Pediatric Diabetes Therapeutic Market Size, Share, Trends, & Industry Analysis Report

By Type (Type 1, Type 2), By Therapy, By Route of Administration, By Application, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6054

- Base Year: 2024

- Historical Data: 2020-2023

Overview

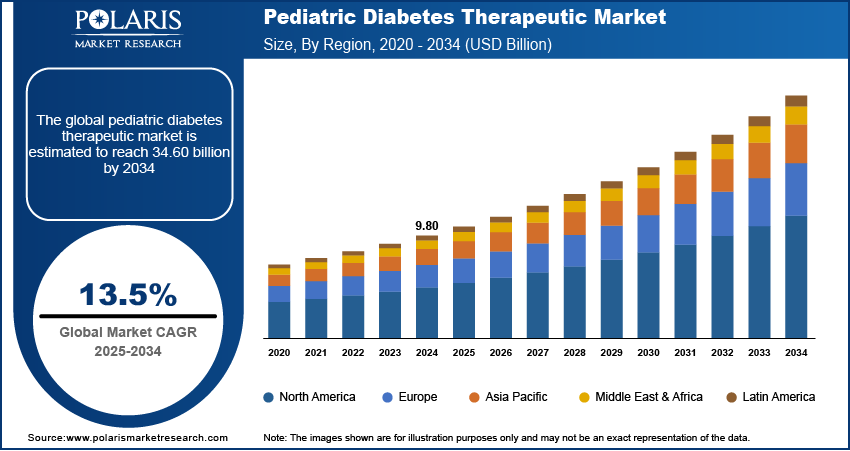

The global pediatric diabetes therapeutic market size was valued at USD 9.80 billion in 2024, growing at a CAGR of 13.5% from 2025–2034. Rising incidence of type 1 diabetes in children coupled with the growing use of remote monitoring and digital therapeutics is driving demand for personalized and continuous diabetes management solutions tailored for pediatric patients.

Key Insights

- The type 1 segment accounted for largest revenue share in 2024, due to its high prevalence in pediatric populations globally.

- The insulin therapy segment accounted for largest revenue share in 2024, owing to its critical role in type 1 diabetes management and expanding use in advanced pediatric type 2 cases.

- The parenteral segment held the largest revenue share in 2024, due to its widespread use in delivering insulin for pediatric type 1 diabetes.

- The insulin segment accounted for largest revenue share in 2024, owing to its essential use in all pediatric type 1 diabetes cases.

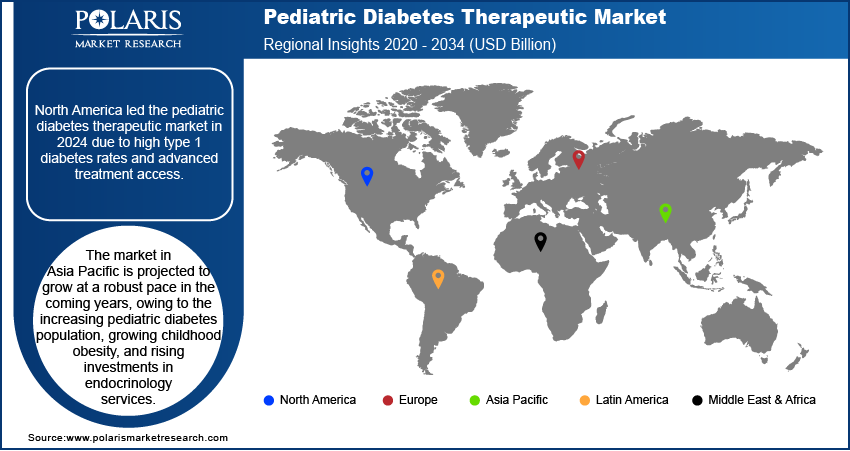

- North America pediatric diabetes therapeutic market accounted for major share of the global market in 2024 due to high prevalence of type 1 diabetes in children across the US and Canada.

- The pediatric diabetes therapeutic landscape in Europe is projected to hold a substantial share in 2034, driven by standardized treatment guidelines, universal healthcare access, and high diagnosis rates across Germany, France, Italy, and the UK.

Market Dynamics

- Rising prevalence of type 1 diabetes in children is increasing the demand for age-appropriate insulin therapies and glucose monitoring solutions.

- Growth in remote monitoring and digital therapeutics is enabling continuous data tracking, which supports timely insulin adjustments and improves patient adherence.

