Perjeta Market Size, Share, & Industry Analysis Report

: By Type, By Product (Monoclonal Antibody and Generic Drug), By Indication, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5704

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

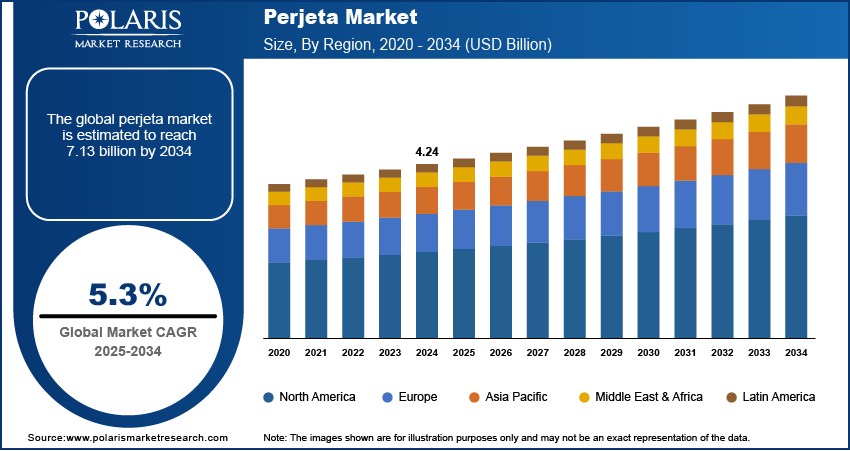

The global Perjeta market was valued at USD 4.24 billion in 2024 and is expected to register a CAGR of 5.3% from 2025 to 2034. The growth is driven by the rising prevalence of HER2-positive breast cancer, rapid expansion of oncology infrastructure, and improved access to advanced cancer treatments.

Perjeta (pertuzumab) is an original monoclonal antibody treatment for HER2-positive breast cancer. When combined with trastuzumab (Herceptin), this dual-targeted approach demonstrates improved clinical outcomes in both neoadjuvant and metastatic treatment settings. While biosimilar versions of these drugs may provide cost advantages, the originator biologics maintain their unique therapeutic value and clinical distinction. The industry is witnessing growth opportunities, primarily driven by the rising global incidence of breast cancer. According to a March 2024 report by the WHO in 2022, global breast cancer cases reached 2.3 million diagnoses among women, with 670,000 fatalities worldwide. HER2-positive breast cancer, a particularly aggressive form, constitutes a substantial portion of total breast cancer cases. The identification of HER2-positive patients is becoming more prevalent with growing awareness, improved diagnostics, and increased screening initiatives. This heightened disease burden directly contributes to the expanding demand for effective treatment options such as Perjeta, positioning it as a critical breast cancer therapy in modern oncology protocols.

To Understand More About this Research: Request a Free Sample Report

The demand for Perjeta is driven by its strong clinical efficacy and demonstrated survival benefits. In May 2025, Roche and research partners reported final APHINITY trial results showing Perjeta (pertuzumab) combined with trastuzumab and chemotherapy reduced mortality risk by 17% over 10 years in HER2+ early breast cancer patients versus trastuzumab/chemotherapy alone. Its dual blockade mechanism, achieved by combining pertuzumab and trastuzumab, offers a more comprehensive inhibition of the HER2 receptor, improving therapeutic outcomes. These clear clinical advantages have earned Perjeta a prominent role in neoadjuvant and metastatic treatment settings. The trust and adoption among oncologists and healthcare providers further reinforce its presence, highlighted by robust clinical data supporting its long-term efficacy.

Market Dynamics

Advancements in Treatment Delivery

Advancements in treatment delivery are improving the accessibility, convenience, and overall patient experience associated with HER2-targeted therapies. Innovations such as fixed-dose combinations and subcutaneous formulations have streamlined the administration process, reducing the need for prolonged infusion times and hospital visits. In April 2025, Roche received a positive CHMP opinion for EU label updates to Phesgo (pertuzumab/trastuzumab), allowing subcutaneous administration by healthcare professionals in nonclinical settings such as homes after clinical establishment for HER2+ breast cancer treatment. These delivery enhancements improve patient compliance and satisfaction as well as optimize healthcare resource utilization. Perjeta’s usability across a broader patient population strengthens as treatment becomes more adaptable to diverse clinical settings, further supporting its integration into standard care practices and boosting its growth trajectory.

