Point of Exit PFAS Treatment Systems Market Size, Share, Trend, Industry Analysis Report

By Technology (Reverse Osmosis, Granular Activated Carbon, Ion Exchange Filter), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5922

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

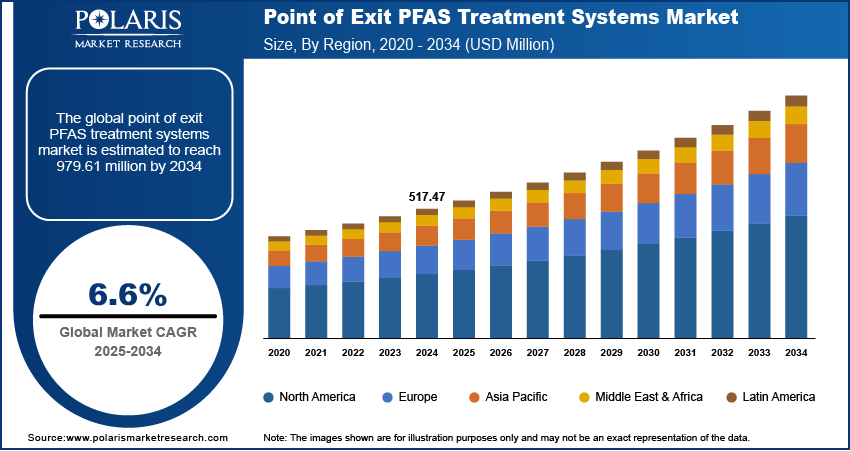

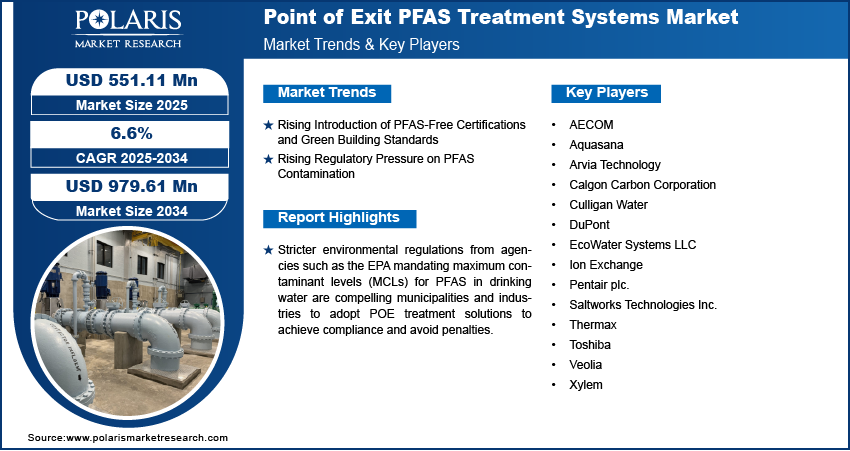

The global point of exit PFAS treatment systems market size was valued at USD 517.47 million in 2024 and is projected to register a CAGR of 6.6% from 2025 to 2034. The imposition of stringent environmental regulations from agencies, such as the EPA mandating maximum contaminant levels (MCLs) for PFAS in drinking water. is compelling municipalities and industries to adopt point of use water treatment systems to achieve compliance and avoid penalties.

The point of exit PFAS treatment systems market refers to the segment focused on systems installed at the point where water exits a building or facility, ensuring that per- and polyfluoroalkyl substances (PFAS) are removed before the water is used. These systems serve as a last barrier for purifying contaminated water at homes, commercial buildings, or industrial sites, offering protection from PFAS, which are linked to serious health risks. Rising awareness of the long-term health impacts of PFAS exposure, including cancer and developmental disorders, is driving demand for residential and commercial POE systems as consumers seek reliable solutions for safe drinking water.