- Advancements in insulin pumps and continuous glucose monitoring technologies are creating opportunities for personalized and real-time pediatric diabetes care.

- High treatment costs and limited access to advanced devices in low-resource regions are restricting market penetration and adoption scalability.

Market Statistics

- 2024 Market Size: USD 9.80 Billion

- 2034 Projected Market Size: USD 34.60 Billion

- CAGR (2025-2034): 13.5%

- North America: Largest market in 2024

Pediatric diabetes therapeutics involve the use of insulin formulations, delivery devices, and glucose monitoring systems specifically designed for children and adolescents. These solutions are developed to support age-appropriate glycemic control, reduce hypoglycemic events and improve long-term health outcomes. Healthcare providers, pediatric hospitals and endocrinology centers are adopting advanced therapies to enhance treatment accuracy and patient adherence.

The rising prevalence of type 1 diabetes in children and the growing availability of continuous glucose monitoring and insulin pump systems are driving market expansion. Regulatory focus on pediatric-specific safety standards and real-world data integration is shaping therapeutic innovation. Additionally, the increasing adoption of digital tools for remote monitoring and data-driven insulin dosing is supporting the transition toward personalized and proactive diabetes management in pediatric populations.

Regulatory bodies such as the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the Central Drugs Standard Control Organization (CDSCO) are strengthening compliance requirements for pediatric diabetes therapies by focusing on safety, efficacy and age-specific dosing standards. These mandates are driving the development of insulin formulations and delivery systems tailored for children. Moreover, growing government-based diabetes care programs and insurance reimbursement for continuous glucose monitoring and insulin pumps are promoting treatment accessibility. Also, rising partnerships between device manufacturers, pediatric hospitals, and endocrinology clinics are fueling the rollout of integrated care models for early intervention and long-term disease management.

Drivers & Opportunities

Rising Incidence of Type 1 Diabetes in Children Globally: The rising incidence of type 1 diabetes in children is increasing the need for targeted and continuous disease management solutions. According to the Centers for Disease Control and Prevention (CDC), an estimated 352,000 children and adolescents under the age of 20 in the US were diagnosed with diabetes, which equals 35 cases per 10,000 youths. This includes approximately 304,000 cases of type 1 diabetes. Higher detection rates in urban and semi-urban regions are driving demand for insulin therapies and pediatric-specific care models. In addition, public health authorities are implementing screening programs and early intervention protocols to manage disease progression in pediatric diabetes. Thus, the growing pediatric diabetic population, healthcare systems are expanding investments in insulin delivery and monitoring technologies tailored for children and adolescents.

Growing Adoption of Remote Monitoring and Digital Therapeutics: The adoption of remote monitoring and digital therapeutics is improving clinical outcomes in pediatric diabetes management by enabling continuous glucose tracking and timely insulin adjustments. This, in turn, boosts the demand for the pediatric diabetes therapeutics industry. Moreover, increasing adoption of mobile applications, wearable glucose sensors, and connected insulin pumps is enhancing real-time decision-making for caregivers and clinicians in pediatric diabetes care. These digital platforms are improving treatment adherence and reducing hospital visits by enabling continuous monitoring and timely intervention. Additionally, the integration of digital tools into diabetes care models is expanding access to personalized treatment in areas with limited access to pediatric endocrinology services.

Segmental Insights

Type Analysis

Based on type, the segmentation includes type 1 and type 2. The type 1 segment accounted for largest revenue share in 2024, due to its high prevalence in pediatric populations globally. It requires lifelong insulin therapy and close glucose monitoring, which is increasing demand for insulin pumps and continuous glucose monitors. For instance, in January 2023, AGC Biologics announced a new commercial manufacturing project at its Seattle protein biologics facility to produce TZIELD (teplizumab-mzwv). This therapy is developed to target type 1 diabetes and aims to prevent or delay the progression of immune-mediated diseases. Public health programs focused on early diagnosis and improved disease awareness is driving segment dominance. The availability of integrated insulin delivery platforms and rising insurance coverage for pediatric type 1 care are further contributing to segment growth.

The type 2 segment is projected to grow at the fastest pace during the forecast period, due to the rising incidence of childhood obesity and sedentary behavior. Increasing awareness about lifestyle-related risk factors and early screening efforts is enabling timely therapeutic intervention. Expansion of oral and non-insulin therapies suitable for adolescents is widening the treatment landscape. In addition, rising focus on clinical compliance is promoting early-stage pharmacological intervention, while growing public-private healthcare partnerships are improving access to type 2 diabetes care in middle-income countries.