Expanding Approvals and Guidelines

Expanding approvals and evolving clinical guidelines are boosting the adoption of Perjeta as they validate and broaden the therapeutic scope of the drug. Regulatory endorsements for use in early-stage, neoadjuvant, and metastatic breast cancer settings have solidified their role across multiple stages of disease progression. For instance, in March 2022, Chugai Pharmaceutical received MHLW approval for Perjeta (pertuzumab) and Herceptin biosimilars (trastuzumab) to treat unresectable, advanced/recurrent HER2-positive colorectal cancer progressing after chemotherapy. Furthermore, updates in treatment protocols by global oncology bodies often incorporate Perjeta-based regimens as preferred options, encouraging wider adoption by healthcare providers. These clinical endorsements improve prescriber confidence, reinforce its relevance in evolving treatment landscapes, and open new patient pools, all contributing to the drug’s sustained market momentum.

Segment Insights

Market Assessment by Product

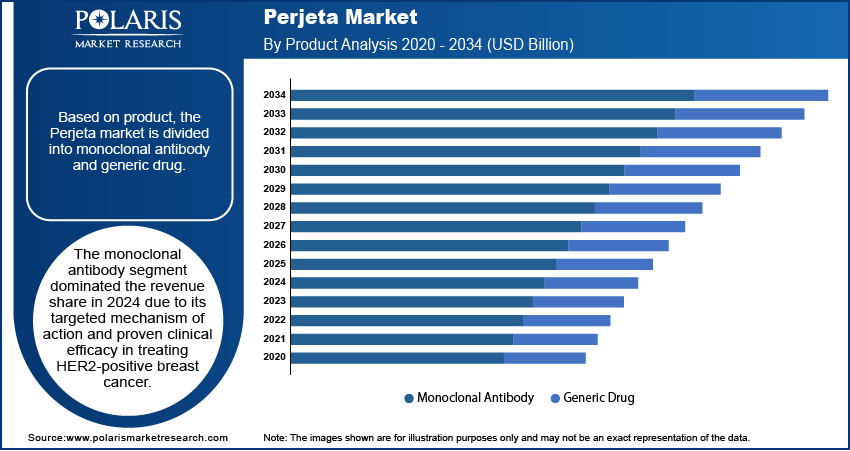

The global Perjeta market segmentation, based on product, includes monoclonal antibody and generic drug. The monoclonal antibody dominated the revenue share in 2024 due to its targeted mechanism of action and proven clinical efficacy in treating HER2-positive breast cancer. Perjeta, a monoclonal antibody therapy, offers high specificity in inhibiting HER2 receptors, minimizing off-target effects and improving patient outcomes. Its established role in combination therapy regimens, particularly in both neoadjuvant and metastatic settings, has reinforced its clinical utility. Moreover, the consistent demand for biologics in oncology care has contributed to the segment’s strong performance, supported by favorable reimbursement frameworks and clinical adoption trends.

Market Evaluation by Indication

The segmentation, based on indication, includes early breast cancer, and metastatic breast cancer. Early breast cancer segment is expected to witness substantial growth during the forecast period due to increased focus on early detection, screening programs, and preventative healthcare strategies. Treatment guidelines increasingly recommend HER2-targeted therapies such as Perjeta for early-stage HER2-positive breast cancer to reduce recurrence risk and improve long-term survival. The incorporation of Perjeta in neoadjuvant and adjuvant settings has expanded its application in earlier stages of disease management. The demand for effective therapies in this segment is poised to rise significantly as healthcare systems prioritize early intervention.

