Activated Carbon Market Size, Share, & Industry Analysis Report

: By Product Type (Granular, Powdered, Others), By Application, By Raw Material, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1477

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

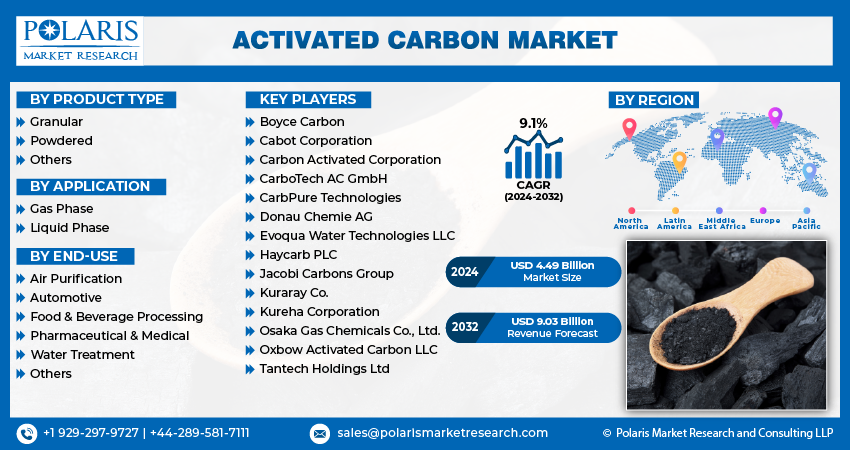

The global activated carbon market was valued at USD 9.8 billion in 2024 and is projected to grow at a CAGR of 8.90% from 2025 to 2034. The market is expanding due to rising demand for water and air purification solutions, advancements in carbon production, and increasing industrial air pollution control.

Key Insights

- The coal-based segment is expected to experience significant growth during the forecast period due to its extensive use in large-scale industrial filtration and purification applications.

- The distributor networks segment is projected to grow the fastest, as it effectively connects manufacturers with smaller or regional buyers.

- In 2024, the water treatment segment held the largest market share, driven by its extensive use in municipal and industrial water purification.

- The Asia Pacific activated carbon market led revenue shares in 2024, supported by high demand across various industries including water purification, air treatment, and gold recovery.

- North America’s activated carbon market is forecasted to grow significantly, fueled by stringent environmental regulations and increasing awareness of air and water quality issues.

- Growth in the European activated carbon market is mainly driven by environmental compliance requirements and advancements in sustainable, green technologies.

Industry Dynamics

- Increasing industrial and municipal demand for purification and filtration solutions is driving strong growth in the activated carbon market globally.

- Expansion of distributor networks is accelerating market reach by effectively connecting manufacturers with regional and smaller buyers.

- High costs of advanced activated carbon products and regional regulatory differences pose challenges to broader market penetration and adoption.

- Technological advancements in green production methods and tailored activated carbon formulations are enhancing performance and sustainability, fostering innovation in the activated carbon market.

Market Statistics

- 2024 Market Size: USD 9.8 billion

- 2034 Projected Market Size: USD 22.94 billion

- CAGR (2025-2034): 8.90%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Activated Carbon refers to the process by which pharmaceutical and biotechnology companies trust the research and development of biologics, such as antibodies, proteins, and nucleic acid-based therapies, to specialized contract research organizations (CROs). The rising demand for biologics and next-generation therapies such as monoclonal antibodies, ADCs, and RNA therapies, which has transformed the drug development landscape, boosts the expansion opportunities. According to a July 2024 report published in PLOS, monoclonal antibodies (mAbs) represented a growing share of newly developed drugs, accounting for 27% of all new drug approvals by the US FDA in 2022. Companies are increasingly relying on outsourcing partners to access specialized capabilities in protein engineering, bio analytics, and cell line development, as biopharmaceuticals offer high specificity and efficacy in treating chronic and complex diseases such as cancer, autoimmune disease diagnostics, and rare genetic conditions. This shift allows companies to efficiently address the growing therapeutic demand while reducing internal workload and infrastructure investment.

The increasing R&D investments by both large pharmaceutical companies and emerging biotech firms aim to expand their biologics pipelines. For instance, in April 2022, Catalent invested USD 350 Billion in its Indiana facility to expand biologics manufacturing. The upgrade includes new bioreactors, prefilled syringes, and lyophilisation capacity to support the demand for biologics production. The development of large molecule drugs is complex and expensive, necessitating advanced technologies and expertise in DNA diagnostics technology and biologics manufacturing. Therefore, outsourcing becomes a strategic move. Outsourcing partners offer scalability, regulatory expertise, and faster turnaround times, helping clients minimize risk while optimizing discovery timelines. This rising investment in R&D, combined with the pressure to accelerate drug development, continues to strengthen the outsourcing model as an important part of innovation in the large molecule drug discovery ecosystem.

