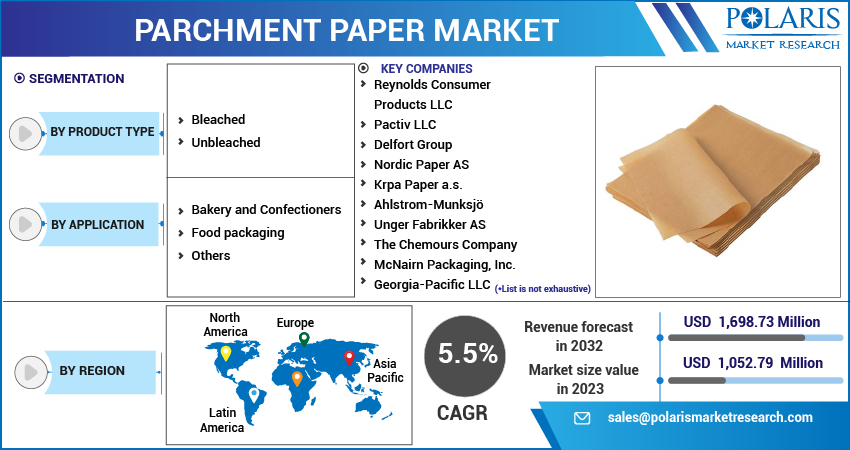

Parchment Paper Market Share, Size, Trends, Industry Analysis Report

By Product Type (Bleached, and Unbleached); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 116

- Format: PDF

- Report ID: PM3524

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

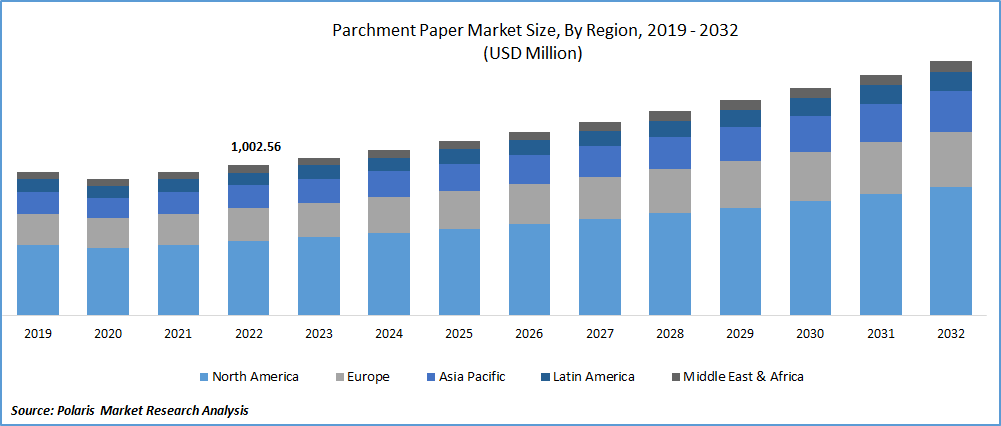

The global parchment paper market was valued at USD 1,002.56 million in 2022 and is expected to grow at a CAGR of 5.5% during the forecast period. The demand for parchment paper from the food service industry has recently increased, as it is widely used for packaging, cooking, and baking. With the growing trend of takeout and delivery services, there has been a surge in demand for parchment paper products in the food service industry. For instance, in 2022, Reynolds Consumer Products launched its Reynolds Kitchens Quick Cut Plastic Wrap and Parchment Paper Dispenser, designed for the food service industry.

To Understand More About this Research: Request a Free Sample Report

The dispenser allows for easy dispensing of plastic wrap and parchment paper, making it an ideal solution for busy commercial kitchens. Similarly, in 2021, Delfort Group launched its DelfortFresh product line, including parchment paper products designed to improve food safety and freshness in the food service industry. The products are coated with a natural antimicrobial agent that helps to prevent the growth of bacteria and other microorganisms, which is important for maintaining food safety standards.

Parchment paper, also known as baking paper or bakery release paper, is a cellulose-based paper treated with a non-stick coating on both sides. It is commonly used in baking and cooking as a convenient and versatile food preparation and presentation tool. Parchment paper is heat-resistant, moisture-resistant, and grease-resistant, making it an ideal choice for lining baking sheets, pans, and trays. It can also be used to wrap and store food and make piping bags and cooking pouches. Parchment paper is available in various sizes and thicknesses to meet culinary needs. It is widely used in both commercial and household kitchens around the world.

The COVID-19 pandemic has had a significant impact on the parchment paper market. While the demand for parchment paper from the food service industry has increased due to the growing trend of home cooking and baking, the closure of restaurants and bakeries during lockdowns has reduced demand from these sectors. Moreover, the disruption of global supply chains has led to an increase in the price of raw materials and transportation costs, which has further impacted the parchment paper market. On the other hand, the pandemic has also led to increased health consciousness and a shift towards sustainable and eco-friendly packaging solutions, which has benefited the parchment paper market.

Several companies in the parchment paper market have taken steps to adapt to the challenges posed by the pandemic. For instance, Georgia-Pacific, a leading player in the market, has ramped up its parchment paper production to meet the increased demand from the home baking segment. The company has also implemented safety measures in its facilities to ensure the well-being of its employees. Similarly, Nordic Paper, another major player in the market, has focused on maintaining its supply chain and ensuring the availability of its products to customers. The company has also continued its sustainability efforts, such as using renewable energy sources and reducing its carbon footprint.

