Organic Personal Care Products Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Hair, Oral, Skincare, and Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM1055

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

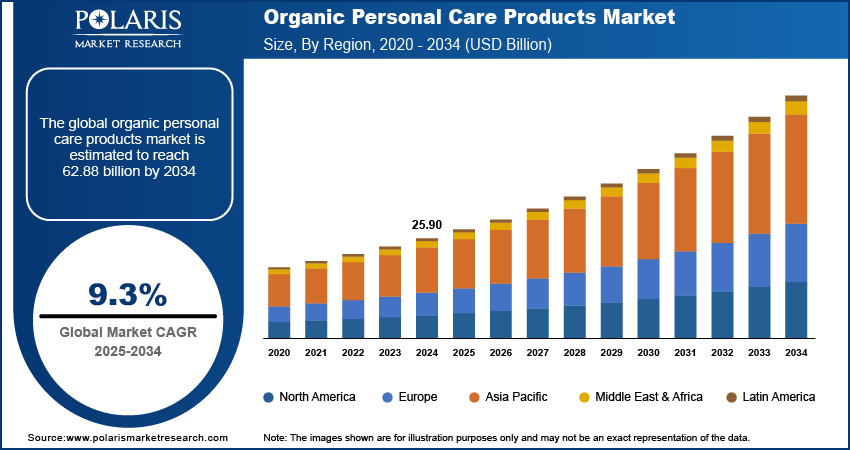

The organic personal care products market size was valued at USD 25.90 billion in 2024. The market is projected to grow from USD 28.25 billion in 2025 to USD 62.88 billion by 2034, exhibiting a CAGR of 9.3% during 2025–2034. The market is driven by rising consumer awareness of health risks, demand for eco-friendly products, strict regulations, and increased availability through e-commerce and retail channels.

Key Insights

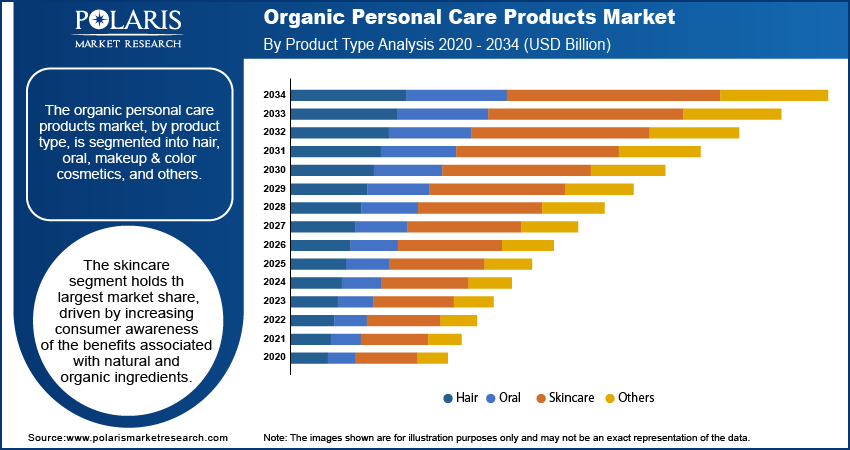

- The skincare segment accounted for the largest market share in 2024.

- The supermarkets & hypermarkets segment held the largest market hare due to them being the primary distribution channel providing the consumers the benefit of physically assessing the commodities before buying.