Industry Dynamics

Advancements in Activated Carbon Production

Recent innovations in activation methods, such as steam, chemical, and microwave-based processes have improved its performance by optimizing pore structure, adsorption efficiency, and reusability. These improvements enable tailored solutions for specialized applications, such as PFAS removal from water and VOC capture in air purification.

Private and public partnerships are accelerating the development of advanced carbon materials, such as nanostructured and hybrid systems integrating zeolites or resins. For instance, in May 2023, Huntsman launched advanced polyurethane, carbon nanotube, and epoxy materials for EV batteries. The innovations target underbody protection, enclosures, and covers, focusing on light weighting, flame resistance, and structural performance while optimizing manufacturing efficiency. Such collaborations are broadening their role in cutting-edge sectors such as automotive, energy storage, pharmaceuticals, and advanced water treatment, fueling technological-driven market expansion.

Increasing Industrial Air Pollution Control Requirements

Industrial emissions from power plants, cement production, and chemical manufacturing significantly contribute to air pollution. According to a 2025 IEA report, global energy-related CO2 emissions rose 0.8% in 2024, reaching a record 37.8 Gt. Atmospheric CO2 concentrations hit 422.5 ppm, three ppm above 2023 levels and 50% higher than pre-industrial averages. Activated carbon has emerged as a major solution for capturing hazardous pollutants, such as mercury, VOCs, and sulfur compounds. Stricter emission regulations, such as the Mercury and Air Toxics Standards (MATS) and updated EPA air quality rules, have accelerated the adoption of these advanced materials. A March 2024 Clean Air Fund report noted the EPA reduced the annual PM2.5 limit from 12μg/m³ to 9μg/m³ for industrial and vehicular sources, further driving demand for vapor-phase systems.

Additionally, growing environmental awareness and corporate ESG commitments are also propelling investments in sustainable air purification technologies. Industries increasingly deploy activated solutions to comply with regulations, reduce environmental impact, and enhance stakeholder confidence, reinforcing its critical role in clean air initiatives.

Segmental Insights

Raw Material Analysis

The segmentation, based on raw material, includes coal-based, coconut shell, hardwood-based, softwood-based, and other materials. The coal-based segment is projected to grow with a significant CAGR during the forecast year due to its widespread application in industrial-scale filtration and purification systems. Coal-based carbon is known for its high porosity and excellent adsorption capacity, making it suitable for treating large volumes of contaminated water and air. Its cost-effectiveness and availability in large quantities further improve its use across sectors such as municipal water treatment and flue gas cleaning. Moreover, continuous technological improvements in activation processes are improving the performance characteristics of coal-based variants, supporting its increasing preference in both developing and developed markets.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes direct wholesale to manufacturers, distributor networks, and retail channel. The distributor networks segment is projected to witness fastest growth during the forecast period driven by its role in bridging the gap between manufacturers and smaller-scale or regional buyers. Distributors enable widespread market penetration by managing logistics, warehousing, and localized customer service, which is particularly beneficial in emerging markets. Their ability to offer customized packaging, flexible pricing, and technical support adds value for various end users with changing demand profiles. Additionally, the growing complexity of these carbon applications across industries is also boosting reliance on specialized distributors capable of offering tailored solutions.

End User Analysis

The segmentation, based on end user, includes water treatment, air & gas purification, food & beverage processing, pharmaceutical, mining & metallurgy, automotive & transportation, and others. The water treatment segment held largest share of the market in 2024 owing to the widespread use in municipal and industrial water purification processes. It is highly effective in removing organic contaminants, chlorine, and other chemical impurities, making it essential in achieving safe drinking water standards. Rising global concerns over water quality, coupled with strict environmental regulations, are further boosting the demand for reliable filtration materials. Additionally, increasing investment in water infrastructure and wastewater recycling initiatives are driving the segment’s growth.

