Power Electronics Software Market Size, Share, Trends, & Industry Analysis By Technology (RCP, Embedded System Prototyping, MBD, HIL Simulation, and Other Technologies), By Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5906

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

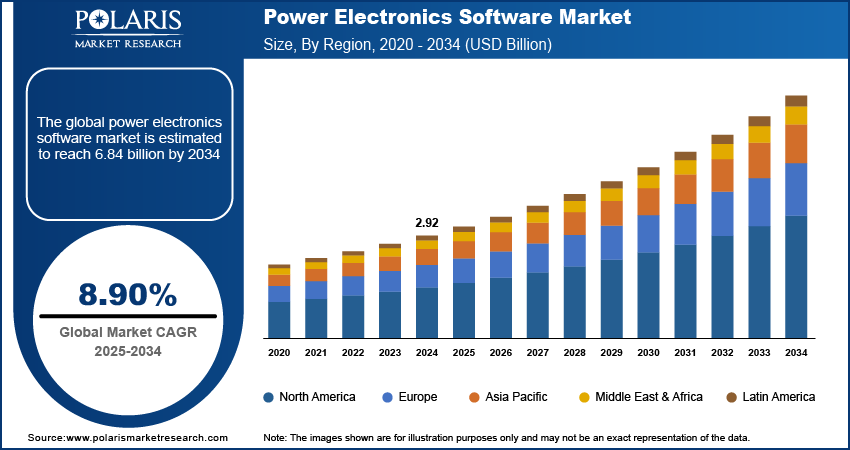

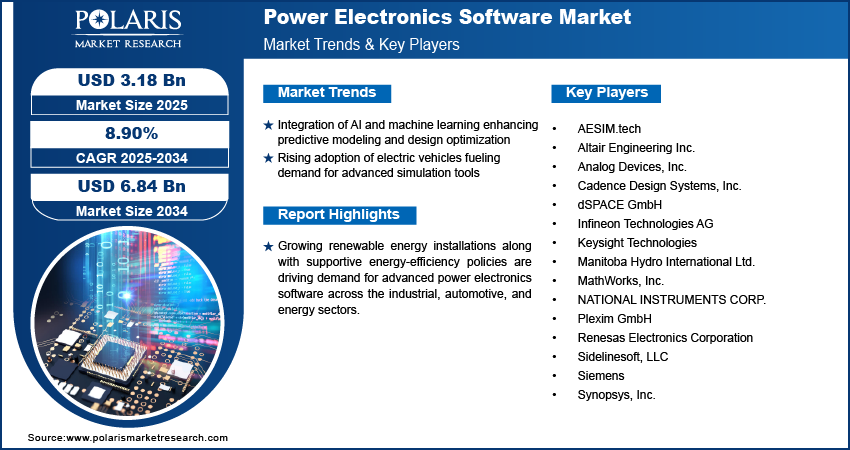

The power electronics software market size was valued at USD 2.92 billion in 2024, growing at a CAGR of 8.90% from 2025–2034. Integration of AI and machine learning platforms coupled with rising adoption of electric vehicles is fueling the demand for power electronics software.

Power electronics software enables engineers and designers to simulate switching behavior, thermal management, electromagnetic interference, and circuit response under different load and environmental conditions. This allows for early-stage design corrections, better thermal efficiency, and faster development of energy-efficient power systems. The growing shift toward wide bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), further increased the need for advanced simulation environments that handle higher frequencies and voltage stresses. In renewable energy projects and EV manufacturing, where reliability and safety are paramount, power electronics software are essential in ensuring compliance with global performance standards. The rising digital transformation in the energy and manufacturing industries is pushing the relevance of these tools, as companies seek integrated software ecosystems that support real-time monitoring, optimization, and lifecycle management of power electronic systems.

Power electronics software is used for modeling, simulation, verification, and optimization of electronic systems that control and convert electric power. These tools help in improving system reliability, reducing design cycles, and optimizing the performance of power devices such as inverters, converters, motor drives, and battery management systems. The software is deployed across a wide range of applications including electric vehicles (EVs), renewable energy systems, industrial automation, and smart grids, where precision, real-time control, and predictive diagnostics are essential.

