Penetration Testing Market Size, Share, Trends, Industry Analysis Report

: By Offering (Solution and Services), By Application, By Deployment Mode, By Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM2372

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

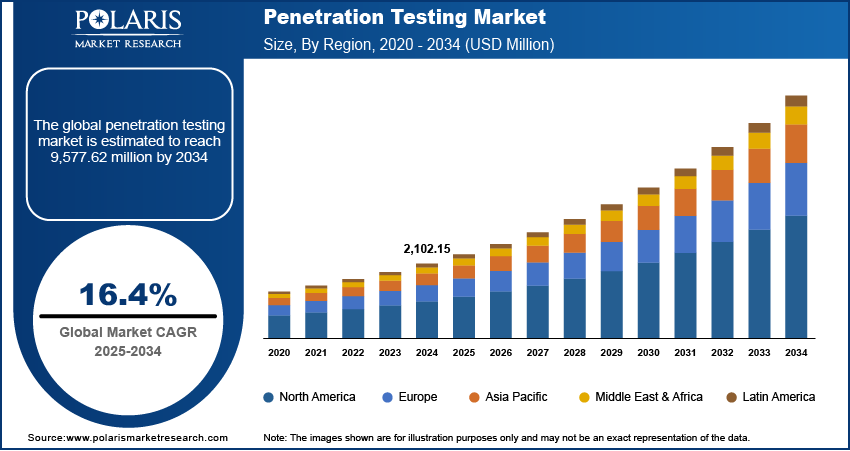

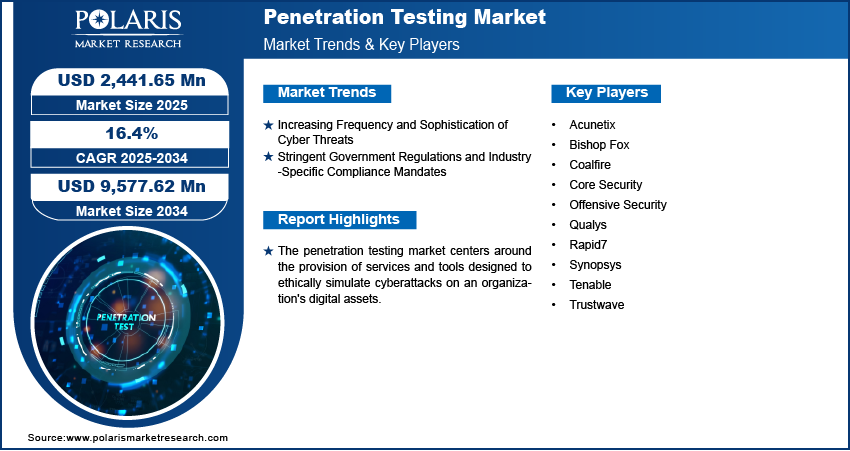

The penetration testing market size was valued at USD 2,102.15 million in 2024, growing at a CAGR of 16.4% during 2025–2034. The market growth is primarily fueled by the rising frequency and complexity of cyberattacks and the growing emphasis on regulatory compliance.

Key Insights

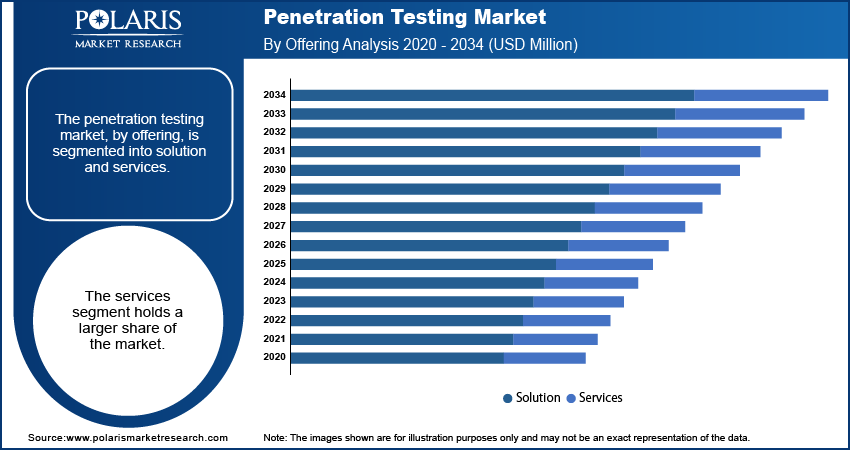

- The services segment accounts for a larger market share, primarily due to penetration testing fundamentally being a service-oriented engagement.

- The cloud segment is projected to register the highest growth rate during the projection period. Rapid adoption of cloud computing across various deployment models contributes to the segment’s growth.

- The cloud-based segment dominated the market, owing to the increasing preference of organizations for cloud-based solutions due to their inherent benefits.

- North America holds the largest market share. The robust presence of leading market participants and early adoption of cybersecurity-based practices contribute to the region’s leading market share.

- Asia Pacific is anticipated to register the highest growth rate during the projection period. The rapid expansion is primarily fueled by the rising digitalization across various nations in the region.

Industry Dynamics

- The growing complexity and frequency of cyberattacks has created a need for comprehensive security assessments to protect sensitive information and maintain operational integrity, fueling market growth.

- The establishment of stringent cybersecurity frameworks by various regulatory bodies globally is driving the need for penetration testing.

- The rapid expansion of cloud computing and widespread digital transformation initiatives across industries are anticipated to create significant market opportunities.

- Shortage of skilled cybersecurity professionals may present market challenges.

Market Statistics

2024 Market Size: USD 2,102.15 million

2034 Projected Market Size: USD 9,577.62 million

CAGR (2025-2034): 16.4%

North America: Largest Market in 2024

AI Impact on Penetration Testing Market

- AI automates vulnerability scanning and threat detection. This significantly reduces the time required to uncover security weaknesses.

- Machine learning adapts to evolving attack vectors, improving the accuracy and depth of penetration testing.

- AI-powered tools simulate complex cyberattacks and provide a realistic assessment of system defenses.

- Continuous AI learning enhances testing strategies over time. That way, it enables quicker remediation and stronger protection against emerging cybersecurity threats.

To Understand More About this Research: Request a Free Sample Report

The penetration testing market focuses on services designed to evaluate the security posture of an organization's IT infrastructure by simulating cyberattacks. These tests identify vulnerabilities in networks, applications, and systems that malicious actors could exploit. The increasing frequency and sophistication of cyber threats are compelling businesses to proactively assess and strengthen their defenses. Furthermore, stringent government regulations and industry-specific compliance mandates, such as GDPR and HIPAA, necessitate regular penetration testing to ensure adherence to security standards. This growing emphasis on regulatory compliance is a key factor fueling the overall market development.

The rising adoption of cloud computing solutions and services has broadened the attack surface, creating new avenues for potential exploitation and thus increasing the demand for specialized cloud security and penetration testing. The proliferation of interconnected devices and the Bring Your Own Device (BYOD) trend within organizations amplify security concerns, driving the need for comprehensive penetration testing across various endpoints. Moreover, the increasing integration of advanced technologies such as artificial intelligence (AI) and deep learning (ML) in cyberattacks necessitates sophisticated penetration testing methodologies to identify and mitigate these evolving threats, shaping future market trends.

Market Dynamics

Increasing Frequency and Sophistication of Cyber Threats

Organizations are facing a relentless barrage of malicious activities, including ransomware, data breaches, and advanced persistent threats (APTs), which can result in substantial financial losses and reputational damage. The evolving tactics of cybercriminals necessitate proactive security measures to identify and mitigate potential vulnerabilities before they can be exploited. For instance, a publication on the National Institutes of Health (NIH) website in 2023 discussed the rising complexity of cyber threats targeting healthcare systems, emphasizing the need for comprehensive security assessments to protect sensitive patient information and maintain operational integrity. Therefore, the escalating frequency and sophistication of cyber threats boost the penetration testing market growth.

Stringent Government Regulations and Industry-Specific Compliance Mandates

Various regulatory bodies across the globe are establishing stringent cybersecurity frameworks and data protection laws, such as the European Union's General Data Protection Regulation (GDPR) and the United States' Health Insurance Portability and Accountability Act (HIPAA). These regulations often mandate or strongly recommend that organizations conduct regular security assessments, including penetration testing, to demonstrate compliance and safeguard sensitive data. For example, the Cybersecurity and Infrastructure Security Agency (CISA), a US government agency, released guidelines in 2024 emphasizing the importance of proactive testing and vulnerability assessments for critical infrastructure entities to ensure resilience against cyber threats. Hence, the implementation and enforcement of stringent government regulations and industry-specific compliance mandates propel the penetration testing market demand.

Expansion of Cloud Computing and Digital Transformation Initiatives

As organizations increasingly migrate their operations, data, and applications to the cloud, the attack surface expands, introducing new and complex security challenges. Ensuring the security of these cloud environments is paramount, leading to a heightened demand for specialized cloud penetration testing services. Furthermore, the broader digital transformation efforts, involving the adoption of new technologies and interconnected systems, necessitate thorough security assessments to identify and address potential vulnerabilities introduced by these changes. A research article published on PubMed in 2022 discussed the security implications of cloud adoption in healthcare and highlighted the critical role of penetration testing in identifying cloud-specific vulnerabilities. Therefore, rapid expansion of cloud computing and widespread digital transformation initiatives across industries are expected to create substantial growth opportunities for the market during the forecast period.

Segment Insights

Market Assessment – By Offering

The penetration testing market, by offering, is bifurcated into solution and services. The services segment holds a larger share. This dominance is attributed to the fact that penetration testing is fundamentally a service-oriented engagement. Organizations typically rely on specialized expertise to conduct these complex security assessments, requiring skilled professionals to simulate attacks, analyze findings, and provide actionable recommendations for remediation. The need for tailored testing methodologies, based on specific infrastructure and application environments, further reinforces the preference for penetration testing as a service over standalone solutions. This reliance on expert-driven engagements ensures comprehensive vulnerability identification and contributes significantly to the substantial share held by the services segment.

The solution segment is anticipated to exhibit a higher growth rate during the forecast period. This growth is driven by the increasing development and adoption of automated penetration testing tools and platforms. These solutions offer benefits such as scalability, efficiency, and the ability to conduct more frequent assessments. While not entirely replacing human expertise, these tools are becoming increasingly sophisticated in identifying common vulnerabilities and streamlining the initial stages of testing. The continuous advancements in AI and machine learning are further enhancing the capabilities of these solutions, enabling more comprehensive and intelligent vulnerability scanning. This growing adoption of automated tools and platforms is expected to fuel the highest growth rate of the solution segment.

Market Evaluation– By Application

The penetration testing market, by application, is segmented into web applications, mobile applications, network infrastructure, social engineering, cloud, and others. The web applications segment holds the largest share, primarily due to the ubiquitous nature of web applications in modern business operations. Organizations across all industries heavily rely on web applications for customer interaction, internal processes, and various critical functionalities. Consequently, securing these applications from potential vulnerabilities is a paramount concern, leading to a significant demand for web application penetration testing services and solutions. The constant evolution of web technologies and the increasing complexity of web applications further contribute to the dominant share held by the segment.

The cloud segment is projected to experience the highest growth rate during the forecast period. The rapid adoption of cloud computing across various deployment models, including public, private, and hybrid clouds, is driving this accelerated growth. As organizations increasingly migrate their data, applications, and infrastructure to the cloud, the need to ensure the security of these cloud environments becomes critical. The unique security challenges associated with cloud environments, coupled with the expanding attack surface in the cloud, are fueling the demand for specialized cloud penetration testing services and solutions. This increasing focus on securing cloud assets is expected to propel the growth of the cloud segment.

Market Assessment – By Deployment Mode

By deployment mode, the penetration testing market is segmented into cloud-based and on-premises. The cloud-based segment holds a larger share. This dominance is primarily driven by the increasing preference of organizations for cloud-based solutions due to their inherent advantages such as scalability, flexibility, and cost-effectiveness. The ease of deployment and management offered by cloud-based penetration testing services and platforms aligns well with the evolving IT infrastructure landscape, where many organizations are adopting or have already adopted cloud environments. This widespread acceptance and the benefits associated with cloud deployments contribute significantly to the leading share of the cloud-based segment.

The cloud-based deployment mode is also anticipated to experience a higher growth rate during the forecast period. This rapid growth is fueled by the ongoing migration of businesses toward cloud infrastructures and the increasing demand for security solutions tailored to these environments. As organizations continue to leverage cloud services for various critical operations, the need for penetration testing solutions that can effectively assess the security posture of their cloud assets will continue to rise in the coming years. The agility and scalability offered by cloud-based penetration testing solutions make them an attractive option for organizations looking to secure their evolving cloud environments, thus positioning this segment for the highest growth.

Market Assessment – By Vertical

The penetration testing market, by vertical, is segmented into banking & financial services & insurance, healthcare, IT and ITes, telecom, retail & ecommerce, manufacturing, education, and others. The banking & financial services & insurance (BFSI) segment holds the largest share. This significant share is attributed to the highly regulated nature of the BFSI sector and the sensitive financial and personal data it handles. The stringent compliance requirements, coupled with the severe consequences of security breaches in this industry, necessitate frequent and comprehensive penetration testing to safeguard critical assets and maintain customer trust. This consistent and substantial demand for security assessments makes the BFSI sector the leading vertical.

The healthcare segment is anticipated to experience the highest growth rate during the forecast period. The increasing digitalization of healthcare records, the rise of connected medical devices, and the growing threat of cyberattacks targeting patient data are driving this rapid growth. The sensitive nature of healthcare information and the strict regulatory landscape, including laws such as HIPAA, are compelling healthcare organizations to prioritize healthcare cybersecurity and adopt penetration testing as a crucial security measure. This increasing focus on protecting patient data and ensuring the security of healthcare systems is expected to propel the healthcare vertical to the highest growth trajectory in the coming years.

Regional Analysis

The penetration testing market demonstrates a significant global presence, with key regions exhibiting varying levels of market penetration and growth. North America and Europe have historically been significant contributors to the overall market size, driven by stringent regulatory frameworks and a high awareness of cybersecurity risks. Asia Pacific is emerging as a high-growth area, fueled by increasing digitalization and a growing number of cyber threats. Latin America and the Middle East & Africa are also witnessing increased adoption of penetration testing services and solutions as their digital infrastructures expand and cybersecurity concerns become more prominent. Each region presents unique market dynamics and growth opportunities based on local regulations, industry maturity, and the evolving threat landscape.

North America holds the largest share of the penetration testing market. This dominant position can be attributed to the early adoption of cybersecurity based practices, a strong presence of leading players, and stringent regulatory mandates across various industries. The high level of awareness regarding potential cyber threats and the significant investments in cybersecurity infrastructure by organizations in this region contribute to the substantial demand for penetration testing services and solutions. Furthermore, the presence of a mature and competitive market with a wide range of service providers and solution vendors solidifies North America's leading position in the global market.

The Asia Pacific market is anticipated to exhibit the highest growth rate during the forecast period. This rapid expansion is driven by the accelerating pace of digitalization across various economies in the region, coupled with a growing awareness of the escalating cyber threat landscape. Increasing investments in IT services, the proliferation of online businesses, and the implementation of supportive government initiatives toward cybersecurity fuel the demand for penetration testing services and solutions across the region. As businesses in this region increasingly recognize the importance of proactive security measures, the Asia Pacific market is poised to become a major contributor to the global market.

.webp)

Key Players and Competitive Insights

A few of the major players actively operating in the penetration testing market include Acunetix (Invicti Security), Rapid7, Qualys, Tenable, Core Security (HelpSystems), Synopsys, Trustwave (Singtel), Coalfire, Bishop Fox, and Offensive Security. These organizations offer a range of services and solutions designed to identify and mitigate security vulnerabilities in IT infrastructures, web applications, mobile applications, and cloud environments, catering to the growing demand for proactive cybersecurity measures across various industries.

The competitive landscape is characterized by a mix of established cybersecurity vendors and specialized penetration testing service providers. Competition is driven by factors such as the breadth and depth of service offerings, technological innovation in testing methodologies and tools, the expertise of security professionals, and the ability to address evolving security threats and compliance requirements. Market insights reveal a trend toward the integration of penetration testing with other security assessment tools and the increasing adoption of continuous testing approaches. Organizations are also seeking providers with specific industry expertise and the ability to deliver actionable remediation guidance, fostering a dynamic and competitive environment within the market.

Rapid7, headquartered in Boston, Massachusetts, provides a comprehensive suite of cybersecurity solutions, including its InsightVM vulnerability management platform and Metasploit framework, which are extensively used for penetration testing activities. Their offerings encompass vulnerability scanning, penetration testing services, and security automation, making them a relevant player in helping organizations identify and address security weaknesses across their digital assets.

