Polylactic Acid Market Share, Size, Trends, Industry Analysis Report

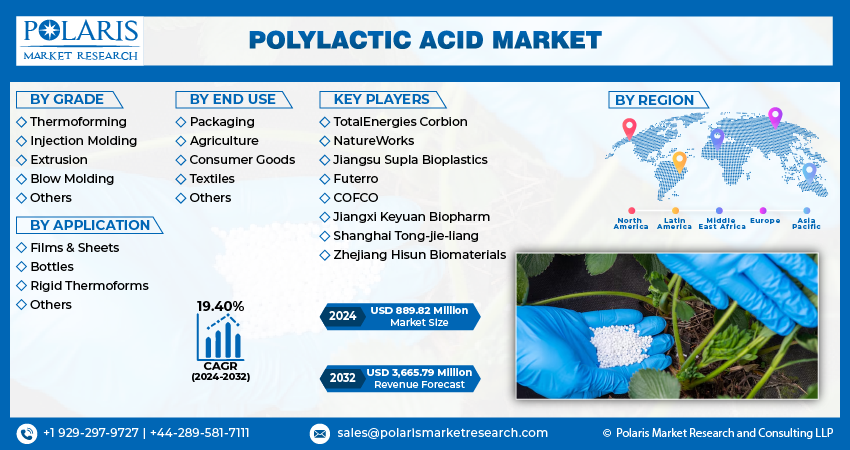

By Grade (Thermoforming, Injection Molding, Extrusion, Blow Molding, Others); By Application; By End-use (Packaging, Agriculture, Consumer Goods, Textiles, Others); By Region, and Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM3592

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global polylactic acid market was valued at USD 747.75 million in 2023 and is expected to grow at a CAGR of 19.40% during the forecast period.Increasing application of the bioplastics, particularly Polylactic Acid (PLA), in various industries such as packaging, automotive & transport, agriculture, electronics, and others, is expected to drive the demand for PLA in the foreseeable future. PLA finds extensive use in end-use sectors like agriculture, textile, transport, and packaging. PLA is a bio-based polymer known for its low-carbon emission characteristics, making it an environmentally-friendly alternative to conventional polymers. As sustainability and environmental concerns gain prominence, there has been a rapid surge in the global demand for PLA compared to traditional plastics. The versatility and biodegradability of PLA make it an attractive choice for a wide range of applications, including food packaging, disposable cutlery, textiles, automotive parts, and more.

To Understand More About this Research: Request a Free Sample Report

The agricultural industry utilizes PLA for applications like mulch films, plant pots, and agricultural films, benefiting from its biodegradability and bio-based nature. The textile industry incorporates PLA fibers into apparel, home textiles, and nonwoven applications. In the transport sector, PLA is used for interior components and automotive parts, offering lightweight and sustainable alternatives. Additionally, PLA finds extensive usage in packaging materials, including films, bottles, containers, and trays, owing to its renewable and compostable nature.

The versatility of PLA allows it to be processed into various packaging formats, providing manufacturers with flexibility in design and functionality. Additionally, PLA's compostable nature aligns with the increasing adoption of circular economy principles, where packaging materials can be recycled or composted after use. Considering the expanding packaging industry and the growing consumer demand for sustainable packaging solutions, the demand for PLA is anticipated to increase over the forecast period. The unique properties of PLA make it an attractive choice for manufacturers seeking environmentally-friendly packaging materials to meet the evolving market demands.

The United States exhibits strong growth potential in the polylactic acid market due to several factors. The country benefits from abundant availability of raw materials and the presence of major PLA manufacturers. The increasing consumer preference for packaged food and ready-to-eat meals has fueled the growth of the food processing market in the United States. The U.S. government has implemented favorable laws and regulations concerning the production of PLA, which further supports its market growth. Moreover, the easy availability of raw materials for PLA synthesis within the country contributes to its market expansion.

