Phosphoramidite Market Size, Share, Trends, & Industry Analysis Report

By Type (DNA Phosphoramidites, RNA Phosphoramidites), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6267

- Base Year: 2024

- Historical Data: 2020-2023

Overview

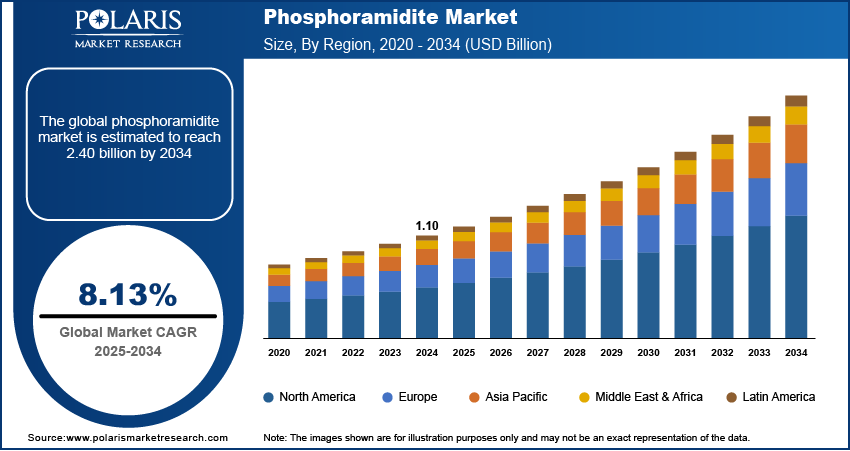

The global phosphoramidite market size was valued at USD 1.10 billion in 2024, growing at a CAGR of 8.13% from 2025–2034. Global healthcare expenditure and R&D investments are increasing steadily coupled with rising prevalence of genetic disorders and chronic diseases is driving demand for advanced therapeutics.

Key Insights

- The DNA phosphoramidites segment dominated the global phosphoramidite market share in 2024.

- The RNA phosphoramidites segment is projected to grow at the fastest CAGR, driven by rising research and development in RNA-based therapeutics such as mRNA vaccines and siRNA drugs.

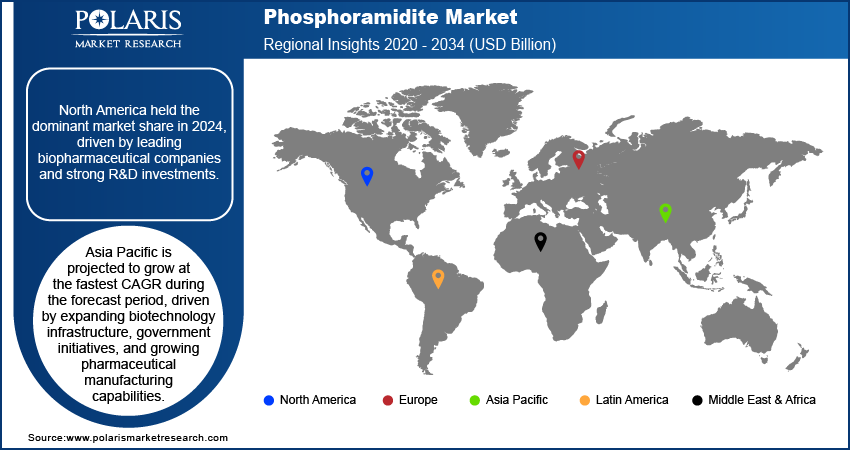

- The North America phosphoramidite market dominated the global market share in 2024, fueled by leading pharmaceutical companies, advanced R&D infrastructure, and strong biotechnology investment.

- The U.S. market held the largest regional share in North America in 2024, fueled by extensive genomic research, robust healthcare expenditure, and favorable regulatory frameworks.

- The Asia Pacific market is projected to grow at the fastest CAGR during the forecast period, driven by increasing biotech investments, expanding pharmaceutical manufacturing capabilities, and government support for genomics research.

- The China market is emerging steadily, fueled by government initiatives in life sciences, growing CRO activities, and rising domestic demand for nucleic acid therapeutics.

Industry Dynamics

- Increasing healthcare expenditure and R&D investments is fueling growth in the phosphoramidite market.

- Rising prevalence of genetic disorders and chronic diseases is driving demand for nucleic acid-based therapeutics and diagnostics.

- Rising investments in personalized medicine and genomics research are creating new opportunities for phosphoramidite manufacturers.

- Complex production processes and stringent regulatory requirements limit market expansion and pose challenges for new entrants.

