Organ-on-a-Chip Market Size, Share, Trends, Industry Analysis Report

By Product & Services (Products, Services), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 115

- Format: PDF

- Report ID: PM4648

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

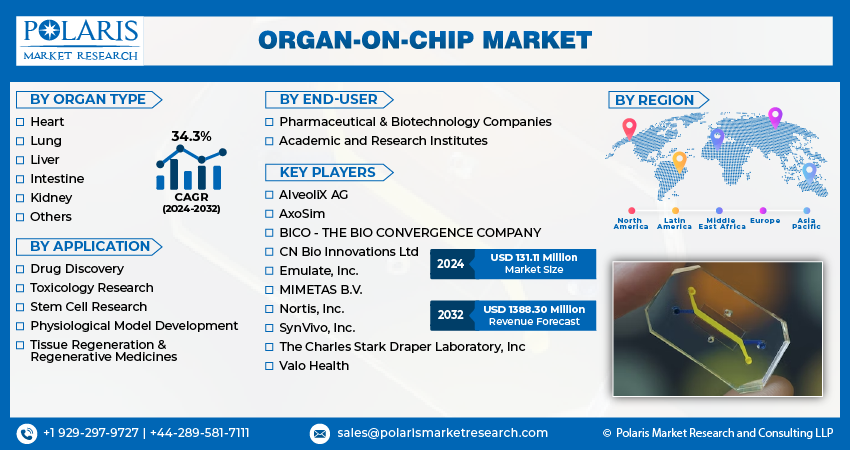

The global organ-on-a-chip (OoC) market size was valued at USD 163.75 million in 2024 and is anticipated to register a CAGR of 34.9% from 2025 to 2034. The growing need for new ways to test drugs and the rising push to reduce the use of animals in research drive the market growth. The technology also benefits from more research and development funding from both private and public groups.

Key Insights

- By product & services, the products segment held the largest share in 2024. This is mainly due to the essential nature of the physical devices, instruments, and consumables that form the foundation of this technology and are crucial for all research and testing applications.

- Based on application, the drug discovery segment held the largest share in 2024. This is because of its critical role in the pharmaceutical industry's efforts to develop new medications more efficiently and reduce the high rate of drug failures in late-stage clinical trials.

- In terms of end use, the pharmaceutical and biotechnology companies segment held the largest share in 2024. Their significant investments in research and development, particularly for improving drug discovery and toxicology screening, drive their leading position in the industry.

