Power Rental Market Share, Size, Trends, Industry Analysis Report

By Equipment (Transformers, Generators, Load Banks, Others); By Fuel Type; By Application; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4849

- Base Year: 2022

- Historical Data: 2019-2022

Report Outlook

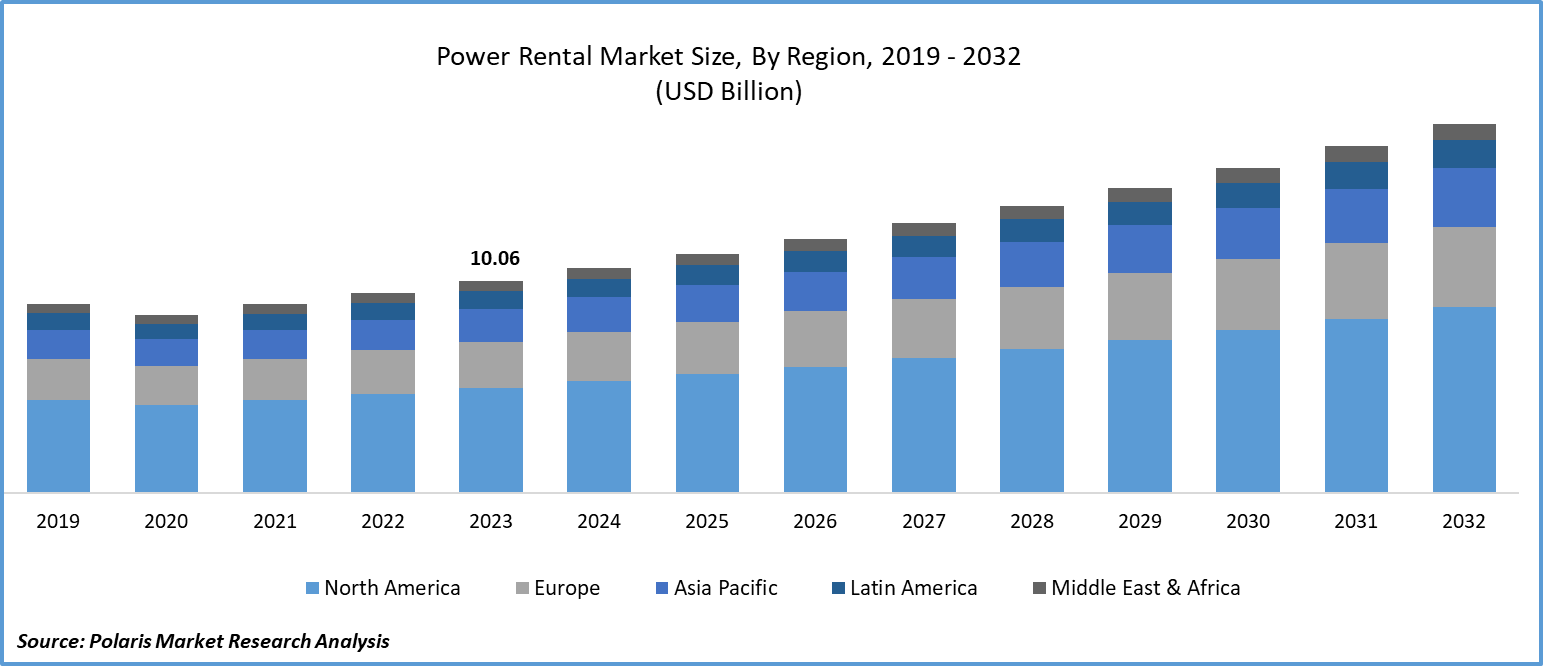

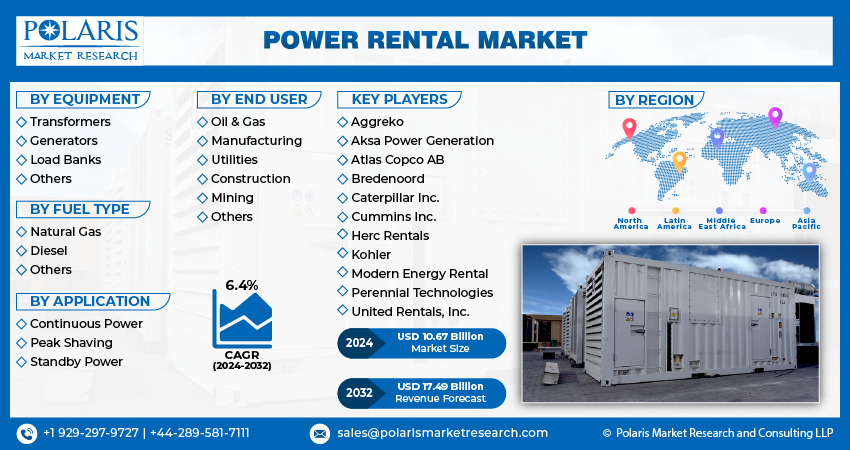

Global power rental market size was valued at USD 10.06 billion in 2023. The market is anticipated to grow from USD 10.67 billion in 2024 to USD 17.49 billion by 2032, exhibiting the CAGR of 6.4% during the forecast period.

