Portable Air Compressor Market Size, Share, & Industry Analysis Report

By Product (Reciprocating and Rotary/Screw), By Operation Mode, By Lubrication, By Range, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5813

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

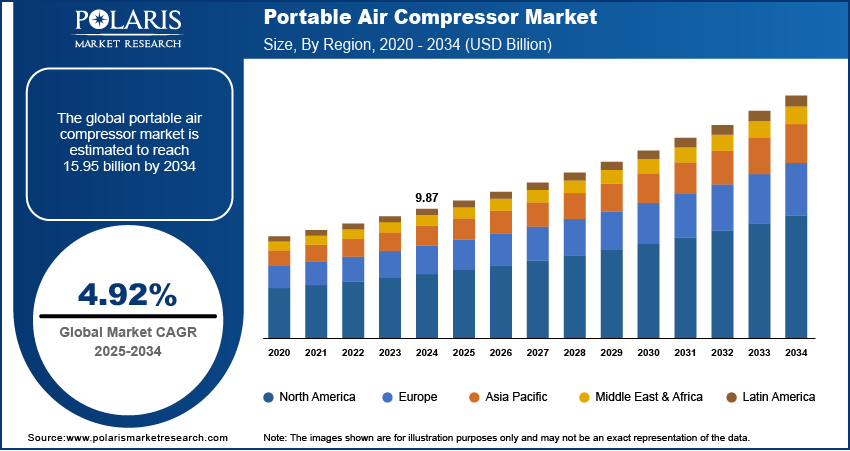

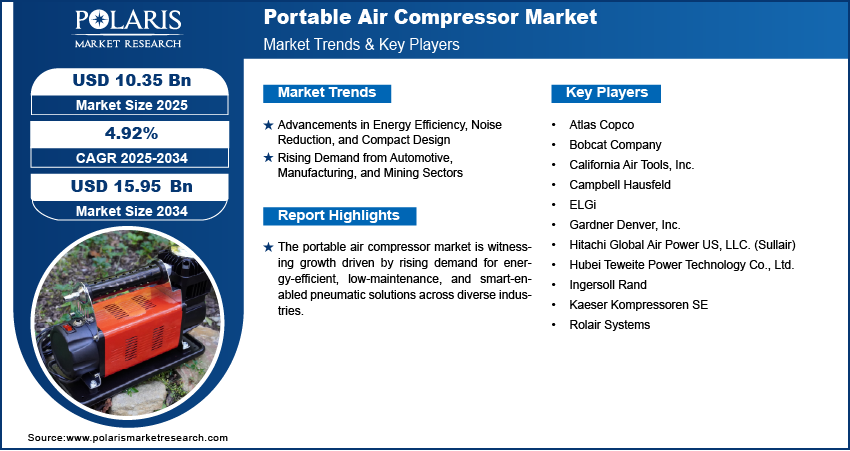

The global portable air compressor market size was valued at USD 9.87 billion in 2024, growing at a CAGR of 4.92% during 2025–2034. The growth is driven by the rising demand for portable compressors, providing cost-effective solutions for short-term needs.

A portable air compressor is a compact, mobile device that supplies compressed air for powering tools and machinery across various applications. The demand for portable air compressors is rising due to the increasing pace of industrialization and construction activities. According to a report from the WHO in December 2023, there has been a 2.3% expansion across global industrial sectors. Also, a UNEP report published in March 2025 noted that global building floor space grew by 5 billion square meters between 2022 and 2023, marking a 2% year-on-year increase and a 2.2% rise since 2020. There is a rising need for efficient, mobile air compression solutions to support on-site operations as economies expand and manufacturing bases diversify. These compressors enable the smooth execution of tasks such as drilling, nailing, and painting, making them essential on construction sites and in the industrial sector, where flexibility and reliability are crucial. The convenience of portability allows businesses to reduce operational downtime and improve productivity, further reinforcing their adoption in emerging industrial landscapes.

The rise in infrastructure development and urbanization boosts growth opportunities. Urban expansion projects such as residential and commercial building developments, road construction, and public utility installations require consistent and adaptable pneumatic conveying systems, which portable compressors effectively provide. According to the OECD 2021 report, Africa's urbanization reached 54% in 2020, accounting for nearly one-third of GDP per capita gains. The need for compact, efficient, and durable equipment grows as urban planning increasingly incorporates smart cities initiatives and rapid development agendas. This rising urban footprint creates a favorable environment for these air compressors, as they offer operational flexibility across diverse terrains and project scales, making them a strategic tool in modern infrastructure execution.

