Pea Protein Market Share, Size, Trends & Industry Analysis Report

By Form (Wet, Dry); By Source; By Product; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM1859

- Base Year: 2024

- Historical Data: 2020-2023

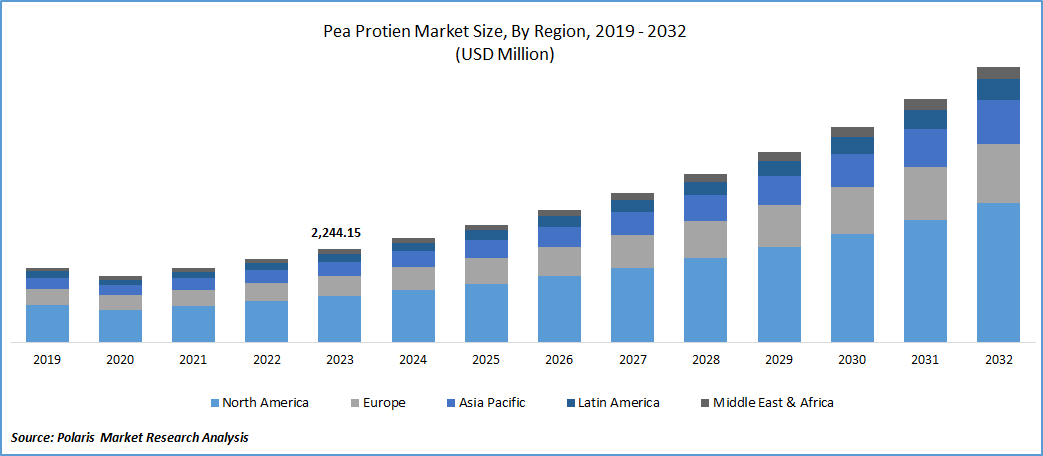

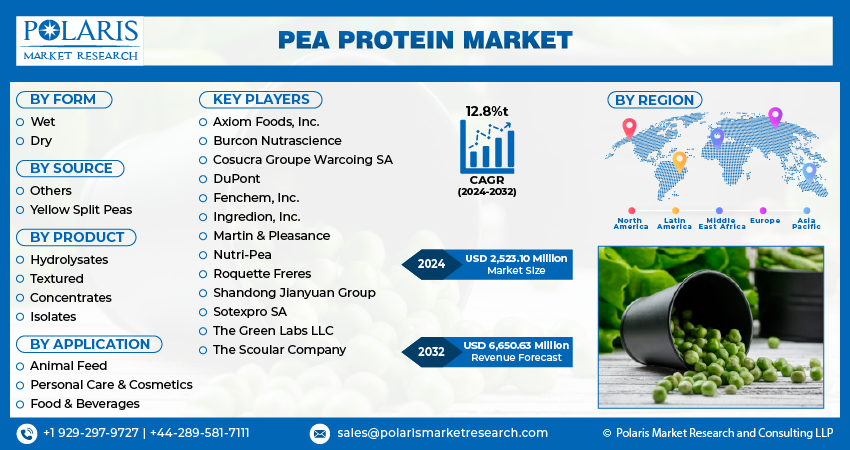

The global pea protein market was valued at USD 2.8 billion in 2024 and is anticipated to grow at a CAGR of 15.20% from 2025 to 2034. Growth is driven by increasing demand for plant-based nutrition and allergen-friendly protein sources.

Projected demand growth is driven by factors such as the rise in plant-based protein demand, health and fitness trends, and the expanding vegan and vegetarian population. Pea protein's versatility, offering functional properties like texture enhancement, emulsification, and foaming, has further expanded its market potential. Additionally, the market is anticipated to benefit from ongoing product innovations in manufacturing, catering to specific functions such as energy balance, muscle repair, weight loss, and satiety.