For Specific Research Requirements, Speak With a Research Analyst

Industry Dynamics

Growth Drivers

Rising health consciousness has impacted the market’s growth in recent years. Companies like Reynolds Consumer Products and If You Care LLC have capitalized on this trend by offering eco-friendly and non-toxic parchment paper products. In addition, implementing strict environmental laws on the usage of non-biodegradable packaging materials has led to bakeries, restaurants, and food delivery services adopting parchment paper. For example, KFC in India has replaced its plastic packaging with biodegradable alternatives, including parchment paper. This trend is expected to continue, especially in China and India, where the food service sector is accelerating.

Moreover, the increasing concern over plastic pollution is also expected to drive demand for biodegradable options. Restaurants are utilizing parchment paper as a unique marketing tool by printing their logos on the paper, highlighting the growing trend of using parchment paper for branding and promotional purposes.

Report Segmentation

The market is primarily segmented based on product type, application, and region.

|

By Product Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The unbleached segment is expected to witness the largest growth in 2022

Unbleached parchment paper held the largest market share in 2022 and is expected to grow at a CAGR during the forecast period. Unbleached parchment paper is gaining popularity due to its eco-friendliness and safety features. Many companies focus on developing and offering unbleached parchment paper to meet the increasing demand for sustainable and safe packaging solutions. For instance, If You Care, a leading brand offers unbleached and chlorine-free parchment paper.

The brand claims that its parchment paper is non-toxic, environmentally friendly, and safe for use in food packaging. Similarly, Reynolds Consumer Products, a global leader in consumer products, offers unbleached parchment paper that is compostable and made from responsibly sourced wood fibers. The brand promotes its parchment paper as a sustainable and safe option for baking and cooking purposes. Other key players in the market also focus on offering eco-friendly and safe options to cater to the changing consumer demands.

The bakery and Confectioners segment accounted for the significant market share in 2022

The baking and confectionery industry is expected to hold a significant market share. Changes in lifestyle and dietary patterns directly impact the demand for bakery goods, which drives the demand for parchment paper as it resists oil and is non-stick, ensuring the quality of food items. This leads to steady growth of the confectionery and bakery industry in the global market. Furthermore, the market operations of various companies are expected to advance the industry.

For instance, in 2020, Nordic Paper initiated a campaign aimed at professional bakers who are selective about the materials they use in their baked goods. Many baking sheets contain fluorochemicals that could transfer to baked goods. The campaign, carried out in collaboration with the National Swedish Baking Team, successfully promoted sales of unbleached parchment paper throughout Europe, meeting the demand for safe and hygienic food packaging solutions in the baking industry.

The demand in Asia Pacific is expected to witness significant growth over the projected period

The Asia Pacific region is expected to have the fastest-growing market for parchment paper during the forecast period. This is due to the increasing demand for convenience products from end-use industries such as baking & confectionery, which is driving the growth of the market in emerging economies like China and India. For instance, the Indian food service industry is rapidly growing, leading to a rise in demand for paper packaging solutions such as parchment papers.

Additionally, the increasing consumption of packed foods due to the population surge is directly impacting the growth of the market in the region. Moreover, key food and food services players in the region are transitioning from clamshell products to sustainable parchment paper to reduce their carbon footprint. For example, food and beverage giant Nestle India has shifted from plastic to parchment paper packaging for its confectionery products.

In North America is expected to experience growth due to the increasing demand for safe and hygienic food packaging solutions that comply with stringent food safety regulations. Parchment paper is being widely used by end-users in the region to transport food products because it can help maintain the quality of the food products for a longer period. For instance, the bakery chain Panera Bread uses unbleached parchment paper to wrap its bakery products, ensuring their freshness during transportation. Moreover, parchment paper is the preferred choice for exporting confectionery products in bulk across the globe. For example, the confectionery company Hershey's uses parchment paper to wrap its chocolate products during transportation to ensure their quality and freshness.

Competitive Insight

Some of the major players operating in the global market include Reynolds Consumer Products, Pactiv LLC, Delfort Group, Nordic Paper, Krpa Paper, Ahlstrom-Munksjö, Unger Fabrikker, Chemours Company, McNairn Packaging, Georgia-Pacific, Essity Aktiebolag, Fripa Papierfabrik Albert Friedrich, Metsa Board Corporation, Torraspapel, Dispapali.

Recent Developments

- In September 2022, Nordic Paper obtained compost certification for its baking papers after a three-year process in collaboration with the testing institute TUV. The certification confirms that the papers are biodegradable, do not contain harmful substances, and can be composted in both industrial and home settings.

- In January 2022, Batory Foods announced a partnership with paper manufacturer Schweitzer-Mauduit International (SWM) to distribute its new line of parchment paper products in the United States. The new line, DeliWrap, is designed for Delis and food service operations and features a proprietary coating that improves grease resistance.

Parchment Paper Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,052.79 million |

|

Revenue forecast in 2032 |

USD 1,698.73 million |

|

CAGR |

5.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Application; By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Reynolds Consumer Products LLC, Pactiv LLC, Delfort Group, Nordic Paper AS, Krpa Paper a.s., Ahlstrom-Munksjö, Unger Fabrikker AS, The Chemours Company, McNairn Packaging, Inc., Georgia-Pacific LLC, Essity Aktiebolag (publ), Fripa Papierfabrik Albert Friedrich KG, Metsä Board Corporation, Torraspapel S.A., Dispapali S.r.l. |

FAQ's

The global parchment paper market size is expected to reach USD 1,698.73 million by 2032.

Key players in the parchment paper market are Reynolds Consumer Products, Pactiv LLC, Delfort Group, Nordic Paper, Krpa Paper, Ahlstrom-Munksjö.

Asia Pacific contribute notably towards the global parchment paper market.

The global parchment paper market is expected to grow at a CAGR of 5.5% during the forecast period.

The parchment paper market report covering key segments are product type, application, and region.