Industry Dynamics

Advancements in Energy Efficiency, Noise Reduction, and Compact Design

Advancements in energy efficiency, noise reduction, and compact design are driving expansion opportunities by improving product functionality and user convenience. Manufacturers are increasingly focusing on developing compressors that consume less power, produce lower noise levels, and are more space-efficient to meet the evolving expectations of end users across sectors. For instance, in July 2023, Atlas Copco launched the XATS 900E electric portable compressor with a 160kW motor for efficient, quiet operation. The unit is up to 50% smaller and up to 30% lighter. These improvements reduce operational costs and allow for wider applicability in noise-sensitive and confined environments such as residential construction zones or indoor industrial settings. The integration of lightweight materials and smart technologies further supports easier handling, transportation, and on-site usage, thereby making modern compressors more attractive to a broader range of users and applications.

Rising Demand from Automotive, Manufacturing, and Mining Sectors

The automotive, manufacturing, and mining industries rely heavily on pneumatic tools and systems for a few tasks such as painting, tire inflation, assembly line operations, and drilling, which require reliable and mobile sources of compressed air. In particular, portable compressors allow greater flexibility and mobility in field operations and maintenance activities, which is critical in sectors such as mining and heavy machinery. The need for high-performance, transportable compressors continues to grow as these industries expand and modernize, reinforcing their value as an essential component of industrial productivity and operational efficiency. Therefore, rising demand from the automotive, manufacturing, and mining sectors is further accelerating the adoption of portable air compressors.

Segmental Insights

By Product Analysis

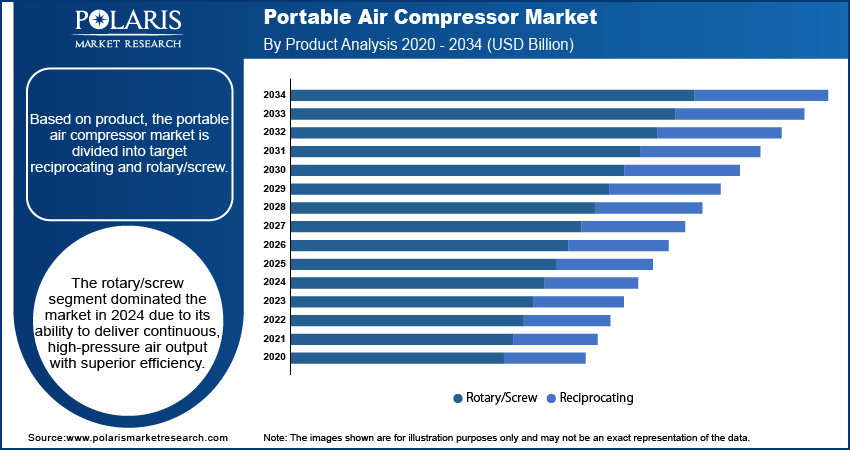

The segmentation, based on product, includes reciprocating and rotary/screw. The rotary/screw segment dominated the market in 2024 due to its ability to deliver continuous, high-pressure air output with superior efficiency. These compressors are particularly favored in demanding industrial and construction environments where consistent operation is essential. Their lower maintenance requirements, higher energy efficiency, and quieter operation compared to reciprocating models have made them the preferred choice for large-scale and commercial applications. The robust design and better adaptability to varying load conditions further contribute to the widespread adoption of rotary/screw compressors across diverse end-use sectors.

By Operation Modes Analysis

The segmentation, based on operation modes, includes electric and internal combustion engines. The electric segment is expected to witness substantial growth during the forecast period, driven by increasing environmental concerns and the shift toward cleaner energy alternatives. Electric compressors offer several advantages, such as lower emissions, quieter operation, and reduced maintenance compared to internal combustion engine models. Electrically powered compressors are becoming a popular choice across the construction, manufacturing, and services sectors as industries and regulatory bodies push for greener operations. Additionally, advancements in battery technology and the expansion of reliable power infrastructure are making electric compressors more viable for both urban and semi-remote applications.