Tenable, based in Columbia, Maryland, is another significant player, primarily known for its Nessus vulnerability assessment scanner, a widely adopted tool for identifying security flaws. They also offer Tenable.io and Tenable.sc platforms, providing broader vulnerability management and penetration testing capabilities, enabling organizations to gain a comprehensive understanding of their security posture and address potential risks.

List of Key Companies

- Acunetix

- Bishop Fox

- Coalfire

- Core Security

- Offensive Security

- Qualys

- Rapid7

- Synopsys

- Tenable

- Trustwave

Penetration Testing Industry Developments

- July 2025: Trustwave introduced its advanced Operational Technology (OT) services portfolio. The company stated that the OT portfolio is aimed at enabling companies in defending industrial operations and critical infrastructure against cyber threats. Key services in the portfolio include OT Security & Architecture Design, Penetration Testing an OT Environment, and Threat Intelligence Integration.

- April 2025: RySec LLC officially launched its cybersecurity consulting division, providing enterprise-level penetration testing—commonly referred to as ethical hacking—at transparent and competitive rates.

- April 2025: Terra Security, an innovative startup transforming the cybersecurity space with its agentic AI-driven penetration testing platform, announced it has secured $8 million in seed funding, led by SYN Ventures and FXP Ventures.

Penetration Testing Market Segmentation

By Offering Outlook (Revenue – USD Million, 2020–2034)

- Solution

- Services

By Application Outlook (Revenue – USD Million, 2020–2034)

- Web Applications

- Mobile Applications

- Network Infrastructure

- Social Engineering

- Cloud

- Others

By Deployment Mode Outlook (Revenue – USD Million, 2020–2034)

- Cloud-Based

- On-Premises

By Vertical Outlook (Revenue – USD Million, 2020–2034)

- Banking & Financial Services & Insurance

- Healthcare

- IT and ITeS

- Telecom

- Retail & Ecommerce

- Manufacturing

- Education

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Penetration Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,102.15 million |

|

Market Size Value in 2025 |

USD 2,441.65 million |

|

Revenue Forecast by 2034 |

USD 9,577.62 million |

|

CAGR |

16.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The penetration testing market has been segmented into detailed segments of offering, application, deployment mode, and vertical. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: Growth strategies within the penetration testing market are increasingly focused on expanding service portfolios to address emerging security domains such as cloud environments, IoT devices, and operational technology (OT). Providers are also emphasizing the integration of AI and automation to enhance the efficiency and scalability of their testing services. Marketing efforts are highlighting the proactive risk mitigation benefits of penetration testing, emphasizing compliance adherence and the prevention of costly data breaches. Strategic partnerships with managed service providers and technology vendors are also becoming crucial for expanding market reach. Furthermore, educating organizations about the evolving threat landscape and the necessity of regular, sophisticated security assessments is a key marketing drive to fuel market demand.

FAQ's

The market size was valued at USD 2,102.15 million in 2024 and is projected to grow to USD 9,577.62 million by 2034.

The market is projected to register a CAGR of 16.4% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market include Acunetix (Invicti Security), Rapid7, Qualys, Tenable, Core Security (HelpSystems), Synopsys, Trustwave (Singtel), Coalfire, Bishop Fox, and Offensive Security.

The services segment accounted for a larger share of the market in 2024.

Following are a few of the market trends: ? Increased Focus on Cloud Security Testing: With the widespread adoption of cloud services, there is a growing demand for specialized penetration testing to secure cloud infrastructures, applications, and data. ? Integration of Automation and AI: The market is witnessing a rise in the use of automated tools and AI to enhance the efficiency, speed, and coverage of penetration testing processes. ? Growing Importance of Continuous Testing: Organizations are moving toward more frequent or continuous penetration testing to keep pace with the evolving threat landscape and ensure the ongoing security posture.

Penetration testing, often called a "pen test," is a simulated cyberattack performed on a computer system, network, or web application to identify security vulnerabilities that an attacker could exploit. It is a "white hat" hacking exercise. Ethical hackers, with the organization's permission, try to break into the system to find weaknesses in its defenses.