Therapy Analysis

Based on therapy, the segmentation includes drug therapy and insulin therapy. The insulin therapy segment accounted for largest revenue share in 2024, owing to its critical role in type 1 diabetes management and expanding use in advanced pediatric type 2 cases. The introduction of smart insulin pens and sensor-integrated pumps is improving treatment compliance and glycemic control in children. For instance, in August 2021, the US Food and Drug Administration (FDA) approved Eli Lilly’s Lyumjev insulin to help manage blood glucose levels in adults and children with diabetes. It is designed for faster absorption and improved post-meal glucose control compared to traditional insulin formulations. Healthcare systems are adopting structured insulin protocols with digital integration to support personalized pediatric diabetes management. Widespread insurance coverage and extensive clinical familiarity with insulin regimens are maintaining dominance of insulin therapy in pediatric diabetes management.

The drug therapy segment is projected to grow at the fastest pace during the forecast period, driven by increasing approval of oral antidiabetic drugs for pediatric populations. Growing acceptance of GLP-1 receptor agonists, metformin, and SGLT2 inhibitors for adolescents with early-stage type 2 diabetes is driving segment growth. Regulatory focus on pediatric trials and label extensions is further fueling market expansion. Moreover, the rising demand for non-injectable therapies in regions with limited access to insulin delivery infrastructure is boosting segment expansion across primary and community healthcare settings.

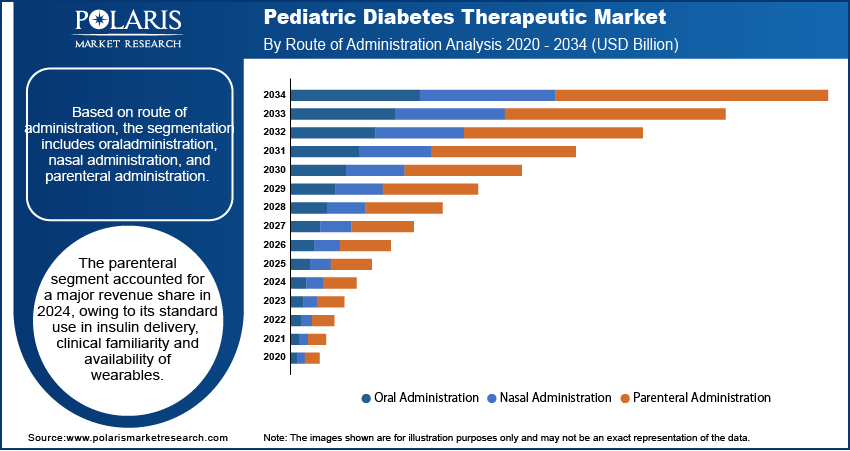

Route of Administration Analysis

By route of administration, the market includes parenteral, oral, and nasal. The parenteral segment held the largest revenue share in 2024, due to its widespread use in delivering insulin for pediatric type 1 diabetes. Also, growing pediatric diabetes therapeutics such as insulin pumps, pens and syringes help to enable precise subcutaneous administration to support effective glycemic control. Additionally, the integration of glucose monitoring systems with parenteral delivery methods is driving the segment dominance in the market.

The oral segment is anticipated to grow at the fastest rate, due to the increasing adoption of antidiabetic drugs in pediatric type 2 diabetes. Oral formulations are preferred for their ease of use and better compliance in adolescent populations. Rising regulatory support for pediatric use of biguanides and SGLT2 inhibitors is accelerating availability. Market players are focusing on developing pediatric-friendly dosage forms and taste-masked tablets, while healthcare systems are promoting oral drug use in non-critical early-stage diabetes management.

Application Analysis

Based on application, the segmentation includes insulin, GLP-1 receptor agonists, biguanide, SGLT2 inhibitors, and other applications. The insulin segment accounted for largest revenue share in 2024, owing to its essential use in all pediatric type 1 diabetes cases. Long-acting and rapid-acting analogs are widely adopted in basal-bolus regimens, driven by advanced delivery devices such as automated injectors and wearable patch pumps. National diabetes management programs and favorable reimbursement policies are promoting consistent insulin access in high-income countries.