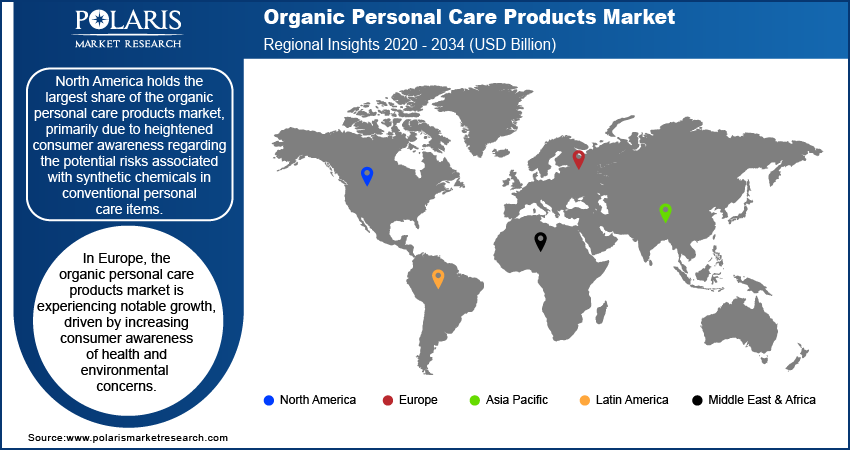

- North America organic personal care products market dominated the market in 2024 due to elevated consumer consciousness in context to probable risks linked with synthetic chemicals in traditional personal care items.

- In Europe, the market is witnessing a sizeable growth because of growing consumer consciousness of health and ecological worries

Industry Dynamics

- The market advancement is notably propelled by growing consciousness amongst consumers in context to probable adverse impacts of synthetic chemicals in traditional personal care items.

- The application of meticulous regulatory standards and certification procedures is pushing the market possibilities.

- The market demand is evolving sizably due to growing consumer consciousness in context to advantages of chemically liberated commodities, growing demand for green eco friendly options and strict regulatory policies.

- High costs and limited shelf life associated with organic care products may hinder market growth.

Market Statistics

2024 Market Size: USD 25.90 billion

2034 Projected Market Size: USD 62.88 billion

CAGR (2025-2034): 9.3%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The organic personal care products market encompasses skincare, haircare, cosmetics, and other personal hygiene products formulated with natural and organic ingredients, free from synthetic chemicals, parabens, and artificial fragrances. The organic personal care products market demand is growing substantially due to rising consumer awareness regarding the benefits of chemical-free products, increasing demand for green, sustainable and eco-friendly alternatives, and stringent regulatory policies promoting the use of organic ingredients. Additionally, the expansion of e-commerce channels has facilitated greater accessibility, enabling consumers to explore a wide range of organic personal care options.

Key drivers of the organic personal care products market growth include the growing preference for clean-label products, increasing disposable income, sustainable manufacturing, and heightened awareness of health concerns related to synthetic ingredients. Regulatory frameworks, such as the USDA Organic and ECOCERT certifications, further drive market demand by ensuring product authenticity and quality. Additionally, the rise of vegan and cruelty-free product preferences, coupled with innovations in organic formulations, contributes to organic personal care products market expansion.

Market Dynamics

Increasing Consumer Awareness and Demand for Natural Products

The organic personal care products market development is significantly driven by the escalating awareness among consumers regarding the potential adverse effects of synthetic chemicals in conventional personal care items. Individuals are increasingly seeking products formulated with natural and organic ingredients to mitigate health risks associated with synthetic additives. This shift is evident in the growing preference for clean beauty products, as consumers become more conscious of product compositions and their impact on health and the environment.

Stringent Regulatory Frameworks and Certifications

The implementation of rigorous regulatory standards and certification processes has been pivotal in propelling the organic personal care products market opportunities. Certifications such as USDA Organic and ECOCERT serve as benchmarks for product authenticity, ensuring that items meet specified organic criteria. These certifications enhance consumer trust and compel manufacturers to adhere to stringent production and sourcing standards. For instance, the European Union's Corporate Sustainability Reporting Directive, introduced in 2021, mandates comprehensive sustainability disclosures from companies, thereby promoting transparency and accountability in the personal care industry. This regulatory emphasis on sustainability and ethical practices has incentivized companies to align their operations with organic and environmentally friendly principles.

Segment Insights

Assessment – By Product Type

The organic personal care products market, by product type, is segmented into hair, oral, skincare, and others. The skincare segment holds the largest share of the organic personal care products market revenue, driven by increasing consumer awareness of the benefits associated with natural and organic ingredients. Consumers are increasingly seeking products that address specific skin concerns such as dryness, aging, and sensitivity, leading to a surge in demand for organic skincare solutions. Manufacturers are responding by developing formulations tailored to various skin types and concerns, incorporating plant-based oils and ingredients known for their efficacy and gentleness. This trend is further supported by the growing millennial demographic, which exhibits a strong preference for organic and natural skincare products, influenced by heightened exposure to social media and a desire for healthier lifestyle choices.

