence of cancer globally necessitates efficient data management and treatment planning, fueling the demand for OIS. Advancements in medical imaging and diagnostic technologies require sophisticated information systems for data integration and management. The increasing adoption of electronic health records (EHR) and government initiatives aimed at improving healthcare infrastructure also contribute to growth. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into OIS platforms enhances their capabilities in predictive analytics, treatment planning, and patient monitoring, making them indispensable tools in modern cancer care.

Industry Dynamics

Rising Global Cancer Incidence

The increasing global burden of cancer is a significant driver for oncology information systems. According to the World Health Organization (WHO), in 2022, there were an estimated 20 million new cancer cases and 9.7 million cancer deaths worldwide. This growing prevalence necessitates efficient and sophisticated systems for managing the increasing volume of patient data, treatment complexities, and follow-up care. Oncology information systems play a crucial role in organizing patient information, streamlining workflows, and optimizing resource allocation to handle the rising number of cancer patients. The need for effective data management and improved treatment coordination in the face of escalating cancer cases directly contributes to the demand trends for oncology information systems.

Technological Advancements in Cancer Care

Rapid technological advancements in cancer diagnostics and treatments are fueling the development of oncology information systems. Innovations such as advanced imaging techniques, genomic profiling, and personalized medicine approaches generate vast amounts of complex data that require sophisticated management and integration. A study published in Nature Medicine highlighted the increasing use of multi-omics data in precision oncology, emphasizing the need for robust data management systems to analyze and interpret this information effectively. Oncology information systems provide the necessary infrastructure to integrate diverse data sets, support clinical decision-making, and facilitate the delivery of cutting-edge cancer therapies. Consequently, the continuous evolution of cancer care technologies acts as a significant driver for advanced oncology information systems.

Government Initiatives and Healthcare Infrastructure Development

Government initiatives and investments in healthcare infrastructure worldwide are creating a favorable environment for the growth. Many countries are implementing national cancer control programs and promoting the adoption of electronic health records to improve healthcare delivery. For instance, the National Cancer Institute (NCI) in the United States supports numerous research and infrastructure development projects aimed at enhancing cancer care through improved data management and information technology. Such government support, along with the increasing focus on interoperability and data exchange in healthcare, drives the market demand for oncology information systems that can seamlessly integrate with existing healthcare infrastructure and support national healthcare goals.

Segmental Insights

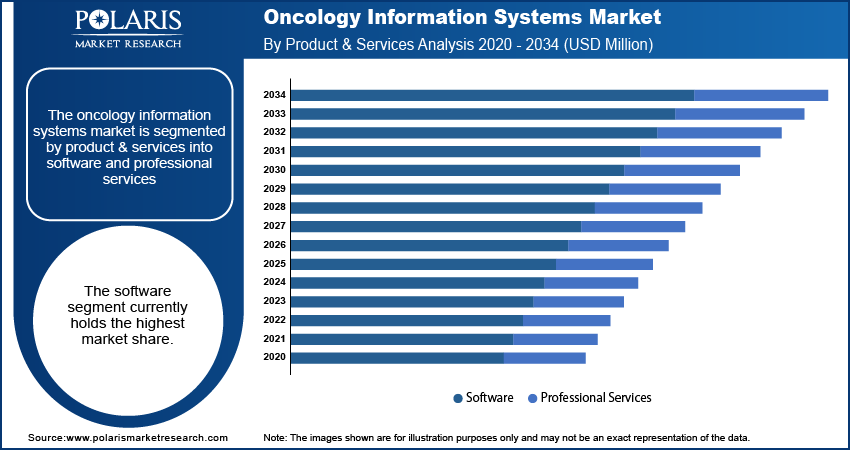

Market Assessment By Product & Service

The software segment holds the highest share during forecast period. This dominance is attributed to the essential role of software solutions in managing the core functionalities of oncology departments. These software systems encompass a wide range of applications, including electronic medical records tailored for oncology, treatment planning tools, scheduling systems, and data analytics platforms. The fundamental need for these tools across various healthcare settings, from hospitals and cancer centers to clinics, underpins the substantial penetration of the software segment.