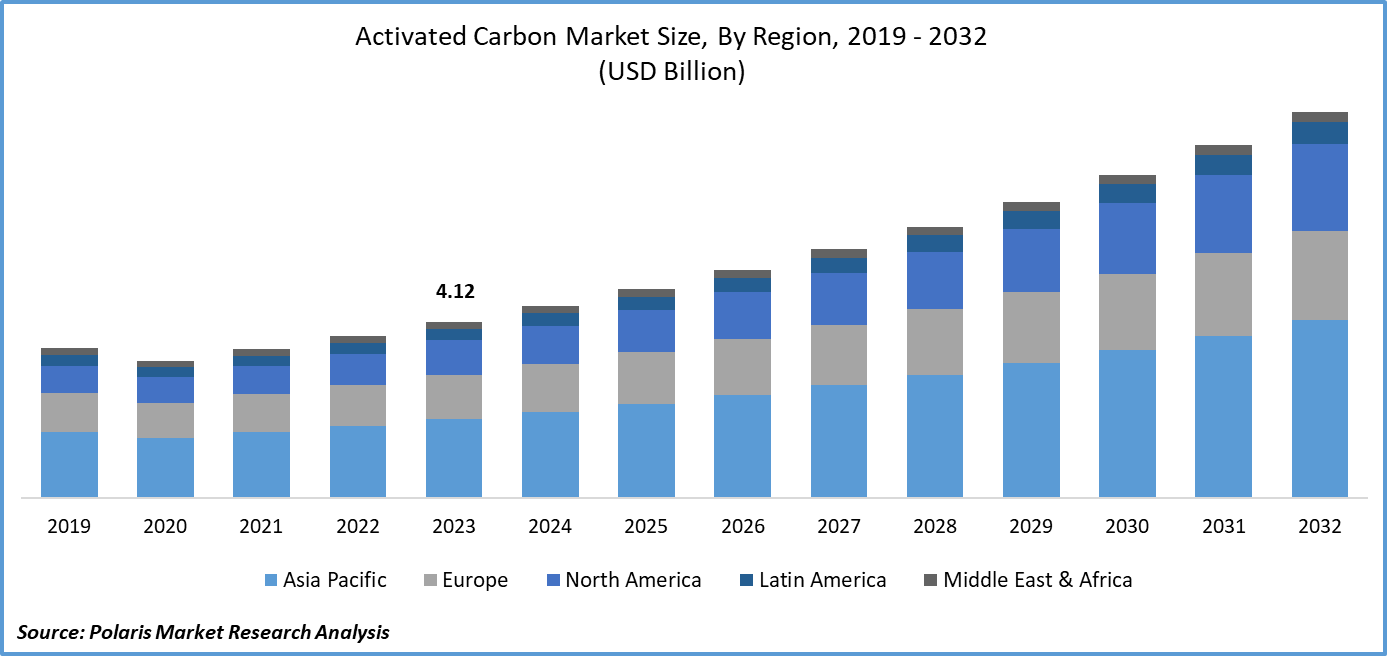

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific activated carbon market dominated the revenue share in 2024 primarily driven by strong demand across diverse industrial applications such as water purification, air treatment, and gold recovery. The region's robust industrial base and increasing focus on environmental sustainability have boosted the use of carbon in pollution control technologies as the pollution level increases. According to a November 2024 WHO report, poor air quality causes 6.5 Billion annual deaths globally, with approximately 70% of these air pollution-related fatalities occurring in the Asia Pacific region. Additionally, the presence of large-scale manufacturing facilities and readily available raw materials has contributed to cost-effective production, further improving regional competitiveness. The rising consumption across end-use industries, including food & beverage and pharmaceuticals, continues to reinforce Asia Pacific’s leadership position in the market.

China activated carbon market held the largest share, owing to its vast manufacturing ecosystem and availability of raw materials such as coal and coconut shells. The country’s high-volume demand across water purification, food processing, and metal extraction sectors has further driven consumption levels. In addition, government initiatives focused on improving air and water quality have encouraged the widespread adoption of activated carbon in environmental applications.

The North America activated carbon market is anticipated to witness the significant growth during the forecast period fueled by strict environmental regulations and rising awareness of air and water quality. The growing adoption of activated carbon in municipal and industrial water treatment systems, along with its increasing usage in automotive emission control and industrial gas purification, are driving the market expansion. Moreover, a growing shift towards renewable energy and clean technologies is strengthening the demand for power generation and energy storage applications. The focus on circular economy practices and reusability of materials is further expected to support long-term growth.

The US activated carbon sector is witnessing growth, fueled by strict environmental standards and increasing investments in industrial air and water purification technologies. The rise in demand from sectors such as automotive, healthcare, and chemicals is also contributing to steady expansion opportunities. Moreover, advancements in production technologies and an increasing focus on sustainability are strengthening domestic capabilities and supply chains.