Evaluation – By Distribution Channel

By distribution channel, the organic personal care products market is segmented into supermarkets & hypermarkets, departmental stores, drug stores, brand outlets, online sales, and others. According to the organic personal care products market statistics, the supermarkets & hypermarkets segment held the largest market share. Supermarkets and hypermarkets serve as the primary distribution channels, offering consumers the advantage of physically evaluating products before purchase. These retail environments provide a diverse range of brands and products, often accompanied by promotional offers and discounts, enhancing their appeal to a broad customer base. The visibility and accessibility of organic personal care items in such settings play a significant role in attracting consumers. For instance, major supermarket chains such as Walmart and Tesco have expanded their organic product offerings, reflecting the growing consumer demand for natural and organic personal care products.

Regional Insights

By region, the study provides organic personal care products market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the organic personal care products market, primarily due to heightened consumer awareness regarding the potential risks associated with synthetic chemicals in conventional personal care items. This awareness has led to a significant shift toward organic alternatives perceived as safer and more environmentally friendly. The region's market is further bolstered by the presence of key industry players and a well-established distribution network, facilitating widespread availability of organic products. Additionally, the increasing demand for eco-friendly and sustainable products aligns with the growing preference for organic personal care items among North American consumers.

In Europe, the organic personal care products market is experiencing notable growth, driven by increasing consumer awareness of health and environmental concerns. Consumers are progressively seeking products with natural and organic ingredients, leading to a surge in demand for clean beauty products. The market is characterized by a diverse range of products, including skincare, haircare, and cosmetics, with a significant emphasis on sustainability and ethical sourcing. Companies such as the Burren Perfumery and the Nature of Things in Ireland exemplify this trend, offering natural, sustainable, and cruelty-free products that resonate with environmentally conscious consumers.

The Asia Pacific organic personal care products market is witnessing robust expansion, fueled by rising consumer awareness and preference for natural and chemical-free products. Countries such as Japan and China are at the forefront of this growth. In Japan, consumers prioritize minimalist and clean beauty, favoring products with simple, natural ingredients. The global appeal of J-Beauty, known for its focus on traditional botanical ingredients and gentle formulations, further drives this trend. In China, increasing awareness of clean beauty and ingredient safety, along with government support for sustainable products, has led to a growing demand for natural and organic cosmetics. The expansion of e-commerce platforms has also made these products more accessible to a broader consumer base.

Key Players and Competitive Insights

The organic personal care products market features several prominent companies that have maintained their independence and continue to operate actively. A few notable companies are The Estée Lauder Companies Inc., Revlon Inc., Unilever PLC, Shiseido Company Limited, Mary Kay Inc., The Procter & Gamble Company, L’Oréal S.A., Coty Inc., Beiersdorf AG, and Kao Corporation. Additionally, companies such as The Hain Celestial Group, Inc.; Aubrey Organics, Inc.; Burt's Bees, Inc.; Weleda AG; and Arbonne International, LLC have established significant presences in the market.

These companies have demonstrated resilience and adaptability in the competitive landscape of organic personal care products. For instance, The Estée Lauder Companies Inc. has expanded its portfolio through strategic acquisitions and innovation, enhancing its position in the luxury segment. Similarly, L’Oréal S.A. has invested in research and development to introduce organic and sustainable products, catering to the growing consumer demand for environmentally friendly options. Unilever PLC has focused on integrating sustainability into its business model, emphasizing transparency and ethical sourcing in its product lines.

The competitive dynamics among these companies are shaped by their efforts to differentiate through product innovation, brand positioning, and sustainability initiatives. For example, Burt's Bees, Inc. emphasizes natural ingredients and eco-friendly packaging, appealing to environmentally conscious consumers. Shiseido Company Limited leverages its heritage and expertise in skincare to offer high-quality organic products. Additionally, companies such as Weleda AG and Arbonne International, LLC focus on holistic wellness approaches, integrating organic personal care products into broader health and wellness lifestyles. These strategies reflect the diverse approaches companies employ to capture market share and meet evolving consumer preferences in the organic personal care products market.

