Postbiotics Market Size, Share, Trends, Industry Analysis Report

By Form (Powder, Capsules, Liquid, Tablets, and Others), By Type, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6291

- Base Year: 2024

- Historical Data: 2020-2023

Overview

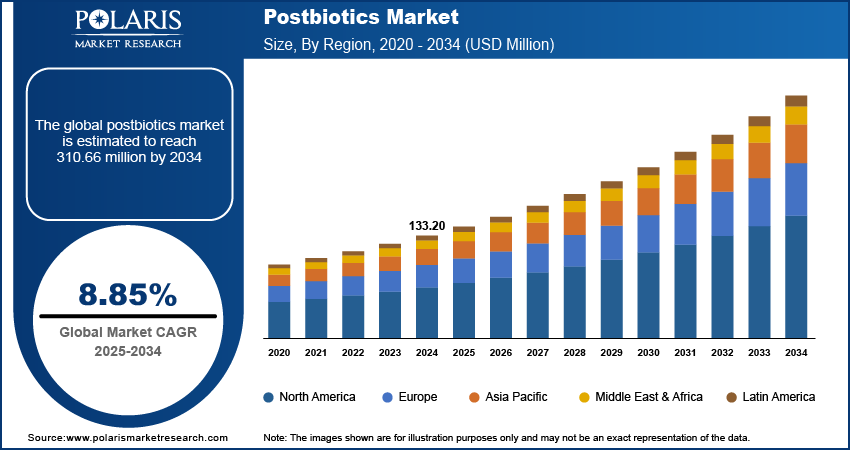

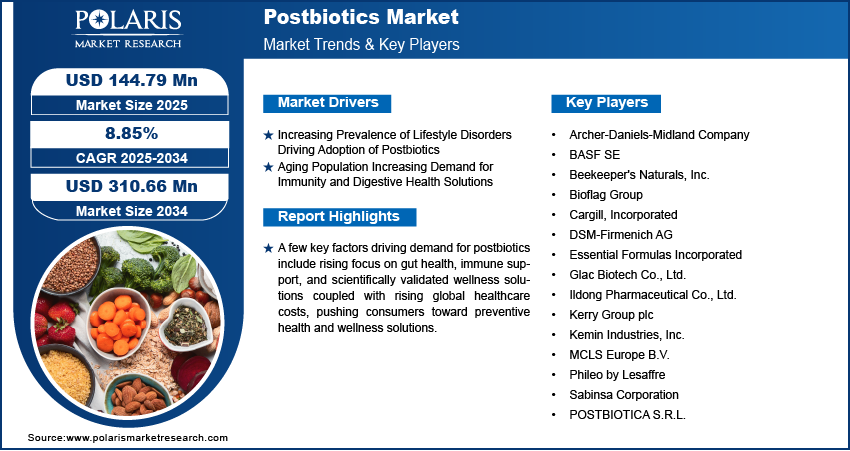

The global postbiotics market size was valued at USD 133.20 million in 2024, growing at a CAGR of 8.85% from 2025 to 2034. Key factors driving demand for postbiotics include increasing prevalence of lifestyle disorders along with aging population increasing demand for immunity and digestive health products.

Key Insights

- The powder segment dominated the market share in 2024.

- The lipopolysaccharides segment is projected to grow at a rapid pace in the coming years, attributed to its emerging role in immune system modulation and potential application in therapeutic formulations.