The GLP-1 receptor agonists segment is projected to grow at the fastest pace during the forecast period, due to its expanding use in managing pediatric type 2 diabetes and obesity-linked metabolic dysfunction. These therapies offer glycemic control with added weight reduction benefits, which makes them suitable for adolescent patients. Growing clinical trials and positive safety outcomes are supporting regulatory review and label expansion. Furthermore, healthcare providers are adopting GLP-1 therapies as part of combination treatment plans in the US and selected European markets to address complex metabolic needs in pediatric patients.

Distribution Channel Analysis

By distribution channel, the market includes hospitals, specialty clinics, retail pharmacies, and drug stores. The hospital segment held the largest revenue share in 2024, due to the high volume of pediatric diabetes diagnoses and insulin therapy initiations conducted in inpatient and outpatient hospital settings. Hospitals offer access to multidisciplinary care, including endocrinologists, pediatricians and certified diabetes educators, which supports comprehensive disease management. The availability of advanced insulin delivery systems and emergency services makes hospitals the primary point of care for newly diagnosed children and for managing complications in severe cases.

The retail pharmacies segment is anticipated to grow at the fastest rate, owing to the increasing shift toward outpatient care and prescription refills for chronic diabetes management. The growing availability of insulin pens, oral antidiabetic medications and glucose monitoring supplies through retail chains is improving treatment accessibility. Also, growing partnerships between pharmaceutical manufacturers and pharmacy networks are expanding drug distribution and enhancing inventory management. In addition, the inclusion of patient counseling and diabetes education services at retail outlets is contributing to segment growth in urban and semi-urban areas across Asia Pacific and North America.

Regional Analysis

North America pediatric diabetes therapeutic market accounted for major share of the global market in 2024. This dominance is due to high prevalence of type 1 diabetes in children and the widespread adoption of insulin pumps and continuous glucose monitoring systems across the US and Canada. The region benefits from strong clinical infrastructure, established pediatric endocrinology networks and favorable reimbursement frameworks. In addition, the increasing product innovation in pediatric-friendly insulin delivery devices and growing awareness regarding early diabetes management are further driving market expansion across North America.

US Pediatric Diabetes Therapeutic Market Insight

The US held significant market share in the North America pediatric diabetes therapeutic landscape in 2024, driven by expanding screening programs and increasing healthcare investment in pediatric chronic disease care. According to the American Diabetes Association, 38.4 million individuals in the US, representing 11.6% of the population were living with diabetes in 2021. Among the total cases, 2 million individuals have type 1 diabetes, including 304,000 children and adolescents and approximately 1.2 million new cases are diagnosed each year. Moreover, the increasing insurance coverage for insulin therapies and glucose monitoring technologies is driving higher treatment adoption. Many healthcare facilities across the US are actively deploying digital platforms and AI-enabled dosing systems to enhance long-term glycemic control in children.

Asia Pacific Pediatric Diabetes Therapeutic Market

The market in Asia Pacific is projected to grow at a highest CAGR from 2025-2034, due to the rising incidence of type 1 and type 2 diabetes in children coupled with rapid urbanization and lifestyle shifts. Countries such as China, India, and Japan are witnessing increasing childhood obesity and earlier onset of metabolic disorders, contributing to the growing diabetes burden. In addition, the government efforts to expand screening programs and improve access to pediatric endocrinology services are fueling regional market growth.

China Pediatric Diabetes Therapeutic Market Overview

The market in China is expanding due to the growing prevalence of type 1 diabetes and government-led improvements in chronic disease care. Also, the growing focus of public hospitals on enhancing pediatric diabetes care by adopting insulin therapy protocols and expanding access to digital monitoring tools is contributing to market growth. Moreover, increasing healthcare expenditure, ongoing urban migration, and broader health insurance coverage are contributing to the growing demand for pediatric diabetes therapeutics. According to a report by Shanghai University of Engineering Science, the China’s total healthcare expenditure amounted to approximately USD 1,268.60 billion in 2022, accounting for 7.05% of the national GDP.

Europe Pediatric Diabetes Therapeutic Market

The pediatric diabetes therapeutic landscape in Europe is projected to hold a substantial share in 2034, driven by standardized treatment guidelines, universal healthcare access, and high diagnosis rates across Germany, France, Italy, and the UK. According to the National Library of Medicine, the incidence rate of type-1 diabetes among European children aged 0–14 years nearly doubled from 10.85 to 20.96 per 100,000 person-years between 1994–2003 and 2013–2022. Moreover, hospital-based care and structured school-based management programs are improving treatment adherence among pediatric patients, thus driving market expansion across Europe. In addition, the availability of advanced insulin delivery technologies and supportive regional policies for early screening and digital health monitoring are driving steady market growth.