The professional services segment is anticipated to exhibit the highest growth rate over anticipated years. This growth is driven by the increasing demand for specialized expertise to support the implementation, optimization, and maintenance of OIS software. These services include consulting, system integration, training, and ongoing technical support, which are crucial for healthcare providers to effectively leverage the full potential of their OIS investments. As the complexity of OIS solutions increases, and as healthcare organizations seek to tailor these systems to their specific needs and integrate them with existing infrastructure, the demand for skilled professionals to guide and support these processes will continue to rise, leading to the highest growth rate in the professional services segment.

Market Evaluation By Application

The medical oncology segment holds the largest share in upcoming years. This significant share is primarily due to the central role of medical oncology in the overall cancer treatment landscape. Medical oncology involves the use of chemotherapy, immunotherapy, targeted therapy, and hormonal therapy to treat cancer, often requiring intricate treatment plans, detailed patient monitoring devices, and extensive data management. The widespread application of these systemic therapies across a vast majority of cancer patients necessitates robust oncology information systems to manage patient information, track treatment regimens, schedule appointments, and monitor outcomes. Consequently, the broad scope and high volume of activity within medical oncology contribute to its leading position in terms of share for oncology information systems.

The surgical oncology segment is expected to demonstrate the highest growth rate in the forecast period. This anticipated growth is driven by the increasing adoption of minimally invasive surgical techniques, the rising demand for precise surgical planning, and the need for seamless integration of surgical data with other oncology disciplines. Oncology information systems tailored for surgical oncology can enhance pre-operative planning through advanced imaging integration, optimize surgical workflows, and improve post-operative care coordination. As surgical oncology continues to evolve with technological advancements and a greater emphasis on multidisciplinary care, the demand for specialized OIS solutions to support these complexities will rise, leading to the highest growth rate in this application segment.

Regional Analysis

North America oncology information systems market holds the largest share during forecast period. This dominance can be attributed to the region's sophisticated healthcare infrastructure, the presence of leading healthcare providers, and favorable government regulations promoting the adoption of electronic health records and advanced healthcare IT solutions. Furthermore, the high awareness and acceptance of technology in healthcare settings, coupled with significant healthcare expenditure, contribute to the substantial penetration of oncology information systems across hospitals, cancer centers, and clinics in North America. The focus on improving patient outcomes and the availability of advanced healthcare technologies solidify North America's position as the leading for oncology information systems.

The Asia Pacific oncology information systems market is projected to experience the highest growth rate over the forecast period. This rapid growth is primarily driven by the increasing investments in healthcare infrastructure, rising awareness of the benefits of advanced cancer care management systems, and a growing prevalence of cancer in populous countries like China and India. Additionally, government initiatives to modernize healthcare facilities and promote the adoption of digital health solutions are creating significant opportunities in this region. The confluence of a large patient pool, improving healthcare access, and increasing healthcare spending positions Asia Pacific as the region with the most promising growth prospects for oncology information systems.

Key Players and Competitive Insights

Some of the major active players in the oncology information systems market include Elekta AB, Flatiron Health (F. Hoffmann-La Roche Ltd), RaySearch Laboratories AB, Epic Systems Corporation, Varian Medical Systems (Siemens Healthineers), and Bogardus Medical Systems. These companies offer a range of software and services designed to streamline workflows, manage patient data, and enhance treatment planning in oncology. Their continued presence and development of relevant products underscore their significance in this evolving market.

The competitive landscape is characterized by a mix of established players and emerging innovators. Competition revolves around factors such as the breadth and depth of product offerings, technological innovation, integration capabilities with other healthcare systems, user-friendliness, and customer support. Companies are focusing on developing advanced features like AI-powered analytics, enhanced data interoperability, and personalized medicine support to gain a competitive edge. Strategic collaborations, partnerships, and acquisitions also play a crucial role in shaping the competitive dynamics, as companies strive to expand their market reach and enhance their solution portfolios.

