U.S. Polyolefin Compounds Market Size, Share, Trends, Industry Analysis Report

By Polymer (PP Compounds, PE Compounds, Recycled Polyolefin Compounds, Other), By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6023

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

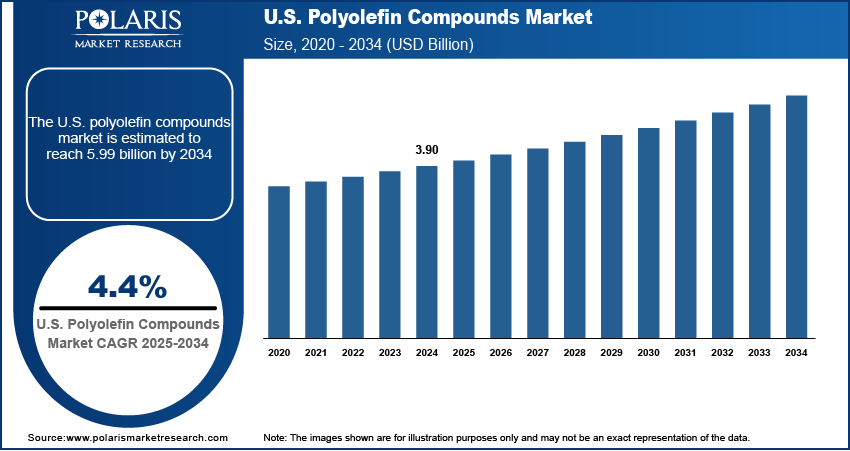

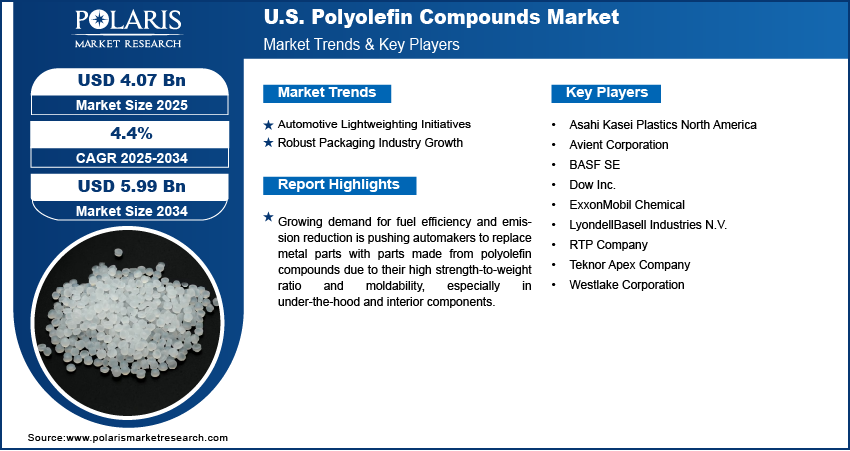

The U.S. polyolefin compounds market size was valued at USD 3.90 billion in 2024 and is projected to register a CAGR of 4.4% during 2025–2034. The growing demand for fuel efficiency and emission reduction is prompting automakers to replace metal parts with polyolefin compounds due to their high strength-to-weight ratio and moldability, particularly in under-the-hood and interior components.

Key Insights

- The conventional ignition modules segment accounted for ~36% of the revenue share in 2024.

- The hall sensor segment is expected to witness the highest CAGR during the forecast period.

- The automotive segment accounted for the largest revenue share in 2024 due to the dominant use of ignition control modules in internal combustion engine vehicles.

The U.S. polyolefin compounds market refers to the industry centered around the production and application of thermoplastic polymers primarily polypropylene (PP) and polyethylene (PE) that are compounded with additives, fillers, or reinforcements to enhance mechanical, thermal, and chemical properties for use in automotive, construction, packaging, electrical, and consumer goods sectors. Expanding production of wire and cable insulation, appliance housings, and battery components is boosting the need for flame-retardant and conductive polyolefin compounds tailored to electrical safety standards.

Rising preference for recyclable and eco-friendly materials is encouraging the use of polyolefins in packaging and consumer goods, where mechanical recycling and mono-material solutions offer compliance with circular economy goals. Additionally, expanding healthcare applications, including medical tubing, containers, and packaging films, are driving demand for high-purity, sterilization-capable polyolefin compounds compliant with FDA and USP standards.

Industry Dynamics

- Growing focus on reducing vehicle weight to improve fuel economy and meet stringent emission standards.

- Surging consumer goods demand and expansion in e-commerce logistics are driving rapid adoption of polyolefin compounds.

- Booming infrastructure renovation and residential development projects are driving demand for polyolefin-based piping systems, insulation, and waterproofing membranes owing to their durability and resistance to chemicals and moisture.

- Fluctuating raw material prices and stringent environmental regulations restrain the U.S. polyolefin compounds market growth.