Market Analysis by Distribution Channel

The segmentation, based on distribution channel, includes hospital pharmacies, specialty pharmacies, and online pharmacies. The online pharmacies segment is expected to witness fastest growth during the forecast period driven by the shift in consumer behavior toward digital healthcare navigation platforms and the increasing demand for convenient access to specialty medications. Online channels provide improved accessibility, privacy, and ease of medication procurement, particularly for patients on long-term cancer therapies like Perjeta. Additionally, advancements in e-commerce infrastructure and telemedicine integration have improved the delivery ecosystem, allowing better support for patients in remote or underserved regions. These developments contribute to the accelerated adoption of online distribution for oncology treatments.

Regional Analysis

By region, the report provides the industry insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America Perjeta market dominated in 2024 due to its advanced healthcare infrastructure, high awareness levels, and widespread access to innovative cancer therapies. The region benefits from robust clinical research activities, early adoption of targeted therapies, and favorable reimbursement environments that support the use of premium biologics. The strong presence of pharmaceutical players and continuous updates in clinical guidelines also contribute to the high utilization of Perjeta.

The US Perjeta market accounts for the majority of usage due to advanced healthcare infrastructure and early access to biological therapies. Canada also shows consistent demand, supported by national cancer care initiatives and increasing uptake of HER2-targeted treatments. Both countries benefit from strong reimbursement systems and clinical adoption. Additionally, the prevalence of HER2-positive breast cancer and emphasis on early treatment further reinforce the region’s market leadership.

The Europe Perjeta market is projected to witness highest growth during the forecast period driven by the increasing adoption of personalized medicine and expanding treatment guidelines across EU states. Efforts to adjust cancer care protocols and improve access to targeted therapies are enabling higher Perjeta uptake. Investments in cancer screening and early detection initiatives has also facilitated greater identification of eligible patients for HER2-targeted treatment. Moreover, rising healthcare expenditure and strategic collaborations across European healthcare systems are expected to accelerate expansion during the forecast period. European markets such as the UK, France, and Italy are witnessing the expanding use of Perjeta, driven by evolving treatment guidelines and broad access to oncology care. Germany, in particular, leads in clinical integration and reimbursement efficiency.

The Germany Perjeta market is projected to witness substantial growth during the forecast period due to its strong healthcare system, well-established oncology care network, and commitment to evidence-based treatment guidelines. The country’s focus on early diagnosis and wide breast cancer screening programs has increased the identification of HER2-positive cases eligible for targeted therapy. For instance, a January 2025 study in Nature Medicine found AI improved breast cancer detection by 18% in Germany’s screening program, identifying 6.7 vs. 5.7 cancers per 1,000 women without increasing false positives. Germany's support for innovative biologics through efficient reimbursement processes and physician adoption of guideline-recommended regimens positions Perjeta favorably in the national oncology clinical trial landscape, driving continued industry expansion.

The Asia Pacific Perjeta market is projected to witness fastest growth during the forecast period due to rising healthcare awareness, improving cancer diagnostics, and growing investments in oncology infrastructure. Governments across the region are prioritizing early cancer detection and expanding access to advanced treatment modalities. The increasing burden of breast cancer, combined with an expanding middle-class population and healthcare access initiatives, is contributing to heightened demand for targeted biologics such as Perjeta. Additionally, the gradual adoption of western treatment protocols and the availability of biosimilar are further supporting expansion opportunities. Countries such as Japan, China, and South Korea are at the forefront of Perjeta adoption in the region, supported by improvements in cancer diagnostics and growing demand for advanced biologics. Japan has established itself as an early adopter of targeted therapies, while China and South Korea are rapidly expanding access through healthcare reforms and investment in oncology services.

Key Players and Competitive Analysis

The perjeta market is evolving rapidly, driven by technological advancements in biosimilars and strategic investments by players such as Roche, which maintains dominance in developed markets through Perjeta. Competitive analysis reveals biosimilar developers (Biocon, Amgen, Celltrion) are accelerating trials to capitalize on latent demand in cost-sensitive regions. Emerging markets, particularly Asia, present expansion opportunities as healthcare systems prioritize affordable oncology solutions, though economic and geopolitical shifts complicate pricing strategies. Disruptions and trends, including FDA/EMA regulatory pathways for biosimilars, are reshaping revenue growth dynamics. While Roche focuses on sustainable value chains through companion diagnostics, biosimilar manufacturers leverage business segments such as pre-filled syringes for competitive positioning. Expert insights highlight two critical challenges such as supply chain disruptions in biologics production and strict regional footprint requirements for cold-chain distribution. The sector’s future hinges on balancing the technological assessment of novel formulations with regional footprint optimization. A few of the key players in the industry are F. Hoffmann-La Roche Ltd; Biocon; Samsung Bioepis; Pfizer Inc.; Genentech, Inc.; Dr. Reddy’s Laboratories Ltd.; and CELLTRION INC.

