Outdoor Air Quality Monitoring System Market Size, Share, Trends, Industry Analysis Report

By Type (Fixed Outdoor Systems, Portable Outdoor Systems), By Component, By Category, By Pollutants, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5910

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

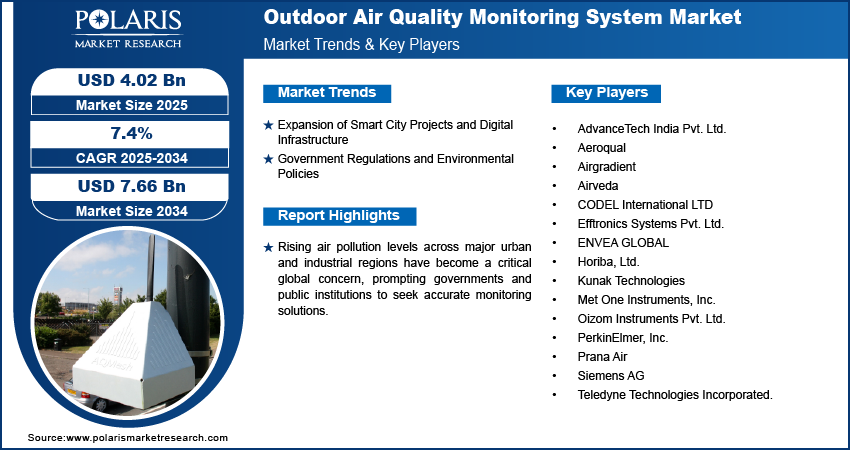

The global outdoor air quality monitoring system market was valued at USD 3.77 billion in 2024 and is expected to register a CAGR of 7.4% from 2025 to 2034. The market growth is driven by the expansion of smart city projects and digital infrastructure and government regulations and environmental policies.

Public awareness about the harmful effects of air pollution is on the rise, propelling the demand for transparent and accessible air quality data. Citizens are using mobile apps, websites, and smart devices to check real-time air quality in their neighborhoods, influencing behaviors such as commuting choices, outdoor activities, and air purifier purchases. This shift in public consciousness is pressuring local governments and businesses to invest in outdoor air quality monitoring solutions that provide open, reliable information. Additionally, community-driven initiatives and advocacy campaigns are playing a pivotal role in growth. In many cities, residents collaborate with environmental groups and academic institutions to deploy localized monitoring systems. This grassroots engagement is improving demand for user-friendly, affordable outdoor monitoring devices and platforms, thereby driving the growth.

To Understand More About this Research: Request a Free Sample Report

Rising air pollution levels across major urban and industrial regions have become a critical global concern, prompting governments and public institutions to seek accurate monitoring solutions. Pollutants such as PM2.5, NO₂, SO₂, and VOCs have been linked to a range of respiratory and cardiovascular illnesses, as well as increased mortality rates. Cities with high traffic congestion, industrial zones, and seasonal environmental issues (e.g., wildfires or crop burning) are witnessing a spike in demand for real-time outdoor air quality data to mitigate health risks. The strong correlation between poor air quality and chronic health conditions is encouraging healthcare professionals, environmental organizations, and policymakers to push for improved air monitoring infrastructure. This growing recognition of air pollution as a public health crisis has led to the development of early warning systems, public dashboards, and community engagement initiatives based on air quality data. These efforts are significantly driving the adoption of outdoor air quality monitoring systems across urban and semi-urban areas, thereby driving the industry growth.

Industry Dynamics

Expansion of Smart City Projects and Digital Infrastructure

The rapid development of smart cities is creating a high demand for integrated environmental monitoring systems. According to Smart America, in 2023 the American city governments planned to invest USD 41 trillion over the next 20 years. Air quality monitoring is a key component of smart urban planning, as it helps cities optimize traffic flow, reduce emissions, and improve residents' quality of life. Smart city platforms increasingly use real-time data from outdoor sensors to automate decision-making, such as adjusting public transport routes or issuing health alerts based on pollution levels. This demand is further supported by advancements in digital infrastructure, including IoT, cloud computing, and AI. These technologies enable remote monitoring, data analytics, and predictive modeling, transforming traditional air quality systems into intelligent networks. The demand for scalable, interconnected outdoor air monitoring solutions rises as smart city investments accelerate globally, thereby driving the industry growth.

Government Regulations and Environmental Policies

Stringent government regulations and global environmental policies on air quality are driving the demand for outdoor air quality monitoring systems. Regulatory authorities such as the U.S. Environmental Protection Agency (EPA), European Environment Agency (EEA), and Central Pollution Control Board (CPCB) in India have mandated continuous ambient air monitoring in polluted regions. These laws require industries and municipalities to install certified air quality monitoring systems to track pollutant levels and ensure compliance with emission limits. In addition to national regulations, participation in international environmental protocols such as the Paris Agreement has compelled countries to improve their air quality management systems. Government-backed programs, such as India’s National Clean Air Programme (NCAP) and China’s Blue Sky Protection Campaign, allocate substantial funding toward deploying outdoor monitoring infrastructure. These initiatives create opportunities for equipment providers, software developers, and service providers.