To Understand More About this Research: Request a Free Sample Report

The development of high-efficiency filtration systems such as granular activated carbon (GAC), ion exchange resins, and membrane filtration is making POE systems more effective and accessible for a wide range of applications. Additionally, proactive testing by municipalities and private entities is revealing the widespread presence of PFAS, pushing stakeholders to implement POE systems to ensure compliance and safeguard public health.

Market Dynamics

Rising Introduction of PFAS-Free Certifications and Green Building Standards

Growing emphasis on sustainable construction and environmental responsibility is influencing how buildings are designed and operated. Certifications such as LEED and WELL and green building standards are encouraging developers to ensure safe, nontoxic environments, including clean water systems. Point of exit PFAS treatment systems are increasingly being integrated into new and renovated structures to help meet these criteria. These systems align well with ESG objectives, as they demonstrate a proactive approach to health and environmental stewardship. Building owners and facility managers are recognizing the value of PFAS-free certifications, for compliance and marketability and tenant assurance, thereby accelerating demand for advanced POE treatment technologies in the construction and real estate sectors.

Rising Regulatory Pressure on PFAS Contamination

Government agencies are tightening control on PFAS contamination through lower permissible limits and mandatory testing requirements. The US Environmental Protection Agency and several state-level bodies have established enforceable standards for PFAS concentrations in public drinking water, prompting urgent responses from municipalities and industrial operators. In March 2024, the U.S. Environmental Protection Agency (EPA) announced that the agency would maintain current National Primary Drinking Water Regulations (NPDWR) for perfluorooctanoic acid (PFOA) and perfluorooctane sulfonic acid (PFOS), which set limits for these “forever chemicals” in drinking water. The agency aims to address PFAS while ensuring regulatory compliance for drinking water systems. To avoid risks related to PFAS contamination, stakeholders are turning to Point of Exit PFAS treatment systems that offer reliable and immediate solutions to meet discharge and potable water standards. This regulatory momentum is not limited to the U.S., as international agencies follow suit, creating a global shift toward responsible water management using proven treatment technologies at critical points of distribution.

Segment Insights

Technology Analysis

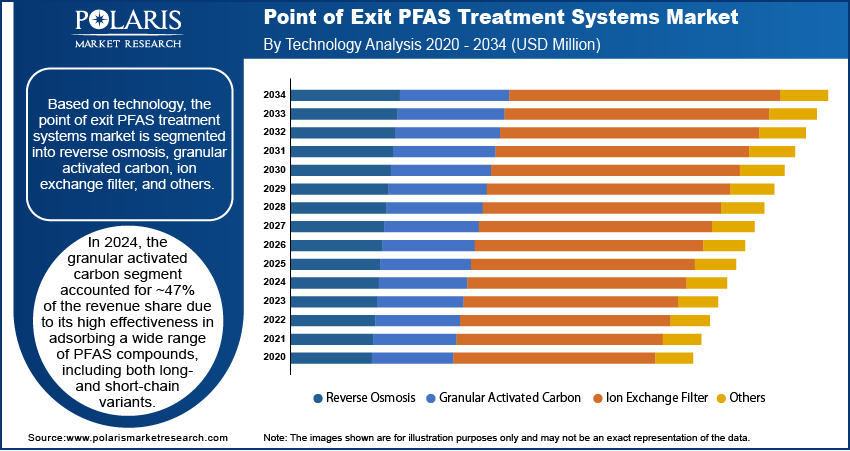

Based on technology, the segmentation includes reverse osmosis, granular activated carbon, ion exchange filter, and others. In 2024, the granular activated carbon segment accounted for ~47% of the revenue share due to its high effectiveness in adsorbing a wide range of PFAS compounds, including both long- and short-chain variants. GAC is widely used due to its operational simplicity, cost-efficiency, and compatibility with existing infrastructure. It allows scalable deployment in various flow conditions, making it ideal for diverse industrial needs. The flexibility to regenerate and reuse carbon media further enhances long-term affordability. Its proven performance in water purification has made it a preferred technology for regulatory compliance across industrial sectors. Strong demand from legacy PFAS-contaminated facilities continues to reinforce its dominance in point of exit treatment applications.