F. Hoffmann-La Roche Ltd, commonly known as Roche, is a Swiss multinational pharmaceutical and diagnostics company recognized as a global company in oncology and biotechnology. Through its subsidiary Genentech, Roche developed and markets Perjeta (pertuzumab), a monoclonal antibody therapy designed for the treatment of HER2-positive breast cancer. Perjeta works by targeting the HER2 receptor, a protein that promotes the growth of cancer cells and is used in combination with trastuzumab and chemotherapy to provide a dual blockade of the HER2 pathway. This approach has been shown to greatly improve outcomes for patients suffering from early-stage and metastatic HER2-positive breast cancer, reducing the risk of recurrence and increasing overall survival. Roche’s commitment to scientific innovation and personalized medicine is reflected in Perjeta’s development, as the company continues to invest heavily in research and development, recently announcing a USD 50 billion investment in the US to expand its pharmaceutical and diagnostics capabilities.

Samsung Bioepis is a biopharmaceutical company dedicated to expanding patient access to high-quality biologic medicines through the development of biosimilars. Established in 2012 and now a wholly owned subsidiary of Samsung Biologics, Samsung Bioepis has rapidly built one of the most advanced biosimilar portfolios, covering therapeutic areas such as oncology, immunology, and ophthalmology. The company’s mission centers on accelerating access to clinically proven, cost-effective alternatives to branded biologics, thereby addressing inequalities in healthcare and reducing treatment costs for patients and healthcare systems. At the same time, Samsung Bioepis is recognized for its oncology biosimilars, including trastuzumab (biosimilar to Herceptin) as of now. Its expertise in monoclonal antibody biosimilars positions Samsung Bioepis as a potential future player in the pertuzumab biosimilar space, especially as patents expire and global demand for affordable cancer therapies grows. Through strategic partnerships and a commitment to innovation, Samsung Bioepis continues to challenge traditional approaches in biological drug development, aiming to make advanced therapies like those for HER2-positive breast cancer more accessible worldwide.

List of Key Companies in Perjeta Market

- F. Hoffmann-La Roche Ltd

- Biocon

- Samsung Bioepis.

- Pfizer Inc.

- Genentech, Inc.

- Dr. Reddy’s Laboratories Ltd.

- CELLTRION INC.

Perjeta Industry Developments

April 2025, AstraZeneca/Daiichi Sankyo's DESTINY-Breast09 Phase III trial showed Enhertu + pertuzumab improved PFS vs. standard THP therapy in HER2+ metastatic breast cancer, with consistent benefits across subgroups.

June 2024, Zydus and Dr. Reddy’s entered a licensing agreement to co-market a pertuzumab biosimilar for HER2+ breast cancer in India.

Perjeta Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Monoclonal Antibody

- Generic Drug

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Early Breast Cancer

- Metastatic Breast Cancer

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospital Pharmacies

- Specialty Pharmacies

- Online Pharmacies

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Perjeta Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.24 billion |

|

Market Size Value in 2025 |

USD 4.46 billion |

|

Revenue Forecast by 2034 |

USD 7.13 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.24 billion in 2024 and is projected to grow to USD 7.13 billion by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are F. Hoffmann-La Roche Ltd; Biocon; Samsung Bioepis; Pfizer Inc.; Genentech, Inc.; Dr. Reddy’s Laboratories Ltd.; and CELLTRION INC.

The monoclonal antibody segment dominated the market revenue share in 2024.

The online pharmacies segment is expected to witness fastest growth during the forecast period.