To Understand More About this Research: Request a Free Sample Report

The rising deployment of renewable energy infrastructure such as solar PV and wind power systems, is accelerating the demand for advanced power electronics software solutions across global energy ecosystems. For instance, in June 2022, China released its 14th five-year plan for renewable energy, setting a goal to increase the share of electricity generated from renewable sources to 33% by 2025, up from approximately 29% in 2021. The plan also includes, for the first time, a dedicated target for renewable heat utilization. Also, in August 2022, the US federal government launched the Inflation Reduction Act (IRA), introducing expanded incentives such as tax credits to accelerate renewable energy development over the coming decade. Energy developers and utilities are increasingly focusing on high-performance software solutions to support the integration of variable renewable sources into traditional power grids. These tools help model, simulate, and manage the behavior of inverters, converters, and other grid-supportive electronics with greater precision.

In addition, supportive government policies promoting energy efficiency and low-emission technologies are contributing significantly to the growth of power electronics software across industrial, automotive, and energy sectors. In 2024, the EU adopted a revised Energy Performance of Buildings Directive requiring all new buildings to be zero-emission by 2030, along with stricter renovation and efficiency targets. Also, the US updated its fuel economy and emissions standards, mandating a 2% annual rise in CAFE targets for passenger cars (2027–2032) and introducing tougher heavy-duty vehicle regulations, aiming for up to 60% of new car sales to be zero-emission by 2032. Regulatory frameworks such as the European Green Deal, the US Inflation Reduction Act, and China’s Renewable Energy Development Plan are further boosting the transition to digitally enabled, high-efficiency energy systems.

Industry Dynamics

Integration of AI and Machine Learning Enhancing Predictive Modeling and Design Optimization

The integration of artificial intelligence (AI) and machine learning (ML) algorithms into power electronics software platforms is transforming the design and testing landscape for power systems, thus fueling the market growth. For instance, in June 2025, Siemens Digital Industries Software unveiled its AI-enhanced EDA toolset, featuring a dedicated EDA AI System with secure, generative, and agentic AI capabilities designed for semiconductor and PCB design flows. This launch advanced AI in power electronics design software by enabling engineers to leverage AI-driven automation, optimization, and verification in the development of power electronics control chips and embedded systems. AI-powered tools are used to accelerate simulation cycles, detect anomalies in system behavior, and create predictive models that simulate real-world scenarios with greater accuracy. These capabilities are important in applications that demand high reliability, such as renewable energy integration, automotive power systems, and industrial automation.

Software providers are embedding AI modules into simulation platforms to support advanced functions such as fault prediction, adaptive control, and self-correcting models. These features are becoming increasingly valuable as power electronics systems grow in complexity, particularly with the introduction of wide bandgap semiconductors and multi-level converter architectures. Companies are also using ML-driven digital twins to continuously monitor and refine power system performance post-deployment. This convergence of AI and power electronics design is enabling end users to move from reactive to predictive maintenance strategies, helping avoid downtime and improve operational efficiency.

Rising Adoption of Electric Vehicles Fueling Demand for Advanced Simulation Tools

The expanding electric vehicle (EV) ecosystem is significantly boosting the growth of power electronics software market. The International Energy Agency reported, global sales reached around 11 million battery electric vehicles and 6.5 million plug-in hybrids in 2024, representing a 16% increase compared to the previous year. EVs require efficient and compact designs of inverters, converters, battery management systems (BMS), and onboard chargers. Design teams use software to perform thermal profiling, switching loss analysis, electromagnetic interference (EMI) simulations, and control loop testing, all of which are essential for EV powertrain optimization. This led to increased demand for software platforms that support real-time simulation, multi-domain co-simulation, and virtual prototyping.

Additionally, the growing adoption of silicon carbide (SiC) and gallium nitride (GaN) components in EV systems increased design complexity, pushing manufacturers to rely more heavily on advanced power electronics software. Automakers are leveraging software for component-level development and system-level integration, such as managing power flow between battery packs and drive units. Furthermore, global expansion in EV production is driving demand for flexible and scalable design platforms. This trend highlights the growing importance of advanced software tools in accelerating product development and meeting global safety standards.

Segmental Insights

Technology Analysis

The segmentation, based on technology includes, rapid control prototyping (RCP), embedded system prototyping, model-based design (MBD), hardware-in-the-loop (HIL) simulation, and other technologies. The model-based design (MBD) segment is projected to reach substantial share during the forecast period. This growth is attributed to widespread adoption across automotive, aerospace, and renewable energy sectors. MBD enables developers to simulate, test, and validate power electronics systems in a virtual environment before hardware is built, significantly reducing development time and cost. It facilitates design verification at early stages, minimizing physical prototyping and allowing better control system development. Leading automotive OEMs and energy companies prefer MBD tools due to their compatibility with multi-domain modeling and system-level simulations, which are essential for the accurate design of complex applications such as electric drivetrains and grid-tied inverters.