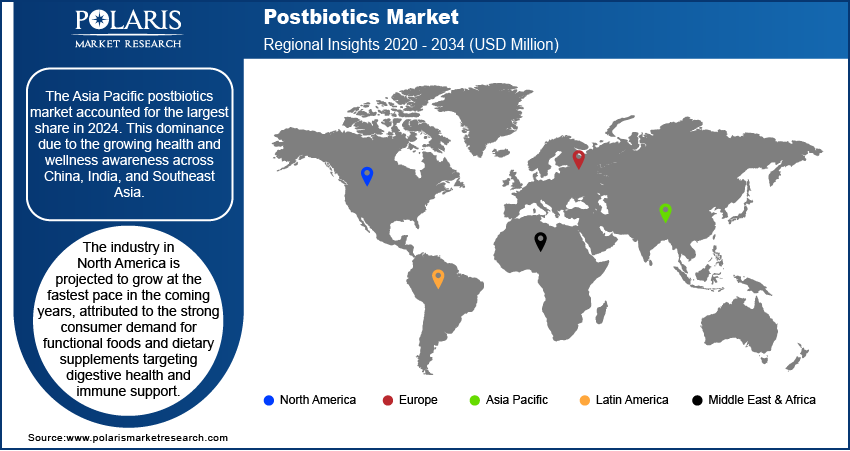

- The Asia Pacific ballistic protective equipment market dominated the global market share in 2024.

- India is emerging as a key growth market, attributed to the expanding pharmaceutical and nutraceutical exports.

- The market in North America is projected to grow at a fast pace from 2025-2034, attributed to the strong consumer demand for functional foods and dietary supplements targeting digestive health and immune support.

- The market in the U.S. is growing due to the rising prevalence of obesity, diabetes, and lifestyle-related disorders that amplified consumer demand for gut microbiome-focused products.

Industry Dynamics

- Increasing prevalence of lifestyle disorders is driving adoption of postbiotics, as consumers seek science-backed solutions for managing conditions such as obesity, diabetes, and gut-related disorders through functional supplements and fortified foods.

- Growing aging population is fueling demand for postbiotics, due to its role in supporting immunity, digestive health, and overall vitality becoming essential for elderly consumers seeking preventive health solutions.

- Advancements in synthetic biology and fermentation technologies present significant opportunities for market expansion, enabling the development of cost-efficient, high-purity postbiotics that enhance scalability and open new product applications across food, pharma, and nutraceutical sectors.

- High R&D and clinical validation costs continue to restrain market growth, as extensive trials and scientific studies are required to substantiate efficacy claims, limiting the ability of smaller players.

Market Statistics

- 2024 Market Size: USD 133.20 Million

- 2034 Projected Market Size: USD 310.66 Million

- CAGR (2025–2034): 8.85%

- Asia Pacific: Largest Market Share

The postbiotics market comprises bioactive compounds generated through the fermentation of probiotics, offering scientifically recognized benefits for gut health, immunity, and overall well-being. Increasingly adopted in dietary supplements, functional foods, pharmaceuticals, and animal nutrition, postbiotics provide stability, safety, and efficacy without the viability concerns associated with live microorganisms. Advancements in fermentation technology, encapsulation methods, and clinical research are enhancing their bioavailability, formulation diversity, and therapeutic applications. Postbiotics, characterized by improved shelf stability, resistance to harsh processing conditions, and compatibility with diverse delivery formats, address the rising consumer demand for evidence-based, safe, and sustainable health solutions while ensuring adherence to global regulatory and safety standards.

Rising focus on gut health, immune support, and scientifically validated wellness solutions is significantly fueling the demand for postbiotics across functional foods, dietary supplements, pharmaceuticals, and animal nutrition. Growing consumer preference for safe, stable, and effective alternatives to probiotics, coupled with increasing clinical research highlighting postbiotics’ health benefits, is driving adoption. Postbiotics, with superior stability, ease of formulation, and ability to withstand harsh processing conditions. This shift toward evidence-based, shelf-stable, and versatile health ingredients is accelerating strong market growth globally.

Rising global healthcare costs are pushing consumers toward preventive health and wellness solutions, driving the demand for functional foods and supplements enriched with postbiotics. According to the Kaiser Family Foundation (KFF) Health System Tracker, healthcare spending per person in the US reached USD 13,432 in 2023, exceeding that of any other high-income nation by more than USD 3,700. Advances in formulation technologies are enabling manufacturers to integrate postbiotics into a wide range of food, beverage, and nutraceutical applications while ensuring stability, bioavailability, and efficacy.