Market Statistics

- 2024 Market Size: USD 1.10 Billion

- 2034 Projected Market Size: USD 2.40 Billion

- CAGR (2025–2034): 8.13%

- North America: Largest Market Share

Phosphoramidites are critical chemical intermediates primarily used in the synthesis of oligonucleotides, which serve as building blocks for DNA and RNA in genetic research, diagnostics, and therapeutics. The industry comprises key raw materials, including nucleoside derivatives and protecting groups, combined through specialized chemical processes to produce high-purity phosphoramidites. These products are essential for applications in pharmaceutical development, genetic testing, and molecular biology research, driven by the increasing demand for precision medicine and gene therapies.

The growing adoption of nucleic acid-based therapeutics, such as antisense oligonucleotides and small interfering RNA (siRNA), is a significant growth driver for the phosphoramidite market. Advances in synthetic chemistry techniques and automated oligonucleotide synthesizers are enhancing production efficiency and product quality. Furthermore, rising investments in research and development across biotechnology and pharmaceutical companies are expanding the applications of phosphoramidites in novel therapeutic areas. As an example, in July 2025, the European Parliament is prioritizing biotechnology and biomanufacturing, backing the USD 406.21 million Biotech Act to speed up approvals for products such as cultivated meat and boost the EU’s bioeconomy. Key end-use sectors include contract research organizations (CROs), pharmaceutical manufacturers, and academic research institutions.

Market expansion is driven by technological innovations such as solid-phase synthesis and improved purification methods, which increase yield and reduce production costs. Regulatory frameworks focusing on quality and safety in pharmaceutical ingredients fuels market credibility. Additionally, growing collaborations between chemical suppliers and biotech firms are accelerating product development cycles. The global phosphoramidite industry is poised for steady growth, driven by the rising demand for personalized medicine and increasing funding in genomics research worldwide.

Drivers & Opportunities

Increasing Healthcare Expenditure and R&D Investments: Rising global healthcare expenditure and increased funding for research and development are key drivers for the phosphoramidite market. According to WHO’s 2023 Global Health Expenditure report, global health spending reached a record USD 9.8 trillion in 2021, accounting for 10.3% of global GDP. Governments and private entities are allocating significant budgets toward genetic research, molecular diagnostics, and development of nucleic acid-based therapeutics. These investments enable advancements in synthesis technologies and expand production capacities. The growing focus on personalized medicine and targeted therapies demands high-quality oligonucleotide intermediates, directly boosting phosphoramidite consumption. Continuous R&D efforts also accelerate innovation, creating new applications and strengthening market growth across pharmaceutical and biotechnology sectors worldwide.

Rising Prevalence of Genetic Disorders and Chronic Diseases: The increasing incidence of genetic disorders and chronic diseases such as cancer, rare genetic conditions, and autoimmune diseases is fueling demand for advanced therapeutics. According to the World Health Organization (WHO), chronic diseases including heart disease, cancer, diabetes, and respiratory illnesses are expected to cause 86% of the 90 million annual deaths by 2050, nearly doubling since 2019. Phosphoramidites are essential in manufacturing oligonucleotide-based drugs used to target specific genes involved in these diseases. As the patient population expands, pharmaceutical companies prioritize developing gene-targeted treatments, driving market growth. Early diagnosis and personalized treatment strategies relying on oligonucleotide technologies further enhance the need for phosphoramidite intermediates, underpinning steady industry expansion across global healthcare markets.

Segmental Insights

Type Analysis

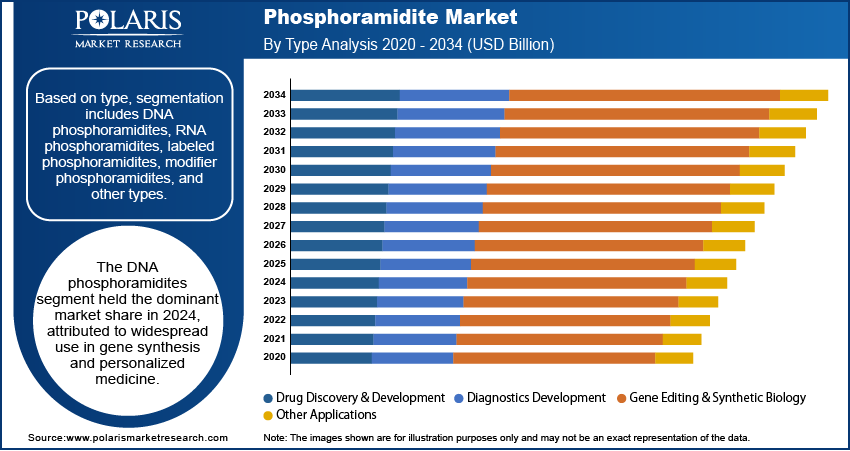

Based on type, the segmentation includes DNA phosphoramidites, RNA phosphoramidites, labeled phosphoramidites, modifier phosphoramidites, and other types. The DNA phosphoramidites segment dominated the market in 2024, driven by their extensive use in oligonucleotide synthesis for therapeutic and diagnostic applications. Their stability and compatibility with automated synthesizers make them preferred intermediates in pharmaceutical research and development. The rising focus on personalized medicine and genetic testing sustains demand for DNA phosphoramidites. Additionally, the presence of well-established production processes and supply chains drive this segment’s market leadership.