Automotive Lightweighting Initiatives: Growing focus on reducing vehicle weight to improve fuel economy and meet stringent emission standards is boosting demand for advanced polymer materials in the U.S. automotive sector. According to the U.S. Department of Energy, advanced materials such as high-strength steel, aluminum alloys, and polymer composites help reduce vehicle weight by up to 50%, improving fuel economy by 6–8% for every 10% weight reduction. Polyolefin compounds are increasingly used to replace heavier metals in structural and functional parts due to their excellent mechanical properties, dimensional stability, and resistance to chemicals. Automakers are integrating these compounds into dashboards, bumpers, and engine covers, enabling cost-effective mass reduction without compromising performance. Advancements in composite formulations and material reinforcement are further enhancing thermal resistance and load-bearing capacity, making polyolefins ideal for next-generation vehicle platforms aimed at balancing efficiency, safety, and design flexibility.

Robust Packaging Industry Growth: Surging demand for consumer goods and expansion in e-commerce logistics are driving the rapid adoption of polyolefin compounds in the U.S. packaging applications. According to the U.S. Census Bureau, retail e-commerce sales in the country reached USD 300.2 billion in Q1 2025, up 6.1% from Q1 2024. Total retail sales rose to USD 1,858.5 billion, a 4.5% increase year-over-year. These materials offer strong impact resistance, high clarity, and excellent processability, making them suitable for both flexible films and rigid containers. Their ability to provide strong barrier properties and sealing performance supports longer shelf life and protection during transit. Growing emphasis on lightweight and recyclable packaging is further increasing interest in polyolefin-based mono-material solutions. Enhanced compounding technologies are enabling the development of customizable packaging grades tailored for high-speed production, product differentiation, and sustainability targets across food, personal care, and retail sectors.

Segment Insights

Polymer Analysis

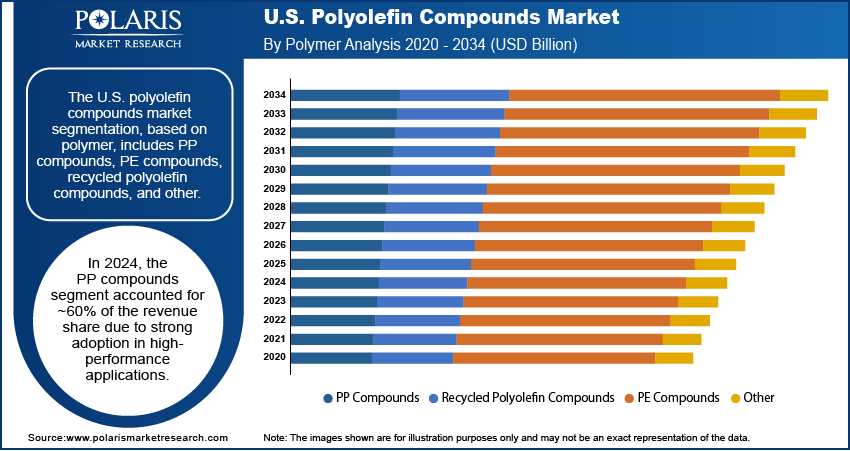

The U.S. polyolefin compounds market segmentation, based on polymer, includes PP compounds, PE compounds, recycled polyolefin compounds, and other. In 2024, the PP compounds segment accounted for ~60% of the revenue share due to strong adoption in high-performance applications such as automotive interiors, bumpers, under-the-hood components, and consumer appliances. The segment's dominance is supported by the material’s high strength-to-weight ratio, impact resistance, and thermal stability. Continuous innovation in mineral and glass-filled PP grades is enabling enhanced stiffness and durability, making it a preferred material in metal replacement strategies. Its compatibility with diverse processing techniques, including injection molding and extrusion, further solidifies its role across industries focused on cost-efficient and scalable production of complex geometries and long-life-cycle parts.

The polyethylene (PE) compounds segment is projected to register a CAGR of 4.9% during the forecast period due to increasing use in cable insulation, protective films, pipes, and industrial liners. The compound's excellent chemical resistance, toughness at low temperatures, and stress-crack resistance make it ideal for infrastructure and consumer packaging. Growth in renewable energy projects and smart grid expansion is supporting PE’s role in electrical and telecom cable sheathing. The segment also benefits from tailored formulations that offer UV resistance and flame retardancy, enabling wider use in outdoor and high-temperature applications where material durability and reliability are crucial for performance and safety compliance.

The recycled polyolefin compounds segment is expanding due to the increasing regulatory pressure on plastics sustainability, circular economy initiatives, and corporate commitments to reduce carbon footprints. Manufacturing sectors are shifting toward recycled content in automotive interiors, packaging trays, and pallets, where high-quality recycled polyolefins can match virgin resin performance. Improved sorting, cleaning, and compounding technologies are making it feasible to incorporate post-consumer and post-industrial waste into value-added applications. Brands and OEMs are increasingly adopting recycled polyolefin compounds to meet ESG targets, reduce raw material dependency, and align with industry-wide sustainability certifications, boosting the segment’s commercial viability across both industrial and consumer sectors.