The hardware-in-the-loop (HIL) simulation segment is projected to grow at the fastest rate through 2034, fueled by the increasing complexity of electronic systems and the need for real-time validation. HIL systems allow for the testing of control algorithms and embedded software in a closed-loop environment without risking physical equipment, making it ideal for automotive EV testing, motor control, and renewable energy applications. The growing demand for functional safety testing in compliance with standards such as ISO 26262 and IEC 61850 is driving HIL simulation adoption among engineers seeking to validate performance under varying real-world conditions.

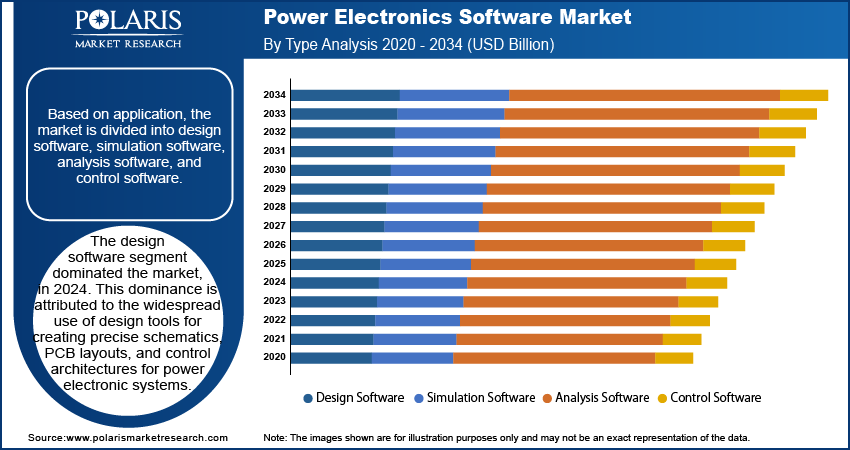

Type Analysis

The segmentation, based on type includes, design software, simulation software, analysis software, and control software. The design software segment dominated the market, in 2024. This dominance is attributed to the widespread use of design tools for creating precise schematics, PCB layouts, and control architectures for power electronic systems. These tools support the early-phase development of converters, inverters, and power modules across various end-use industries. The capability of design software to simulate component behavior under defined electrical and thermal parameters made them indispensable in product development workflows. Rising electrification in industrial and transport sectors is driving the need for advanced design software that supports innovation in energy-efficient solutions. These tools are becoming central to developing reliable and optimized power electronics systems.

The simulation software segment is anticipated to expand at the highest CAGR from 2025 to 2034 due to the increasing demand for dynamic modeling and predictive analysis in power system development. Simulation software enables engineers to analyze performance under different load conditions, conduct EMI/EMC studies, and validate thermal profiles with a high degree of accuracy. For instance, in June 2024, Siemens introduced the Solido Simulation Suite, delivering AI-accelerated SPICE, FastSPICE, and LibSPICE simulation engines for analog, mixed-signal, RF, and custom IC designs. The integration of AI and machine learning algorithms enhanced these platforms to deliver optimization suggestions, perform real-time scenario testing, and conduct rapid fault analysis. This evolution is transforming simulation software as an essential resource for R&D teams working in sectors such as electric vehicles, industrial automation, and aerospace power systems.

Application Analysis

The segmentation, based on application includes, automotive, consumer electronics, industrial, renewable energy, aerospace & defense, and other applications. The automotive segment growth is driven due to the rapid shift toward electric vehicles (EVs) and hybrid electric vehicles (HEVs). Manufacturers developing advanced traction inverters, onboard chargers, and power distribution units increasingly depend on power electronics software for component simulation, thermal analysis, and real-time control validation. For example, in January 2025, Infineon introduced the new EiceDRIVER isolated gate driver ICs designed specifically for traction inverters in electric vehicles. These drivers enable precise and reliable operation within inverter modules, allowing for enhanced switching performance and better electronic thermal management material critical aspects for traction applications. This reliance supports faster development cycles and improved system performance. Major OEMs and Tier 1 suppliers utilize software platforms to meet stringent efficiency standards, reduce switching losses, and optimize the layout of high-voltage powertrains. The increasing integration of silicon carbide (SiC) and gallium nitride (GaN) materials in EV systems further boosting the role of advanced simulation tools in automotive design.