The increased production of PLA in the United States has resulted in its expanded utilization in the packaging and healthcare industries. This can be attributed to factors such as increased consumer awareness regarding the use of bioplastics and the presence of key enterprises within the country. However, the outbreak of the COVID-19 pandemic has had a negative impact on the industry, particularly in the fashion apparel segment, due to decreased demand from end-use customers.

Nevertheless, there has been a surge in demand for personal protective apparel as a result of the rising number of COVID-19 cases. This has subsequently fueled the growth of the textile industry. As PLA is used as a material in the textile industry, the increased demand for personal protective apparel is expected to drive the demand for PLA in this sector as well. Despite the challenges faced by the industry during the pandemic, the growing demand for personal protective apparel presents an opportunity for the PLA market in the textile industry. This, along with its established presence in packaging and healthcare applications, is anticipated to contribute to the overall growth of the market.

Industry Dynamics

Growth Drivers

Packaging industry is experiencing significant growth, driven by the increasing demand for flexible packaging solutions. Various factors contribute to this growth, including the rising need for convenience, changing lifestyles, and the growing popularity of ready-to-eat meals, snacks, and packaged foods. As a result, there is a surge in demand for innovative and sustainable packaging materials, including bioplastics like Polylactic Acid (PLA).

PLA, being a bio-based and biodegradable polymer, is well-suited for applications in the packaging industry. It offers several advantages, such as excellent clarity, barrier properties, and printability, making it suitable for flexible packaging solutions. PLA films and coatings can be used for applications like food packaging, including wraps, pouches, trays, and labels. PLA provides a renewable and compostable alternative to conventional plastics, reducing the environmental impact associated with packaging waste. As regulatory bodies and consumers increasingly emphasize sustainability and waste reduction, the adoption of PLA in packaging solutions is expected to grow.

Report Segmentation

The market is primarily segmented based on grade, application, end use, and region.

|

By Grade |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Packaging segment accounted for the largest market share in 2022

The segment growth can be attributed to the extensive utilization of PLA in the manufacturing of jars, containers, bottles, and fresh food packaging. There is a global consumer preference for sustainable and eco-friendly packaging, which has compelled manufacturers to incorporate PLA in their packaging solutions. PLA finds significant application in the food packaging industry, where it is used for producing disposable, durable, and visually appealing plastic bottles.

These bottles exhibit properties such as gloss and transparency, enhancing their attractiveness to both manufacturers and consumers. Additionally, various countries and states, including Taiwan, the UK, Zimbabwe, New Zealand, and certain states in the United States (such as New York, Hawaii, and California), have implemented stringent regulations on single-use plastics. This has further contributed to the growing demand for PLA in the packaging sector as companies seek alternatives to traditional plastics.

Textile segment recorded registered the highest growth rate. The textile industry is another significant market with a high level of adoption and growth rate for PLA. Polylactic acid offers the advantage of providing smooth and comfortable materials for textile production. With increasing consumer awareness and demand for sustainable and eco-friendly textiles, PLA-based fabrics and fibers have gained popularity. The use of PLA in the textile industry aligns with the industry's focus on developing environmentally friendly alternatives to traditional materials.

Due to its biodegradability and reduced emission of harmful gases during combustion, the demand for PLA in packaging applications is expected to remain robust during the forecast period. Bioplastic packaging, especially in rigid and loose-fill forms, has received substantial legislative support due to the imperative to reduce greenhouse gas emissions. As a result, there is a growing emphasis on sustainable packaging solutions, driving the demand for PLA in this sector.