Application Analysis

The U.S. polyolefin compounds market, based on application, is segmented into automotive, packaging, building & construction, electrical & electronics, consumer goods, industrial, and others. The automotive segment accounted for ~33% of the revenue share due to widespread integration of lightweight polymer solutions aimed at improving fuel efficiency and meeting emission standards. OEMs and Tier 1 suppliers are increasingly adopting polyolefin compounds in nonstructural applications, such as dashboards, trims, door panels, and bumper fascias. Demand is further strengthened by the material’s recyclability, low density, and design flexibility. Advancements in filled compounds offer higher rigidity, better thermal performance, and reduced NVH (noise, vibration, and harshness) characteristics. The segment also benefits from ongoing developments in electric vehicles and connected car platforms, which require new material innovations for thermal and electrical insulation purposes.

The packaging segment is projected to register a CAGR of 5.0% during the forecast period, driven by increased demand for efficient, sustainable, and customizable packaging formats in food, e-commerce, and consumer goods sectors. Polyolefin compounds provide essential properties such as puncture resistance, clarity, sealability, and moisture barrier, which are crucial for shelf stability and protection. Growth in lightweight mono-material packaging solutions that are easier to recycle is also contributing to segment expansion. Industry focus on downgauging, material savings, and sustainability certifications is prompting converters to shift toward advanced PE and PP compounds that offer both processing efficiency and enhanced product integrity.

The industrial segment is gaining traction due to its growing use in pallets, crates, pipes, tanks, and protective coverings that demand durability, chemical resistance, and long-term weatherability. The versatility of polyolefin compounds allows for custom formulations tailored to specific mechanical and environmental requirements. Industries such as logistics, warehousing, and agriculture are leveraging these materials to enhance product lifecycle, reduce replacement frequency, and improve operational safety. Rising labor and maintenance costs are pushing industries to adopt robust, low-maintenance materials, positioning polyolefin compounds as a cost-effective alternative to metals and traditional thermoplastics in demanding operational environments.

Key Players and Competitive Analysis

The competitive landscape of the U.S. polyolefin compounds market is shaped by strategic activities centered on product innovation, capacity expansion, and vertical integration. Industry analysis indicates a steady push toward lightweighting solutions, particularly in the automotive and packaging sectors, which is driving competition around advanced polypropylene and polyethylene compounds. Companies are increasingly focusing on market expansion strategies by forming joint ventures with local processors and recyclers to enhance raw material access and improve sustainability footprints.

Mergers and acquisitions in the U.S. polyolefin compounds market are reshaping the supplier base, particularly among compounders seeking to consolidate capabilities in post-consumer resin integration and specialty compounding. Post-merger integration efforts are targeting improved operational efficiencies and technology transfer across facilities. Strategic alliances with OEMs and downstream manufacturers are enabling co-development of application-specific formulations, aligning compound performance with end-use demands.

Technology advancements in compatibilizers, fiber reinforcement, and odor control are becoming core differentiators, especially in recycled polyolefin markets. In addition, players are investing in digital platforms for order tracking, logistics, and product customization, further enhancing market competitiveness.

List of Key Companies

- Asahi Kasei Plastics North America

- Avient Corporation

- BASF SE

- Dow Inc.

- ExxonMobil Chemical

- LyondellBasell Industries N.V.

- RTP Company

- Teknor Apex Company

- Westlake Corporation

U.S. Polyolefin Compounds Industry Developments

In March 2024, Dow Inc. launched a new polyolefin elastomer (POE)-based artificial leather for automotive interiors, developed with HIUV Materials Technology and approved by an electric vehicle maker. The material offers softness, color durability, cold resistance, and is free from harmful chemicals.

In January 2024, LyondellBasell introduced Petrothene T3XL7420, a cross-linkable flame-retardant polymer compound. Designed for wire and cable applications, it enhances production efficiency, reduces costs, and improves manufacturing line speeds.

U.S. Polyolefin Compounds Market Segmentation

By Polymer Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- PP Compounds

- PE Compounds

- Recycled Polyolefin Compounds

- Other

By Applications Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Automotive

- Packaging

- Building & Construction

- Electrical & Electronics

- Consumer Goods

- Industrial

- Others

U.S. Polyolefin Compounds Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.90 billion |

|

Market Size in 2025 |

USD 4.07 billion |

|

Revenue Forecast by 2034 |

USD 5.99 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons; Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 3.90 billion in 2024 and is projected to grow to USD 5.99 billion by 2034.

The U.S. market is projected to register a CAGR of 4.4% during the forecast period.

A few of the key players are Asahi Kasei Plastics North America, Avient Corporation, BASF SE, Dow Inc., ExxonMobil Chemical, LyondellBasell Industries N.V., RTP Company, Teknor Apex Company, and Westlake Corporation.

In 2024, the PP compounds segment accounted for ~60% of the revenue share due to strong adoption in high-performance applications.

The automotive segment accounted for ~33% of the revenue share due to widespread integration of lightweight polymer solutions aimed at improving fuel efficiency and meeting emission standards.