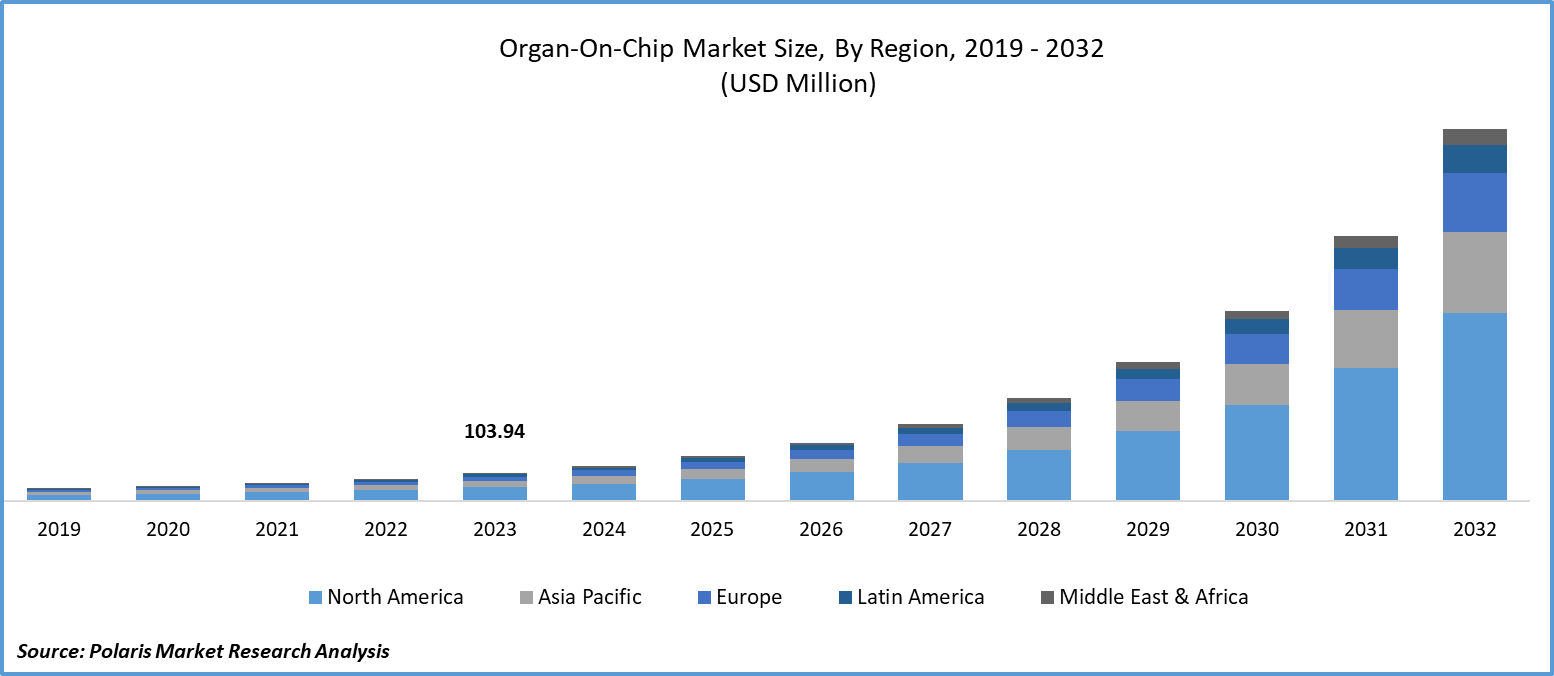

- North America is the leading region in the global market. The region's strong presence of major pharmaceutical and biotechnology companies and its significant funding for research and development are key factors driving its dominance.

Industry Dynamics

- There is a growing need for more accurate methods to test drugs before they are given to people. This technology helps by providing a better way to model human diseases and how the body will respond to new treatments, which can reduce the high rate of drug failures in clinical trials.

- This technology is also being driven by the push for personalized medicines. These devices can use a patient's cells to create a unique model of their organs, allowing doctors to test different drugs to see which treatment will be most effective and safe for that specific person.

- Another important driver is the increasing concerns regarding ethical practices and government rules about using animals for drug and chemical testing. These systems offer a valuable alternative that can replace or reduce the need for animal testing, making research more humane while also providing more relevant human data.

Market Statistics

- 2024 Market Size: USD 163.75 million

- 2034 Projected Market Size: USD 3,262.08 million

- CAGR (2025–2034): 34.9%

- North America: Largest market in 2024

AI Impact on Organ-on-a-Chip Market

- Advancements in AI technology provide improvements for the data processing and design of OoCs.

- The integration of artificial Intelligence (AI) and organs-on-chips (OoCs) is expected to emerge as a key trend that can transform therapeutic development in the future.

- The integration is projected to be used significantly in the development of precision medicine to predict patient-specific drug responses, elucidate disease mechanisms for various patient subgroups, facilitate patient classification, and support decision-making with ML algorithms.

- In drug discovery and development, the AI and OoC integration is expected to enhance efficiency and accuracy, as well as reduce costs, time, and ethical concerns.

The organ-on-a-chip (OoC) landscape is focused on creating microengineered systems that replicate the structure and function of human tissues. These small devices combine cell biology and engineering to provide a more accurate and realistic environment for studying human organs outside the body. This technology aims to provide a more effective way to test drugs and model diseases.

One driver is the rising interest from academic and research institutes. These institutes are using the OoC technology to explore complex biological processes and disease mechanisms in a controlled setting. The ability to use these chips for advanced modeling and to publish research on new applications helps push the science forward, which in turn boosts the growth. The availability of open-source designs and increased collaboration between researchers also contribute to this trend.