The renewable energy segment is expected to be the fastest-growing during the forecast period. The expansion of solar PV and wind energy installations, along with global decarbonization initiatives, is accelerating the demand for power electronics software to optimize the performance of converters and grid-tied inverters. In this sector, simulation tools are used to manage fluctuating energy flows, improve power factor correction, and ensure compliance with grid codes. Government and utility investments in smart grid upgrades and hybrid energy storage are fueling demand for precise, software-driven control and monitoring systems. This trend is accelerating the demand for power electronics software across renewable energy applications.

Regional Analysis

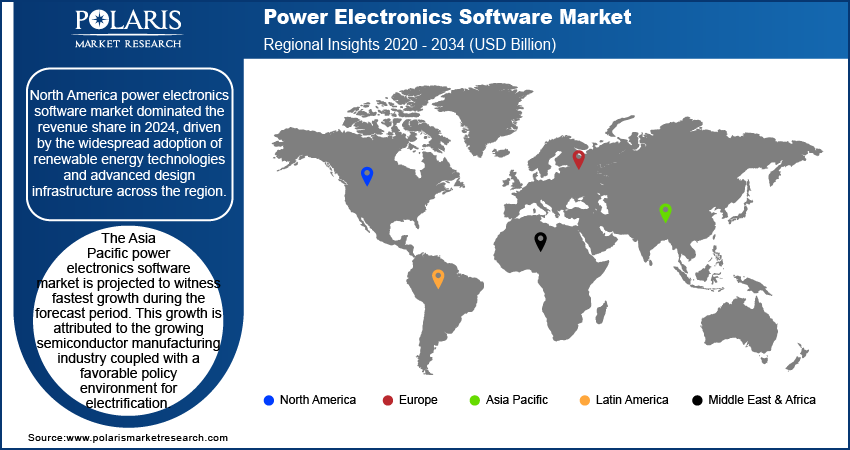

North America power electronics software market dominated the revenue share in 2024, driven by the widespread adoption of renewable energy technologies and advanced design infrastructure across the region. The increasing deployment of solar and wind projects including utility-scale installations in fueled the need for simulation and control tools to manage inverters, converters, and smart grid integrations. Software tools that offer precise modeling and real-time control are gaining traction among energy developers and grid operators. Additionally, the region’s well-established aerospace and defense sector actively utilizes power electronics software for aircraft electrification, power conversion systems, and ruggedized equipment. This growing reliance is further driving the demand across specialized high-performance applications.

The US Power Electronics Software Market Insight

The US power electronics software, dominated the regional market, in 2024, due to the federal grid modernization efforts and government investment in energy resilience. For instance, in August 2022, the US federal government introduced the Inflation Reduction Act (IRA), expanding renewable energy support over the next decade through extended tax incentives and additional policy measures. Modernization of aging infrastructure under national energy programs is increasing reliance on simulation platforms that ensure reliability, safety, and efficiency of power electronics systems. This shift toward digitalized grid infrastructure is accelerating the adoption of advanced power electronics software across public and private utilities.

Asia Pacific Power Electronics Software Market

The Asia Pacific power electronics software market is projected to witness fastest growth during the forecast period. This growth is attributed to the growing semiconductor manufacturing industry coupled with a favorable policy environment for electrification. Countries such as China, South Korea, and Taiwan are home to leading chip foundries and electronics manufacturing hubs, resulting in continuous demand for simulation and testing tools in power component design. According to a report by the Asian Development Bank, more than 80% of global semiconductor manufactured in East and Southeast Asia. The presence of advanced fabrication capabilities for silicon carbide (SiC) and gallium nitride (GaN) devices is further fueling the need for software platforms. The region’s advanced manufacturing base is pushing local and global firms to adopt cutting-edge development software to stay competitive in design accuracy and speed.

Also, governments across the region are introducing large-scale electric mobility programs that rely on high-performance electronics for efficiency and safety. For instance, national targets for EV production and sales in China, Japan, and India are expanding investment in technologies such as motor control, inverter simulation, and battery management. This increase in electric mobility infrastructure requires sophisticated power electronics software tools, thus boosting the growth of the market.