Companies Sales Area and Product Type

|

Company Name |

Sales Area |

Product Type |

|

Aeroqual |

New Zealand and Global |

|

|

Horiba, Ltd. |

Asia, North America, Europe, and Global |

|

|

PerkinElmer, Inc. |

Asia, Europe, and the Americas |

|

|

Siemens AG |

North America, South America, Europe, Asia, the Middle East, and Africa |

|

|

Teledyne Technologies Incorporated |

Americas, Europe, the Middle East, Africa, and Asia Pacific |

|

|

Prana Air |

India and Global |

|

Segmental Insights

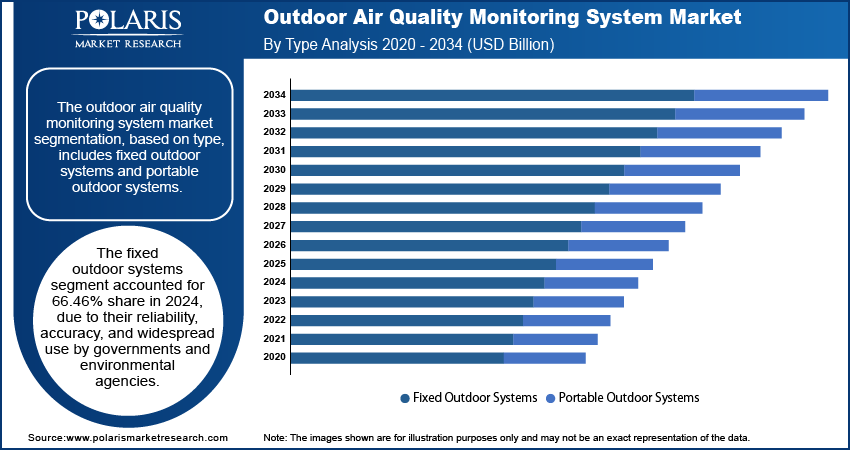

Type Analysis

The fixed outdoor systems segment accounted for 66.46% share in 2024 due to their reliability, accuracy, and widespread use by governments and environmental agencies. These systems are permanently installed at specific locations to continuously monitor pollutants over time. They are used in urban areas, near industrial zones, and along highways to gain real-time data for long-term air quality analysis. Their ability to offer detailed and regulatory-grade data has made them a preferred choice for public health monitoring and policy enforcement, thereby driving the segment growth.

By Component Analysis

The services segment accounted for 19.24% market share in 2024. The segment includes system maintenance, calibration, software upgrades, and data analysis. As more cities and organizations adopt air quality monitoring systems, the demand for professional services to manage, maintain, and interpret data is rising. Many government bodies and private companies prefer outsourcing these tasks to specialized service providers. The growing need for accurate reporting, regulatory compliance, and ongoing support is driving this growth, making services an essential and fast-growing part of the outdoor air quality monitoring ecosystem, thereby driving the segment growth.

By Category Analysis

The ambient air quality monitoring segment accounted USD 1.15 billion in revenue in 2024 due to the increasing global focus on assessing the general environmental air that people breathe daily. This category measures pollutants such as PM2.5, NO₂, SO₂, and CO in outdoor environments, especially in cities and residential zones. Governments use ambient monitoring to track air quality trends, issue health advisories, and ensure compliance with air quality standards. Its broad application across both developed and developing regions contributed to its dominant position, driven by rising public health awareness and stricter environmental regulations.

By Pollutant Analysis

The ozone segment accounted for USD 814.09 million in revenue in 2024, due to its rising levels in many urban environments and its harmful health impacts. Ground-level ozone is a major component of smog and causes respiratory issues, especially in children and the elderly. The need to monitor and manage ozone pollution is becoming urgent with climate change and increasing vehicular emissions, which contribute to higher ozone formation. Governments and environmental organizations are prioritizing ozone detection, especially during summer, which is expected to drive substantial growth in this segment over the coming years.