The ion exchange filters segment is expected to register the highest CAGR during the forecast period due to their high selectivity and efficiency in removing low concentrations of short-chain PFAS, which are often difficult to capture using traditional methods. These filters operate through engineered resins that target specific PFAS molecules, allowing for higher removal rates and lower breakthrough risks. Industries seeking compact, high-performance systems are increasingly adopting ion exchange technologies to meet evolving discharge standards. The growing availability of advanced resins and system designs has made this solution more attractive for decentralized installations. Its rapid adoption reflects the shift toward more targeted, efficient treatment solutions in high-risk environments.

Application Analysis

Based on application, the segmentation includes commercial and industrial. In 2024, the industrial segment accounted for ~90% of the revenue share due to the widespread presence of PFAS in manufacturing sectors such as chemical production, aerospace, textiles, and electronics. These industries often discharge PFAS through process wastewater, requiring robust on-site treatment systems to meet environmental regulations. Point of exit PFAS treatment systems are preferred for their ability to offer localized, precise control over effluent quality before it reaches the environment or public infrastructure. High stakes related to legal compliance, brand reputation, and sustainability goals are driving large-scale investments in PFAS mitigation strategies. Industrial users demand scalable, high-throughput systems that can operate continuously, making POE solutions integral to operations.

The commercial segment is projected to register a higher CAGR over the forecast period due to increasing adoption by property developers, hospitality chains, schools, and healthcare facilities, seeking to ensure potable water safety. Growing awareness of PFAS contamination in municipal supplies is pushing commercial establishments to install point of exit systems as an added layer of protection. Real estate stakeholders are also leveraging PFAS-free certification as a competitive advantage in leasing and tenant retention. The availability of compact, turnkey systems has lowered barriers to adoption, enabling even small-scale commercial sites to implement effective treatment. The trend reflects a broader shift toward proactive water quality management in the built environment.

Regional Analysis

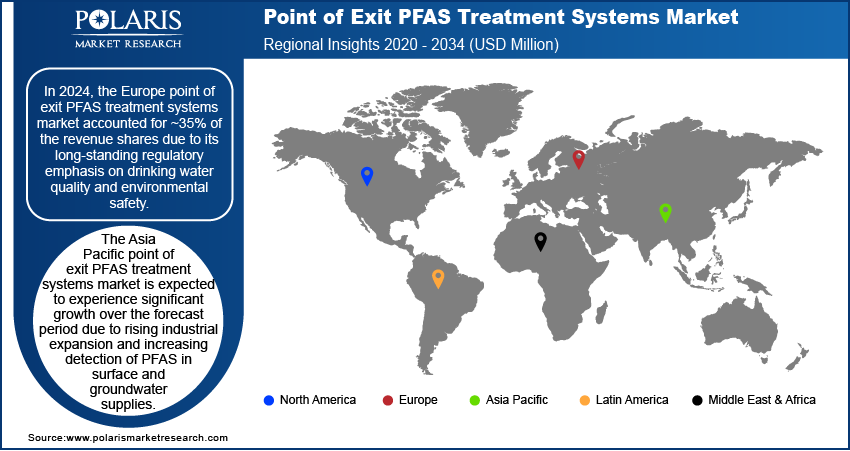

In 2024, the Europe point of exit PFAS treatment systems market accounted for ~35% of the revenue shares due to its long-standing regulatory emphasis on drinking water quality and environmental safety. The European Union has implemented comprehensive directives targeting per- and polyfluoroalkyl substances, compelling municipalities and industries to adopt advanced filtration and remediation technologies. For instance, in September 2024, the European Environment Agency reported that over 300 new PFAS remediation projects were initiated across Europe in the first half of the year alone, with activated carbon (GAC) and ion exchange systems being the most widely deployed technologies. Strong institutional support for water safety, paired with aggressive action plans by national governments, is accelerating the deployment of point of exit PFAS treatment systems across sectors in Europe. Industrial hubs in Western Europe and expanding urban regions are increasingly integrating GAC and ion exchange systems to meet stringent limits on PFAS concentrations. Public concern over persistent chemicals and increased environmental monitoring has placed water purification at the forefront of infrastructure investment, contributing to robust market performance.