Market Introduction

Infrastructure development and construction activities play a key role in propelling the power rental market. As countries pursue economic growth and urbanization, there's a heightened demand for dependable power sources to support large-scale construction projects. Power rental solutions offer temporary electricity supply during construction phases, ensuring uninterrupted operations of heavy machinery and equipment. Additionally, infrastructure projects often occur in remote or off-grid locations where permanent power infrastructure isn't feasible. In such instances, rental power solutions provide a flexible and efficient alternative.

In addition, companies operating in the market are introducing new solutions and initiatives to expand market reach and strengthen their presence.

To Understand More About this Research: Request a Free Sample Report

For instance, in October 2023, Aggreko introduced Greener Power Packages, an innovative initiative focused on streamlining eco-friendly energy solutions for clients. These packages, compatible with Aggreko's Greener Upgrades, integrate the firm's temporary power technologies and services to offer tailored solutions for enhanced operational efficiency and performance.

Technological advancements are driving significant growth in the power rental market. Innovations in power generation equipment, including advanced diesel generators and renewable energy solutions, enhance efficiency and environmental sustainability. Digitalization and automation technologies enable remote monitoring and predictive maintenance, optimizing performance. Smart systems and IoT devices provide real-time insights for proactive maintenance and resource allocation. Additionally, energy storage and microgrid solutions offer resilient and sustainable power options, particularly in remote or unstable grid areas.

Industry Growth Drivers

Increasing Demand for Reliable Power Supply is Projected to Spur the Product Demand

The power rental market is on the rise due to the escalating demand for dependable power supply solutions across various sectors. Rapid industrialization, urbanization, and infrastructure expansions contribute to this trend. In regions with inadequate or unreliable power infrastructure, industries turn to rental power solutions for uninterrupted operations. Additionally, events like concerts and festivals require temporary power for lighting and sound systems. Natural disasters prompt the deployment of power rental services for disaster relief and temporary shelters. With businesses prioritizing continuity, the power rental market serves as a flexible and cost-effective solution to meet diverse power needs in planned and unforeseen circumstances.

Rapid Urbanization and Industrialization are Expected to Drive Power Rental Market Growth

Rapid urbanization and industrialization are key drivers for the power rental market growth. As cities grow and industries develop, there's a heightened need for reliable temporary power solutions for construction, events, and emergencies. Challenges in establishing permanent power infrastructure in urban areas and industrial zones drive demand for flexible and cost-effective power rental services. Urban expansion necessitates temporary power for construction projects and public events, while industrial growth requires consistent power for manufacturing and mining operations. As these trends continue globally, the power rental market is poised for significant growth, playing a vital role in supporting various sectors and applications.

Industry Challenges

The High Initial Investment is Likely to Impede the Power Rental Market Growth

The power rental market faces a constraint due to high initial investment requirements. Obtaining and maintaining rental equipment demands substantial capital, including generators, transformers, and distribution panels. Moreover, ongoing investments in maintenance, upgrades, and regulatory compliance are necessary to ensure equipment reliability and safety. The competitive landscape often necessitates additional spending on marketing, customer acquisition, and technological advancements. For smaller players or newcomers, these financial burdens can impede market entry or expansion.

Report Segmentation

The power rental market analysis is primarily segmented based on equipment, fuel type, application, end-user, and region.

|

By Equipment |

By Fuel Type |

By Application |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Equipment Analysis

The Generators Segment Held a Significant Power Rental Market Share in 2023

The generators segment held a significant power rental market share in 2023. Renowned for their reliability, generators offer dependable temporary power solutions across diverse applications. Their versatility allows usage in construction sites, events, industrial facilities, and remote locations. With various sizes and power capacities, generators offer scalable solutions catering to different power requirements. Rapid deployment during emergencies or planned events underscores their flexibility and convenience. Despite initial investment costs, generators prove cost-effective compared to permanent power infrastructure. Additionally, power rental companies typically offer maintenance and support services, ensuring uninterrupted operation and minimizing downtime for customers.