Regional Analysis

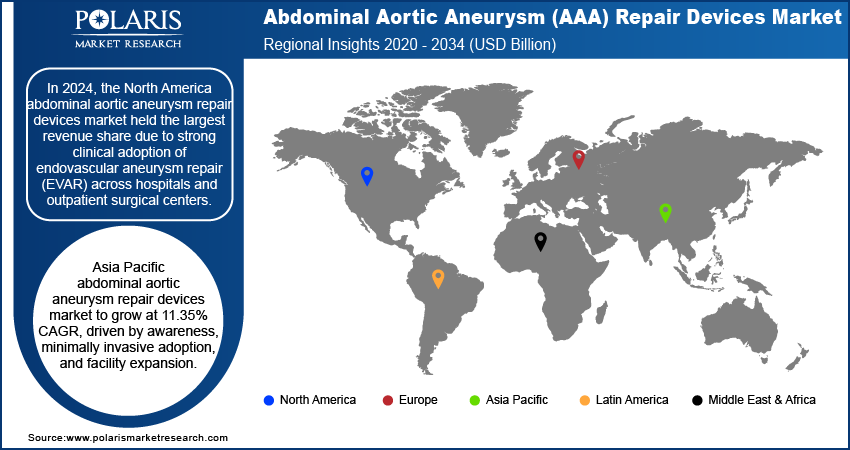

North America Outdoor Air Quality Monitoring System Market Trends

The outdoor air quality monitoring system market in North America accounted for 34.34% global share in 2024 due to strict environmental regulations and growing concerns about pollution-related health issues. Governments and agencies across the region are investing in monitoring infrastructure to track pollutants such as ozone, PM2.5, and nitrogen dioxide in urban centers, industrial zones, and transportation corridors. Additionally, technological advancement and data-driven policymaking further support growth. Public awareness campaigns and pressure from environmental groups are fueling investments in outdoor air quality systems to ensure cleaner air and better public health outcomes, thereby driving industry growth in the region.

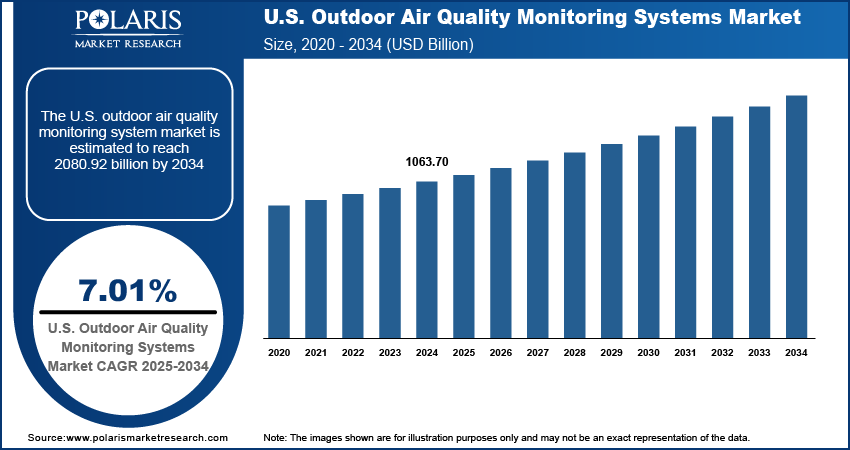

U.S. Outdoor Air Quality Monitoring System Market Assessment

The outdoor air quality monitoring system market in the U.S. is projected to reach USD 2.08 billion by 2034, driven by the Environmental Protection Agency’s (EPA) strong regulatory framework and the Clean Air Act. Major cities and states have established fixed monitoring networks to measure and report air quality in real time. Increased wildfires, urban smog, and vehicle emissions have raised concerns about air pollution, prompting both federal and state-level investments. The U.S. further supports innovation in mobile and remote-sensing technologies, helping local governments and industries meet environmental standards. The demand for advanced monitoring systems is growing, with rising public interest in air quality and climate change, thereby driving the growth.

Asia Pacific Outdoor Air Quality Monitoring System Market Overview

The outdoor air quality monitoring system market in Asia Pacific recorded USD 1.03 billion revenue in 2024, due to rising urbanization, industrial activities, and air pollution levels. Governments of the region, especially in countries such as India, China, and South Korea, are implementing stricter air quality regulations. Public pressure and rising health concerns have led to large-scale investments in monitoring infrastructure. In many cities, poor air quality is now considered a critical public health issue. International funding, along with smart city initiatives, is helping to expand the use of digital monitoring technologies and real-time data platforms to tackle pollution more effectively, thereby driving the growth.

China Outdoor Air Quality Monitoring System Market Analysis

The outdoor air quality monitoring system market in China accounted for 33.56% regional share in 2024, driven by its severe air pollution challenges and aggressive environmental reforms. The Chinese government has launched extensive air quality monitoring programs under its “Blue Sky” initiative, focusing on industrial emissions, coal usage, and urban smog. Cities such as Beijing and Shanghai have comprehensive monitoring networks that include both fixed and mobile systems. China is further investing in AI and big data tools to analyze air quality trends and enforce compliance. The demand for high-performance outdoor air quality monitoring systems is expected to rise in the coming years, as the country prioritizes green development.