Drivers & Opportunities

Increasing Prevalence of Lifestyle Disorders Driving Adoption of Postbiotics: Rising cases of lifestyle-related disorders, including obesity, diabetes, and irritable bowel syndrome (IBS), are boosting the use of postbiotics in functional foods, supplements, and medical nutrition products. Postbiotics provide clinically proven benefits for gut health, metabolic balance, and overall wellness, positioning it as a preventive approach to managing chronic health conditions. According to the International Diabetes Federation, around 589 million adults aged 20–79 years were living with diabetes worldwide in 2024, and this figure is projected to reach 853 million by 2050. The growing burden of metabolic disorders is accelerating demand for postbiotics as part of daily diets, supporting long-term health management while reducing pressure on healthcare systems.

Aging Population Increasing Demand for Immunity and Digestive Health Solutions: The expanding global elderly population is fueling the need for postbiotic products that enhance immunity, improve digestion, and support healthy aging. Older adults face higher risks of infections, digestive issues, and chronic diseases, which is increasing the demand for postbiotics as a safe and stable solution with clinically validated efficacy. United Nations data indicates that the population aged 65 years and above is expected to reach nearly 2.2 Million by the late 2070s. This demographic trend is pushing manufacturers to focus on postbiotic-based formulations targeting elderly consumers, thus fueling the market growth worldwide.

Segmental Insights

By Form

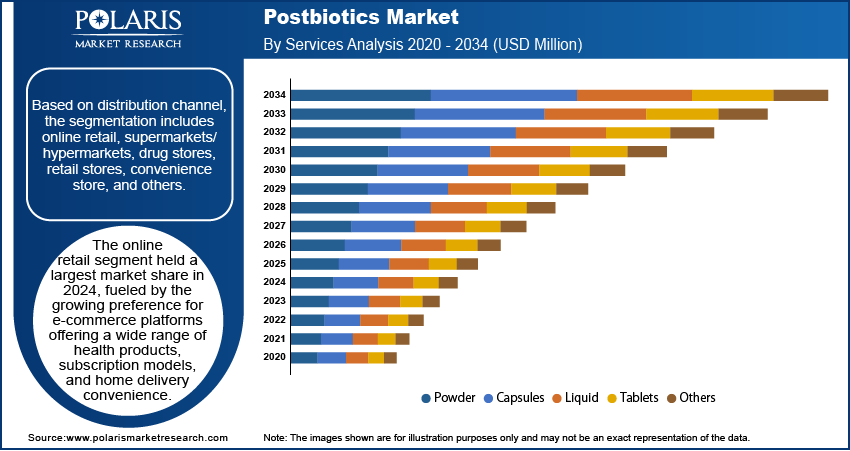

Based on form, the postbiotics market is segmented into powder, capsules, liquid, tablets, and others. Powder accounted for the largest share in 2024, due to its stability, ease of formulation, and high compatibility with functional foods, beverages, and dietary supplements. Widely used in protein powders, fortified drinks, and nutraceutical blends, powdered postbiotics enable efficient absorption and convenient consumer use.

Capsules are projected to grow significantly during the forecast period, driven by rising consumer demand for precise dosage formats and increased adoption in the nutraceutical and pharmaceutical industries. The portability, controlled release, and higher shelf stability of capsules are accelerating its demand across health-conscious populations.

By Type

Based on type, the market is segmented into short-chain fatty acids, lipopolysaccharides, muramyl dipeptide, indole, teichoic acid, lactose pin, and P40 molecule. Short-chain fatty acids (SCFAs) accounted for the largest share in 2024, owing to its clinically validated role in maintaining gut health, regulating metabolism, and reducing inflammation. The application of SCFAs in functional foods and supplements continues to expand, supported by strong evidence linking SCFAs with overall wellness.

Lipopolysaccharides are anticipated to register substantial growth over the forecast period, attributed to its emerging role in immune system modulation and potential application in therapeutic formulations. Growing research on interaction with the gut microbiome is enhancing adoption across medical nutrition and advanced dietary solutions.