The Estée Lauder Companies Inc. is a global manufacturer and marketer of skincare, makeup, fragrance, and hair care products. Founded in 1946 and headquartered in New York City, the company boasts a diverse portfolio of over 20 brands, including Estée Lauder, Clinique, MAC, and La Mer. Its products are sold in approximately 150 countries and territories, catering to a wide range of consumer preferences. The company emphasizes innovation and quality, continually developing new products to meet evolving beauty trends.

L'Oréal S.A., established in 1909 and based in Clichy, France, is one of the world's largest cosmetics and beauty companies. Its extensive brand portfolio encompasses various segments, from luxury to mass market, featuring names like Lancôme, Garnier, Maybelline, and Kiehl's. L'Oréal operates globally, offering products in skincare, haircare, makeup, and fragrance categories. The company invests significantly in research and development, focusing on innovation and sustainability to address diverse consumer needs.

List of Key Companies

- Arbonne International, LLC

- Aubrey Organics, Inc.

- Beiersdorf AG

- Burt's Bees, Inc.

- Coty Inc.

- Kao Corporation

- L’Oréal S.A.

- Mary Kay Inc.

- Revlon Inc.

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

- The Hain Celestial Group, Inc.

- The Procter & Gamble Company

- Unilever PLC

- Weleda AG

Organic Personal Care Products Industry Developments

- June 2025: Unilever announced the signing of an agreement for the acquisition of personal care brand Dr. Squatch. The Dr. Squatch brand is known for its natural personal care products. Unilever stated that the acquisition will expand its portfolio of premium and high-growth spaces.

- April 2025: BASF launched natural-based innovations for personal care at in-cosmetics Global 2025, featuring biodegradable ingredients such as Verdessence Maize, Lamesoft OP Plus, and Dehyton PK45 GA/RA for sustainable solutions.

- December 2024: L'Oréal acquired Gowoonsesang Cosmetics, the parent company of South Korean skincare brand Dr.G, from Swiss retailer Migros.

Organic Personal Care Products Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Hair

- Oral

- Skincare

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Supermarkets & Hypermarkets

- Departmental Stores

- Drug Stores

- Brand Outlets

- Online Sales

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.90 billion |

|

Market Size Value in 2025 |

USD 28.25 billion |

|

Revenue Forecast by 2034 |

USD 62.88 billion |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The organic personal care products market has been segmented into detailed segments of product type and distribution channels. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the organic personal care products market focus on product innovation, sustainability, and digital marketing to expand their consumer base. Many brands emphasize natural and ethically sourced ingredients to appeal to environmentally conscious consumers. E-commerce and social media play a significant role in marketing strategies, with brands leveraging influencer partnerships and targeted digital campaigns to enhance visibility. Strategic collaborations, acquisitions, and geographic expansions help companies strengthen their market presence. Additionally, certifications and eco-friendly packaging initiatives further align with shifting consumer preferences toward clean beauty and sustainable products.

FAQ's

The organic personal care products market size was valued at USD 25.90 billion in 2024 and is projected to grow to USD 62.88 billion by 2034.

The market is projected to register a CAGR of 9.3% during 2025–2034.

North America had the largest share of the market in 2024.

The organic personal care products market features several prominent companies that have maintained their independence and continue to operate actively. A few notable companies are The Estée Lauder Companies Inc., Revlon Inc., Unilever PLC, Shiseido Company Limited, Mary Kay Inc., The Procter & Gamble Company, L’Oréal S.A., Coty Inc., Beiersdorf AG, and Kao Corporation. Additionally, companies such as The Hain Celestial Group, Inc.; Aubrey Organics, Inc.; Burt's Bees, Inc.; Weleda AG; and Arbonne International, LLC have established significant presences in the market.

The skincare segment accounted for the largest share of the market in 2024.

Organic personal care products are skincare, haircare, oral care, and cosmetic products formulated using natural ingredients grown without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs)