Peracetic Acid Market Size, Share, Trend, Industry Analysis Report

By Grade (<5% Grade, 5%–15% Grade, >15% Grade), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6094

- Base Year: 2024

- Historical Data: 2020-2023

Overview

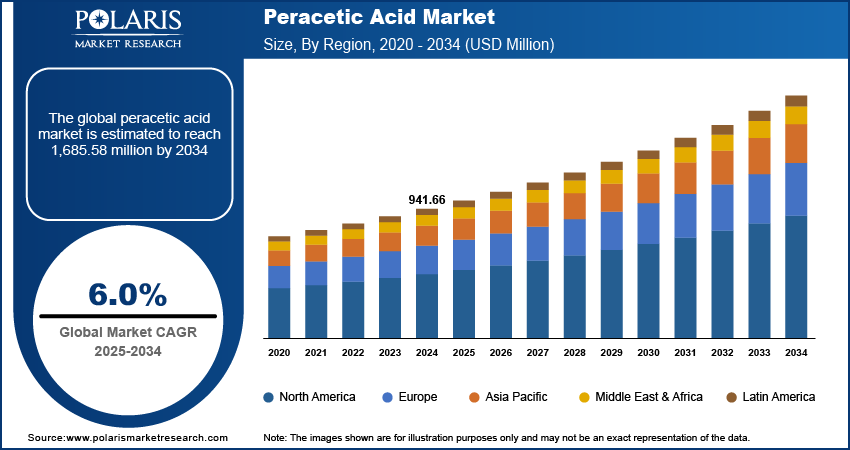

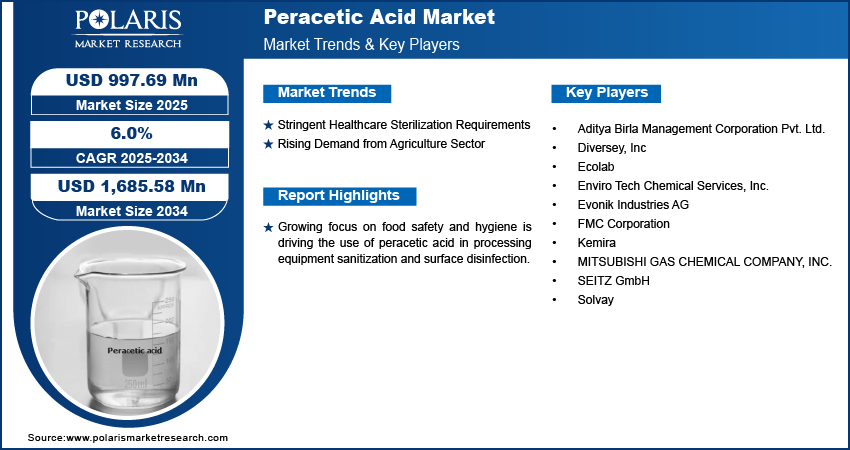

The global peracetic acid market size was valued at USD 941.66 million in 2024, growing at a CAGR of 6.0% from 2025 to 2034. Growing focus on food safety and hygiene is driving the use of peracetic acid in processing equipment sanitization and surface disinfection. Its effectiveness against bacteria and spores, combined with no harmful residue, makes it ideal for compliance with stringent food safety standards.

Key Insights

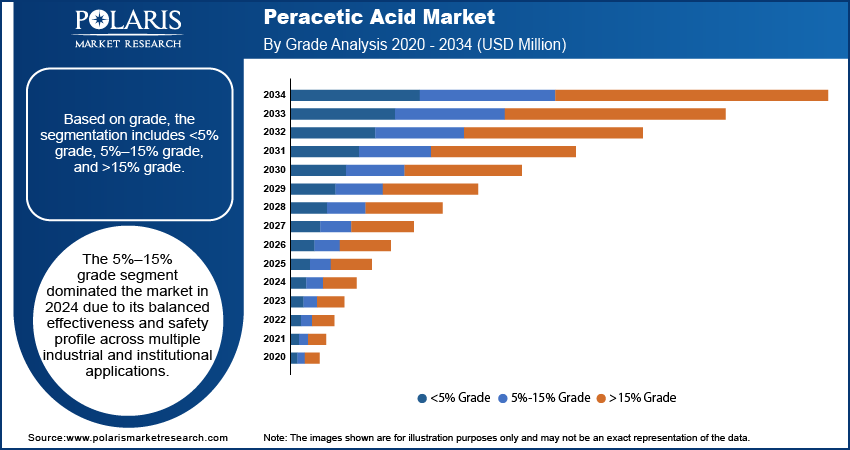

- The 5%–15% grade segment dominated the industry in 2024 due to its balanced effectiveness and safety profile.

- The disinfectant segment held the largest revenue share in 2024, driven by strong demand in healthcare and food processing environments.

- The North America peracetic acid market held a significant revenue share in 2024 due to strong adoption across the healthcare and food processing industries.

- The U.S. dominated in North America due to high volumes of medical procedures.

- The industry in Asia Pacific is expected to grow significantly during the forecast period due to rapid expansion in the food & beverage, healthcare, agriculture, and pharmaceutical sectors.

- China led in Asia Pacific in 2024 due to strong investments in water treatment infrastructure.

- The Europe market is growing steadily due to strict environmental and hygiene regulations that promote the use of biodegradable, chlorine-free disinfectants in water treatment, healthcare, and food industries.

Industry Dynamics

- Rising use in food processing for surface disinfection and packaging sanitization is boosting demand for safe, nontoxic biocides.

- Growing adoption in water treatment for biofilm control and microbial reduction is supporting consistent industrial consumption.

- Increasing focus on eco-friendly disinfectants opens opportunities as peracetic acid is a sustainable alternative to chlorine-based chemicals.

- Corrosive nature and handling risks limit usage in facilities without appropriate storage or delivery infrastructure.

Market Statistics

- 2024 Market Size: USD 941.66 million

- 2034 Projected Market Size: USD 1,685.58 million

- CAGR (2025–2034): 6.0%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The peracetic acid market revolves around the production, distribution, and application of peracetic acid, a powerful oxidizing agent used primarily for disinfection, sterilization, and bleaching. It is widely employed across industries such as food & beverage, healthcare, water treatment, agriculture, and pulp & paper due to its effectiveness against a broad range of microorganisms and its environmentally friendly decomposition into nontoxic byproducts. Rising surgical procedures and hospital-acquired infection (HAI) concerns are pushing healthcare facilities to adopt peracetic acid for equipment sterilization. Its ability to destroy resistant pathogens and spores is enhancing its role in infection control protocols.

Dairy and brewing industries are increasingly adopting peracetic acid for CIP (clean-in-place) systems. Its rapid action, compatibility with stainless steel, and minimal rinsing needs are streamlining cleaning processes while maintaining product quality. Moreover, peracetic acid is gaining traction as a bleaching agent in the pulp & paper industry due to its eco-friendly nature. It offers high pulp brightness without producing chlorinated waste, aligning with cleaner production practices.

Drivers and Opportunities

Stringent Healthcare Sterilization Requirements: Rising number of surgical procedures is driving stricter sterilization practices across healthcare settings due to increasing concerns over hospital-acquired infections. According to the World Health Organization (WHO), there were an estimated 20 million cancer cases in 2022. Projections indicate that the number of new cancer cases will surpass 35 million by 2050, signifying a substantial 77% increase from 2022. This surge in cancer incidence is poised to create heightened demand for surgical procedures, thereby fueling the demand for peracetic acid. The acid is increasingly being used for sterilizing surgical equipment, endoscopes, and other reusable medical devices due to its broad-spectrum antimicrobial activity. It effectively destroys resistant pathogens, spores, bacteria, and viruses, making it a reliable alternative to traditional disinfectants. Unlike some sterilants that require long contact times or leave toxic residues, peracetic acid breaks down into nontoxic byproducts such as water, oxygen, and acetic acid. Its rapid action and compatibility with a wide range of materials allow hospitals to improve turnaround time while maintaining safety standards in infection control.

Rising Demand from Agriculture Sector: Farmers and agribusinesses are turning to peracetic acid to meet the growing demand for residue-free disinfection methods in crop and irrigation management. It is being widely adopted to sanitize greenhouse surfaces, irrigation lines, storage bins, and post-harvest tools, where microbial contamination can compromise yields. Peracetic acid’s ability to neutralize fungi, bacteria, and biofilms without leaving harmful residues aligns with sustainable farming practices. It breaks down quickly, posing no risk to soil or plant health. Regulatory support for safer alternatives to synthetic pesticides is also encouraging its use, especially in organic and precision farming, where chemical control must balance efficacy and environmental safety.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes <5% grade, 5%–15% grade, and >15% grade. The 5%–15% grade segment dominated in 2024 due to its balanced effectiveness and safety profile across multiple industrial and institutional applications. This concentration range is widely adopted in healthcare, food processing, and sanitation sectors for surface disinfection, medical equipment sterilization, and clean-in-place (CIP) systems. The formulation offers strong antimicrobial activity while remaining manageable in terms of storage, transport, and handling safety. Regulatory bodies often recommend this grade for routine sanitization, making it a standard in healthcare protocols and food-grade cleaning operations. Its versatility and wide approval across use cases have contributed to its broad commercial appeal and higher volume consumption.

The >15% grade segment is expected to register the highest CAGR during 2025–2034 due to increasing use in industrial and water treatment sectors where higher concentration is required for biofilm removal and oxidative cleaning. Large-scale wastewater facilities and pulp & paper industries are adopting high-strength peracetic acid to tackle resilient microbial contaminants and reduce chemical load in effluent discharge. Its ability to deliver rapid disinfection while minimizing chlorinated byproducts makes it suitable for regulatory-compliant water purification processes. Market preference is shifting toward higher concentration formats to increase process efficiency and reduce application volume, especially in high-throughput operations.

Application Analysis

In terms of application, the segmentation includes disinfectant, sanitizer, sterilant, and others. The disinfectant segment held the largest revenue share in 2024, driven by strong demand in healthcare and food processing environments where microbial control is a regulatory and operational priority. Peracetic acid is widely used as a surface disinfectant, offering rapid action against a broad spectrum of pathogens, including spores and viruses. Its efficacy at low temperatures and lack of toxic residue post-application have positioned it as a preferred alternative to chlorine-based agents. Demand from cleanroom settings, pharmaceutical labs, and food-grade environments where hygiene standards are non-negotiable is sustaining high volume consumption in this category.

The sanitizer segment is expected to register the highest CAGR from 2025 to 2034, due to growing preference in food processing plants, dairy facilities, and agricultural settings where microbial load control must meet safety standards without impacting product integrity. The trend toward replacing harsh chemicals with safer, residue-free sanitizers is favoring peracetic acid-based formulations. Use in sanitizing food contact surfaces, beverage pipelines, and horticultural equipment is rising as compliance requirements for organic and sustainable production tighten. Peracetic acid’s biodegradable nature and compatibility with automated systems make it a cost-effective choice in ongoing sanitation cycles.

End Use Analysis

In terms of end use, the segmentation includes food & beverage, healthcare, pulp & paper, water treatment, and others. The healthcare segment held a significant revenue share in 2024 due to high utilization of peracetic acid in sterilizing surgical instruments, endoscopes, and critical care devices. Its superior sporicidal properties and compatibility with low-temperature processes make it ideal for sensitive medical equipment. Hospitals and diagnostic centers are increasingly choosing peracetic acid-based sterilants to improve turnaround times and reduce exposure to harmful disinfectant byproducts. Enhanced infection control protocols and the growing number of surgeries and outpatient procedures are reinforcing demand in this sector.

The water treatment segment is expected to register the highest CAGR from 2025 to 2034 driven by increasing investment in municipal and industrial wastewater systems that require non-chlorinated, eco-friendly disinfection solutions. Peracetic acid's ability to oxidize organic pollutants and pathogens without forming harmful chlorinated residues makes it highly suitable for sustainable water treatment. Its performance in controlling biofilm, algae, and microbial regrowth in distribution networks and cooling towers is gaining traction across utilities and manufacturing sectors. Strict environment regulations and the shift toward green chemistry in wastewater management are accelerating its adoption across new treatment infrastructure.

Regional Analysis

The North America peracetic acid market held significant revenue share in 2024, due to strong adoption across the healthcare and food processing industries, where stringent disinfection standards drive demand for high-performance biocidal agents. Widespread use in clean-in-place systems, endoscope reprocessing, and food surface sanitation has supported consistent product consumption across commercial and institutional facilities. Robust regulatory frameworks encouraging the use of environmentally friendly disinfectants have also contributed to market strength. The presence of advanced healthcare infrastructure and highly automated food production facilities continues to sustain regional uptake, while the trend toward sustainable sanitation practices reinforce long-term market potential in both public and private sectors.

U.S. Peracetic Acid Market Insights

The U.S. dominated in North America in 2024 due to high volumes of medical procedures, strong infection control mandates, and widespread deployment of advanced sterilization systems across hospitals and ambulatory care centers. Demand for peracetic acid is being further driven by its use in biofilm removal, endoscope sterilization, and pharmaceutical equipment sanitation. National food safety regulations have encouraged its integration in dairy, poultry, and ready-to-eat food processing operations. The presence of multiple manufacturers and distributors offering customized concentrations also improves product availability and adoption across small-scale industries and institutional segments. Preference for biodegradable, non-residual disinfectants is gaining traction across both healthcare and non-healthcare verticals.

Asia Pacific Peracetic Acid Market Overview

Asia Pacific is expected to grow significantly due to rapid expansion in the food & beverage, healthcare, agriculture, and pharmaceutical sectors that demand reliable, eco-friendly sanitation agents. According to the International Trade Administration (ITA), the hospital market in India is valued at USD 99 billion and is expected to grow to USD 193 billion by 2032. Industrial facilities across emerging economies are upgrading water treatment and sanitation infrastructure, which is increasing demand for cost-effective oxidizing agents such as peracetic acid. Growth in dairy processing, poultry production, and crop protection practices has created new application avenues, particularly where residue-free disinfection is critical. Regional awareness of hygiene and regulatory compliance has improved, supported by government programs encouraging safe agricultural and industrial practices. A rising focus on sustainable water management is also fueling industry expansion.

China Peracetic Acid Market Overview

China led the Asia Pacific industry in 2024 due to strong investments in water treatment infrastructure, high-volume food processing industries, and growing demand for residue-free disinfectants in agricultural applications. Manufacturing plants are incorporating peracetic acid for equipment sanitation and wastewater disinfection to meet export quality standards and regulatory benchmarks. The presence of a large domestic chemical industry base allows for scalable, low-cost production, encouraging adoption across industrial and municipal sectors. Government-led efforts to modernize hygiene standards in healthcare, meat processing, and environmental sanitation have also created favorable market conditions. Demand is particularly strong in urban centers where rapid industrialization requires efficient and safe disinfection solutions.

Europe Peracetic Acid Market Trends

The Europe market is growing steadily due to strict environmental and hygiene regulations that promote the use of biodegradable, chlorine-free disinfectants in water treatment, healthcare, and food industries. Demand for peracetic acid is being supported by sustainability mandates in industrial cleaning and wastewater treatment plants. The region’s established healthcare infrastructure uses it extensively for surgical instrument sterilization and surface decontamination. Expansion of organic food processing and eco-conscious agricultural practices has further enhanced product usage in food-grade applications. High awareness of antimicrobial resistance and a push toward low-toxicity chemical substitutes are reinforcing adoption, while manufacturers are investing in advanced formulations to meet evolving compliance standards.

Key Players and Competitive Analysis

The competitive landscape of the peracetic acid market is shaped by a mix of established chemical manufacturers and emerging players focusing on high-purity and application-specific formulations. Industry analysis indicates a strong emphasis on market expansion strategies, particularly through capacity upgrades and geographic diversification. Leading participants are engaging in joint ventures and strategic alliances to strengthen distribution networks and enhance regional market access. Mergers and acquisitions are enabling vertical integration and post-merger synergies, particularly in food safety, water treatment, and healthcare disinfection verticals.

Technology advancements are being prioritized to improve product stability, shelf life, and safety during handling, especially in concentrated solutions. Players are also investing in research and development (R&D) to develop customized peracetic acid blends that meet evolving regulatory and environmental standards. The growing demand for eco-friendly and non-chlorinated disinfectants is encouraging innovation in packaging and delivery mechanisms, while digital integration in supply chain and dosing systems is becoming a key differentiator among competitors.

Key Players

- Aditya Birla Management Corporation Pvt. Ltd.

- Diversey, Inc.

- Ecolab

- Enviro Tech Chemical Services, Inc.

- Evonik Industries AG

- FMC Corporation

- Kemira

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- SEITZ GmbH

- Solvay

Industry Development

May 2025: Evonik received EPA approval for VIGOROX Trident, a peracetic acid formulation for use in recirculating aquaculture systems (RAS) and ponds. This biocide effectively reduces fish pathogens, including bacteria and viruses, and can be applied safely in the presence of fish, breaking down into water, oxygen, and acetic acid.

Peracetic Acid Market Segmentation

By Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- <5% Grade

- 5%–15% Grade

- >15% Grade

By Application Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Disinfectant

- Sanitizer

- Sterilant

- Others

By End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Food & Beverage

- Healthcare

- Pulp & Paper

- Water Treatment

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Peracetic Acid Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 941.66 million |

|

Market Size in 2025 |

USD 997.69 million |

|

Revenue Forecast by 2034 |

USD 1,685.58 million |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons; Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 941.66 million in 2024 and is projected to grow to USD 1,685.58 million by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

North America peracetic acid market held a significant revenue share in 2024 due to strong adoption across healthcare and food processing industries, where stringent disinfection standards drive demand for high-performance biocidal agents.

A few of the key players in the market are Aditya Birla Management Corporation Pvt. Ltd.; Diversey, Inc; Ecolab; Enviro Tech Chemical Services, Inc.; Evonik Industries AG; FMC Corporation; Kemira; MITSUBISHI GAS CHEMICAL COMPANY, INC.; SEITZ GmbH; and Solvay.

The 5%–15% grade segment dominated the market in 2024 due to its balanced effectiveness and safety profile across multiple industrial and institutional applications.

The disinfectant segment held the largest revenue share in 2024 driven by strong demand in healthcare and food processing environments where microbial control is a regulatory and operational priority.