The RNA phosphoramidites segment is projected to register the fastest CAGR during the forecast period. This growth stems from increasing research and development in RNA-based therapeutics such as mRNA vaccines and siRNA drugs. Advancements in synthesis technology and rising demand for RNA oligonucleotides in gene silencing and editing applications are expanding this segment rapidly. Growing adoption in novel therapeutic areas positions RNA phosphoramidites for significant market expansion.

Application Analysis

Based on application, the segmentation includes drug discovery & development, diagnostics development, gene editing & synthetic biology and other applications. The drug discovery and development segment dominated the market in 2024, fueled by the growing use of oligonucleotide intermediates in early-stage pharmaceutical research. Increasing investments in developing gene-targeted therapies and personalized medicines drive demand for phosphoramidites. The segment benefits from continuous innovation in synthesis methods and expanding clinical pipeline of nucleic acid-based drugs, securing its dominant market position.

The gene editing and synthetic biology segment is expected to witness the fastest growth during the forecast period. Innovations in technologies such as crispr and synthetic gene circuits require high-quality phosphoramidites for precise oligonucleotide synthesis. Expanding applications in synthetic biology for therapeutic and industrial purposes, along with increasing funding for gene editing research, propel rapid growth in this segment.

End User Analysis

Based on end user, the segmentation includes pharmaceutical and biotechnology companies, academic and research institutes, and other end users. The pharmaceutical and biotechnology companies segment dominated the market in 2024. These companies drive demand through extensive research in nucleic acid therapeutics and diagnostics, requiring large volumes of high-purity phosphoramidites. Strategic collaborations and outsourcing to specialized suppliers further support the segment’s leadership. Continuous expansion in biopharmaceutical pipelines maintains robust demand.

The academic and research institutes segment is projected to grow at the fastest rate during the forecast period. Increasing government and private funding for genetic research and molecular biology studies fuels demand for phosphoramidites. These institutes contribute to innovations in nucleic acid synthesis and novel therapeutic discovery, driving the adoption of phosphoramidite products. Growing focus on fundamental research in genomics supports this rapid growth.

Regional Analysis

North America phosphoramidite market dominated the global market in 2024. This is due to the presence of leading pharmaceutical and biotechnology companies investing heavily in genetic research. Moreover, strong government funding and supportive regulatory frameworks push R&D activities in oligonucleotide therapeutics. As an example, in April 2025, Eli Lilly partnered with Bachem to develop oligonucleotide drugs using GMP-grade materials. This collaboration highlights the key role of phosphoramidite chemistry in producing therapeutic oligonucleotides. In addition, the well-established infrastructure for pharmaceutical manufacturing and advanced research facilities drive innovation. Furthermore, collaborations between academia and industry accelerate product development and commercialization maintaining market leadership.

The U.S. Phosphoramidite Market Insight

The U.S. held a dominating market share in the North America phosphoramidite landscape in 2024, fueled by its significant investment in biotechnology and pharmaceutical R&D. Moreover, the presence of well-established ecosystem of biopharma companies and advanced research institutions drives innovation in nucleic acid therapeutics. In addition, robust regulatory frameworks and strong intellectual property protection drive development and commercialization. Furthermore, the increasing government initiatives supporting gene therapy and personalized medicine fuel market growth. The U.S. remains the hub for cutting-edge oligonucleotide research and production maintaining its dominant position in the global phosphoramidite industry.

Europe Phosphoramidite Market

The phosphoramidite landscape in Europe is projected to hold a substantial share in 2034. This is due to its robust pharmaceutical industry and extensive research activities in molecular medicine. Moreover, increasing collaborations between industry and research institutions foster innovation in nucleic acid therapeutics. In addition, government funding for rare disease research and advanced healthcare systems support the use of phosphoramidites. For instance, the European Union supported rare disease research by providing over USD 3.5 billion between 2007 and 2020. This funding, through the 7th Framework Programme and Horizon 2020, helped more than 550 multinational research projects. Furthermore, the countries such as Germany, the UK, and France lead the market with strong biotech clusters and progressive regulatory policies pushing development and adoption of gene therapies.