By Distribution Channel

Based on distribution channel, the market is segmented into online retail, supermarkets/hypermarkets, drug stores, retail stores, convenience stores, and others. Online retail dominated the market in 2024, fueled by the growing preference for e-commerce platforms offering a wide range of health products, subscription models, and home delivery convenience. Digital marketplaces are enabling greater product visibility and expanding consumer access to specialized postbiotic supplements.

Supermarkets and hypermarkets are expected to expand steadily during the forecast period, driven by increasing shelf placement of functional foods and wellness products. The combination of in-store promotions, consumer education, and wider product assortments is accelerating demand for postbiotics through offline retail formats.

Regional Analysis

The Asia Pacific postbiotics market held the largest market share in 2024, due to the growing health and wellness awareness across China, India, and Southeast Asia. Rising consumer focus on gut health and immunity accelerated demand for functional foods, beverages, and nutraceutical products. The availability of large-scale local production capacity and expansion of domestic nutraceutical hubs are further fueling market growth. Increasing investments in healthcare infrastructure and government-led nutrition programs are strengthening adoption of postbiotics across the region.

India Overview

India is emerging as a key growth center in the Asia Pacific postbiotics market, attributed to the expanding pharmaceutical and nutraceutical exports. Rising demand for gut health-supporting dietary supplements, coupled with the proliferation of functional food products, is boosting the market growth. According to the Confederation of Indian Industry (CII), India’s medical technology exports are expected to reach nearly USD 20 Million by FY30, highlighting the country’s growing position as a global supply hub. The increasing penetration of online retail and e-commerce platforms is further enabling broader consumer access to postbiotic-based products.

North America Postbiotics Market Insights

The North America postbiotics market expected to grow at the fastest CAGR, attributed to the strong consumer demand for functional foods and dietary supplements targeting digestive health and immune support. Favorable regulatory clarity from the FDA and Health Canada has improved commercialization pathways for postbiotic ingredients, boosting product availability across retail and nutraceutical channels. The region’s well-established food and healthcare sectors, combined with rising health-conscious consumer behavior, are further driving market expansion.

The U.S. Postbiotics Market Analysis

The U.S. postbiotics market held the largest share in North America in 2024, driven by the rising prevalence of obesity, diabetes, and lifestyle-related disorders that amplified consumer demand for gut microbiome-focused products. According to U.S. Facts data, nearly 70% of adults in the country are either overweight or obese, underscoring the urgent need for innovative nutritional solutions. The increasing availability of functional beverages and supplements enriched with postbiotics is strengthening adoption in the consumer and clinical nutrition segments across the country.

Europe Postbiotics Market Assessment

The Europe postbiotics market held a significant share globally in 2024, propelled by growing consumer acceptance of scientifically validated gut health solutions. Strong research and development initiatives across Germany, France, and the UK are driving innovation in postbiotic formulations. For instance, in May 2025, functional ingredient leader ADM won the Immune & Gut Health Ingredient category at the inaugural Vitafoods Europe Innovation Awards for its heat-treated postbiotic, Bifidobacterium longum CECT 7347 (HT-ES1). These accolades underscore ADM’s strength in clinical research and ingredient design, supported by European scientific validation including clinical trials demonstrating ES1’s capacity to reduce bloating and improve digestive health in IBS-D patients. Rising incidence of digestive disorders, metabolic diseases, and age-related health conditions is accelerating demand across dietary supplements, medical nutrition, and functional food categories. The region’s well-defined regulatory framework for probiotics and postbiotics, alongside emphasis on preventive healthcare, is further accelerating the growth of the market.

Key Players & Competitive Analysis

The global postbiotics market is highly competitive, with leading companies such as Archer-Daniels-Midland Company, BASF SE, and Cargill, Incorporated driving industry growth through product innovation, capacity expansion, and robust distribution networks. Archer-Daniels-Midland Company continues to enhance its postbiotic portfolio with scientifically backed functional ingredients for dietary supplements and functional foods, while BASF SE and Cargill, Incorporated focus on developing novel formulations, expanding regional presence, and catering to diverse applications across nutraceuticals, beverages, and medical nutrition.