The research report offers a quantitative and qualitative analysis of the Pea Protein market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The protein is sourced from various pea varieties, including green, dry, and chickpeas, offered in concentrates, textured, and isolated forms. Derived from plant-based origins, these products are well-suited for consumers adhering to non-toxic, vegan diets, non-allergenic, and easily digestible qualities with broad applications in beverages, meat substitutes, dietary supplements, and bakery items. The growing emphasis on a flexitarian diet, driven by concerns about the cardiovascular impacts linked to red meat consumption, is anticipated to favor market expansion. Additionally, heightened awareness regarding the adverse effects of gluten- and lactose-containing foods is expected to contribute significantly to product demand in the coming years.

To Understand More About this Research:Request a Free Sample Report

Moreover, the rising consumption of protein-fortified functional foods is expected to boost product demand. The escalating demand for protein supplementation in food items has led to the introduction of new products by various food and beverage companies, positively influencing market growth.

For instance, in December 2021, Tiptoh, a pioneering start-up based in Belgium, partnered with Olympia Dairy and SIG to introduce a fresh lineup of pea protein beverages in the Belgian market.

Additionally, the increasing awareness regarding the consumption of protein powder for enhancing bone health and muscle growth is anticipated to contribute to market growth throughout the forecast period.

Industry Dynamics

Growth Drivers

Increasing Demand Driven by the Rising Population of Vegans in European Nations

The expanding vegan community in European nations, driven primarily by environmental and health considerations, is poised to boost market growth. With a preference for plant-based protein-fortified products to meet their protein needs, the growing vegan population plays a key role. Livestock farming and meat processing contribute significantly to greenhouse gas emissions, necessitate extensive feedstock, and demand agricultural land, pesticides, and water. Given the sustainability challenges linked to livestock production, an increasing segment of the population in the region is opting for a vegan diet.

Moreover, health concerns related to the high-fat content and cholesterol in meat, leading to issues like heart diseases and cancer, contribute to the rising adoption of a vegan diet. Additionally, concerns about animal cruelty, the proliferation of vegan alternatives to meat products, and the growing impact of veganism on social media are among the factors contributing to the expansion of the vegan population in Europe. Processed food manufacturers are increasingly incorporating plant-sourced ingredients to cater to the growing vegan demographic, thus further fueling the growth of the pea protein market.

Report Segmentation

The market is primarily segmented based on form, product, source, application, and region.

|

|

|

|

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

The Isolates Segment Held the Largest Revenue Share in 2024

Isolates find extensive application as nutritional supplements in meat products, fruit mixes, energy drinks, and bakery items, given their favorable emulsification and non-allergenic properties. Anticipated growth in the sports nutrition sector, particularly in developed countries such as the U.S., Germany, and the UK, driven by the introduction of new products like Amway and Cadbury in the energy mix segment, is likely to boost product demand. Likewise, in October 2022, Roquette launched an organic pea protein isolate range, aligning with the growing demand for organic and plant-based alternatives.

Pea protein concentrates are anticipated to witness significant growth with a high CAGR. The demand for these concentrates in weight control and dietary supplements is propelled by attributes such as effective emulsification and high digestibility. Moreover, there is a gradual integration of these concentrates into bakery products like cakes and pastries to augment flavor and impart a dry texture. The strong manufacturing presence of bakery products in countries such as Germany and France, benefiting from proximity to equipment producers and easy access to raw materials like wheat and rice, is expected to contribute to an expanded application of concentrates in the coming years.

Textured pea protein plays a pivotal role as a texturing agent in a variety of food products, including meat items, baked goods, and confectionery. Its fibrous content enhances its potential application in energy powders and fruit juice blends. The functional, sustainable, versatile, and nutritionally rich profile of textured pea protein makes it a suitable ingredient for the development of meat analogs or extenders.

By Form Analysis

The Dry Segment Accounted for the Highest Market Share During the Forecast Period

Due to its heightened protein concentration, enhanced functionality, extended shelf life, and convenient handling and storage, pea protein, when processed using dry methods to create concentrates and isolates, results in a more concentrated protein product. This characteristic makes it highly appealing to both manufacturers and consumers seeking efficient protein sources. The powdered form of dry pea protein enables seamless integration into various food applications without compromising texture or taste, and its low moisture content ensures prolonged shelf life and stability. Additionally, its ease of handling and storage, along with its clean label appeal and alignment with the growing demand for plant-based protein alternatives, has firmly established its market dominance.