By Lubrication Analysis

The segmentation, by lubrication, includes oil free and oil filled. The oil free segment is expected to witness a faster growth during the forecast period due to the rising demand in industries that require clean, contaminant-free air, such as food processing, pharmaceuticals, and electronics. Oil-free compressors eliminate the risk of oil contamination in end products, assuring compliance with strict quality and hygiene standards. Their low maintenance needs and growing compatibility with precision applications further increase their appeal. The shift toward oil-free technologies is expected to accelerate rapidly as sustainability and product purity gain priority in industrial processes.

By Range Analysis

The segmentation, based on range, includes up to 20 kW, 21–50 kW, 51–250 kW, 251–500 kW, and over 500 kW. The 251–500 kW segment growth is driven by the increasing need for high-capacity mobile air compression solutions in large-scale industrial and infrastructure projects. These mid-to-high-range compressors provide a balance of portability and power, making them suitable for demanding applications such as tunneling, mining, and heavy equipment operations. Their ability to support long operations without frequent refueling or interruptions adds value in remote or off-grid locations. The segment’s growth reflects a broader trend toward more efficient, high-output portable systems tailored to large-volume needs.

Regional Analysis

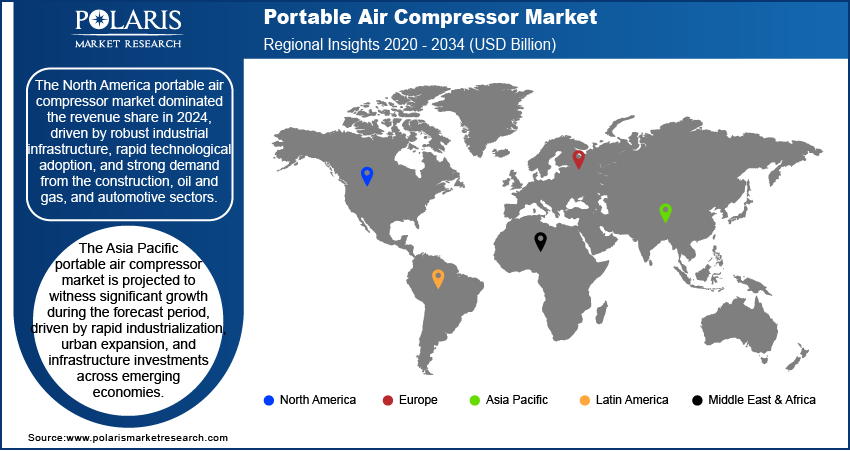

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America portable air compressor market dominated the revenue share in 2024, driven by robust industrial infrastructure, rapid technological adoption, and strong demand from construction, oil and gas, and automotive sectors. Substantial foreign direct investments further reinforce the region’s growth. According to ITA data, FDI in America's automotive industry reached USD 195.6 billion during 2023. This capital investment has accelerated modernization efforts, fueling demand for advanced, energy-efficient compressor technologies. The region’s developed end-user base and early adoption of innovations such as low-noise systems have boosted its position.

The US portable air compressor market held the largest share, primarily due to the country’s strong aftermarket service ecosystem and widespread equipment rental networks. This accessibility supports flexible usage across various short-term and long-term projects, particularly in construction and industrial maintenance. Additionally, the high rate of technology adoption in machinery and tools improves the appeal of portable compressors designed with smart features and remote monitoring capabilities.

The Asia Pacific portable air compressor market is projected to witness significant growth during the forecast period, driven by rapid industrialization, urban expansion, and infrastructure investments across emerging economies. According to an April 2025 IBEF report, India's Union Budget 2025–2026 allocated USD 128.64 billion for infrastructure capital investment, representing 3.1% of GDP. Increasing construction activities, rising manufacturing output, and supportive government initiatives are further creating favorable conditions for the adoption of these air compressors. Moreover, the region’s cost-sensitive market is fueling demand for efficient, compact, and durable air compressors suitable for diverse field operations, particularly in countries undergoing rapid urban transformation and industrial modernization.

The China portable air compressor sector is experiencing growth, fueled by the expanding presence of domestic manufacturers offering cost-effective and customizable solutions. The country’s focus on boosting export-oriented manufacturing, coupled with ongoing infrastructure megaprojects, is increasing the need for reliable compression systems. Moreover, the adoption of automation in local industries is further accelerating the integration of compact, efficient compressors into production workflows.