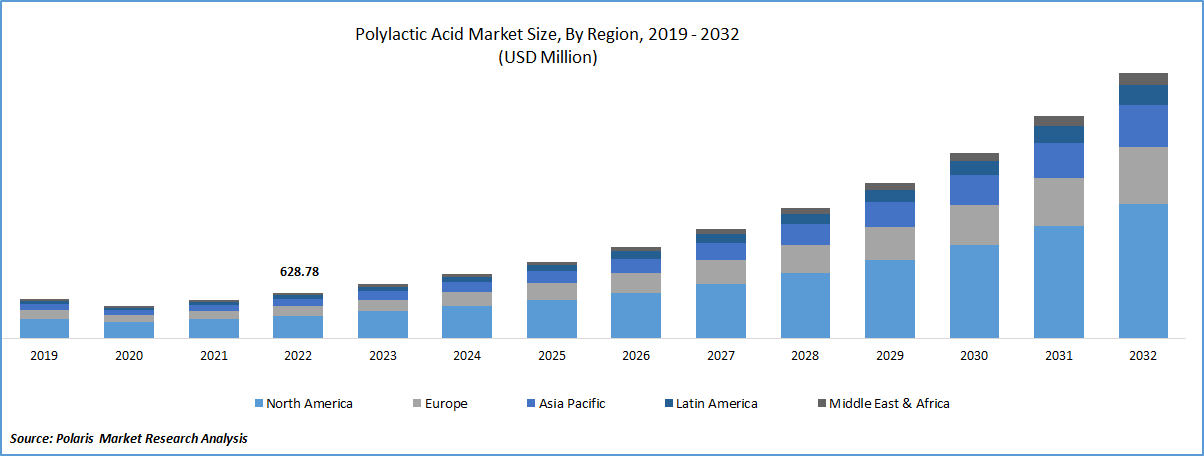

North America region dominated the global market in 2022

The North America region dominated the global market with considerable market share in 2022. The region's growth can be attributed to the increase in the demand of the bioplastics, with Europe being one of the major markets for poly-lactic acid, followed by the Asia Pacific. The market is expected to witness further growth, driven by increasing demand for environmentally-friendly products, supported by various initiatives promoting the use of bioplastics in the region.

The North American region is also experiencing increased demand for polylactic acid (PLA) from key industries such as automobile and transport, electronics, textile, packaging, appliances, and medical sectors. Furthermore, the region is expected to dominate the packaging market in the forecast period, driven by the growing food and beverage sector, particularly in India and China.

The increasing demand for packaged food, coupled with rising disposable income, is anticipated to boost the demand for flexible packaging in the region. Additionally, the robust growth of the healthcare sector in Europe is expected to drive the demand for pharmaceuticals, subsequently impacting the demand for flexible packaging and contributing to the growth of the PLA market in the years to come.

Competitive Insight

To gain a competitive edge and higher market shares, companies are actively undertaking various strategies such as acquisitions, mergers, and collaborations. These strategic moves allow companies to strengthen their market positions, expand their product portfolios, and leverage synergies to drive growth. By joining forces or forming strategic alliances, companies can tap into new markets, access new technologies, and enhance their capabilities to meet the evolving demands of customers.

Some of the major players operating in the global market include TotalEnergies Corbion, NatureWorks, Jiangsu Supla Bioplastics, Futerro, COFCO, Jiangxi Keyuan Biopharm, Shanghai Tong-jie-liang, and Zhejiang Hisun Biomaterials.

Recent Developments

- In May 2023, DuPont completed the acquisition of the Spectrum Plastics. This will add the company’s existing bio-pharma, packaging solutions in the medical devices.

Polylactic Acid Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 889.82 million |

|

Revenue forecast in 2032 |

USD 3,665.79 million |

|

CAGR |

19.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Grade, by Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

TotalEnergies Corbion, NatureWorks, Jiangsu Supla Bioplastics, Futerro, COFCO, Jiangxi Keyuan Biopharm, Shanghai Tong-jie-liang, and Zhejiang Hisun Biomaterials |

FAQ's

The Polylactic Acid Market report covering key are grade, application, end use, and region.

Polylactic Acid Market Size Worth $ 3,665.79 Million By 2032.

The global polylactic acid market expected to grow at a CAGR of 19.3% during the forecast period.

North America is Polylactic Acid Market.

key driving factors in Polylactic Acid Market are increasing demand for flexible packaging solutions.