Expected to undergo the swiftest CAGR, wet pea protein preserves more of the natural properties and characteristics of whole peas, appealing to consumers in search of minimally processed and whole food options. The processing methods for wet pea protein also offer potential cost benefits in comparison to the production of dry pea protein. Typically involving simpler extraction techniques, the wet process leads to reduced production costs. The inauguration of Pésol Pea, Spain's inaugural wet textured protein plant in 2021, signifies a significant stride in the wet pea protein industry.

Regional Insights

North America Dominated the Largest Market in 2024

Propelled by strong consumer demand for plant-based products, a flourishing food and beverage industry, and ample agricultural resources in the form of yellow split peas, the U.S. pea protein market is experiencing significant expansion. A 2021 survey conducted by Sprouts Farmers Market highlights the increasing popularity of plant-based diets and meat alternatives in the U.S., with nearly half of Americans (47%) identifying as flexitarians and opting for plant-based meals over meat. Key industry participants like Nutri-Pea, Burcon, and Roquette have significantly contributed to improving the availability and quality of pea protein in the U.S. market. Furthermore, the implementation of Benson Hill's advanced yellow pea breeding and commercialization program in August 2021 has further strengthened the U.S. pea protein industry. Led by Benson Hill, a Missouri-based food tech company, this initiative seeks to drive growth in the alternative protein sector by developing superior yellow pea varieties and introducing them to the market.

The Asia Pacific pea protein sector is poised for rapid growth, driven by the increasing population and evolving dietary preferences. Opportunities for incorporating pea protein into a variety of products have arisen due to the expanding food and beverage industry in countries such as China, India, and Australia.

Moreover, the China pea protein market has established dominance in the Asia Pacific region, capitalizing on the expanding plant-based market and addressing allergen challenges linked to mainstream ingredients. The pea protein industry in India is projected to experience the fastest Compound Annual Growth Rate (CAGR), fueled by substantial demand from the food and beverages sector, especially in bakery and snacks.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Axiom Foods, Inc.

- Burcon Nutrascience

- Cosucra Groupe Warcoing SA

- DuPont

- Fenchem, Inc.

- Ingredion, Inc.

- Martin & Pleasance

- Nutri-Pea

- Roquette Freres

- Shandong Jianyuan Group

- Sotexpro SA

- The Green Labs LLC

- The Scoular Company

Recent Developments

- In July 2024, Ingredion launched VITESSENCE® Pea 100 HD, a pea protein optimized for cold-pressed bars. This new solution maintained softness, improved texture, and boosted nutritional value, offering a superior snacking experience with enhanced consumer preference.

- In June 2023, Cosucra disclosed securing a 45 million Euro investment from Wallonie Entreprendre, Sofiprotéol, and the SFPIM (Société Fédérale de Participations et d’Investissement). This financial infusion aims to facilitate the company in executing its energy transition strategy and substantially enhancing its production capacity.

- In May 2023, Burcon NutraScience unveiled the expansion of its protein development and innovation business, offering services like pilot plant processing and scale-up validation to its customers and partners. The Winnipeg Technical Centre, spanning 10,000 sq. ft, is equipped with a laboratory and pilot-scale production area, utilizing advanced commercial processing equipment to facilitate comprehensive product development.

- In March 2023, Nepra Foods disclosed a manufacturing and distribution collaboration with Scoular for specialized plant-based products. In this partnership, Nepra will contribute its R&D expertise to develop new products, incorporating specialty ingredients from both companies. Scoular, leveraging its robust supply chain network, will actively promote Nepra's products.

Pea Protein Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 3.23 billion |

|

Revenue forecast in 2034 |

USD 11.5 billion |

|

CAGR |

15.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Form, By Product, By Source, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

Pea Protein Market Size Worth $11.5 Billion By 2034 .

The top market players in Pea Protein Market are include Axiom Foods, Inc., Burcon Nutrascience, Cosucra Groupe Warcoing SA, DuPont

North America is the region contribute notably towards the Pea Protein Market.

The global Pea Protein market is expected to grow at a CAGR of 15.20% during the forecast period.

Pea Protein Market report covering key segments are form, product, source, application, and region.