Europe Outdoor Air Quality Monitoring System Market Outlook

The outdoor air quality monitoring system market in Europe accounted for a 23.09% share in 2024, driven by the imposition of strict EU regulations such as the Ambient Air Quality Directive. The European Environment Agency (EEA) coordinates comprehensive monitoring efforts across member states, focusing on pollutants such as PM2.5, NO₂, and ozone. Many European cities are investing in smart environmental monitoring as part of climate action and urban sustainability goals. The rise in electric mobility, green infrastructure, and public awareness further supports demand for accurate, real-time air quality data. Funding from the EU and cross-border initiatives further contributes to continuous innovation and deployment of monitoring systems, thereby driving the growth in Europe.

Germany Outdoor Air Quality Monitoring System Market Insights

The outdoor air quality monitoring system market in Germany recorded USD 210.78 million revenue in 2024, driven by a strong regulatory framework and advanced technological infrastructure. The German Environment Agency (UBA) oversees a dense network of fixed monitoring stations across the country, especially in urban and industrial regions. Germany’s focus on reducing traffic emissions and meeting EU air quality standards drives investments in traditional and smart air monitoring systems. Public concern over health impacts from diesel pollution and fine dust has increased pressure on local governments to improve transparency and real-time reporting, thereby driving the growth.

Key Players and Competitive Analysis

The competitive landscape of the outdoor air quality monitoring systems market is characterized by a mix of global giants and regional innovators. Companies such as Siemens AG, Teledyne Technologies, Horiba Ltd., and PerkinElmer Inc. dominate with comprehensive, high-precision monitoring solutions tailored for regulatory compliance and industrial applications. These firms leverage global networks, advanced research and development (R&D), and strong brand presence. Meanwhile, specialized players such as Aeroqual, Met One Instruments, and CODEL International focus on niche technologies and modular systems. In Asia Pacific, especially India, emerging companies such as Airveda, Oizom, Prana Air, Efftronics, and AdvanceTech India are gaining traction through cost-effective, IoT-based, and portable monitoring solutions suited for urban deployment. Airgradient and Kunak Technologies are innovating in compact, wireless sensors with cloud connectivity, targeting smart city and public health projects. Overall, competition is intensifying, driven by regulatory pressures, climate concerns, and increasing demand for real-time, accessible, and scalable monitoring systems worldwide.

Key Players

- AdvanceTech India Pvt. Ltd.

- Aeroqual

- Airgradient

- Airveda

- CODEL International LTD

- Efftronics Systems Pvt. Ltd.

- ENVEA GLOBAL

- Horiba, Ltd.

- Kunak Technologies

- Met One Instruments, Inc.

- Oizom Instruments Pvt. Ltd.

- PerkinElmer, Inc.

- Prana Air

- Siemens AG

- Teledyne Technologies Incorporated

Industry Developments

April 2025: HORIBA STEC KOREA, Ltd., a HORIBA subsidiary that oversees the Group's semiconductor business in South Korea, acquired EtaMax Co., Ltd., a developer, manufacturer, and supplier of wafer inspection systems.

March 2024: Siemens AG reached an agreement to purchase ebm-papst's industrial drive technology (IDT) business. The company employs approximately 650 people and manufactures intelligent, integrated mechatronic systems in the protective extra-low voltage range, as well as unique motion control systems.

May 2024: AirGradient announced that it is collaborating with The International Centre for Integrated Mountain Development (ICIMOD) to test air quality monitors in high-altitude habitats of the Hindu Kush Himalaya Mountain range.

Outdoor Air Quality Monitoring System Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Fixed Outdoor Systems

- Portable Outdoor Systems

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Category Outlook (Revenue, USD Billion, 2020–2034)

- Industrial Perimeter

- Industrial Hygiene

- Ambient Air Quality Monitoring

- Construction Site Monitoring

- Smart City Air Monitoring

- Others

By Pollutants Outlook (Revenue, USD Billion, 2020–2034)

- Nitrogen Oxides

- Carbon Compounds

- Ozone

- Hydrogen Sulfide (H₂S)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Outdoor Air Quality Monitoring System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.77 Billion |

|

Market Size in 2025 |

USD 4.02 Billion |

|

Revenue Forecast by 2034 |

USD 7.66 Billion |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.77 billion in 2024 and is projected to grow to USD 7.66 billion by 2034.

The global market is projected to register a CAGR of 7.4% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AdvanceTech India Pvt. Ltd.; Aeroqual; Airgradient; Airveda; CODEL International LTD; Efftronics Systems Pvt. Ltd.; ENVEA GLOBAL; Horiba, Ltd.; Kunak Technologies; Met One Instruments, Inc.; Oizom Instruments Pvt. Ltd.; PerkinElmer, Inc.; Prana Air; Siemens AG; and Teledyne Technologies Incorporated.

The fixed outdoor system segment dominated the market share in 2024.

The ozone segment is expected to witness the fastest growth during the forecast period.