The market is witnessing rising adoption of postbiotics in functional foods, supplements, and beverages, supported by increasing consumer focus on digestive health, immunity, and preventive healthcare. Companies are introducing high-quality postbiotic formulations with targeted health benefits, enhanced stability, and regulatory compliance to meet the growing demand for scientifically validated gut health solutions. Strategic collaborations with food manufacturers, nutraceutical brands, and research institutions are helping players expand their market footprint, while investments in sustainable sourcing and advanced manufacturing practices are aligning offerings with global health and wellness trends.

Prominent companies operating in the postbiotics market include Archer-Daniels-Midland Company, BASF SE, Beekeeper's Naturals, Inc., Bioflag Group, Cargill, Incorporated, DSM-Firmenich AG, Essential Formulas Incorporated, Glac Biotech Co., Ltd., Ildong Pharmaceutical Co., Ltd., Kerry Group plc, Kemin Industries, Inc., MCLS Europe B.V., Phileo by Lesaffre, Sabinsa Corporation, and POSTBIOTICA S.R.L.

Key Players

- Archer-Daniels-Midland Company

- BASF SE

- Beekeeper's Naturals, Inc.

- Bioflag Group

- Cargill, Incorporated

- DSM-Firmenich AG

- Essential Formulas Incorporated

- Glac Biotech Co., Ltd.

- Ildong Pharmaceutical Co., Ltd.

- Kerry Group plc

- Kemin Industries, Inc.

- MCLS Europe B.V.

- Phileo by Lesaffre

- Sabinsa Corporation

- POSTBIOTICA S.R.L.

Postbiotics Industry Developments

In May 2025, Lallemand Inc. entered a strategic global distribution agreement with Kirin Holdings to promote IMMUSE, one of the most clinically documented postbiotics available. The collaboration strengthened Lallemand’s portfolio with a science-backed immune health postbiotic and expanded the global visibility and market reach of IMMUSE.

In February 2025, ADM (US) entered into an exclusive distribution agreement with Asahi Group Foods for Lactobacillus gasseri CP2305, a proprietary postbiotic developed by Asahi. Supported by eight human clinical trials, this postbiotic is formulated to aid stress management, mood enhancement, and sleep improvement.

Postbiotics Market Segmentation

By Form Outlook (Revenue, USD Million, 2020–2034)

- Powder

- Capsules

- Liquid

- Tablets

- Others

By Type Outlook (Revenue, USD Million, 2020–2034)

- Short-chain fatty acids

- Lipopolysaccharides

- Muramly dipeptide

- Indole

- Teichoic acid

- Lactose Pin

- P40 molecule

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Online Retail

- Supermarkets/Hypermarkets

- Drug Stores

- Retail Stores

- Convenience Store

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Postbiotics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD133.20 Million |

|

Market Size in 2025 |

USD144.79 Million |

|

Revenue Forecast by 2034 |

USD 310.66 Million |

|

CAGR |

8.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 133.20 Million in 2024 and is projected to grow to USD 310.66 Million by 2034.

The global market is projected to register a CAGR of 8.85% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Archer-Daniels-Midland Company, BASF SE, Beekeeper's Naturals, Inc., Bioflag Group, Cargill, Incorporated, DSM-Firmenich AG, Essential Formulas Incorporated, Glac Biotech Co., Ltd., Ildong Pharmaceutical Co., Ltd., Kerry Group plc, Kemin Industries, Inc., MCLS Europe B.V., Phileo by Lesaffre, Sabinsa Corporation, and POSTBIOTICA S.R.L.

The powder segment dominated the market revenue share in 2024, due to its stability, ease of formulation, and high compatibility with functional foods, beverages, and dietary supplements.

The lipopolysaccharides segment is projected to witness the fastest growth during the forecast period, attributed to its emerging role in immune system modulation and potential application in therapeutic formulations