Asia Pacific Phosphoramidite Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is driven by increasing investments in biotechnology and expanding healthcare infrastructure. Moreover, growing government initiatives in countries including China and India promote genomics research and personalized medicine. In addition, rising pharmaceutical manufacturing capabilities and increasing CRO activities attract global players. Furthermore, expanding academic research and improving regulatory environment support market growth. China and India are the key countries, with strong government support for biotech innovation and growing domestic demand for advanced therapeutics fueling regional expansion.

China Phosphoramidite Market Overview

The market in China is expanding due to increasing government funding for biotech innovation and genomics research. As per the GISAID, in 2023, China ranked in the top 3.89% globally for genome sequence quantity, 22.78% for timeliness, and 17.78% for quality, with contributions from all provinces and Shanghai leading. Human samples made up 99.73% of shared genomes, with a slightly higher male representation (52.06%) and increased data from those aged 65 and above. Moreover, the expanding pharmaceutical manufacturing capabilities and favorable regulatory reforms promote local production and adoption. In addition, rising prevalence of chronic diseases drives demand for advanced therapeutics. Furthermore, the growth of contract research organizations and collaborations with global firms accelerate technology transfer and capacity expansion. China’s strategic focus on life sciences positions it as a key player in the regional and global phosphoramidite market.

Key Players & Competitive Analysis Report

The phosphoramidite market is moderately competitive, with key players focusing on improving product purity, synthesis efficiency, and application-specific formulations. Leading companies are expanding their portfolios by adopting advanced synthesis technologies, automation, and customized phosphoramidite derivatives to address evolving therapeutic and research demands. In addition, increasing collaborations between chemical manufacturers, biotechnology firms, and contract research organizations enable tailored solutions for pharmaceutical, diagnostic, and academic applications. These strategic partnerships enhance innovation and operational efficiency, strengthening long-term competitiveness across nucleic acid therapeutics, gene editing, and synthetic biology markets.

Major companies operating in the phosphoramidite industry include Thermo Fisher Scientific, Merck KGaA, Cytiva, LGC Biosearch Technologies, Integrated DNA Technologies, Synthena AG, Bioneer Corporation, GenePharma Co., Ltd., Takara Bio Inc., Wuhan Sun Biological Engineering Co., Ltd., BioAutomation, LLC, and CEM Corporation.

Key Players

- BioAutomation, LLC

- Bioneer Corporation

- CEM Corporation

- Cytiva

- GenePharma Co., Ltd.

- Integrated DNA Technologies

- LGC Biosearch Technologies

- Merck KGaA

- Synthena AG

- Takara Bio Inc.

- Thermo Fisher Scientific

- Wuhan Sun Biological Engineering Co., Ltd.

Industry Developments

- June 2024: Suven Pharmaceuticals announced to acquire a 67.5% stake in Sapala Organics, an oligonucleotide drug CDMO, for around USD 27.5 million. The deal boosted Suven’s stock by 4.59%. It aims to boost its capabilities in producing phosphoramidites and other oligonucleotide building blocks.

- January 2024: GSK partnered with Elegen to develop DNA-based medicines using cell-free technology that offers a scalable, GMP-compliant alternative to traditional phosphoramidite synthesis. This approach addresses limitations in producing long, complex DNA sequences for therapies.

Phosphoramidite Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- DNA Phosphoramidites

- RNA Phosphoramidites

- Labeled Phosphoramidites

- Modifier Phosphoramidites

- Other Types

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Drug Discovery & Development

- Diagnostics Development

- Gene Editing & Synthetic Biology

- Other Applications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Phosphoramidite Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.10 Billion |

|

Market Size in 2025 |

USD 1.19 Billion |

|

Revenue Forecast by 2034 |

USD 2.40 Billion |

|

CAGR |

8.13% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Applicationat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.10 billion in 2024 and is projected to grow to USD 2.40 billion by 2034.

The global market is projected to register a CAGR of 8.13% during the forecast period.

North America dominated the phosphoramidite market in 2024, driven by significant investments in biotechnology research and advanced pharmaceutical manufacturing infrastructure

A few of the key players in the market are Thermo Fisher Scientific, Merck KGaA, Cytiva, LGC Biosearch Technologies, Integrated DNA Technologies, Synthena AG, Bioneer Corporation, GenePharma Co., Ltd., Takara Bio Inc., Wuhan Sun Biological Engineering Co., Ltd., BioAutomation, LLC, and CEM Corporation

The DNA phosphoramidites segment dominated the market in 2024, driven by its extensive use in oligonucleotide synthesis for therapeutics and diagnostics.

The academic and research institutes segment is projected to grow at the fastest CAGR, fueled by increasing government and private funding for genetic and molecular biology research.