North America Point of Exit PFAS Treatment Systems Market Insight

The North America market is projected to register the highest CAGR from 2025 to 2034 due to rapidly advancing regulatory frameworks and widespread identification of PFAS contamination sites. Federal and state-level mandates, including the EPA’s enforceable maximum contaminant levels, are pressuring utilities and manufacturers to adopt efficient mitigation technologies. Funding support through infrastructure bills and environmental programs is enabling public and private sectors to invest in advanced water treatment systems. Increasing legal scrutiny and class-action lawsuits have pushed many industries to proactively install point of exit systems to manage reputational and financial risks. The Bipartisan Infrastructure Law (BIL) allocated over USD 9 billion in funding through 2025–2028 to support state and local efforts in PFAS remediation. States like Michigan, New York, and California have launched large-scale PFAS cleanup initiatives using this funding, prioritizing GAC, ion exchange, and membrane-based filtration systems. The urgency to safeguard public health, combined with a mature technological ecosystem, is creating a favorable environment for accelerated adoption across the region.

U.S. Point of Exit PFAS Treatment Systems Market

The U.S. point of exit PFAS treatment systems market is witnessing strong growth driven by the increasing implementation of PFAS limits in public and private water systems. A sharp rise in state-led initiatives, combined with federal efforts under the Safe Drinking Water Act, has made point of exit solutions a strategic necessity for industries and municipal providers. Companies across aerospace, chemical, and food processing sectors are investing in site-specific treatment systems to meet compliance and prevent legal exposure. Residential and commercial developments are also adopting POE technologies as part of broader ESG goals. Growing consumer awareness around PFAS-linked health risks is driving local governments and institutions to install certified systems. Advances in filter media and modular construction are reducing installation time and maintenance costs, further boosting demand.

Asia Pacific Point of Exit PFAS Treatment Systems Market Overview

The market in Asia Pacific is expected to experience significant growth during the forecast period due to rising industrial expansion and increasing detection of PFAS in surface and groundwater supplies. Countries such as Japan, South Korea, and India are beginning to impose stringent environmental standards and monitor fluorinated chemical discharge more rigorously. Infrastructure development programs in the region are increasingly focused on water safety, prompting investment in advanced treatment technologies. Rising demand from the electronics, textile, and chemical processing industries is accelerating the deployment of POE systems to address regulatory compliance. Growing collaboration between public health agencies and private vendors is supporting pilot installations and technology trials. Rapid urbanization, along with awareness initiatives around PFAS-related toxicity, is likely to expand the market in both industrial and residential applications.

China Point of Exit PFAS Treatment Systems Market

The market in China is growing rapidly due to increasing environmental crackdowns on industrial pollutants, including PFAS compounds. National policies are encouraging stricter discharge limits and more rigorous environmental audits, leading to proactive adoption of point of exit treatment systems in industrial parks and urban water supplies. The textile and manufacturing sectors are facing mounting pressure to implement closed-loop water treatment processes, pushing demand for scalable and efficient POE solutions. Domestic technological advancements are making treatment systems more affordable and tailored to local conditions. Public concern around contaminated drinking water is driving municipal programs to integrate PFAS removal at distribution points. Supportive government incentives, along with increasing participation from domestic water technology firms, are transforming China into a key growth market for PFAS remediation infrastructure.