By Fuel Type Analysis

The Diesel Segment Held a Major Power Rental Market Share in 2023

The diesel segment held a major power rental market share in 2023. Diesel equipment is renowned for its reliability and robustness, making it the preferred choice for critical applications. Its versatility allows operation in diverse environments and conditions, catering to various needs like construction sites and emergency backup systems. With high power output, it suits heavy-duty applications such as industrial manufacturing. Cost-effectiveness and global availability of diesel fuel make it an economical option. Moreover, diesel equipment offers a longer lifespan and requires less maintenance, ensuring a reliable and cost-effective power solution.

By Application Analysis

The Continuous Power Segment Held a Significant Power Rental Market Share in 2023

The continuous power segment held a significant power rental market share in 2023. It serves critical industries like healthcare, data centers, and telecommunications, ensuring uninterrupted operations. Renowned for reliability, continuous power solutions offer a stable electricity supply vital for sensitive equipment and processes. Long-term contracts provide steady revenue streams for rental companies. Customization options meet specific customer needs, enhancing appeal and revenue potential. Technological advancements, including hybrid systems and fuel efficiency improvements, drive adoption. Moreover, stringent regulatory compliance mandates in industries necessitate continuous power solutions to meet reliability standards.

By End User Analysis

The Utility Segment Held a Significant Power Rental Market Share in 2023

The utilities segment held a significant power rental market share in 2023. Utilities rely on temporary power solutions to maintain grid stability during peak demand periods, scheduled maintenance, or unexpected outages. They also utilize power rental services for emergency backup power during natural disasters to ensure uninterrupted essential services. Power rental solutions also support utilities in electrifying remote areas with limited grid infrastructure. Furthermore, utilities augment their power generation capacity during increased demand or equipment failures. They may also use power rental services for temporary projects like infrastructure construction.

Regional Insights

North America Region Accounted for a Significant Power Rental Market Share in 2023

In 2023, the North American region accounted for a significant power rental market share. Its advanced technological infrastructure facilitates the adoption of cutting-edge power rental solutions. The region's strong economy supports industries like construction, oil and gas, and events that require reliable power sources. Moreover, stringent environmental and safety regulations drive the demand for efficient and compliant rental equipment. North America's vulnerability to natural disasters also increases the need for temporary power solutions for disaster relief efforts. Additionally, the region's thriving events industry and ongoing infrastructure projects contribute to the growing demand for temporary power solutions.

Asia-Pacific is expected to experience significant growth during the forecast period. Rapid industrialization and urbanization drive demand for temporary power solutions in construction, manufacturing, and infrastructure projects. Emerging economies seek cost-effective options to meet increasing energy needs, fueling demand for power rental services. The region's susceptibility to natural disasters underscores the importance of power rental solutions in disaster response and recovery efforts. Additionally, large-scale infrastructure projects and investments in renewable energy further contribute to market expansion.

Key Market Players & Competitive Insights

The power rental market has various players, and anticipated new entries will heighten competition. Market leaders focus on innovation to sustain a competitive edge, prioritizing efficiency, reliability, and safety. Strategic initiatives include forming alliances, enhancing product offerings, and engaging in collaborations aimed at outperforming competitors and securing a substantial market share.

Some of the major players operating in the global power rental market include:

- Aggreko

- Aksa Power Generation

- Atlas Copco AB

- Bredenoord

- Caterpillar Inc.

- Cummins Inc.

- Herc Rentals

- Kohler

- Modern Energy Rental

- Perennial Technologies

- United Rentals, Inc.

Recent Developments

- In June 2022, Cummins Inc. introduced the C1000D6RE, a new 1MW twin-pack rental generator, providing a competitive rental power solution suitable for various applications across North America.

- In November 2023, Aggreko introduced its newest Tier 4 final generators in Canada, providing low-emission technology tailored for Canadian customers. These generators are available in Canadian Standards Association (CSA)-certified options, ranging from 100kW to 500kW.

Report Coverage

The power rental market report emphasizes key regions worldwide to help users better understand the product. It also provides market insights into recent developments and trends and analyzes the technologies gaining traction worldwide. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, equipment, fuel types, applications, end users, and their futuristic growth opportunities.

Power Rental Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.67 billion |

|

Revenue Forecast in 2032 |

USD 17.49 billion |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

key companies in Power Rental Market are Aggreko, Aksa Power Generation, Atlas Copco AB, Bredenoord, Caterpillar Inc

Power Rental Market exhibiting the CAGR of 6.4% during the forecast period.

The Power Rental Market report covering key segments are equipment, fuel type, application, end-user, and region

key driving factors in Power Rental Market are Increasing demand for reliable power supply

The global power rental market size is expected to reach USD 17.49 billion by 2032