Another driving factor is the development of advanced manufacturing techniques such as 3D bioprinting and 3D cell culture. This is making it easier and faster to create complex and customized chips. It allows researchers to build more realistic tissue structures that were difficult to make with older methods, which helps improve the accuracy and usefulness of the technology for various studies. This progress is helping to overcome some of the technical barriers to using these systems more widely.

Drivers and Trends

Demand for Safer and More Effective Drug Discovery: The development of new drugs is a long and expensive process, often with a high failure rate in clinical trials. A major reason for these failures is that traditional methods, such as animal testing, which do not always accurately predict how a drug will work in humans. Organ-on-a-chip technology addresses this issue by providing a more human-relevant testing platform. These chips mimic the physiological environment of human organs, allowing researchers to more effectively screen drug candidates for efficacy and toxicity early in the process. This helps in identifying promising drug candidates faster and weeding out those that are likely to fail, saving significant time and money.

Recent research has highlighted the benefits of this approach. According to an article titled "Organ-on-a-chip platforms for drug development, cellular toxicity assessment, and disease modeling," published in NCBI in 2025, these systems have emerged as a leading tool for testing drug effectiveness and toxicity. This shows how they are being widely adopted to create more reliable results. The ability of these platforms to replicate human-like environments allows for better predictions of how a drug will perform in the human body, reducing the failure rate. The high demand for more reliable drug testing models is a key factor driving the growth.

Push for Alternatives to Animal Testing: For decades, animal testing has been a standard part of drug and chemical safety assessments. However, there are growing ethical concerns and scientific limitations associated with this method. Animal models often fail to replicate human diseases accurately due to species differences in genetics, metabolism, and physiology. This has created a strong push for alternative testing methods that are more humane and produce data that is more relevant to humans. The organ-on-a-chip technology provides a perfect solution by using human cells to create functioning organ models.

Support for this shift can be seen in various government initiatives. According to the GAO report "Human Organ-On-A-Chip: Technologies Offer Benefits Over Animal Testing but Challenges Limit Wider Adoption" from 2025, regulatory agencies are exploring ways to use these technologies to replace or reduce animal testing. The report notes that using human cells in these chips offers a more relevant method than animal testing. The increasing focus from government bodies on using these alternative methods for safety testing is a powerful force pushing the development and adoption of organ-on-a-chip technology.

Segmental Insights

Product & Service Analysis

Based on product & services, the segmentation includes product and services. The product segment held the largest share in 2024. This category includes the microchips themselves, often designed to replicate specific organs such as the liver, lung, or gut, as well as the instruments, software, and consumables needed to operate them. The widespread adoption of these physical devices is a key factor, as they form the fundamental core of the technology and are essential for any research or testing application. Additionally, the growing focus on creating specialized models for particular diseases or organ systems contributes to the value of this segment. This includes a variety of ready-to-use kits and standardized platforms that provide reliable, reproducible results for scientists and researchers. The dominance of products is also fueled by their increasing use in academic settings and pharmaceutical companies, where they are a critical part of lab equipment for early-stage drug discovery and toxicology studies. This continuous demand for the hardware and materials needed for research helps maintain its leading position.

The services segment is anticipated to register the highest growth rate during the forecast period, due to the rising trend of outsourcing complex research and development activities. Many companies, especially smaller biotech firms or academic labs, find it more cost-effective to use the specialized services offered by others rather than investing in the expensive equipment and highly skilled staff required to operate the technology in-house. These services can include custom chip design, advanced testing, data analysis, and technical support. The demand for specialized expertise in using these platforms is high, and service providers offer solutions that can be tailored to specific projects. They allow clients to get detailed, reliable data without the high initial cost and ongoing maintenance of the devices themselves. This shift toward a service-based model, which offers greater flexibility and reduces barriers to entry, is the main reason for the rapid expansion of this segment.