Europe in Power Electronics Software Market Overview

Europe power electronics software market accounted for significant share in 2024, driven by strong regulatory frameworks and robust academic-industrial collaboration. The European Union’s Green Deal and the Ecodesign Directive created a compliance-driven landscape, pushing manufacturers to incorporate simulation and optimization software into their product development pipelines. These tools assist in reducing power loss and achieving stringent energy performance requirements, in renewable energy integration, electric transportation, and building automation systems. Manufacturers are leveraging design software to validate component behavior in early development phases, reduce prototyping cycles, and meet market launch deadlines while maintaining compliance with environmental norms. In addition, well-developed R&D infrastructure supported by national and EU-level funding mechanisms is further accelerating the market growth in the region. Programs under Horizon Europe are actively financing collaborative research projects aimed at advancing simulation models, predictive analytics, and digital twins for power electronics applications.

Key Players & Competitive Analysis Report

The power electronics software market is characterized by a combination of multinational technology leaders and specialized simulation software developers competing across product innovation, strategic collaborations, and market expansion. Companies are increasingly focusing on developing integrated platforms that support end-to-end power electronics design from modeling and simulation to testing and validation tailored to the needs of electric mobility, renewable energy, aerospace, and industrial automation sectors. The market is witnessing rapid evolution due to the convergence of AI, model-based design, hardware-in-the-loop (HIL) simulation, and embedded system prototyping. Vendors are actively investing in enhancing user interface capabilities, real-time data visualization, and multi-domain co-simulation to meet growing customer expectations around accuracy, speed, and scalability. Additionally, partnerships with semiconductor manufacturers, OEMs, and academic institutions are enabling software providers to co-develop application-specific toolchains and maintain technical alignment with emerging hardware innovations.

Prominent players in the global power electronics software market include AESIM.tech, Altair Engineering Inc., Analog Devices, Inc., Cadence Design Systems, Inc., dSPACE GmbH, Infineon Technologies AG, Keysight Technologies, Manitoba Hydro International Ltd., MathWorks, Inc., National Instruments Corp., Plexim GmbH, Renesas Electronics Corporation, Sidelinesoft, LLC, Siemens, and Synopsys, Inc.

Key Players

- AESIM.tech

- Altair Engineering Inc.

- Analog Devices, Inc.

- Cadence Design Systems, Inc.

- dSPACE GmbH

- Infineon Technologies AG

- Keysight Technologies

- Manitoba Hydro International Ltd.

- MathWorks, Inc.

- NATIONAL INSTRUMENTS CORP.

- Plexim GmbH

- Renesas Electronics Corporation

- Sidelinesoft, LLC

- Siemens

- Synopsys, Inc.

Industry Developments

February 2025: dSPACE released XSG Power Electronics Systems (XSG PES), a real-time simulation software capable of modeling highly dynamic power electronics circuits with switching frequencies up to 500 kHz. XSG PES incorporated a library of ready-made models for converters using wide-bandgap semiconductors such as SiC and GaN, enabling easy parameter adjustment during run-time and seamless integration with other dSPACE tools.

November 2024: MathWorks, Inc. partnered with NXP Semiconductors to launch the Model-Based Design Toolbox (MBDT) tailored for Battery Management Systems (BMS), supporting faster and more efficient system development.

November 2024: Keysight unveiled an advanced EDA software suite incorporating AI and machine learning to streamline RF device modeling. The new portfolio aims to boost designer productivity and accelerate the transition from simulation to verification across various development tools.

Power Electronics Software Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Rapid Control Prototyping (RCP)

- Embedded System Prototyping

- Model-Based Design (MBD)

- Hardware-In-The-Loop (HIL) Simulation

- Other Technologies

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Design Software

- Simulation Software

- Analysis Software

- Control Software

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Consumer Electronics

- Industrial

- Renewable Energy

- Aerospace & Defense

- Other Applications

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Power Electronics Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.92 Billion |

|

Market Size in 2025 |

USD 3.18 Billion |

|

Revenue Forecast by 2034 |

USD 6.84 Billion |

|

CAGR |

8.90% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.92 billion in 2024 and is projected to grow to USD 6.84 billion by 2034.

The global market is projected to register a CAGR of 8.90% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AESIM.tech, Altair Engineering Inc., Analog Devices, Inc., Cadence Design Systems, Inc., dSPACE GmbH, Infineon Technologies AG, Keysight Technologies, Manitoba Hydro International Ltd., MathWorks, Inc., National Instruments Corp., Plexim GmbH, Renesas Electronics Corporation, Sidelinesoft, LLC, Siemens, and Synopsys, Inc.

The design software segment dominated the market, in 2024.

The renewable energy segment is expected to be the fastest-growing during the forecast period.