Environmental compliance standards and advancements in green technologies primarily drive Europe activated carbon market growth. The region’s transition towards low-emission industries has increased the demand in air filtration, wastewater treatment, and flue gas desulfurization applications. Additionally, regulatory initiatives aimed at reducing industrial carbon footprints are encouraging industries to adopt high-performance filtration and adsorption solutions. Ongoing innovation in material science and increasing incorporation in consumer products such as cosmetics and personal care items are also boosting development across the region.

UK activated carbon market is supported by a growing focus on eco-friendly industrial practices and strict regulatory frameworks surrounding emissions and water treatment. The rising integration in medical applications, consumer goods, and energy storage solutions is expanding its end use potential. Additionally, innovation in material engineering and efforts to transition toward circular economy models are improving the country’s position in the European market.

Key Players & Competitive Analysis

The activated carbon industry is witnessing transformation driven by technological advancements and sustainable value chains. Major players are leveraging strategic investments to improve production efficiency and expand applications in water treatment and air purification. Industry trends reveal growing demand for PFAS removal and industrial emission control, particularly in developed markets with strict environmental regulations. The Asia-Pacific region dominates consumption due to rapid industrialization and pollution concerns, while North America focuses on emerging technologies such as hybrid sorbent systems. Small and medium-sized businesses are gaining traction by specializing in niche applications, such as biogas purification. However, supply chain disruptions and raw material volatility pose challenges. Future development strategies highlight circular economy models, such as reactivation services and bio-based feedstocks. Expert insights highlight expansion opportunities in energy storage and pharmaceuticals, though competitive positioning hinges on scaling advanced material innovations. Regulatory shifts, like tighter EPA standards, are accelerating adoption, creating latent demand for high-performance solutions.

A few key players are Boyce Carbon; Cabot Corporation; Carbon Activated Corporation; CarboTech AC GmbH; CarbPure Technologies; Donau Chemie AG; Evoqua Water Technologies LLC; Haycarb PLC; Jacobi Carbons Group; Kuraray Co.; Kureha Corporation; Osaka Gas Chemicals Co., Ltd.; Oxbow Activated Carbon LLC; and Tantech Holdings Ltd.

Key Players

- Boyce Carbon

- Cabot Corporation

- Carbon Activated Corporation

- CarboTech AC GmbH

- CarbPure Technologies

- Donau Chemie AG

- Evoqua Water Technologies LLC

- Haycarb PLC

- Jacobi Carbons Group

- Kuraray Co.

- Kureha Corporation

- Osaka Gas Chemicals Co., Ltd.

- Oxbow Activated Carbon LLC

- Tantech Holdings Ltd

Industry Developments

May 2024: Organic Recycling Systems Limited launched GAC-01, a biomass-based activated carbon granule for water treatment. Crafted from discarded biomass, the product offers effective water purification, supporting sustainable solutions in both domestic and international markets.

November 2024: SOLEVO signed an exclusive distribution agreement with Carbonitalia to supply activated carbon products for water treatment and mining applications across African markets.

Activated Carbon Market Segmentation

By Raw Material Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Coal-Based

- Coconut Shell

- Hardwood-Based

- Softwood-Based

- Other Materials

By Distribution Channel Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Direct Wholesale to Manufacturers

- Distributor Networks

- Retail Channel

By End User Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Water Treatment

- Air & Gas Purification

- Food & Beverage Processing

- Pharmaceutical

- Mining & Metallurgy

- Automotive & Transportation

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Activated Carbon Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.80 billion |

|

Market Size in 2025 |

USD 10.65 billion |

|

Revenue Forecast by 2034 |

USD 22.94 billion |

|

CAGR |

8.90% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Tons; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.80 billion in 2024 and is projected to grow to USD 22.94 billion by 2034.

The global market is projected to register a CAGR of 8.90% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Boyce Carbon; Cabot Corporation; Carbon Activated Corporation; CarboTech AC GmbH; CarbPure Technologies; Donau Chemie AG; Evoqua Water Technologies LLC; Haycarb PLC; Jacobi Carbons Group; Kuraray Co.; Kureha Corporation; Osaka Gas Chemicals Co., Ltd.; Oxbow Activated Carbon LLC; and Tantech Holdings Ltd.

The water treatment segment dominated the market in 2024.

The distributor networks segment is expected to witness the fastest growth during the forecast period.