Application Analysis

Based on application, the segmentation includes drug discovery, toxicology research, and others. The drug discovery segment held the largest share in 2024. This application area uses the technology to screen thousands of potential drug candidates in the early stages of research, which is a critical step in identifying which compounds are likely to be safe and effective. By creating more accurate human-like models of organs, these chips provide better data than traditional animal models or basic cell cultures. This helps companies save a lot of time and money by reducing the number of drugs that fail in late-stage clinical trials. The high costs and long timelines associated with traditional drug development make this technology very attractive to large pharmaceutical and biotechnology firms, solidifying its leading position in the industry. The constant need for new treatments for a wide range of diseases ensures that the use of these chips for drug discovery, along with AI in drug discovery, remains the most dominant application.

The toxicology research segment is anticipated to register the highest growth rate during the forecast period, due to a growing demand for more reliable and humane methods for testing the safety of chemicals and new drugs. The technology allows scientists to quickly and accurately determine if a substance is toxic to a specific organ or system by using human cells. This capability is becoming increasingly important as governments and organizations worldwide push for a reduction in animal testing. The need for quicker and more predictive toxicity data in fields such as cosmetics, chemicals, and food safety is expanding the use of these chips beyond just the pharmaceutical sector. This growing demand for a more ethical and accurate way to test for potential harm is a key factor that is driving the rapid expansion of this application area.

End Use Analysis

Based on end use, the segmentation includes academic & research institutes, pharmaceutical & biotechnology companies, and others. The pharmaceutical & biotechnology companies segment held the largest share in 2024. These companies are the primary users of the technology for tasks such as early-stage drug screening, efficacy testing, and toxicology studies. Their main goal is to improve the efficiency and success rate of drug development, and these chips provide a more accurate and human-relevant way to test new drug candidates than older methods. The high financial stakes in bringing a new drug to market and the need to reduce late-stage failures are major factors that compel these companies to adopt the technology. Additionally, a growing number of collaborations between these firms and organ-on-a-chip developers cement their dominance, as they are at the forefront of applying this technology to solve real-world problems in the sector.

The academic and research institutes segment is anticipated to register the highest growth rate during the forecast period. This growth is fueled by a significant increase in government and private funding for research in areas such as biomedical engineering, tissue engineering, disease modeling, and personalized medicine. Academic researchers are using these chips to gain a deeper understanding of human biology and complex diseases, which helps create new ways to use the technology. This segment is also a major source of innovation, as universities and research labs are constantly developing new designs and applications. The continuous flow of research papers, the training of future scientists, and the creation of new startups from these institutions are all key factors driving this rapid growth. This trend suggests that as research expands, the technology will find even more uses and become a standard tool in various scientific fields.

Regional Analysis

The North America organ-on-a-chip market accounted for the largest share in 2024, driven by a strong presence of major pharmaceutical and biotechnology companies. The region's focus on innovation, coupled with significant funding for research and development from both private and public sources, accelerates the adoption of this technology. The growing emphasis on personalized medicine and the need for more efficient and cost-effective drug discovery platforms are key factors driving the market here. A well-established healthcare and research infrastructure also supports the development and use of these advanced systems.

U.S. Organ-on-a-Chip Market Insights

The U.S. is a central hub for the technology, largely due to its robust life sciences sector and supportive regulatory environment. The country is home to a high number of biotechnology startups and major pharmaceutical firms that are actively investing in these systems to enhance their drug development processes. The demand for alternatives to animal testing, driven by both ethical and scientific concerns, is a powerful force pushing the growth forward in the U.S. Additionally, a strong academic research community and the availability of substantial venture capital contribute to a thriving ecosystem for innovation.

Europe Organ-on-a-Chip Market Trends

The market in Europe is growing steadily, supported by strong regulatory frameworks that favor alternative methods over animal testing. This has created a favorable environment for the adoption of organ-on-a-chip technology, particularly in toxicology and drug screening applications. There is a strong network of academic and research institutions collaborating on projects, often with government funding, to advance the science behind these systems. The presence of a mature pharmaceutical industry and a high level of research investment across the region contribute to a positive market outlook.