List of Key Companies in Oncology Information Systems Industry

- Bogardus Medical Systems

- Elekta AB

- Epic Systems Corporation

- Flatiron Health (F. Hoffmann-La Roche Ltd)

- RaySearch Laboratories AB

- Varian Medical Systems (Siemens Healthineers)

Oncology Information Systems Industry Developments

- April 2025: Elekta AB announced a partnership with Azra AI to integrate artificial intelligence-powered automation into cancer registry operations. This collaboration aims to streamline the often time-consuming and complex process of cancer data management, improving efficiency and data quality for healthcare providers.

- March 2025: Varian Medical Systems, a Siemens Healthineers company, and Embolx announced a U.S. co-marketing and sales agreement for Embolx's Sniper Balloon Occlusion Microcatheter.

Oncology Information Systems Market Segmentation

By Product & Services Outlook (Revenue – USD Million, 2020–2034)

- Software

- Patient Information Systems

- Treatment Planning System

- Professional Services

By Application Outlook (Revenue – USD Million, 2020–2034)

- Medical Oncology

- Radiation Oncology

- Surgical Oncology

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Oncology Information Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,951.72 million |

|

Market Size Value in 2025 |

USD 3,180.48 million |

|

Revenue Forecast by 2034 |

USD 6,357.75 million |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The oncology information systems market has been segmented into detailed segments of product & services and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: A key growth strategy centers on enhancing interoperability and data integration across diverse healthcare platforms to provide a holistic view of patient data. Market development efforts should emphasize the integration of advanced technologies like artificial intelligence and machine learning to offer predictive analytics and personalized treatment insights. Market penetration can be improved by focusing on cloud-based solutions and subscription models to lower initial costs and increase accessibility for smaller healthcare facilities. Furthermore, strategic partnerships with other healthcare technology providers and a focus on demonstrating tangible improvements in patient outcomes and operational efficiency will be crucial for driving demand trends and fostering growth. Tailoring solutions to meet the specific needs of different oncology sub-specialties will also enhance potential and facilitate deeper penetration.

FAQ's

The global market size was valued at USD 2,951.72 million in 2024 and is projected to grow to USD 6,357.75 million by 2034.

The market is projected to register a CAGR of 8.0% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some of the major players include Elekta AB, Flatiron Health (F. Hoffmann-La Roche Ltd), RaySearch Laboratories AB, Epic Systems Corporation, Varian Medical Systems (Siemens Healthineers), and Bogardus Medical Systems.

The software segment accounted for the larger share of the market in 2024.

Following are some of the trends: ? Integration of Artificial Intelligence (AI) and Machine Learning (ML): AI in oncology and ML are being increasingly integrated into OIS to enhance treatment planning, predict patient outcomes, automate workflows, and improve diagnostic accuracy by analyzing large datasets. ? Cloud-Based Solutions: The adoption of cloud-based OIS platforms is rising due to their scalability, cost-efficiency, accessibility, and enhanced data security features, enabling easier remote access and collaboration. ? Enhanced Interoperability: There is a growing emphasis on improving the interoperability of OIS with other healthcare IT systems like electronic health records (EHR), picture archiving and communication systems (PACS), and laboratory information systems (LIS) to ensure seamless data exchange and a holistic view of patient information.

Oncology information systems (OIS) are specialized software solutions designed to manage the intricate data and operational workflows within oncology departments. These systems serve as central hubs for organizing patient records, treatment plans, scheduling, and other critical information related to cancer care. By integrating data from various oncology disciplines like medical, surgical, and radiation oncology, OIS aims to streamline processes, enhance communication among healthcare teams, and ultimately improve the quality and efficiency of care delivered to cancer patients.