Key Players & Competitive Analysis Report

The pediatric diabetes therapeutic market is moderately consolidated, with key players competing on product innovation, pediatric-specific formulations and integration of digital monitoring technologies. Leading manufacturers are focusing on age-appropriate insulin delivery systems, including smart pens, patch pumps and sensor-integrated devices to enhance treatment adherence and safety in children. Increasing investments in pediatric clinical trials, regulatory label expansions and real-world evidence generation are supporting product differentiation. Growing strategic initiatives such as collaborations with pediatric hospitals, distribution partnerships in emerging markets and expansion of digital health platforms are driving market positioning. Companies are adhering to regulatory frameworks and prioritizing R&D to address evolving clinical needs in pediatric diabetes management across hospital-based and outpatient settings.

Major companies operating in the pediatric diabetes therapeutic industry include Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Medtronic plc, Abbott Laboratories, F. Hoffmann-La Roche Ltd, Dexcom Inc., Insulet Corporation, Tandem Diabetes Care Inc., Ascensia Diabetes Care Holdings AG, Glenmark Pharmaceuticals Ltd., and Biocon Limited.

Key Players

- Abbott Laboratories

- Ascensia Diabetes Care Holdings AG

- Biocon Limited

- Dexcom Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Glenmark Pharmaceuticals Ltd.

- Insulet Corporation

- Medtronic plc

- Novo Nordisk A/S

- Sanofi

- Tandem Diabetes Care Inc.

Industry Developments

- February 2025: Nektar Therapeutics entered into a clinical trial partnership with TrialNet to evaluate Rezpegaldesleukin in patients recently diagnosed with type 1 diabetes mellitus. The study aims to assess whether the investigational therapy can preserve beta-cell function by modulating regulatory T cells.

- December 2024: MannKind Corporation announced positive six-month results from its Phase 3 INHALE-1 study, evaluating Afrezza (insulin human) Inhalation Powder in pediatric patients aged 4 to 17 with type 1 or type 2 diabetes. The interim data showed that Afrezza, when added to basal insulin, led to improved postprandial glucose control compared to standard rapid-acting insulin.

- June 2024: US FDA approved AstraZeneca’s Farxiga (dapagliflozin) for the treatment of pediatric patients aged 10 years and older with type-2 diabetes. The approval is based on positive Phase III trial results demonstrating significant reductions in HbA1c levels in children and adolescents.

Pediatric Diabetes Therapeutic Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Type 1

- Type 2

By Therapy Outlook (Revenue, USD Billion, 2020–2034)

- Drug Therapy

- Biguanide

- Sodium-glucose co-transporter 2 (SGLT2) inhibitors

- Insulin Therapy

- Rapid-acting Insulin

- Short-acting Insulin

- Intermediate-acting Insulin

- Long-acting Insulin

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Oral Administration

- Nasal Administration

- Parenteral Administration

- Subcutaneous

- Intramuscular

- Intravenous

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Insulin

- GLP-1 Receptor Agonists

- Biguanide

- SGLT2 Inhibitors

- Other Application

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Specialty Clinics

- Retail Pharmacies

- Drug Stores

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pediatric Diabetes Therapeutic Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.80 Billion |

|

Market Size in 2025 |

USD 11.10 Billion |

|

Revenue Forecast by 2034 |

USD 34.60 Billion |

|

CAGR |

13.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.80 billion in 2024 and is projected to grow to USD 34.60 billion by 2034.

The global market is projected to register a CAGR of 13.5% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Medtronic plc, Abbott Laboratories, F. Hoffmann-La Roche Ltd, Dexcom Inc., Insulet Corporation, Tandem Diabetes Care Inc., Ascensia Diabetes Care Holdings AG, Glenmark Pharmaceuticals Ltd., and Biocon Limited.

The type 1 segment dominated the market in 2024. This is attributed to its higher prevalence among children and the lifelong requirement for insulin therapy and continuous glucose monitoring.

The retail pharmacies segment is expected to witness the fastest growth during the forecast period, owing to the increasing availability of antidiabetic medications and insulin devices.