The Germany organ-on-a-chip market holds a major share in the Europe market. Germany is known for its advanced research infrastructure and strong emphasis on engineering and technology. The country is home to several leading research institutions and a number of prominent pharmaceutical and biotech companies that are key users of this technology. Germany's focus on creating new and more reliable testing methods, combined with a strong push for a reduction in animal testing, positions it as a significant contributor to the regional market's growth and development.

Asia Pacific Organ-on-a-Chip Market Overview

The market in Asia Pacific is expanding rapidly, with a growing number of countries investing in the life sciences and healthcare sectors. This growth is supported by rising government funding for research and development, increasing number of contract research organizations, and a growing focus on building a strong biotechnology sector. The region's large and diverse population also presents a unique opportunity for disease modeling and drug discovery tailored to specific genetic and environmental factors.

Japan Organ-on-a-Chip Market Overview

In Asia Pacific market, Japan is a key country, distinguished by its advanced biomedical research capabilities and strong technological foundation. The country has a long history of innovation in microfluidics and bioengineering, which are core components of this technology. Japanese pharmaceutical companies and academic institutions are increasingly adopting these systems to improve the efficiency and accuracy of their research. This, combined with government support for new research initiatives, helps solidify Japan's position as a significant player in the regional landscape.

Key Players and Competitive Insights

The market is characterized by a competitive landscape with several key players, including Emulate, Inc.; MIMETAS BV; TissUse GmbH; and CN Bio Innovations Ltd. These companies compete on the basis of technological innovation, the range of organ models they offer, and strategic partnerships with pharmaceutical and biotechnology companies. The competition is marked by a focus on developing more complex and predictive multi-organ-on-a-chip systems that can better mimic human physiology. Smaller, specialized companies often focus on niche applications or specific organ models, such as heart-on-a-chip or brain-on-a-chip, to establish a unique position. The competitive strategies also involve offering a combination of products and services, where companies provide chips as well as expertise and analysis needed for complex research.

A few prominent companies in the industry include Emulate, Inc.; MIMETAS BV; TissUse GmbH; CN Bio Innovations Ltd.; InSphero AG; Nortis, Inc.; Hesperos, Inc.; AxoSim, Inc.; Hµrel Corporation; and Tara Biosystems, Inc. (Charles River Laboratories).

Key Players

- AxoSim, Inc.

- CN Bio Innovations Ltd.

- Emulate, Inc.

- Hesperos, Inc.

- Hµrel Corporation

- InSphero AG

- MIMETAS BV

- Nortis, Inc.

- Tara Biosystems, Inc. Charles River Laboratories)

- TissUse GmbH

Organ-on-a-Chip Industry Developments

June 2025: Emulate, Inc. launched its AVA Emulation System, a self-contained platform that combines high-throughput cell culture, environmental control, and real-time imaging for a large number of organ-chip samples.

April 2022: MIMETAS BV became a partner in a large Dutch initiative called the Centre for Animal-Free Biomedical Translation. The project received significant funding to help develop and promote animal-free biomedical innovations.

Organ-on-a-Chip Market Segmentation

By Product & Services Outlook (Revenue – USD Million, 2020–2034)

- Products

- Services

By Application Outlook (Revenue – USD Million, 2020–2034)

- Drug Discovery

- Toxicology Research

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Organ-on-a-Chip Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 163.75 million |

|

Market Size in 2025 |

USD 220.49 million |

|

Revenue Forecast by 2034 |

USD 3,262.08 million |

|

CAGR |

34.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 163.75 million in 2024 and is projected to grow to USD 3,262.08 million by 2034.

The global market is projected to register a CAGR of 34.9% during the forecast period.

North America dominated the share in 2024.

A few key players include Emulate, Inc.; MIMETAS BV; TissUse GmbH; CN Bio Innovations Ltd.; InSphero AG; Nortis, Inc.; Hesperos, Inc.; AxoSim, Inc.; Hµrel Corporation; and Tara Biosystems, Inc. (Charles River Laboratories).

The products segment accounted for the largest share of the market in 2024.

The toxicology research segment is expected to witness the fastest growth during the forecast period.