Key Players and Competitive Analysis

The competitive landscape of the point of exit PFAS treatment systems market is evolving rapidly, driven by intensified regulatory pressure, rising public health concerns, and technological innovation. Industry analysis indicates a growing focus on market expansion strategies such as new product development and geographic diversification to capture opportunities in highly contaminated regions and underserved rural communities. Strategic alliances between water technology providers and municipal utilities are enabling scalable deployment of POE systems integrated with granular activated carbon, ion exchange resins, and advanced filtration membranes.

Companies are increasingly engaging in mergers and acquisitions to enhance their product portfolios, improve distribution channels, and access proprietary treatment technologies. Post-merger integration is being used to streamline operations and optimize R&D resources. Joint ventures between domestic manufacturers and global water tech firms are supporting localized production and compliance with emerging environmental standards. Technology advancements are centered around compact modular units, smart monitoring systems, and PFAS-specific filtration media. The market also sees a growing role for third-party certification bodies, which influence procurement decisions and shape competitive positioning. Emphasis on lifecycle cost reduction, service agreements, and remote system management is intensifying, reflecting the shift toward holistic water treatment solutions. The competitive environment is expected to intensify as demand for PFAS mitigation grows.

Key Players

- AECOM

- Aquasana

- Arvia Technology

- Calgon Carbon Corporation

- Culligan Water

- DuPont

- EcoWater Systems LLC

- Ion Exchange

- Pentair plc.

- Saltworks Technologies Inc.

- Thermax

- Toshiba

- Veolia

- Xylem

Point of Exit PFAS Treatment Systems Industry Developments

In April 2025, AqueoUS Vets introduced the FoamPro system, an advance foam fractionation technology designed for the remediation of PFAS-contaminated water through an energy-efficient vacuum process. This modular system is engineered to accommodate a range of flow rates and manage diverse waste streams, including residues from firefighting foams and leachate from landfills. Its design facilitates adaptable deployment in complex treatment scenarios, making it a versatile solution for addressing persistent environmental contaminants.

In June 2024, AECOM collaborated with Aquatech to promote the use of DE-FLUORO, an electrochemical technology for breaking down PFAS compounds. The system was tested on various waste streams, including firefighting foam and leachate. Aquatech took responsibility for full-scale deployment, from initial assessment to on-site execution. The partnership aimed to provide more sustainable and scalable PFAS treatment options for the public and private sectors.

Point of Exit PFAS Treatment Systems Market Segmentation

By Technology Outlook (Revenue USD Million, 2020–2034)

- Reverse Osmosis

- Granular Activated Carbon

- Ion Exchange Filter

- Others

By Application Outlook (Revenue USD Million, 2020–2034)

- Commercial

- Industrial

- Surgical & medical instruments

- waterproof outerwear

- Broad woven fabric mills

- Perfumes & cosmetics

- Plastic films

- EV battery manufacturing

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Point of Exit PFAS Treatment Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 517.47 million |

|

Market Size in 2025 |

USD 551.11 million |

|

Revenue Forecast by 2034 |

USD 979.61 million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 517.47 million in 2024 and is projected to grow to USD 979.61 million by 2034.

The global market is projected to register a CAGR of 6.6% during the forecast period.

In 2024, the Europe point of exit PFAS treatment systems market accounted for ~35% of the revenue shares due to its long-standing regulatory emphasis on drinking water quality and environmental safety.

A few of the key players are AECOM, Aquasana, Arvia Technology, Calgon Carbon Corporation, Culligan Water, DuPont, EcoWater Systems LLC, Ion Exchange, Pentair plc., Saltworks Technologies Inc., Thermax, Toshiba, Veolia, Xylem.

In 2024, the granular activated carbon segment accounted for ~47% of the revenue share due to its high effectiveness in adsorbing a wide range of PFAS compounds, including both long- and short-chain variants

In 2024, the industrial segment accounted for ~90% of the revenue share due to the widespread presence of PFAS in manufacturing sectors such as chemical production, aerospace, textiles, and electronics.