The Europe portable air compressor market is projected to witness substantial growth during the forecast period, driven by the region's focus on sustainable development, energy efficiency, and technological innovation. The growing shift toward electric and oil-free compressors aligns well with the region’s strict environmental regulations and green building standards. Additionally, advancements in manufacturing technologies, along with robust automotive and aerospace sectors, are fueling consistent demand. The integration of smart technologies and IoT-based monitoring systems in compressors is also gaining momentum, positioning Europe as a hub for innovation-driven growth.

Rising investments in renovation and refurbishment projects across commercial and residential infrastructure drive the UK portable air compressor market growth. These activities require adaptable and lightweight equipment suited for urban job sites with limited space, where portability and low noise levels are essential. In addition, the growing preference for precision tools in sectors such as aerospace and advanced manufacturing is boosting the use of high-performance portable air compressors to meet quality and operational standards.

Key Players and Competitive Analysis

The portable air compressor sector is experiencing dynamic shifts driven by technological advancements and sustainable value chains, with players such as Atlas Copco and Ingersoll Rand focusing on competitive positioning through energy-efficient designs. Latent demand and opportunities in construction, manufacturing, and emerging sectors, such as renewable energy, fuel revenue growth. Industry trends highlight a rise in oil-free compressors for eco-sensitive applications, while supply chain disruptions challenge production scalability. Developed markets dominate adoption, whereas emerging markets show high potential due to infrastructure growth. Strategic investments in IoT-enabled compressors and hybrid models are reshaping future development strategies, with SMEs increasingly adopting compact, cost-effective units. Expert insights highlight regional footprint expansion and partnership ecosystems to address economic and geopolitical shifts. Competitive intelligence reveals consolidation via joint ventures while disruptive technologies such as AI-driven maintenance gain traction.

A few key players are Atlas Copco; Bobcat Company; California Air Tools, Inc.; Campbell Hausfeld; ELGi; Gardner Denver, Inc.; Hitachi Global Air Power US, LLC. (Sullair); Hubei Teweite Power Technology Co., Ltd.; Ingersoll Rand; Kaeser Kompressoren SE; and Rolair Systems.

Key Players

- Atlas Copco

- Bobcat Company

- California Air Tools, Inc.

- Campbell Hausfeld

- ELGi

- Gardner Denver, Inc.

- Hitachi Global Air Power US, LLC. (Sullair)

- Hubei Teweite Power Technology Co., Ltd.

- Ingersoll Rand

- Kaeser Kompressoren SE

- Rolair Systems

Portable Air Compressor Industry Developments

March 2025: TEWATT launched its TWT750D-21T/840D-17T portable air compressor, a Stage V-compliant model designed to combine performance, efficiency, and reduced emissions.

April 2025: Mann+Hummel upgraded its compressed air system with ELGi compressors via Pattons Inc., reducing USD 160K/year in losses from downtime and water waste. The new system improved efficiency across automotive, food & beverage, and other major industries.

February 2024: Bobcat launched the PA12.7v portable air compressor with FlexAir technology, enabling adjustable operation (5.5–12.1 bar) and variable airflow (5.2–7 m³/min).

Portable Air Compressor Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Reciprocating

- Rotary/Screw

By Operation Mode Outlook (Revenue, USD Billion, 2020–2034)

- Electric

- Internal Combustion Engine

By Lubrication Outlook (Revenue, USD Billion, 2020–2034)

- Oil Free

- Oil Filled

By Range Outlook (Revenue, USD Billion, 2020–2034)

- Up to 20 kW

- 21–50 kW

- 51–250 kW

- 251–500 kW

- Over 500 kW

By End Use (Revenue, USD Billion, 2020–2034)

- Construction

- Oil & Gas

- Mining

- Automotive

- Healthcare/Medical

- Food & Beverage

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Portable Air Compressor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.87 billion |

|

Market Size in 2025 |

USD 10.35 billion |

|

Revenue Forecast by 2034 |

USD 15.95 billion |

|

CAGR |

4.92% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.87 billion in 2024 and is projected to grow to USD 15.95 billion by 2034.

The global market is projected to register a CAGR of 4.92% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Atlas Copco; Bobcat Company; California Air Tools, Inc.; Campbell Hausfeld; ELGi; Gardner Denver, Inc.; Hitachi Global Air Power US, LLC. (Sullair); Hubei Teweite Power Technology Co., Ltd.; Ingersoll Rand; Kaeser Kompressoren SE; and Rolair Systems.

The rotary/screw segment dominated the market in 2024.

The oil free segment is expected to witness the fastest growth during the forecast period.